Will Oil Derail Crypto?

Brent oil rallied in July, breaking its nearly year-long downtrend. If oil prices continue to soar, it could pose a problem for cryptocurrencies, as well as most other asset classes. This is because a substantial increase in oil prices could cast doubt on the narrative of an inflation slowdown, which is currently a primary supportive factor for cryptocurrencies, stocks, and bonds. As for the likelihood of such a scenario, it depends on various factors, including geopolitical developments, supply and demand dynamics for oil, and the broader macroeconomic climate.

Oil Rally

The oil price spiked in the first half of 2022 due to the war in Ukraine. However, after that, it entered a relentless downtrend, which lasted from June 2022 until May 2023. This trend changed in June 2023, when oil prices began to stabilize. A strong rally followed this stabilization, with Brent oil soaring by 13% in July. This performance easily outpaced most other assets.

Brent oil price (USD)

Oil prices have risen above their 200-day moving average for the first time since August 2022. Furthermore, they are sustainably trading above the 100-day moving average. This increasingly suggests the emergence of a new uptrend.

Brent oil price (black) and its 100-day (orange) and 200-day (blue) moving averages

A Threat to Crypto

If there is indeed a new uptrend in oil prices, it could pose a problem for cryptocurrencies, bonds, and to a lesser extent, stocks. A significantly higher oil price could undermine the inflation slowdown narrative, which currently serves as a primary supporting factor for cryptocurrencies, stocks, and bonds. US core inflation peaked in September 2022, allowing the bond market to anticipate a more benign monetary policy. Subsequently, in October 2022, real rates ceased their rise (i.e., prices of Treasury Inflation-Protected Securities (TIPS) stopped falling). This development was followed by a rally in both cryptocurrencies and stocks in the ensuing months.

iShares TIPS Bond ETF (TIP)*

While oil prices are explicitly excluded from core inflation, which by definition measures consumer inflation excluding food and energy, this only shields core inflation from short-term oil price spikes. Sustained increases in oil prices can still impact core inflation, as these can affect the prices of other goods and lead to higher inflation expectations. The bond market typically reacts more quickly to oil price movements than the Federal Reserve, and therefore, it might anticipate additional monetary policy tightening in the future, even if the Federal Reserve remains more relaxed about rising oil prices.

Will Oil Continue Rallying?

"I believe the oil rally may continue, as it reflects supply-side discipline by OPEC+ and improvements in demand. US gasoline prices, as defined by the front-month future, have risen to their highest point since October 2022, suggesting strong demand from automobile drivers.

US gasoline price*

Airlines report that travel demand is robust, with their shares increasing by approximately 25% this year (as measured by the US Global Jets ETF). This outperforms all broad stock indexes except for the Nasdaq. Demand for oil in China may also improve, given rising expectations for new, large-scale stimulus measures. Long-depressed Chinese stocks have recovered to their highest level since February.

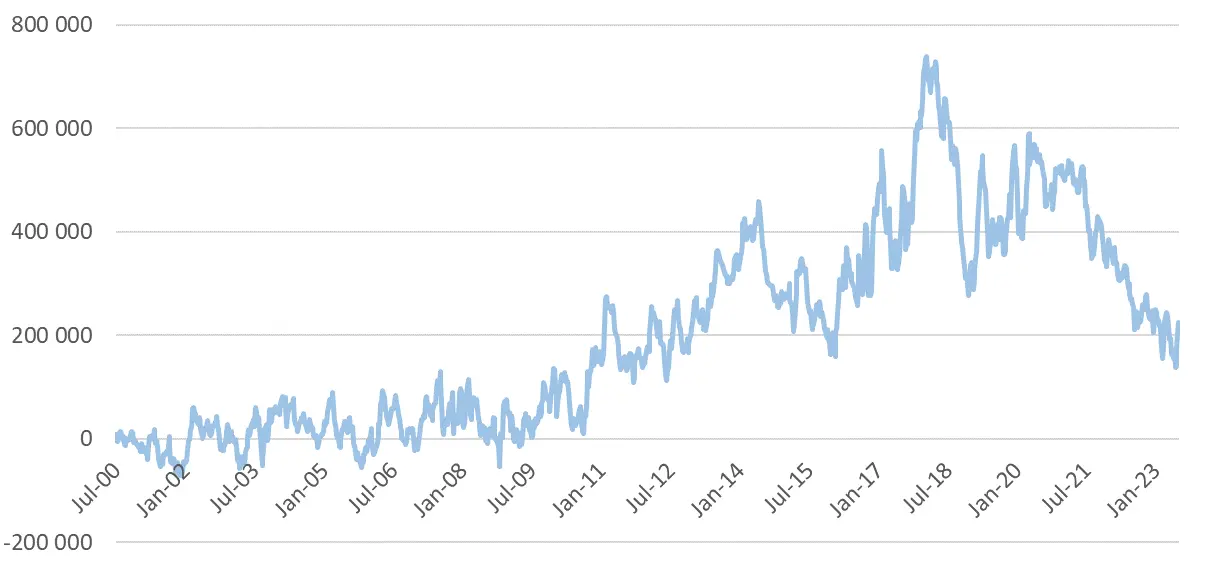

Importantly, the oil futures market isn't currently positioned for an uptrend, catching speculators off-guard with the July rally. According to CFTC data compiled by Bloomberg, hedge funds and other speculators have scaled back their net long oil exposure to lows last seen during the commodity crisis in 2015-2016. This situation leaves potential for an increase in long positions, while limiting the scope for profit taking.

CFTC NYME crude oil net non-commercial futures positions

Interestingly, some of the riskiest oil-related assets have staged an impressive rally this year, despite a nearly flat oil price. This suggests market confidence in the prospects for oil. Offshore drilling companies, which are characterized by high volatility and are particularly sensitive to oil sentiment, have been performing exceptionally well this year. Offshore drilling represents long-term investments in oil production, as these projects have very long timeframes, and most costs are paid upfront. Transocean, the largest company in the sector by revenue and the only one to survive the coronavirus crisis without declaring insolvency, has almost doubled its value this year, reaching its highest level since 2019.

Transocean share price (USD)

Conclusion

I believe the oil rally may have staying power, as it reflects supply-side discipline by OPEC+ and improved demand. The July rally caught speculators off guard, with their net long exposure in oil futures near a decade low. Offshore drilling stocks, among the riskiest oil-related assets, have skyrocketed this year despite a nearly flat oil price, suggesting market confidence in oil prospects.

Let's hope that a further oil uptrend, which I believe is likely, will be measured rather than a sharp rally that could shatter the disinflation narrative and force further monetary tightening. For those heavily exposed to cryptocurrencies or US technology stocks, I suggest considering the purchase of some oil assets as a hedge. In my opinion, European oil majors, in particular, appear undervalued.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.