stETH: Is Arbitrage Worth the Risk?

Lido’s stETH currently trades with a discount to Ethereum. The token will be eventually converted to Ethereum, so it looks like an arbitrage opportunity. But what are the risks?

stETH/ETH

Lido stETH is a staking protocol designed to be a liquid staking solution for ETH. Investors can deposit their ETH into Lido smart contract and receive stETH in return. Lido stakes received ETH into a parallel ETH blockchain known as Beacon Chain. Beacon Chain is co-existing with the mainnet and will be merged with the Ethereum blockchain later this year upon its conversion from PoW to PoS consensus. Ethereum 2.0 is an upgrade from the original Ethereum which is meant to be faster and cheaper to use. Instead of miners, Ethereum 2.0 relies on validators who already hold some ETH to process new transactions. In order to validate a transaction on Ethereum 2.0, a validator must deposit some ETH into a crypto wallet using a smart contract. Validators are then awarded ETH for proving transactions, like crypto miners. So, crypto investors can effectively receive interest on their ETH holdings by becoming validators. Like Ethereum 2.0, Beacon Chain provides rewards for those investors who agree to stake their ETH holdings for securing and governing it. The point is that the staked ETH holdings cannot be sent back to the original Ethereum blockchain and cannot be accessed until after the two systems are merged. So, staked ETH holdings are completely illiquid.

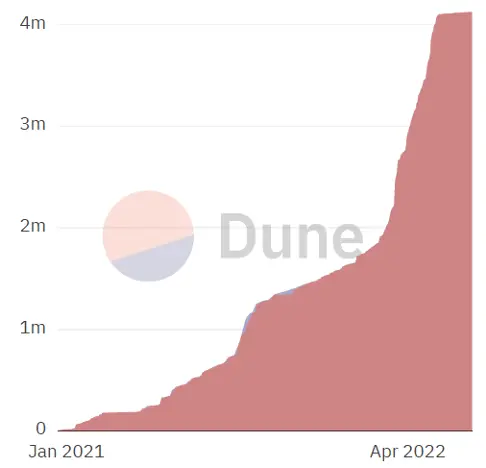

Lido found a way to both get a staking reward and keep staked holdings liquid. This has made it hugely popular, with Lido’s deposits growing from 16.6 thousand ETH at the end of 2021 to 4.1 million ETH as of June 24, accounting for 32% of all staked ETH (according to Dune Analytics).

Lido Deposits (ETH)

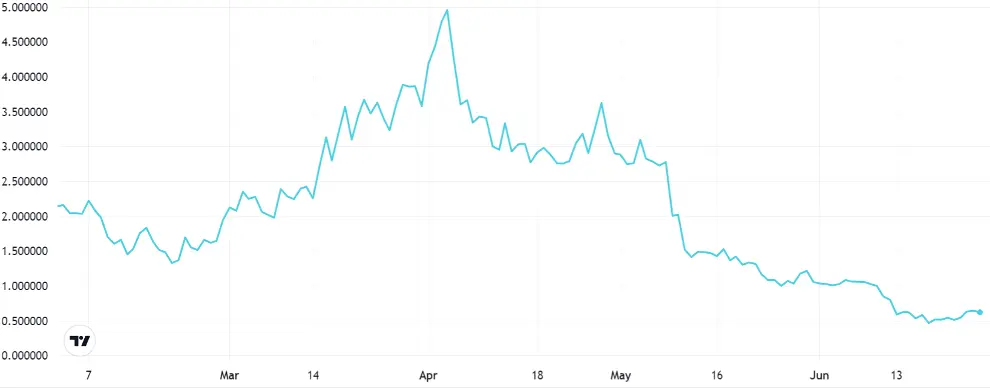

That did not help its own token though.

Lido Finance Price (LDO/USD)

The question is though - how to price stETH? We believe a discount to ETH should be warranted because of available arbitrage opportunities. If stETH becomes significantly more expensive than ETH, it’s easy to stake ETH in Lido, get stETH and sell it for immediate profit. The opposite procedure is far trickier, because stacked ETH will be unblocked only when Ethereum 2.0 arrives. So, the date of stETH conversion into ETH is not known and can only be estimated. First of all, the current Ethereum blockchain needs to merge with Beacon Chain. Vitalik Buterin at Ethereum Shanghai Summit said it could happen in August if there are no issues. After that, there will be a process of providing a bridge between the two environments and eventually uniting them. It may take several quarters before stacked ETH can be unfrozen.

In theory, the discount of stETH to ETH should reflect staking yield and premium for lower liquidity, Lido risk, etc. In practice, we should also account for flows. Many platforms offer to take stETH as collateral. It makes it possible to borrow other cryptocurrencies against stETH holdings and so to get financing while earning rewards. So, it is tempting for crypto investors to stake their ETH holdings and cover their liabilities and expenses by borrowing against stETH. This practice actually became too popular. Some crypto players (most notably Celsius) have gone as far as taking deposits with a fixed rate and staking received assets. That works perfectly as long as fund outflows are modest or stETH price is reasonably close to ETH. However, these conditions may be correlated, because large outflows create selling pressure on stETH and drag its price lower.

We believe margin call prospects are the most important risk to stETH/ETH price. There are numerous reports of big players facing outflows while being trapped in stETH. On Monday (June 17) CNBC said Three Arrows Capital had defaulted on $670 million loan provided by Voyager Digital. Three Arrows Capital was previously a large holder of stETH and had already sold dozens of million USD worth of stETH. While a Binance blogger suggested Three Arrows Capital had no more stETH it’s not clear if it’s true. Three Arrows Capital is just an example and the extent of deleveraging and subsequent contagion is not clear yet.

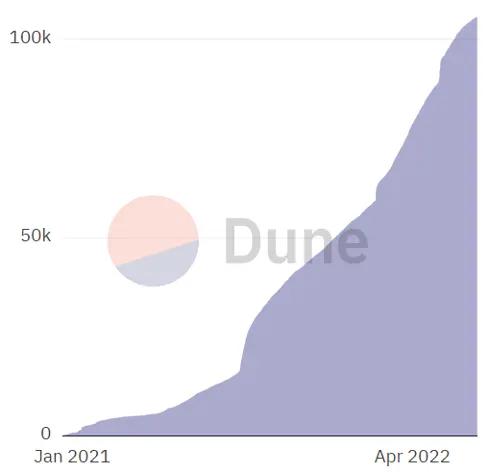

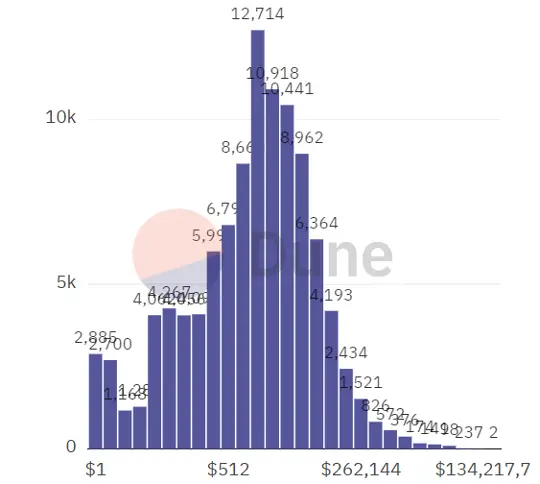

Let’s take a look at Lido deposits data. Lido has about 105,500 unique deposits, with an average deposit of approximately $39,000, but most deposits are in the range of $1000 to $15000. We think such small investors are unlikely to be leveraged and probably represent a relatively stable funding source. In traditional banks, small depositors are usually considered far more reliable funding source compared with large depositors.

Also, there are 572 deposits larger than $1 million, including 98 deposits larger than $17 million. 7 deposits are larger than $67 million. We estimate that the 100 largest deposits represent at least $1550 million, which is 38% of the total deposit value. We have no information about their leverage and risk management, but in traditional banks, large depositors are usually far more sensitive to risks and funding costs. If just 25% of large deposits (more than $17 million) are significantly leveraged, there is margin call risk for almost 10% of all stETH.

Lido's Number of Unique Deposits

Lido’s deposits Value Distribution by Number of Deposits (USD)

So, we think that overhang risk related to margin calls suggests caution. Investors should wait for better visibility into the deleveraging process or allocate only a small part of their funds to stETH/ETH arbitrage.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.