Why bitcoin is not a Ponzi scheme

In the last few weeks, the wild bitcoin price fluctuations have brought much attention to Paul Krugman's articles about bitcoin being a Ponzi scheme. I find Krugman's writings to be generally informative and interesting, and I often read his editorials in economics. However, when it comes to bitcoin, he is simply wrong, and this can be illustrated with some rudimentary arguments.

Ponzi scheme - what is it?

Let's start with what a Ponzi or pyramid scheme is. The Ponzi scheme was invented by a guy named Charles Ponzi back in the 1920s, claiming that he’s making money from arbitraging international postal reply coupons. Ponzi claimed that he was buying reply coupons in one place, selling them in another and making a profit from the difference for his investors. Ponzi promised extreme returns to entice more people to invest in his scheme, however it functioned as a pyramid with later investors funding earlier investors “returns”.

Ponzi, or pyramid scheme as it is sometimes called, is related to, but not quite the same thing as another form of fraud known as the "pump and dump" which was the topic of the movie the Wolf of Wall Street. In the pump and dump scam, a fraudster convinces people to put cash into a fraudulent or overvalued stock which pushes the price of the stock upwards. The difference between a "pump and dump" and a Ponzi scheme is that in a pump and dump fraud, the scammer typically aims to dump his stock holdings at a high price after the pump. Ordinary investors will typically find that they cannot cash out at the high price, and so whatever profits their statements show intermittently eventually disappear.

Unlike the pump and dump scheme in which the customer cannot cash out, in a pyramid scheme, investors initially can cash out at least at one point. What happens is that the scammer uses the funds from new investors to pay out older investors. The fact that older investors can cash out, makes the scheme seem more legitimate, and encourages new investors to put in fresh money. However, all pyramid schemes are eventually doomed by design. Eventually, there are simply not enough new investors to pay out older investors, and the scheme collapses, leaving everyone who didn’t cash out with a permanent loss.

Modern pyramids

One of the more recent prominent examples of a pyramid scheme collapsing was Bernie Madoff's scheme in which he took money from new investors to pay out old investors, while claiming that he made money arbitraging index futures. This worked for years despite Barron's articles questioning the uncanny returns and many professionals wondering how Bernie is putting up such stellar numbers. Fear of missing out (FOMO) kept the scheme going until the 2008 financial crisis occurred, at which point there was no longer money from new investors, and as older investors cashed out, and the scheme collapsed. One curious thing about the Madoff’s scam is that for years, a person named Harry Markopolos had been warning everyone including the SEC that something strange was going on with Madoff’s funds. Although Markopolos did not know that Madoff was engaged in a pyramid scheme, he could identify that something was amiss.

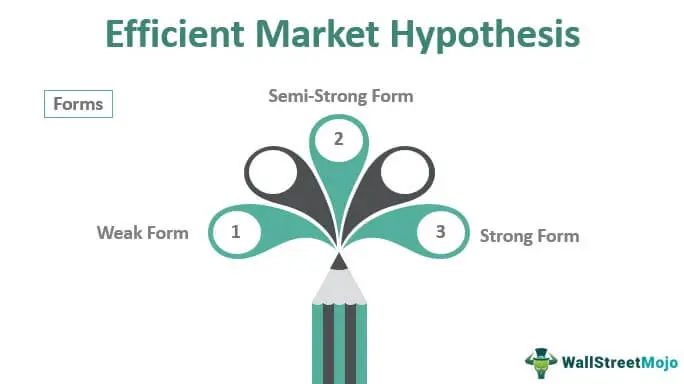

Interestingly Markopolos' argument has some implications for bitcoin. Markopolos's argument can be looked through the prism of efficient market theory. In an efficient market, investments with identical risks must have approximately identical returns. Suppose you have two investments with identical risk, one that pays 10 percent and the other that 50 percent. In an efficient market, the price of the 50 percent investment would rise and the price of the 10 percent investment would fall in due course. Eventually, the price of the investments would adjust such that the investments would pay the same amount.

The reason that all investments don't pay the same return is that the amount of risk can change with the amount of return. Suppose I have an investment which pays 10 percent. I can change the return to anything I want by either borrowing money or adding cash. If I want an investment that pays 50 percent, I can borrow money to leverage my investment so that I can get 50 percent returns. However, there is a clear tradeoff, because in borrowing money to leverage my investment, I am increasing the risk of the investment.

Efficient market theory does not say that investments with high returns are impossible. It merely says that high returns are associated with high volatility. In looking at whether an investment is suspicious or not, one can look at the relationship between the returns and volatility. This is precisely the reason why Bernie Madoff's investments seemed very strange to Harry Markopolos. It wasn't that Madoff was delivering high returns, but seemingly without any volatility, while high returns should typically be associated with large price fluctuations.

How does it apply to bitcoin?

If you apply the Markopolos argument to bitcoin, you will find that there is no evidence of a pyramid scheme or anything unusual. While bitcoin has proved to be a high return asset, over the past few years, this high return has been associated with extremely high volatility, and the return/volatility relationship is not unusual when compared to other investments. In addition, one characteristic of a pyramid scheme is that once they fall, they typically never recover. This is because there is no underlying value and because people who are involved in a pyramid scheme are attracted solely due to the high returns. Once the returns dry up and the investment goes down, things fall apart. However, the history of bitcoin is a series of dramatic ups and downs, and this is not how pyramid schemes typically behave. If Krugman were correct then when bitcoin went down, everything would unravel, and it would never recover.

Just because Paul Krugman doesn't see bitcoin as having any intrinsic value, it does not mean that it has no value. It turns out that bitcoin is very useful for sending money between places that don't have much of a financial infrastructure. If you want to send money between say Tanzania and Estonia, there isn't a better way of moving money than via bitcoin, and that gives this coin value.

You might want to know

1) What are the risks of bitcoin in 2021?

The big risk of bitcoin is that it is extremely volatile and will move up and down drastically, due to this high historical and implied volatility. The good news about bitcoin is that there are likely no new risks in 2021, and so investors can look at the prices of bitcoin over the last few years (which price in existing risks) to see if they want to ride the rollercoaster.

2) Is bitcoin too risky for the average investor?

The question is how much an investor feels comfortable in handling the downturns in bitcoin, and this in turn should dictate how much the investor should put into bitcoin. One question that any investor should ask themselves is how they would react if the minute after they bought bitcoin, it dropped 20% and in the week after they bought bitcoin, it dropped 50%. If this feels uncomfortable, then they've put too much money in.

3) Can Bitcoin be used as a hedge against inflation?

Yes, but it is less correlated than traditional hedges such as gold, real estate or Treasury Inflation-Protected Security (TIPS). The problem with bitcoin is that because the price is volatile, it is affected by many things other than inflation. However, one good thing about bitcoin is that it's portable. Unlike gold or real estate, you can carry a large amount of bitcoin by just remembering the private key.

4) What are the warning signs of a Bitcoin investment scam?

Anything that seems too good to be true and promises a reward without any risk should be viewed as suspect. Also anything that involves trusting someone else to hold assets should be viewed with caution.

One thing that I've noticed about scams versus actual investments, is that real investments will tell you that you could lose your money, whereas scams typically try to make you forget that you could lose your money. One question that you should always ask yourself is how do you know that the person that you are handing money to, won't just run away with it.

5) How to avoid cryptocurrency scams

The main thing is to just be suspicious of anything that offers you something for nothing, and don't be afraid to say no. Also, you can try joining a local bitcoin users group. One thing about bitcoin is that there is a large community of people globally, and many will often offer helpful advice.

6) How to report cryptocurrency scams

One unfortunate fact is that in crypto once you've been scammed of money, it is almost impossible to get your money back. The main thing you can do is to reach out to other people that have been scammed and try to make some noise on the internet, reddit and if possible file a report to the police or competent regulatory authority. It's unlikely that you will get any money back, but you can make it slightly harder for the perpetrators to scam someone else.

This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.