The Boom of Crypto Derivatives Market

The crypto derivatives market has been booming in recent months, with trillions of dollars in monthly market volume and daily volume that sometimes rival the trading volume of the New York Stock Exchange. The derivatives market has been on an upward trend, and more institutional involvement means we might just be scratching the surface.

Let's look at what crypto derivatives are, why they are important, and whether you should consider a CeFi or DeFi Derivatives exchange.

What Are Crypto Derivatives?

Derivatives trading is an alternative to spot trading. As its name implies, derivatives directly derive their value from an underlying asset, but instead of being traded using their current prices, they are a financial contract that involves a buyer and seller to speculate the future value of the asset without owning the asset itself. The assets could be anything from bonds, stocks, or even cryptocurrencies. The most commonly traded crypto derivatives include futures, options, and perpetual futures.

The derivatives market comes with so many liquidity and arbitrage opportunities because the difference between an asset's current value and its perceived future value cannot be the same across the board.

The crypto derivatives market is no different. The possibility for gains is endless, while the possibility of losses might be limited, if structured correctly, and one way to make the most of the crypto derivatives market is to understand how it works.

Why Are Crypto Derivatives Important?

There are many reasons crypto derivatives are essential to the crypto economy. Some of them include:

Diversification: Diversification, in prior times, involved investing in different asset classes, with each one serving as a hedge to others. With the derivatives market, traders can invest in the same assets with more safety and risk reduction.

Risk Reduction: Shorting a crypto position is not appreciated enough. Crypto prices do not always go up, and investors can hedge their long spot positions by opening shorts. With this, they do not need to sell their invested cryptos to avoid the downturn, and they can still profit from the crypto volatility. With the crypto market known for its high volatility, derivatives save traders and investors from unexpected risks.

Price discovery: Derivatives allow investors to determine the value of an asset using several variables. Traders can become a lot more efficient with adjusting their positions by using various information that is embedded into determining the assets' current price, such as liquidity.

Reduced transaction costs: The transaction costs from crypto derivatives are much cheaper than trading the same asset in the spot market.

Centralized and Decentralized Derivatives Markets

There are different platforms where traders can trade derivatives. Some are decentralized, and some others are decentralized. Several researches have revealed that derivatives trading has five times more volume than the spot counterparts.

Decentralized Derivatives Markets

Let's see some of the most popular decentralized derivative exchanges.

Dydx

Look no further if you're wondering why over 15,000 traders are on the dYdX platform. With its off-chain order books and on-chain settlements on perpetual futures, dYdX transformed the perception of DeFi derivatives exchanges.

You can access multiple markets on the dYdX exchange with just one account, and yes, you will have leverage on each of these markets. Leverage can often be up to 25x, and depending on how frequently you trade, you can earn fee discounts. Using StarkWare for security is a wise decision because it increases the privacy of users' accounts.

Opyn

Can you trade options without the strike and expiry date? The answer would have been ‘No’ if Opyn was not created. Opyn uses squeeth (squared ETH) as a new crypto derivative. Instead of tracking ETH, it tracks ETH squared. The two squeeths available are the Long squeeth and the short Squeeth and what makes them different from normal options trading is that the profits from a squeth is more than the profit from a 2x leverage, and the losses are lesser. Opyn has a volume of $3.2 billion, and the TVL is $240 million.

Premia Finance

With its new V2 upgrade, Premia Finance is bringing game-changing innovation to options trading. It has implemented an automated peer-to-pool market architecture, making it easier for option makers to connect with option buyers.

The main drawback of its V1 is that it operated manually, which suggests that buyers may not see options with the desired strike price or expiration date. The new upgrade has added more flexibility. Sellers simply deposit their assets and earn passively, while buyers design their own options with their preferred strike price and expiration dates.

Premia finance will also pique the interest of NFT enthusiasts. You can sell your options positions without actually closing the option. When an option is purchased, the buyer receives a visually appealing certificate which can be traded without affecting the option itself.

Hegic

Hegic is not a company, it is a decentralized protocol. Hegic, which was launched in 2020, just before the March market crash, has some of the most exciting features available to derivatives traders.

Hegic provides 100 percent gas-fee free options trading, which means that all transaction costs are covered on trades of 10 ETH or more, and premium prices for your options are set at the lowest possible level, even lower than popular options trading platforms like Deribit. Because options necessitate extra caution, Hegic includes an auto-hedging feature. You can use this to enable the feature to protect yourself from the downside if your options trade goes wrong.

Centralized Derivatives Exchanges

Here are also some of the most popular centralized derivative exchanges.

Binance

Binance has the most daily volume in derivatives. Averagely, its daily volume is more than the other centralized derivatives exchanges combined. Binance has a user-centric product but, perhaps, one thing that makes it widely loved is that its matching engine can match up to 100,000 orders in one second.

Bitmex

Bitcoin Mercantile Exchange, popularly called Bitmex, is a centralized cryptocurrency exchange as well as a futures trading platform. Bitmex has a few advantages, like low trading costs, substantial liquidity for Bitcoin, and a professional trading dashboard.

Deribit

Deribit which is very popular among crypto options traders, because of its low latency and deep liquidity. Just like Bitmex, Deribit offers a professional trading dashboard. Deribit is a crypto derivatives exchange that offers Bitcoin and Ethereum futures, options, and perpetual swaps, and is a market leader with around 90% of the market’s open interest.

Kraken

Kraken was one of the first crypto exchanges launched. Like in the spot market, Kraken derivatives are easy to use, and beginners will understand its usage with little help. Also, Kraken offers up to 50X leverage.

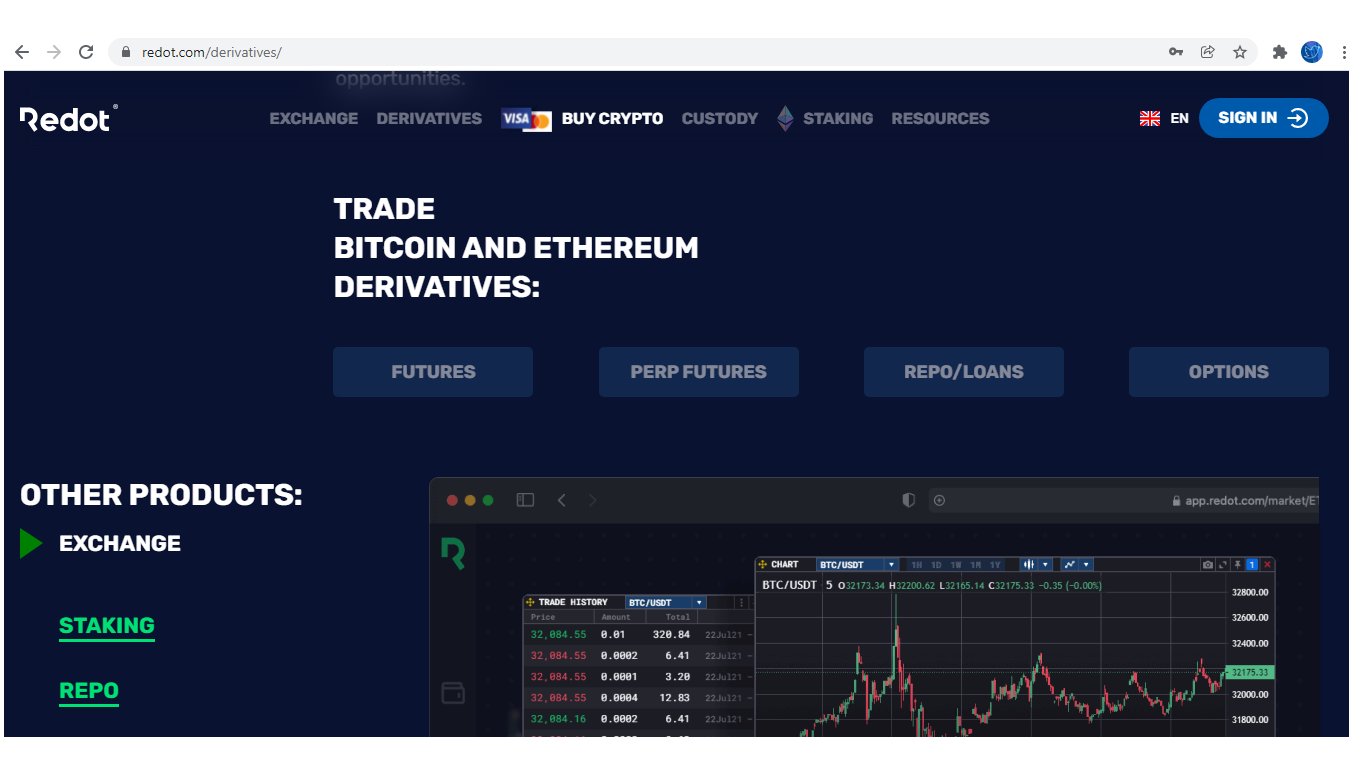

Redot

The Redot derivatives platform is coming soon. It would offer futures, options and perpetual futures. Redot’s margin rates are based on market factors such as volatility which are recalculated in real time and provide fair requirements while allowing high-leverage to maximize market exposure and returns. Watch out for more updates !

Centralized Derivatives Exchanges vs Decentralized Derivatives Exchanges

While both the centralized and decentralized derivative exchanges have their advantages and drawbacks, below we compared them based on pre-selected criteria to help you to do your own research before selecting one of the platforms.

Volume

Centralized exchanges see more volume than their decentralized counterparts. A few reasons make for this; first, the fees offered for both the maker and taker are attractive, and there is also immediate settlement of the contracts. Also, although the goal of the blockchain technology is decentralization, many users still prefer third-party custody of their wallets.

Technology

The technology available on centralized Derivatives exchanges is quite superior to its decentralized counterpart, in terms of ease of use and capital efficiencies. DeFi takes longer time to settle, and the exchange is liable to suffer the same scalability issues as the protocols they are built on. For instance, the DeFi Derivatives exchanges built on Ethereum suffer from high gas fees during network congestion.

Simple structured products

Some decentralized exchanges offer structured products such as covered calls. If you are a novice investor, it might be something to look at.

Security

Both the centralized and decentralized exchanges offer secure perks. Although there have been issues of hacking on both ends, having an underlying company that can show responsibility for the technological breach gives centralized exchanges an edge here.

Closing thought

Crypto derivatives are important in helping both new and adept investors hedge their risks. The crypto market will not always go up, and derivatives offer a means to earn while the market is down. Choosing the right derivatives exchange ultimately comes down to personal preference, and with Redot’s derivatives platform launching soon, you will have one more solid alternative at your disposal.

Like in every other financial instrument, never forget to put proper risk management techniques in place, and don’t trade more than you can lose.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.