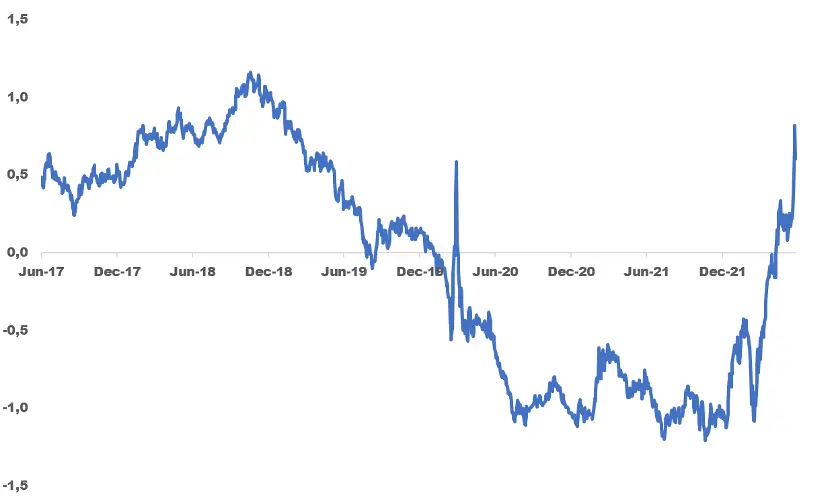

New normal of crypto volatility

Last week the big drop of crypto assets in the aftermath of Celsius saga expectedly led to higher implied volatility of crypto options. But will implied volatility continue to be elevated for a prolonged period?

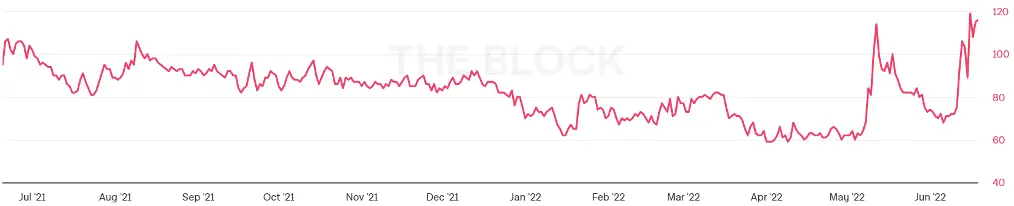

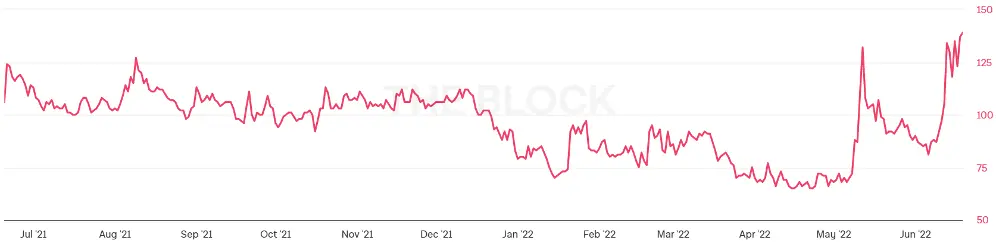

Charts suggest volatility is expensive now. Current level of bitcoin and ethereum volatility as measured by DVOL indexes is at the top of the annual range.

Bitcoin volatility index (DVOL)

Ethereum volatility index (DVOL)

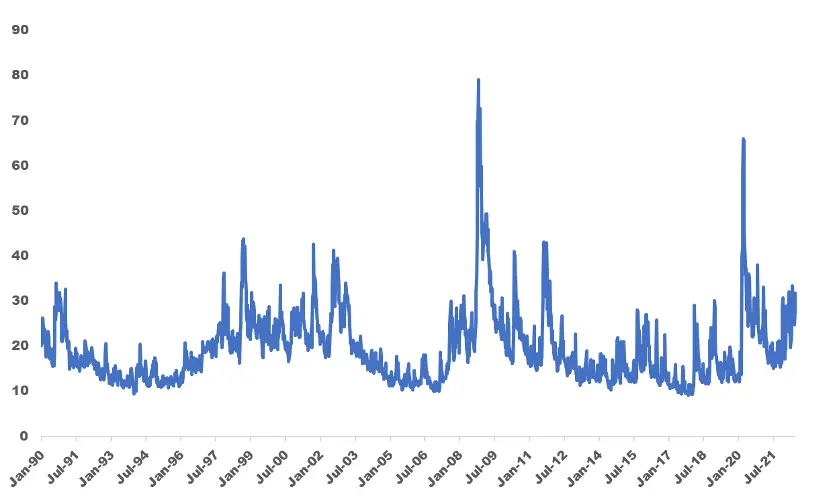

Moreover, volatility of financial assets is usually mean-reverting, particularly from very high readings. The chart below shows long-term performance of CBOE Volatility Index (VIX). VIX is a measure of the stock market's implied volatility and is based on S&P 500 index options. It’s easy to notice that VIX does not stay at elevated levels for long, for instance 40+, thus selling volatility at extremely high readings of VIX seems tempting. VIX is not directly tradable and VIX futures curve is usually in an extreme backwardation when spot VIX is very high, but at least investors can ditch protection or sell cash-secured put options.

VIX index (implied volatility of S&P 500)

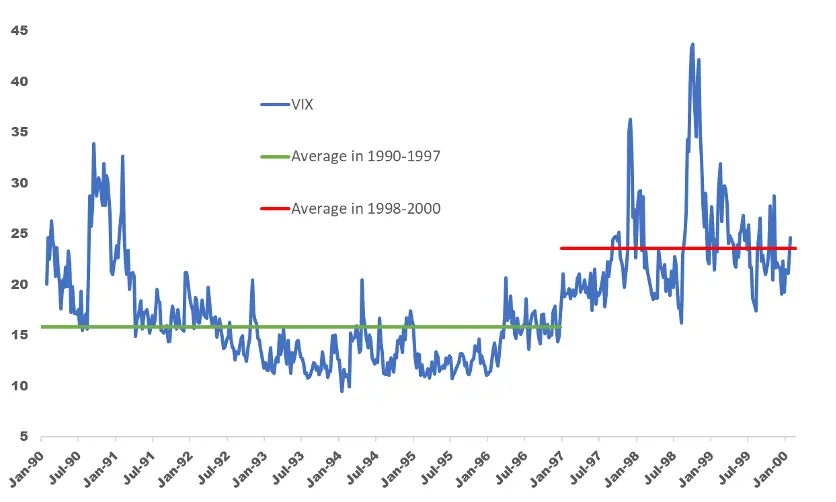

One caveat that should be factored in our analysis is the time scale. VIX exists for more than 3 decades, thus we can reasonably assert what is a high enough level to fade its pop. Crypto is a relatively new asset class, DVOL indexes were announced by Deribit last year, so any mention of “historically very high” should be taken with a grain of salt. For example, 25 looked like a high level for VIX in 1990-1997 but was close to an average value in 1998-2000.

VIX in 1990-2000

Historical volatility of bitcoin suggests 2021 was somewhat calmer than the years prior. We intentionally do not use data older than 5 years, because bitcoin was a niche asset before 2017 which may explain much higher volatility at that time.

Bitcoin historical volatility (30 days)

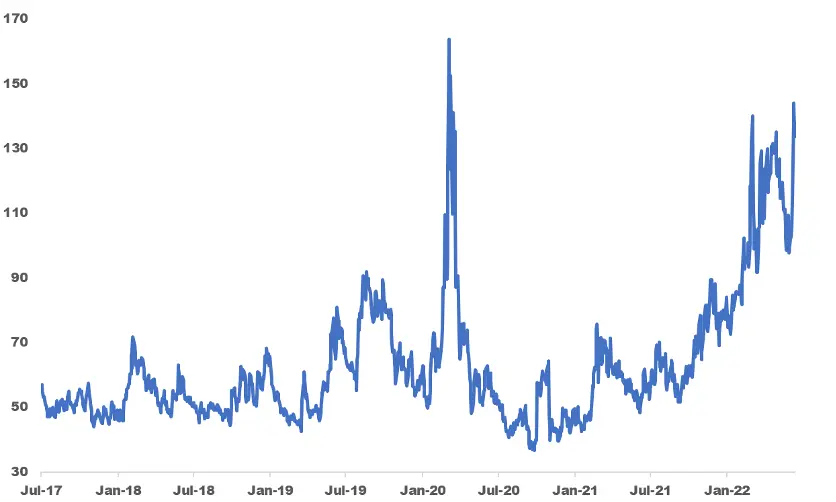

More generally, macro picture changed a lot in 2022 compared with 2021. 2021 was characterized by benign background of strong economic growth and loose monetary policy, despite increasing inflation. In 2022 growth slowed while major central banks started focusing on rampant inflation as a major problem for their economies, and starting to react by both tightening and jawboning, on higher-than-expected inflation prints. For example, above consensus inflation figures published on June 10 forced the Federal Reserve to ditch previous guidance and hike rates by 75 basis points, instead of 50 bps. Real (inflation-adjusted) bond yields were depressed in 2021 but rallied in 2022.

10-year USD real rate (%)

At the same time, tighter monetary policy suggests further slowdown of economic growth and maybe even a recession ahead, which implies potential rate decreases in future. The tug of war between high present inflation and lower expectation of future growth makes the rates path particularly uncertain. Therefore, bond volatility doubles compared to levels which prevailed in 2021 and is now as high as it was in March 2020. The chart below shows ICE BofA MOVE Index which is the most popular measure of US Treasuries implied volatility.

ICE BofA MOVE Index (implied volatility of US Treasuries)

The combination of relatively short trading history and a macro regime shift makes us suspicious about treating current implied volatility of crypto assets as too high. We think the current level of implied volatility is more likely to be mid-range rather than toppish for the remainder of 2022.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.