The Long Straddle Options Strategy: A Safe Bet Against Market Unpredictability

The market has no friends or favorites. It can go your way today, but tomorrow isn't promised. Thus, traders always seek ways to stay to gain maximum profit regardless of market direction.

Being profitable in varying market conditions involves engaging the right strategies that help you get the most from market movements - but because of the market's unpredictable nature, sustaining consistent profit can be arduous. Therefore, protecting yourself from the unpredictability of market movement is paramount. Hence, concepts like the long straddle options strategy.

The long straddle options strategy is essentially a bet on volatility. It's used when an investor takes a view that the market will react strongly to an upcoming event while being unsure of the market direction. So, an investor applies the long straddle strategy that allows them to make money regardless of whether the price of an asset moves up or down, as long as it moves beyond a certain threshold.

Before we delve into the long straddle strategy, let's lay a little foundation by explaining what a straddle is in general.

What Is A Straddle?

A straddle is a strategy in options trading where an investor holds two positions (a buy&sell options) simultaneously on one underlying asset. It involves buying or selling a call option and a put option at the same time on one underlying asset, with the options having the same strike price and expiration date.

The straddle is a market-neutral options strategy. What it means is that the direction of the market doesn't matter. It generates profit and loss, depending on how much the market moves. The straddle trader, therefore, needs to have a good understanding of market dynamics and be able to anticipate significant market event that could trigger large price movements.

The position delta, which measures the sensitivity of the straddle position to changes in the base asset price, is typically close to zero at the time of establishing the position. This means that the straddle position is initially insensitive to changes in the underlying price. However, as the price of the base asset starts to move, the position delta changes and the straddle position starts bringing you gains.

An Overview Of The Long Straddle Option Strategy

The long straddle options strategy is one out of two straddle strategies, the other being the short straddle option strategy or sell straddle.

The long straddle strategy is a wager that the market will react strongly to an event, either causing a rapid spike in price or a sharp decline. Examples of such events include earnings announcements, economic data releases, or major political events. When volatility increases, the prices of both the call and put options increase, which can lead to profits for the long straddle trader.

The straddle has become a popular strategy for a lot of investors over other strategies because of its dual profitability, controlled risk, and unlimited profit potential. The long straddle strategy is often executed on a crypto exchange, where the trader can easily buy and sell options on various cryptocurrencies. The potential for high volatility in cryptocurrency prices makes the long straddle strategy particularly appealing in the crypto market.

Long Straddle Option Strategy, The Whole Idea.

In a long straddle options strategy, an investor purchases both a long call and put on one underlying asset, ensuring it has the same strike price and expiration date.

Once implemented, it nullifies the effect of the unpredictable market movement on profit and loss. With a buy straddle strategy, the market movement doesn't matter. It can move in either direction, as long as the movement is significant enough, it generates profit.

The buy straddle is invoked when an investor predicts sharp market movement but cannot ascertain the price direction. This strategy plays out well in a highly volatile market, unlike the sell straddle that works best in a low volatile market.

Understanding The Concept

A long straddle strategy is a view that the underlying asset will move, either to the upside or to the downside. The whole concept of the long straddle options strategy typically depends on the significant event taking place that would affect the underlying asset.

The investor expects the underlying asset to shift from a low point to a high point in terms of volatility, and because a straddle is neutral in nature, either way, the market moves, the profit margin remains the same. This neutrality is what makes the long straddle a popular strategy among traders who want to profit from volatility, rather than having to accurately predict the direction of the market.

The long call option records profit when there is an increase and the long put option records profit when there is a decrease in the underlying asset, provided that the price reaches a certain threshold that makes up for the cost of the paid premiums. This is why it's important for the trader to carefully consider the exercise price and the premium of the options when setting up a long straddle trade. The exercise price should be chosen such that it is close to the current price of the base asset, while the premium should be as low as possible to maximize potential profits.

The straddle trade becomes an investor's safe bet when he's sure the asset price is about to react significantly to news. The straddle trade can be deployed before a political decision, an earnings release, passage of a new law, or a deciding election result. These events often cause significant volatility in the market, which can lead to large price movements in the base asset. By setting up a long straddle trade in anticipation of these events, the trader can profit from these price movements, regardless of their direction.

The Goal Of A Long Straddle

The only goal of a long straddle options strategy is maximizing profit from a sudden move in either price direction by the underlying asset, usually activated by a newsworthy event. This strategy is particularly useful in markets where there are frequent large price movements, such as the cryptocurrency market. Cryptocurrencies are known for their high volatility, which can lead to large price swings. By using a long straddle strategy, a trader can profit from these price swings, regardless of whether they are upwards or downwards.

Either up or down, the long straddle options strategy provides the investor with coverage from risks and enough leverage to profit from a strong market move, while limiting potential losses. This is because the maximum loss from a long straddle strategy is limited to the premium paid for the options. If the base asset price does not move significantly, the contracts will expire worthless and the trader will lose the premium paid. However, if the base asset price makes a large move in either direction, the trader can make a profit that is potentially much larger than the premium paid.

When To Apply A Long Straddle

The long straddle strategy is usually engaged before the date of a news release. Traders generally assume the market will anticipate such news releases, so trading becomes uncertain and occurs in small ranges. When such news is finally released, all the market tension either to the upside or the downside breaks loose, causing rapid price movements in the underlying asset.

Since the direction of the market is unknown to the investor before the news release, the long straddle becomes the reasonable strategy to maximize profit. This is because the long straddle strategy does not require the trader to predict the direction of the market, but rather to profit from the volatility caused by the news release.

An investor buys a long call and put options at the same strike price. The strike price should be close to the current spot price. In a scenario where there is an increase in price, the trader benefits from the call option and, for a decrease in price, the trader benefits from the put option. This is why the choice of strike price is so important in a long straddle trade. The closer the exercise price is to the current price of the base asset, the higher the potential profits from the trade.

The investor suffers loss when movement in price wasn't large enough to make up for the premium they paid for both options. The maximum loss is restricted to the cost of both options (premium). As with every trading strategy, there are ups and downs. Therefore, it is crucial to consider the potential risks and rewards of a long straddle trade before entering the trade. By understanding the potential outcomes of the trade, the trader can make more informed decisions and manage his risk effectively.

Ups And Downs Associated With The Long Straddle

The primary benefit associated with the options straddle strategy is its dual profitability. It allows an investor uncapped profits while managing risks. On the uptrend, the room for profit is very large, since the news release can cause asset prices to soar. On the downtrend, there is enough room for profit, since the asset price can crash to zero. This dual profitability is what makes the long straddle strategy so attractive to many traders.

The options straddle takes the dilemma of price direction away from the investor, as market direction is unimportant. The important thing is high volatility in either direction. This is why the long straddle strategy is often used in markets that are known for their high volatility, such as the cryptocurrency market.

Another benefit of the straddle trades is limited risk. While its profit is uncapped, the loss has a limit to it. The maximum is restricted only to the cost of the call and put options premium. This limited risk is another factor that makes the long straddle strategy attractive to many traders. Even if the trade does not go as planned, the trader knows that his maximum loss is limited to the premium paid for the options.

The risk associated with the long straddle strategy is that the stock price may not generate enough reaction to the news release. Option sellers further aggravate the risk by increasing the price of options, called premium, as a result of being aware of the approaching news release. Traders need to carefully consider the potential impact of the news release on the price of the base asset. If the news release is not expected to cause a significant price movement, the long straddle strategy may not be the best choice.

As a result, entering the long straddle strategy becomes more expensive. Option sellers make it harder for traders to profit from the move because, in a bid to safeguard their interests, they increase prices just enough to cover the forthcoming event. This increase in contracts price can make the long straddle strategy less profitable, as it requires a larger price movement in the base asset to cover the increased cost of the options.

This increase in options price is a thorn for traders because it requires more significant market movement in order for them to book profit. If the underlying asset fails to react strongly to the news, the investor suffers a loss since the settlement he receives upon expiry, if any, ends up being worth less than the premium he initially paid for the options.

How To Construct A Long Straddle

We've been looking at different aspects of the long straddle options strategy, and we already understand the limitless profit potential it holds should the price of an asset increase. Should the price hit zero, profit becomes the strike price minus the premium paid (cost of purchasing both options).

We've also seen that what makes long straddle an effective strategy is its emphasis on risk control and its dual profitability. Let's now consider how to construct a long straddle.

- To build a long straddle, begin by selecting a base asset with potential for high volatility.

- Next, acquire both a call and a put option on this asset with the same exrcise price and expiration date; ideally, the strike price should approximate the current price of the asset.

- Keep your eye on the market after your purchase to track the asset's price

- Based on its movement, you may exercise your call option for profit if the price rises significantly, or your put option if the price drastically falls.

- To calculate your profit or loss, use the formulas provided below.

- Finally, determine when to close your position. This could be at the point of options expiry, upon reaching a satisfactory profit, or to limit further losses. Keep in mind, you don't need to exercise both contracts; you could let one expire worthless.

Always remember, as trading options can be risky, it's important to do your due diligence and possibly consult a financial advisor.

Effectively using a long straddle involves knowing how to calculate profit (when the long call activates or the long put activates) and loss when there is stagnancy in the market. This requires a good understanding of option pricing and the factors that affect it, including the price of the base asset, the exercise price of the option, the time to expiration, and the volatility of the base asset.

Calculating profit for an increase in price is expressed by :

- Profit (call) = Price of underlying asset – Strike price of call option – Total premium

Calculating profit for a decrease in price is expressed by :

- Profit (put) = Strike price of put option – Price of underlying asset – Total premium

Losses can occur when the price doesn’t move enough, hence the premium paid exceeds the profit derived from market movement in either direction. To help you further grasp the concept, we'll consider a long straddle options example. This example will illustrate how the long straddle strategy can be used to profit from significant price movements in the underlying asset, regardless of their direction.

A Long Straddle Options Example

Let's put all we've been talking about into numbers now.

Take an asset that trades at $100. The cost of a call and put option is $5, respectively. You, as an investor, decide to take a straddle trade, so you purchase one of each option at a strike price of $100. The straddle position is profitable if the asset price is above $110 or below $90 at expiration, or if you sold your option(s) before the expiry for a higher premium than was your entry price. You suffer a maximum loss if the asset strike price remains at $100 at expiration. Your total loss being $10 per contract, provided that the contract represents right to buy/sell 1 underlying asset.

You record profit if the asset strike price goes above $110 or below $90. For instance, if the asset price increases to $130 at expiration date, your profit is ($130 – $100 – $10 = $20). This example shows how the profit from a long straddle strategy is determined by the price of the base asset at the time of expiry. If the base asset price moves significantly from the exercise price, the trader can make a profit that is potentially much larger than the premium paid for the options.

Breakeven In Long Straddle

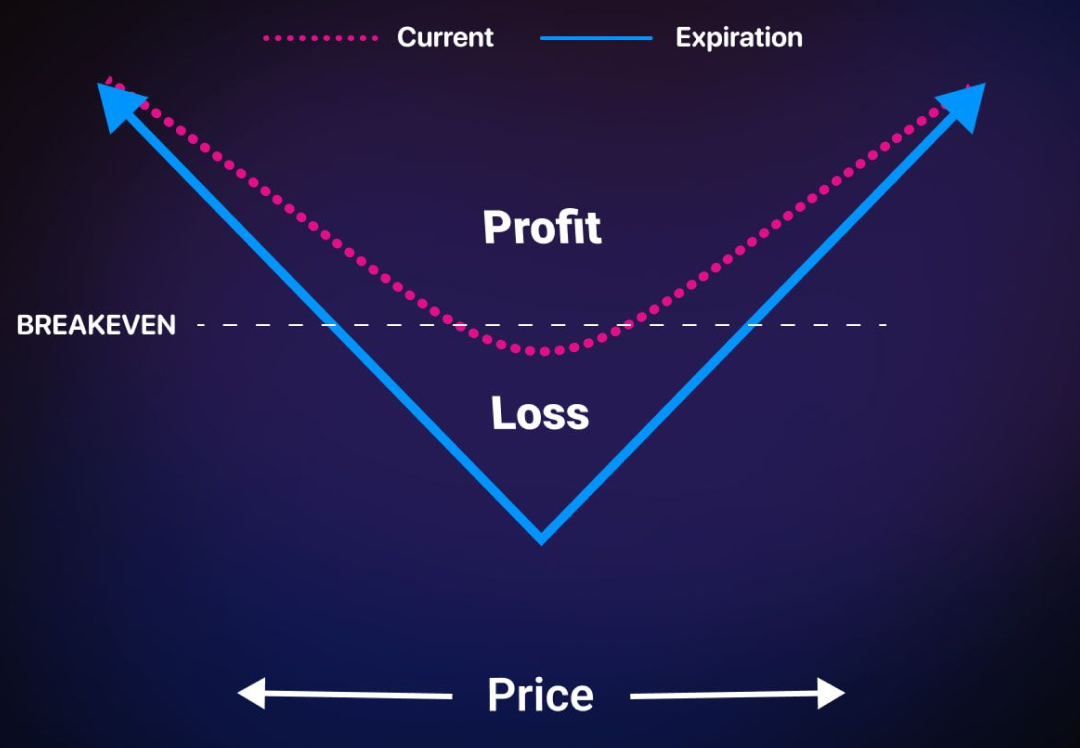

As with every strategy, there are always three exit points in a trade; profit, loss, and breakeven. Breakeven in a straddle trade involves two factors – the strike price and the total premium paid, as they are constants in every trade. The breakeven points are the prices at which the trader neither makes a profit nor a loss. If the base asset price at expiry is equal to one of the breakeven points, the trader will recover the premium paid for the contracts, but will not make a profit.

Calculating the breakeven points in a straddle trade is as easy as calculating profit and loss. Understanding the breakeven concept is very important, as it helps you know whether to use the straddle strategy.

- Breakeven point (call) = Strike price + premium paid

- Breakeven point (put) = Strike price - premium paid

Long Straddle Risk To Reward Ratio (RRR)

The long straddle has a very beneficial risk-reward ratio. It has a limitless profit potential should the price of the stock choose an uptrend and a limited risk profile. This is one of the main advantages of the long straddle strategy. The potential for unlimited profits combined with the limited risk makes the long straddle strategy an attractive choice for many traders.

The RRR of the long straddle is part of what makes it the go-to options' strategy. The total risk is strictly limited to the cost of buying both options (the long call and put). This means that the trader knows exactly how much they stand to lose if the trade does not go as planned. This limited risk is a key feature of the long straddle strategy and is one of the reasons why it is so popular among traders.

Important Factors To Consider

Implied Volatility and Time Decay

Hopefully, this article helped you to answer the question “What is a straddle?” as well as guided you on when you might want to consider deploying this strategy. Mind you, before entering a straddle position, it's important to understand another factors that affect all options strategies, such as implied volatility (IV) and time decay (TD).

These two factors can have a significant impact on the profitability of a long straddle trade. Implied volatility is a measure of the expected volatility of the base asset, while time decay refers to the decrease in the value of an option as it approaches its expiry date.

These two factors are arguably crucial as they largely impact the option premium pricing. In a straddle trade, a significant increase in implied volatility determines the success of the strategy. The increase in implied volatility causes the value of the call and put options to also increase, creating room for traders to close the straddle trade before the options hit the expiration date.

On the other hand, time decay is the gradual or rapid depreciation of an open position till it hits its expiration date. This is why it's important for the trader to consider the time to expiry of the options when setting up a long straddle trade. The longer the time to expiry, the more time there is for the base asset price to make a significant move, which increases the chances of the strategy being profitable.

These two factors might be tagged the most critical, but they don't completely sideline other factors that contribute to the success or failure of the long straddle strategy. For example, the trader also needs to consider the liquidity of the options, the transaction costs associated with the trade, and the potential impact of changes in interest rates on the value of the contracts.

Bringing everything to a close, the long straddle options strategy is easy to apply, but might still require time to fully grasp. It is best suited for volatile asset classes, and offers a solid RRR. However, it's important to remember that while the long straddle strategy can be profitable, it's not a guaranteed way to make money. Like all trading strategies, it involves risk and requires careful planning and execution.

How Do Option Prices Impact the Long Straddle Strategy?

Another factor which significantly impacts the outcome of the strategy is the option prices. The prices can vary and are dependent on the particular exchange where they are traded. As an investor, you make a profit if the base asset's price moves significantly, either upwards or downwards. However, if the option prices are high, the asset's price needs to move even more substantially to reach a break-even point and eventually make a profit. Therefore, high contract prices can reduce the profitability of the long straddle strategy.

Conclusion

In conclusion, the long straddle options strategy is a sophisticated trading strategy that offers the potential for high profits while limiting risk. It's a strategy that requires a good understanding of the market and the factors that affect option prices, but with the right knowledge and experience, it can be a valuable tool for any trader. So, whether you're a seasoned trader looking for a new strategy to add to your toolkit, or a novice trader looking to learn more about the world of options trading, the long straddle options strategy is definitely worth considering.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.