Nvidia as Hedge Against Crypto Winter

I came to a realization that Nvidia stock price does not account for the current mining economy. Nvidia is traded at 29x trailing P/E and has implied volatility lower than Bitcoin. I believe that put options on Nvidia stock are an excellent hedge for crypto assets.

Nvidia is the world’s largest producer of graphics cards and has significantly benefited from crypto mining, which has turned the niche producer of gaming equipment into the most valuable US chipmaker.

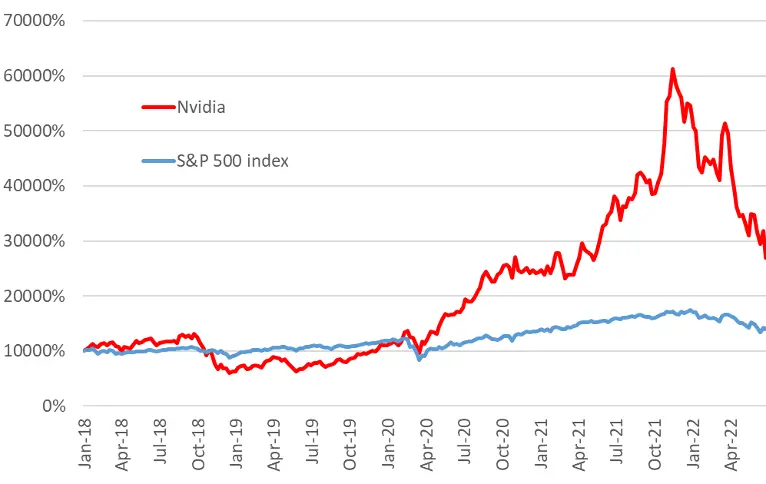

Nvidia stock and S&P 500 index (normalized as of end-2017)

Now Nvidia has a market cap of 363 billion dollars and is the 12th largest company in the US. Nvidia is currently more valuable than Walmart, JP Morgan, Mastercard, or Pfizer.

20 largest US companies by market cap

Source: Bloomberg

Nvidia management often downplays crypto impact on sales and the company recently paid a fine for failing to properly inform investors about how crypto miners were stoking demand for its products.

Nvidia graphics cards are widely used for Ethereum mining. Ethereum price plunge erodes mining profitability, pushing some miners with relatively high electricity prices out of business. Further, the coming shift to proof-of-stake will make Ethereum mining obsolete, with other coins typically less lucrative to mine due to low liquidity and high price swings. As a result, many miners seek to exit the business and sell equipment. That has already pressured graphics card prices on the secondary market. Their prices have dropped by about 50% during the last few months. Moreover, Bloomberg cites the estimate that “more than a third of the consumer graphics-card market could vanish as crypto enthusiasts abandon the technology”. Nvidia has not changed retail prices so far, but future demand for its products looks shaky given the circumstances.

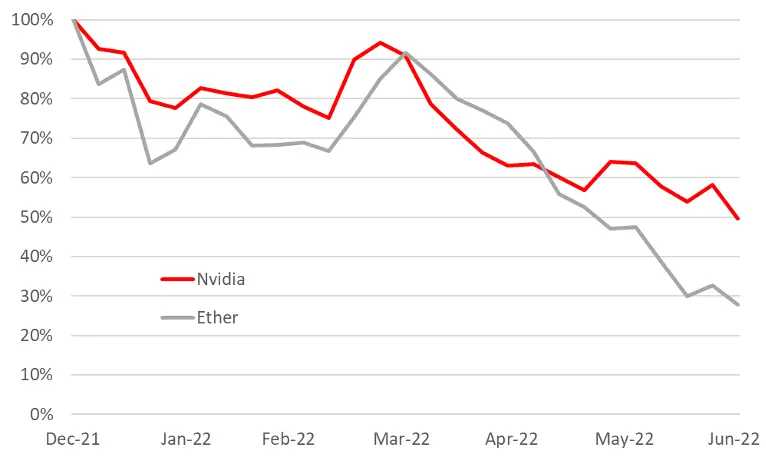

This year Nvidia stock decreased by 50% due to crypto drop and broader stock market correction but still outperformed Ethereum’s 70% drop.

Nvidia stock and Ethereum price (normalized as of end-2021)

Nvidia targets different niches, but graphics cards represent more than 50% of its revenue in recent quarters. I believe the stock market does not fully account for the coming decline in Nvidia's business due to the crypto prices drop. Just look at the consensus estimates for the next 2 financial years! The company is expected to continue steady growth as if there were little change in demand.

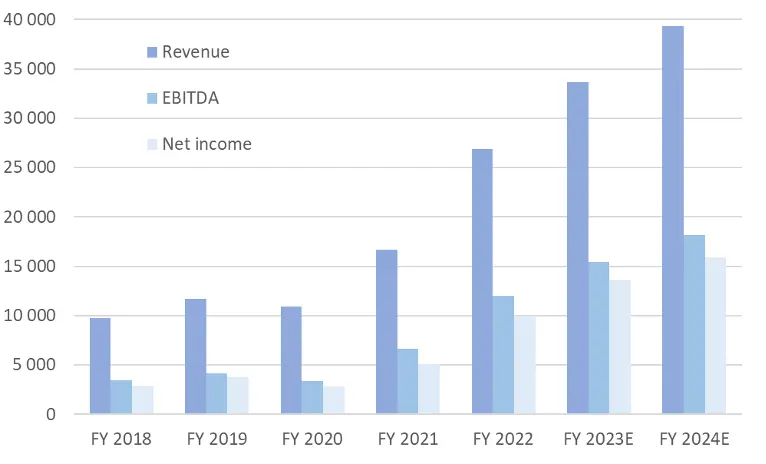

Nvidia revenue, EBITDA, and net income (USD millions)

* Nvidia financial year ends on January 31, EBITDA is “earnings before interest, taxes, depreciation, and amortization” and reflects company’s operating income

I am particularly surprised by expectations for higher operating margin. The consensus forecast suggests that Nvidia will be able to increase its profitability despite an overstocked graphics cards market. I wonder how analysts can believe that Nvidia will sell more products with higher margins while secondary market prices for graphics cards have already dropped by 50%.

Nvidia EBITDA margin

Investors seem to at least partly believe in these forecasts and are willing to pay a hefty premium for Nvidia compared with a broader market. Nvidia is traded at 29 trailing P/E compared with 19 for the S&P 500 index as a whole.

That makes a case for betting against Nvidia stock. Nvidia’s reliance on crypto mining and the high correlation between Nvidia stock and crypto prices make positions benefiting from Nvidia stock decline a hedge for crypto assets.

Investors can open short positions in Nvidia stock or buy put options for a limited downside. The reason for doing that would be that options on Nvidia are more expensive than options on most large-cap US stocks but much cheaper than options on crypto. Nvidia implied volatility is high compared with shares of major US companies (except Tesla), but significantly lower than Bitcoin’s one. Ethereum’s implied volatility is even higher.

Nvidia and Bitcoin ATM implied volatility

* Bitcoin data is based on ProShares Bitcoin Strategy ETF

For example, investors can buy 25% out-of-money put options maturing in January 2023 in a notional size equal to 50% of crypto holdings. It costs about 3.2% of crypto holdings and may significantly improve portfolio performance if crypto prices will not rapidly recover in the second half of 2022.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.