Will Higher Rates Prolong Crypto Winter?

US Treasury yields have broken out to a new cycle high, which appears to be a warning sign for long-duration assets. What is happening, and how will it affect crypto?

New High for the Rate

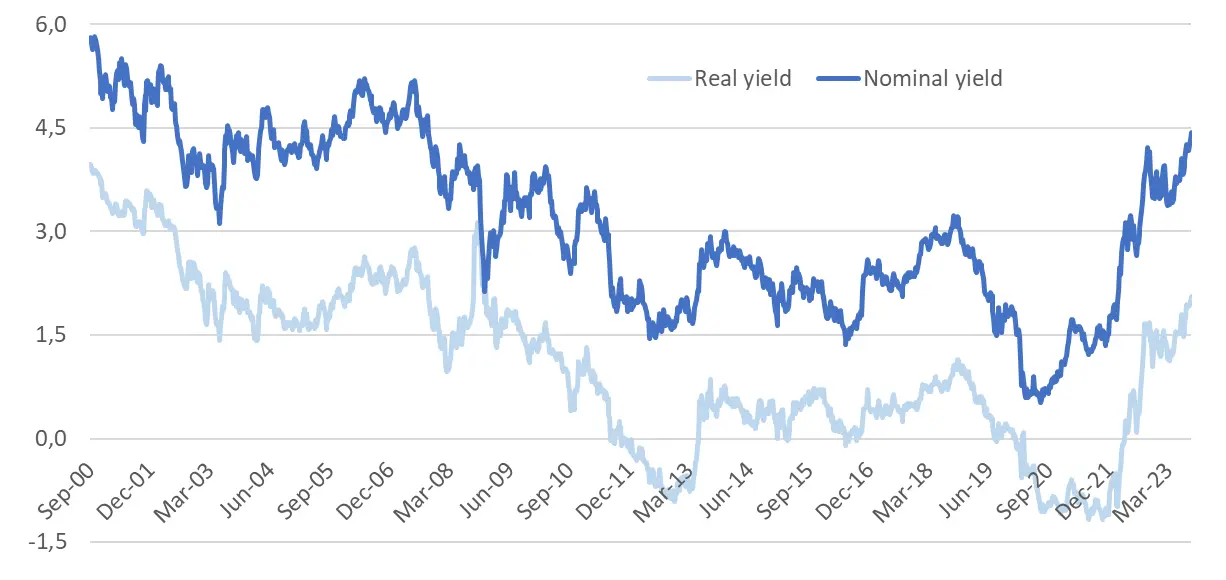

Last week, US Treasury yields reached a new cycle high, breaking above the previous maximums reached in August 2023 and October 2022. Both nominal and real yields are now at 15-year highs, erasing their drop following the 2008 financial crisis.

US Treasury nominal and real 10-year yield

A primary driver of the yield rally is the hawkish news from the latest meeting of the Federal Reserve. At the September 20 meeting, the Fed maintained the existing rates but signaled the potential for a further hike this year and, crucially, fewer cuts in the coming year. The median forecast in the Fed's so-called "dot plot" suggests that the rate is anticipated to close out next year at 5.1%, a significant increase from the 4.6% level predicted in June, indicating fewer rate cuts than previously expected. The Fed Chair explicitly stated in the press conference that the rate would not be reduced in tandem with declining inflation to maintain a restrictive policy and achieve further disinflation, leading the bond market to reassess the expected rate path. This reassessment has resulted in a sharp rise in yields and a drop in bond prices.

More broadly, the rising yield reflects the continued strength of the US economy. With inflation still above target and a historically strong labor market, the Fed is compelled to tighten monetary policy, suggesting higher real yields.

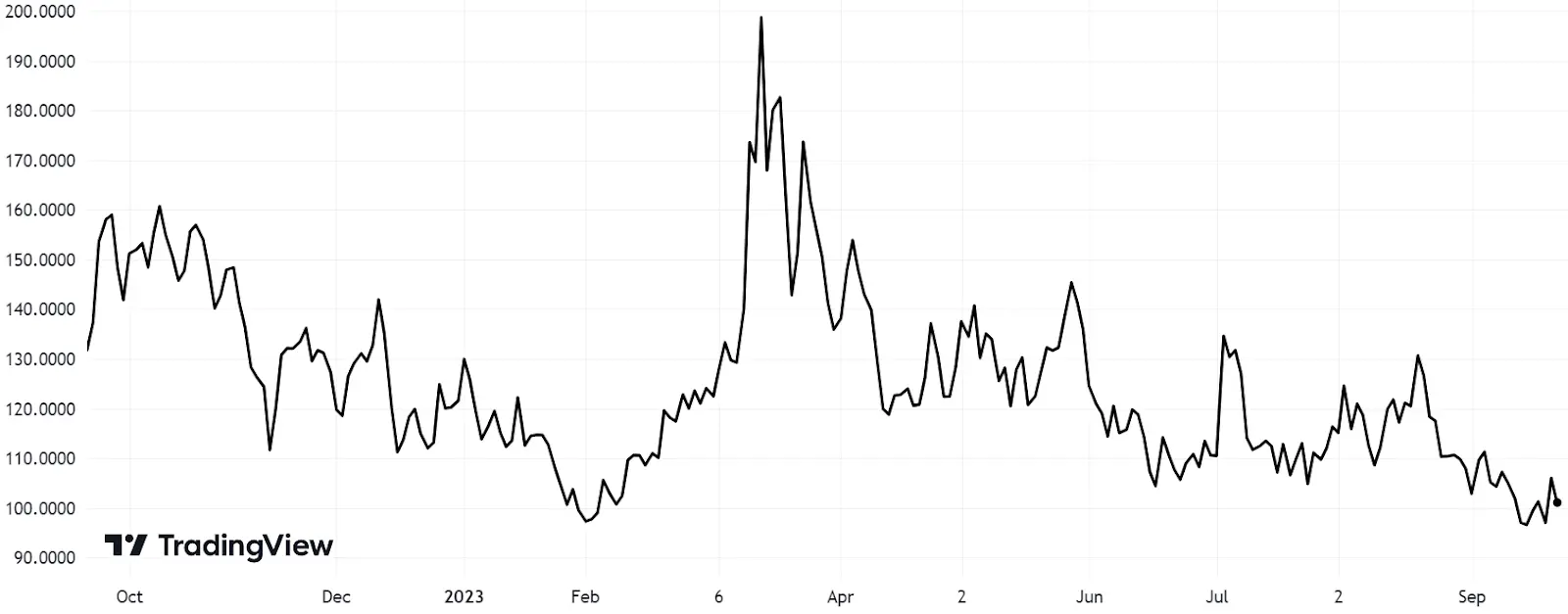

Additionally, the recent oil rally acted as a catalyst for higher yields, as more expensive oil often results in elevated inflation expectations. When oil prices significantly rise, the bond market typically prices in higher inflation breakevens through increased nominal yields. Currently, the oil price is at its highest level since November 2022.

Brent oil price (USD)

Intriguingly, the rapid rise in yield has not resulted in higher implied volatility. The implied volatility of US Treasuries, as measured by the MOVE index, remains subdued, hovering near its lowest level this year. The MOVE index is now less than half of what it was in March when the regional bank crisis spurred a flight to safety, bolstering bond prices. Clearly, the bond market does not yet fear an uncontrolled rise in yields.

MOVE index (implied volatility of the US Treasuries)

Effect on Markets

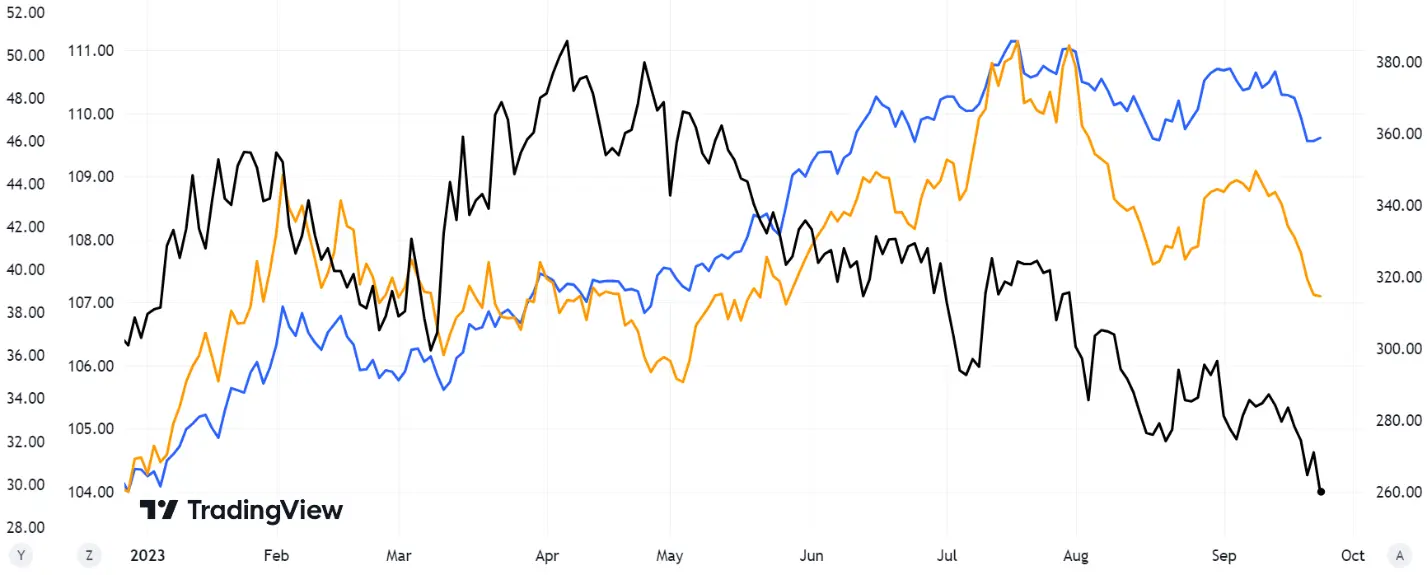

So far, the rise in yield has had a minimal impact on other assets. Much higher real rates have halted the rally of US equity indexes but haven't triggered a significant correction as of yet. Since its July peak, the S&P 500 has experienced a 5% decline but is still up by 13% this year. The tech-centric Nasdaq 100 index has dipped by 7% since July but remains up 35% for the year. The fervor surrounding Artificial Intelligence (AI) has seemingly shielded US stock indexes from higher rates, at least for the time being.

Riskier segments of the stock market have fared worse, though nothing drastic has occurred. The ARK Innovation ETF, considered a proxy for high-risk technology companies, has seen a 23% drop since its July high but is still up 24% since the end of last year.

TIPS ETF* (black, scale Z), Nasdaq 100 ETF** (blue, scale A) and ARK Innovation ETF (orange, scale Y)

** iShares TIPS Bond ETF, which is an inverse proxy for real rates

** Invesco QQQ Trust

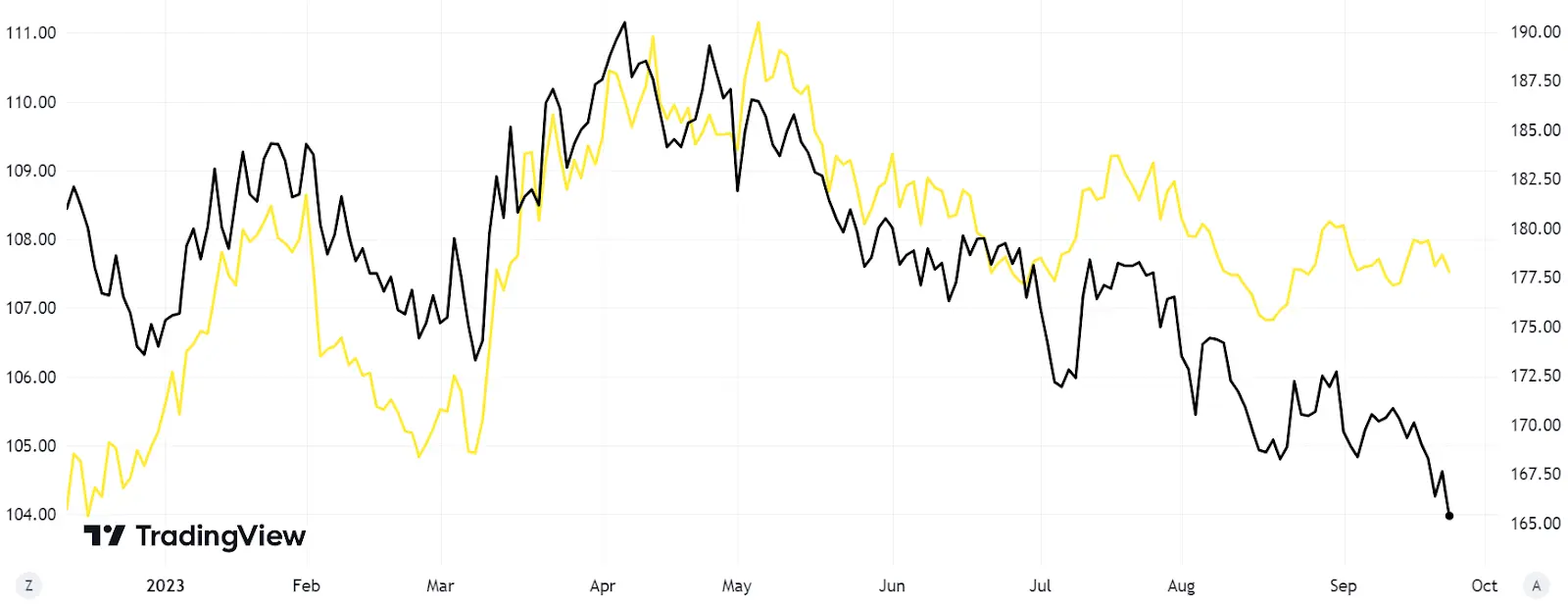

Gold, despite not being part of the AI craze, has performed almost as well as the Nasdaq 100 index, remaining steady since July despite the substantially higher real rates, which typically correspond to lower TIPS prices. The resilience of gold is likely bolstered by central bank purchases and the fact that it isn’t as overbought as the Nasdaq 100. Consequently, some investors may view it as an affordable diversification option.

TIPS Bond ETF (black, scale Z) and gold ETF (yellow, scale A)

Despite the current resilience of stock indexes and gold, I believe it’s only a matter of time before they react to higher real rates. Large-cap tech appears particularly vulnerable due to its sky-high multiples, which have historically been dependent on real rates. High-risk stocks like the ARK Innovation ETF, which has already seen a reduction to half of its gains this year, may serve as a canary in the coal mine for larger tech companies.

Crypto has maintained relative resilience thus far, but the current price levels seem increasingly precarious in the context of rising real rates. Historically, crypto has demonstrated a significant dependency on long-term real rates; for instance, the bear market last year was predominantly a result of higher TIPS yields.

TIPS Bond ETF (black, scale A) and Bitcoin (orange, scale Z)

Conclusion

The stronger-than-expected US economy has prompted renewed hawkishness from the Fed, fueling the yield rally. This has had a restrained effect on other assets for now, but it seems inevitable that, if sustained, higher real rates will exert pressure on tech stocks, gold, and crypto. We might hope that cracks will appear in the US economy sooner rather than later, as its continued resilience increasingly poses a threat to the crypto recovery this year.

In my view, the currently very low implied volatility of crypto may offer a convenient opportunity for hedging via put options.

* This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.