Santa, I Want ETH2 Staking!

In 14th century ancient Greeks believed that αἰθήρ or Ether was the pure essence that the gods breathed, which should be above the upper edge of the picture above, filling the space where they lived, analogous to the air breathed by mere mortals. Some years later in Kolomna, Russia Vitalik Buterin was born, a kid with a knack for math and stubbornness he got from his professor father leading him to repurpose the name into what’s now second cryptocurrency by market capitalization, or what some might consider pure crypto essence.

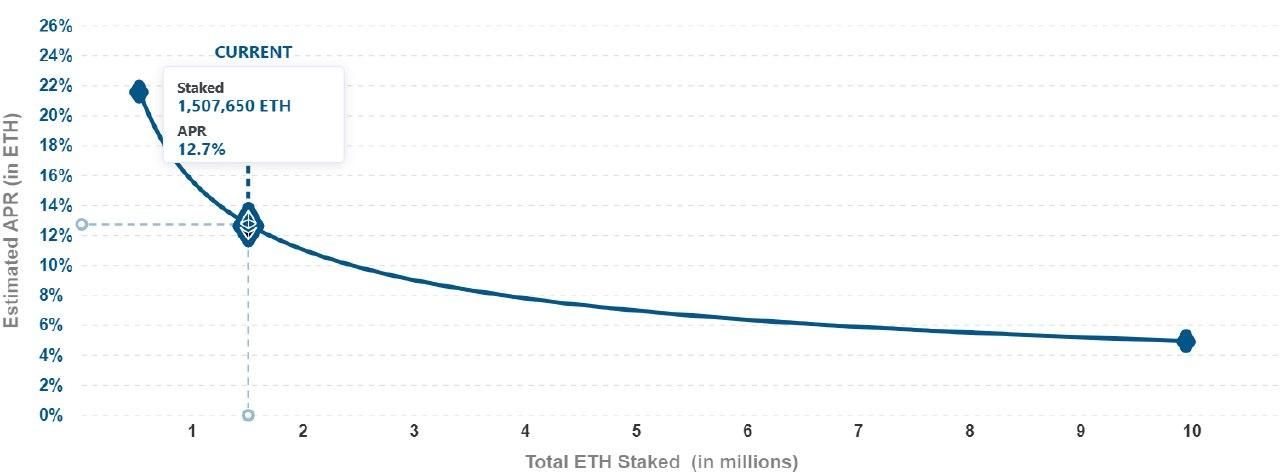

Ethereum has gone a long way from tinkering to try to improve Bitcoin, to futures being launched on the Chicago Mercantile Exchange. If you’ve been keeping your ear to the ground, or simply have ears like Vitalik, I’m sure that you would have heard that significant changes are taking place with ETH and its ecosystem, namely introduction of ETH2. If you read no further past the executive summary, before I proceed to throw jargon at you, and to make sure you are certain that this is not clickbait – current yield if you stake ETH2 is 13.5%. Mind you this is yield in Ethereum 2.0, not is some shitcoin DeFi which was invented yesterday. However, there’s a ton of pesky details so if you can’t go outside or to the coffeeshop because of COVID-19, read further, and also check out launchpad.ethereum.org where the below graph is interactive and you can figure out how much you can earn live. If you don’t care to figure out the details and just want to point – click – earn in a quick plug for the boys at Redot exchange – they will support super easy staking, trading and earning of ETH2 which is the way to go unless you’re a Computer Science major with 4.0 or dropped out of uni to work in Silicon Valley.

So, what’s different between Ethereum and Ethereum 2.0 and why should I care?

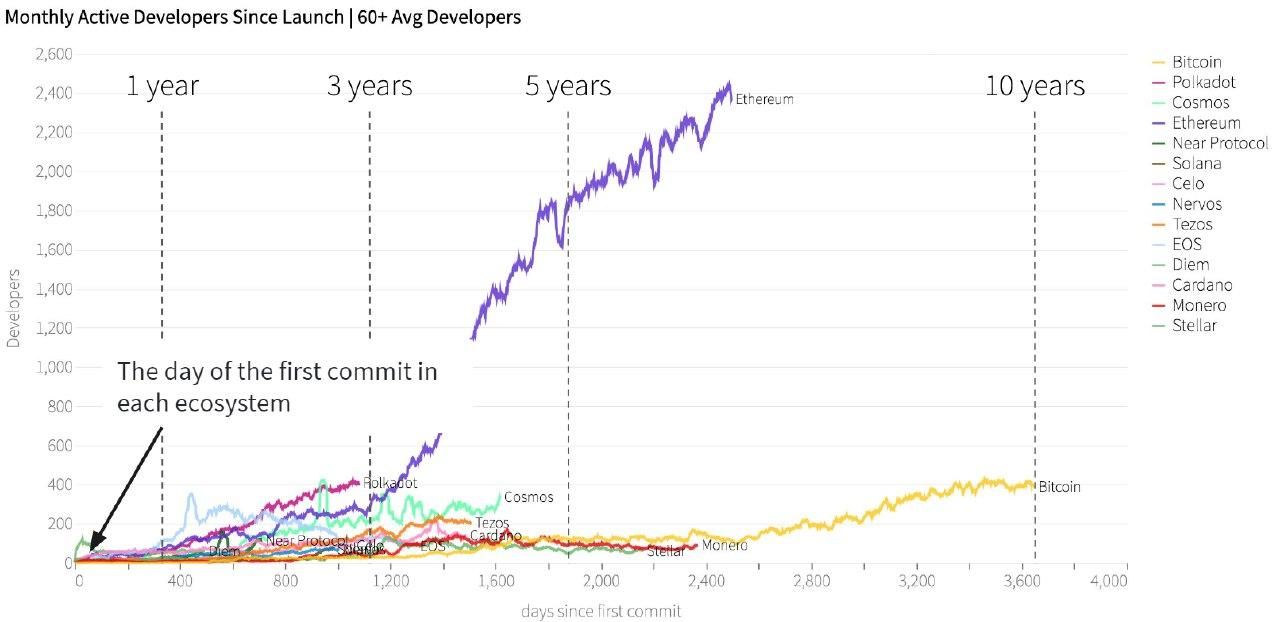

Basically, right now Ethereum is a fully working solution – i.e., it’s a Turing complete smart contract enabled blockchain with hundreds of teams writing code, deploying contracts, ecosystem being built, stable coins issued in the billions of dollars and DeFi projects popping up (albeit some blowing up shortly after), and even more advanced things are being created including potentially several Central Bank Digital Currencies (CBDC) and security tokens. However even many years ago Buterin and team were not satisfied with this, as the system scales poorly compared to existing centralized systems, transaction throughput is anemic compared to say Visa, costs for sending transactions in gas sometime spike to levels where buying a coffee is clearly out of the question, etc. Consequently, the idea for Ethereum 2.0 was outlined in ETH Blog some 6 years ago. Many coffees and pizzas later we’re at the stage where Phase 0 of Ethereum 2.0 has launched.

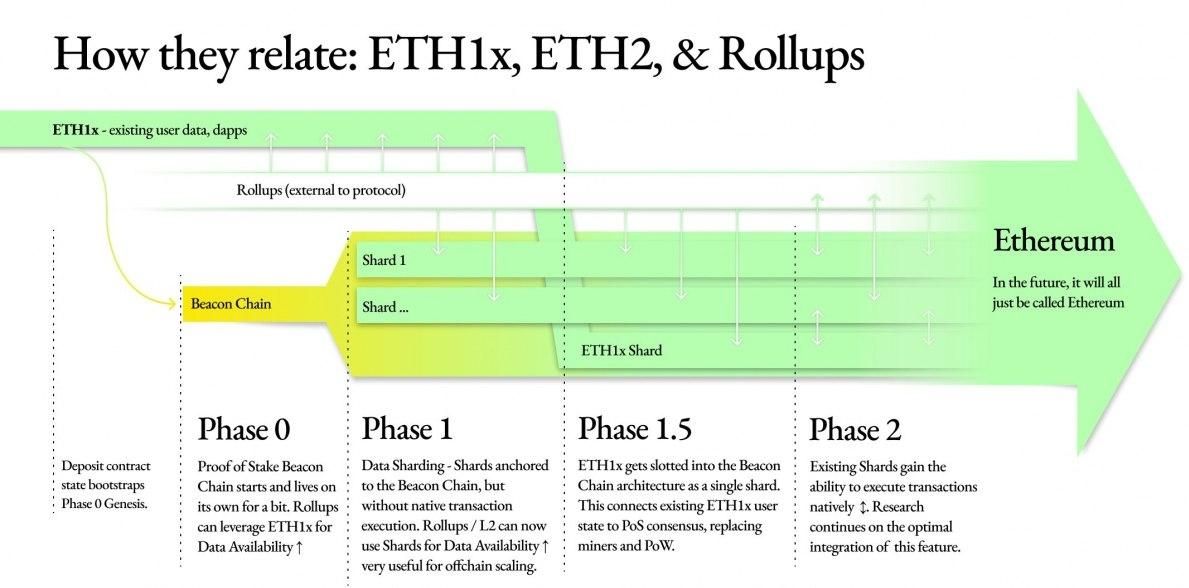

There’s still a lot to go of course, and the mind boggles as to how the team will achieve sharding, moving Ethereum into one of the beacons of Ethereum 2 and achieving full consensus, finality and cross-shard communication but thus far it’s very clear if developer commits are any indication that Ethereum is here to stay.

You might ask what the heck are all these words, and you’re right it’s confusing. In brief, sharding makes it so that every node does not have to be either a supercomputer or store terabytes of data, yet it can still participate in the ecosystem, and when this is achieved scalability kicks in, and transaction speed of 100,000 per second versus only 30 of Ethereum 1.x becomes possible. Further, consensus mechanism securing transactions will switch from Proof of Work (PoW) to Proof of Stake (PoS) meaning that those video cards and mining rigs everyone has been back-ordering will be as good as paperweights and will be replaced with lightweight nodes staking Ethreum 2.0, with the effect of being a much faster and substantially more scalable. Mind you Ethereum 2.0 is not an upgrade to Ethereum 1.0 – the only thing that is the same between ETH and ETH2 are that they have blocks and chains, everything else is totally different and has been redesigned from scratch.

Before I stop reading, tell me why I should care?

So, unless you’re a geek and/or coder why does this matter. The system is still somewhat fragile, and until all phases 1, 1.5 and 2 are passed in sequence creators are asking the community to lock up their hard earned Ethereum in a smart contract of Ethereum 2.0 and keep their computer on all of the time. Also, they state that each of such locked validators must have 32 ETH in order to be eligible. To complicate things further it’s a bit unclear when Vitalik and team finish all phases – they are promising 1-2 years, but frankly a ton of time has passed since Ethereum 2.0 has started and many deadlines have been broken. The good thing is that if you help out in this process by raising a validator or two and stake you will earn rewards – the formula is somewhat tricky but this calculator should simplify things. To bottom-line it, the more people stake the less the yield becomes but the decline is not linear. Initial yield was over 20% just recently and has now stabilized at 13.5%, and rough estimate is if 10% of all ETH is staked in Ethereum 2.0 the yield will go down to around 5%.

The difficulty with this is not only is the yield a moving target, but maturity is as well. The tokens which are locked in the contract are locked there for good until phase 2 goes live. Also, if you don’t read several manuals on Google, and there are many, even some which conflict, and launch validators just right you could get penalized and actually lose your ETH.

Sounds way too complicated, can you do better?

So, here’s a keep it simple stupid (KISS) solution, and sorry again for the plug, but aside from just hosting my posts, I simply could not find a better solution out there than one Redot is promising in January. What the guys allow you to do is simply buy into ETH2 with your ETH, in a bid-offer screen - something a trade monkey like me understands. Just like I trade USDT or BTC with ETH I can just buy ETH2. Moreover, they will not force you to hold 32 ETH and allow you to bid with increments of just 0.01 ETH which is less than €5 as of this writing. And here’s the best part, while you’re holding you earn your daily yield which accumulates, and if you don’t want to hold any more, you just put your ETH2 on offer and sell it for ETH, right on Redot, which means you don’t have to wait for phase 2 to get your principle back, only your interest. After all, who knows if it’s going to be 1 year or more than 2 which are being promised by Vitalik. Meanwhile, to check that everything is honest, you can look at Redot hosted blockchain explorer of ETH2 and see their and other validators. This is as simple a solution that I can think of to participate in HODLing ETH and earning a yield on top.

Word of caution…

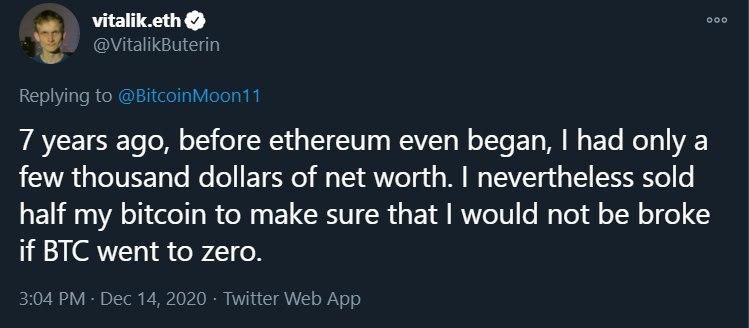

It’s easy to get carried away, especially while crypto reaches sequential highs every single day, and just take your entire HODL savings and stash it into ETH2. Heck it’s rocket fuel which will now has added interest. However I should caution you as someone who’s taken wounds before both in crypto and in regular assets – don’t stake anything you can’t lose, and since my words might mean nothing, in the words of ETH creator himself, “[what if] BTC went to zero”.

7 years ago, of course adoption wasn't great, and uptake from institutional and retail investors alike was much weaker than it is now, but I’d say the risk here is substantial, since despite decentralized nature of ETH and ETH2, Vitalik being hit by the proverbial bus would likely have negative P/L consequences at least in the short term. This said, I hope Redot team hurries this up – as my ETH are burning a hole in my wallet, itching for that 13.5% annual yield without risking penalties if my kid turns off my Linux box with his Mandalorian branded Amban phase-pulse blaster I got him for Christmas. If I don’t write until 2021, please stay safe, warm, long ETH2 and have a great holiday season!