Why Did Ethereum Futures ETFs Fail?

Newly launched ETH futures ETFs failed to gain significant flows and assets. Why did it happen and what are implications for broader crypto adoption by traditional finance investors?

No Interest for New ETFs

Last week, the long-awaited Ethereum futures ETFs began trading on US exchanges. On October 2, several asset managers, including Bitwise, ProShares, Vaneck, and others, launched new ETFs based on Ethereum futures traded on the CME. Some asset managers also introduced mixed products based on both Bitcoin and Ethereum futures. However, these ETFs failed to gain much traction in terms of assets; each new pure-play Ethereum futures ETF attracted less than $10 million. For comparison, the largest Bitcoin futures ETF, BITO (ProShares Bitcoin Strategy ETF), holds about $900 million in assets.

Assets under management of selected crypto ETFs

Source: Bloomberg

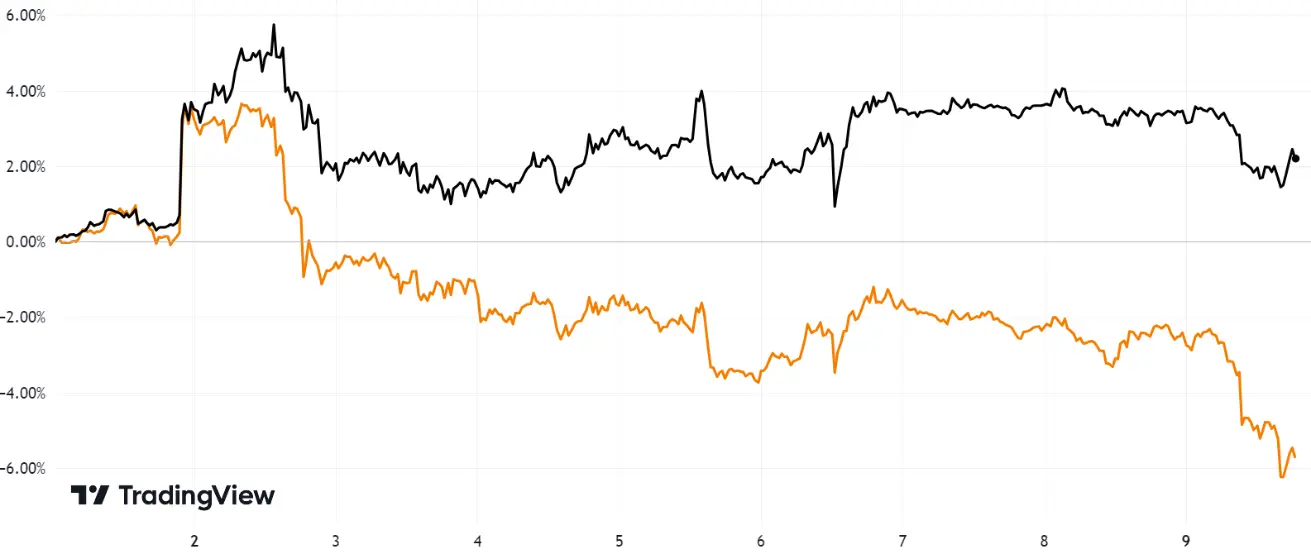

Weak interest in the new ETFs resulted in Ethereum's underperformance. Following an initial surge upon the announcement on October 2, Ethereum's value declined despite Bitcoin remaining stable. Since October 1, Ethereum has dropped by 6%, whereas Bitcoin has appreciated by 2%.

Performance of Bitcoin (black) and Ethereum (orange) since October 1, 2023

Why Did It Happen?

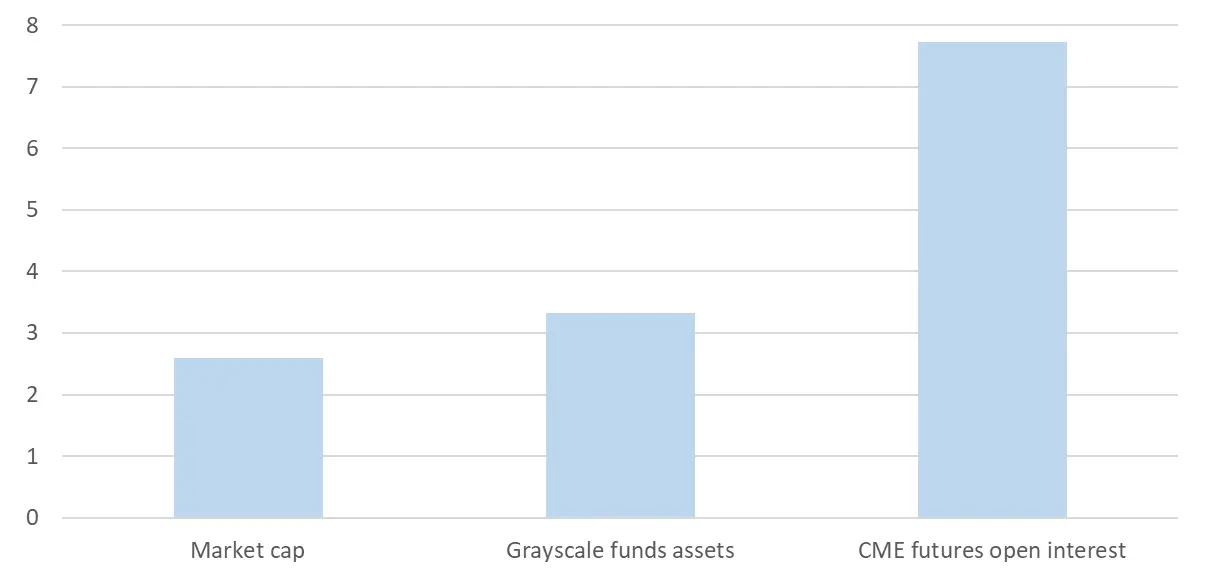

The scant interest in the new ETFs was undoubtedly a disappointment for many analysts, myself included. I believe most experts hadn't anticipated that the collective assets of all Ethereum futures ETFs would only amount to a fraction of BITO's market cap. Roughly two months ago, I had projected assets of $300-400 million for the Ethereum futures ETFs. This estimate was based on several factors:

- A direct comparison of Bitcoin and Ethereum market caps.

- The presence of Grayscale funds for both Bitcoin and Ethereum.

- Futures data from the CME, which offers futures trading for both Bitcoin and Ethereum.

Bitcoin to Ethereum ratio by market cap, Grayscale fund assets and CME futures open interest*

One evident reason for the lackluster reception of the ETFs is the simultaneous launch of multiple offerings, which spread liquidity across several similar securities. An ETF with $50 million in assets would likely be more attractive to investors than five ETFs, each holding $10 million. However, this is more of an exacerbating technical factor rather than the root cause.

A more foundational reason lies in the waning interest in cryptocurrency from stock market investors. When BITO began trading, the crypto market was in the midst of a surge, exacerbated by deeply negative real (inflation-adjusted) rates. This was during the tail end of a significant crypto uptrend, just before Bitcoin reached an all-time high. One could even argue that the launch of BITO may have contributed to this record high by channeling fresh capital into the crypto market from traditional investors. The current context stands in stark contrast. Cryptocurrency values have been subdued, and conventional financial assets now yield attractive returns. For instance, investors can purchase short-term Treasury Bills at 5% with virtually no risk or achieve a real yield of 2.5% over five years with TIPS. Furthermore, low-risk, investment-grade bonds currently offer a 6-7% nominal yield. This presents a stark contrast to the previous situation, where the real rate was -1.5% compared to today's 2.5%.

5-year risk-free real interest rate (5-year TIPS yield, %)

No Crypto Adoption by TradFi Yet?

The conclusion of the crypto boom prompts a broader question: Do investors in the US stock market require exposure to cryptocurrency? Cryptocurrencies operate independently of traditional financial systems, making them invaluable for residents in countries lacking dependable banking infrastructures. Yet, US stock market investors already have access to the world's most secure assets, like Treasury bills. Given the current 5% interest rate on these assets, the need for an alternative independent of the US financial system becomes less evident.

This rationale might be applied to gold as well. However, physical gold is costly to store. For most retail investors, acquiring physical gold, even if it's just 1% of their net worth, isn't feasible due to exorbitant storage costs. Hence, ETFs become their primary avenue for gold investments. Similarly, institutional investors often eschew the risks associated with storing physical gold.

In contrast, cryptocurrencies are straightforward to store. For retail investors, there's little reason to hold crypto via ETFs when cold wallets provide a more direct alternative. The more pressing concern pertains to when, or even if, institutional investors will truly adopt cryptocurrencies. Their acceptance will likely be contingent on improved crypto performance, extended timelines, and decreased real interest rates.

Adding to the complexity, futures-based ETFs are less appealing due to the inherent drawbacks. These ETFs inherently detract from potential returns because of the carrying costs of futures. For instance, since its inception on October 18, 2021, BITO has markedly underperformed spot Bitcoin, witnessing a 65% decline compared to a 54% drop for spot Bitcoin.

Performance of spot Bitcoin (black) and BITO (orange) since BITO inception date (October 18, 2021)

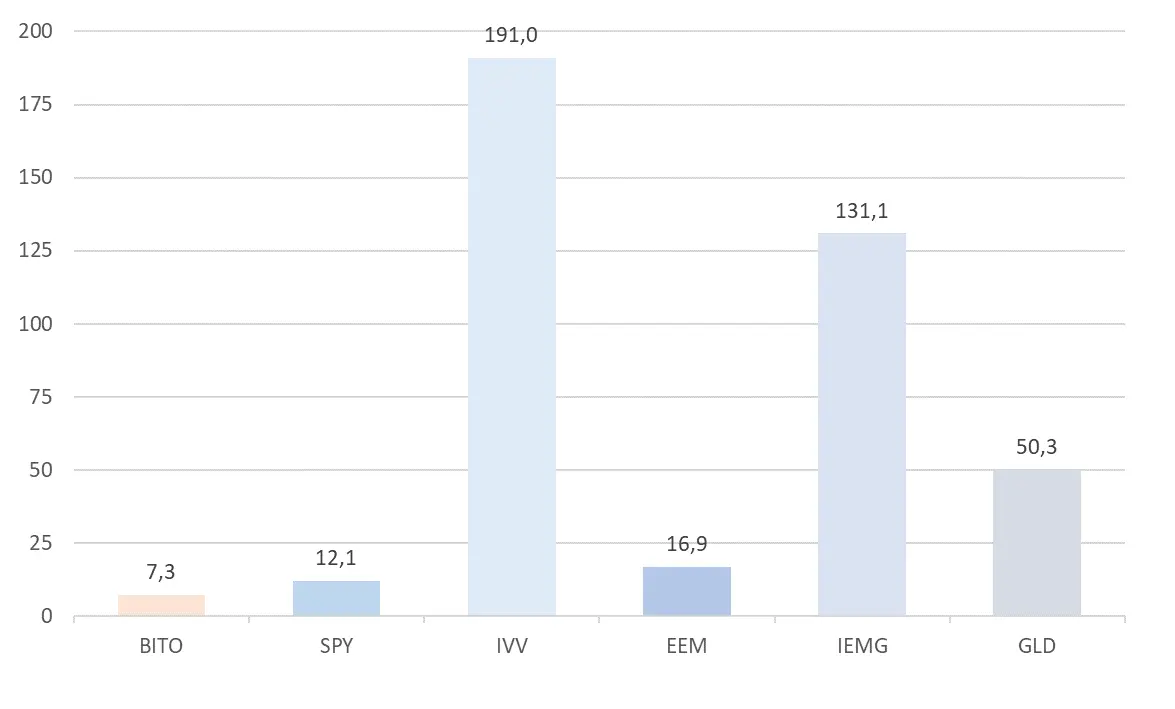

It's evident that BITO is primarily utilized for trading rather than long-term investing. A telling metric is the ratio of assets under management (AUM) to daily average trading volume, which can be interpreted as the average holding period by ETF investors. For BITO, this ratio is remarkably short at just 7 days. This duration is even lower than those for renowned actively traded ETFs typically used as trading tools.

For instance, SPDR S&P 500 ETF Trust (SPY) and iShares MSCI Emerging Markets ETF (EEM) are favored by traders due to their ample liquidity, attractively priced options, and marginally higher fees charged by asset managers. In contrast, iShares Core S&P 500 ETF (IVV) and iShares Core MSCI Emerging Markets ETF (IEMG) might have slightly reduced liquidity but compensate with lower costs, making them more enticing for long-haul investors.

Although SPY and IVV both track the S&P 500, the former is optimized for trading while the latter leans more towards investing. Similarly, both EEM and IEMG offer exposure to the MSCI Emerging Markets index. However, as illustrated in the chart below, the AUM-to-daily trading volume ratio is several months for IVV and IEMG, roughly 2 weeks for SPY and EEM, a mere week for BITO, and nearly 2 months for the prominent gold ETF, SPDR Gold Shares (GLD).

The ratio of assets under management to daily average trading volume

Conclusion

The collective assets attracted by the new ETFs amount to just a small fraction of BITO's market cap, which is undoubtedly disappointing. This likely signifies a waning interest in crypto among stock market investors. While BITO launched amidst a crypto surge and deeply negative real (inflation-adjusted) rates, the landscape has since shifted with depressed crypto prices and real rates nearing 15-year highs. This shift prompts a broader question: Do investors in the US stock market even require cryptocurrency exposure? While cryptocurrencies offer financial independence, making them invaluable in countries with unreliable banking, US investors already have access to the world's most secure assets.

BITO primarily functions as a speculative trading tool rather than a long-term investment vehicle. With Bitcoin and Ethereum highly correlated, many stock market players possibly perceive little distinction between BITO and the newer ETFs, gravitating towards the older, more liquid option.

In summary, this tepid response might carry adverse implications for the prospects of a spot Bitcoin ETF. The declining interest in crypto, except for short-term trading (already facilitated by BITO), could be a forewarning.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.