Modern Monetary Theory vs. Bitcoin

If you spend any time on the internet, you will find that most economic commentary on Bitcoin comes from supporters of non-mainstream economic ideas that the political and academic elite do not share. This skews the commentary and raises the question of how Bitcoin should be seen in the context of economic theories that are more mainstream.

Key Takeaway

- Right now, we are in a transition between two groups of economic theories, and in both, Bitcoin performs well as a financial investment.

- The new economic ideas -- neoliberalism and monetarism -- were created by economists such as Milton Friedman and Fredrich Hayek.

- Just as the crisis of the 1970s produced new economic theories in the form of monetarism and neoliberalism, the crisis of the 2020s is creating a new economic theory that is influencing political elites.

Bitcoin and World Economic Ideologies

First, let us look at the economic commentary that comes from supporters of non-mainstream economic ideas. Cryptocurrencies are popular among supporters of anarchism, libertarianism, and Austrian school of economics. These ideologies argue that governments are inherently bad, hence it's not hard to see why cryptocurrencies are popular among these people. Governments print money, and if you believe that governments are intrinsically self-destructive, you would naturally support something that eliminates a fundamental function of government. Economic analysis from these people invariably concludes that governments are doomed, and we are nearing a crisis that will cause collapse of government, and one should put money into cryptocurrencies to protect oneself from the coming end of the world.

However, most people do not subscribe to these economic views, and in particular, policy-makers and political elites believe in other more mainstream economic ideas. This lack of interest in non-mainstream ideas is a result of the consequences of those ideas. An anarchist is not likely to become Chairman of the Federal Reserve, and conversely, the heads of the world's central banks and investment banks are not anarchists. So let us look at how Bitcoin will fare, assuming that the anarchists and libertarians are wrong and that a more mainstream economic ideology is correct.

Much of the internet discussion with people that subscribe to more mainstream economic ideas is dominated by people who think Bitcoin is doomed because it is a scam. However, Bitcoin has been around long enough so that it can be demonstrated that it is not a scam, and if you look at how governments are treating Bitcoin and cryptocurrencies, the attitude is not that Bitcoin is fraudulent but that it is just another financial product which should be taxed and regulated. If we look at how bitcoin behaves, it’s akin to any other financial product, we find that there is little discussion about how Bitcoin would act under the major economic theories that are popular among policy-makers. Right now, we are in a transition between two groups of economic theories, and in both, Bitcoin performs well as a financial investment. To understand the current situation, we should look back at history and see how we got to our current situation.

History during the Pre-Bitcoin Era

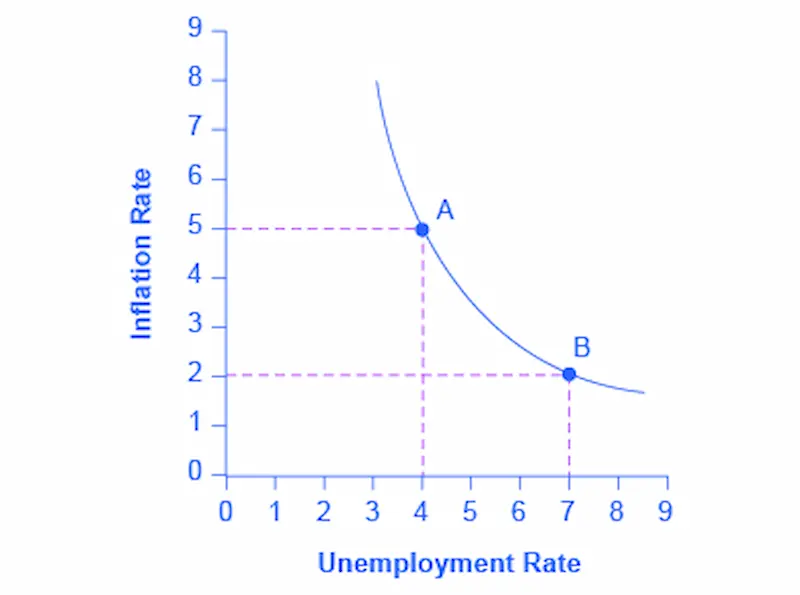

The economic foundations of the current world date from the 1980s and arose out of the crisis of the 1970s. In the 1970s, the world was hit by oil shocks and inflation. The economic thinking at the time was based on Keynesian economics in which there was a trade-off between unemployment and inflation. The prevailing economic theory in the 1970s was that governments would use budget deficits to maintain a balance between unemployment and inflation. Furthermore, in the 1970s, people still remembered the collapse of market economies in the 1930s, so direct government economic intervention in high taxes and price controls was accepted.

However, these economic theories failed because, during the 1970s, there was stagflation or combination of both inflation and low economic growth. This situation was impossible under existing economic theory, so people had to invent new economic theories for politicians to use.

The new economic ideas were neoliberalism and monetarism and were created by economists such as Milton Friedman and Fredrich Hayek. These ideas were then converted into a political program in the early 1980s by politicians such as Ronald Reagan and Margaret Thatcher. One task of a politician is to take complicated economic theories and turn them into something simple for voters to understand. And both Reagan and Thatcher created Reaganomics and Thatcherism. A one-sentence summary of these neoliberal ideas is "governments are bad, markets are good, cut taxes, cut government spending."

These economic ideas of limited government started with the political right, but with the collapse of the Soviet Union, they spread into the center-left and manifested in the 1990s in the center-left in the form of Bill Clinton and Tony Blair's "New Labour." They were largely unchallenged until 2016, even after the great financial crisis of 2008. In the immediate aftermath of 2008, it was believed that the events in 2008 were merely a minor correction that did not require a fundamental reevaluation of the neo-liberal ideas of the 1980s. Interestingly in this situation Barack Obama had the same ideas as George W. Bush, while in the UK, both David Cameron and Gordon Brown had economic ideas which were not different from each other, nor were they a break from the economic orthodoxy of the 1980s.

The Great Ideological Shift

It was not until the end of the 2010s people began to abandon the ideas of the 1980s and look for something very different. There is massive economic discontent in Western nations, and it is now impossible for a politician to get elected on a platform of not changing anything. Moreover, the solutions provided by neoliberalism and monetarism do not create politically viable programs for governments. Governments can no longer stimulate the economy by cutting interest rates to zero, and the lack of Chinese and Russian financing means that a low tax, low spending, low deficit policy would result in government cuts that would be suicidal. So, just as the crisis of the 1970s produced new economic theories in the form of monetarism and neoliberalism, the crisis of the 2020s is creating a new economic theory that is influencing political elites.

The big new economic theory is called "modern monetary theory" or MMT. As with all influential economic theories, there are many academic papers and books describing the theory, but at the same time, a politician can explain the theory in one sentence to voters. The core idea of MMT is "just print money to pay for essential government spending, and everything will be fine."

Modern Monetary Theory

This new idea goes against generations of economic theory. The economic theories of the last generation have argued that printing money would lead to inflation and economic turmoil. The MMT economists have spent a great deal of effort to say that the monetarists are wrong. In any event, because there are no politically viable alternatives, politicians have started to embrace MMT ideas.

Among crypto-enthusiasts, the reaction to MMT has been that it is a horrible idea. Because many Bitcoin people are anti-government, an economic theory that says it is acceptable for governments to print money is something they do not support. Among anarchists and libertarians, MMT is the final straw that will cause the United States and the United Kingdom to turn into Zimbabwe or Venezuela.

Putting that aside, we can look at the future of Bitcoin using more mainstream economic theories, and the result is that both the scenarios in which MMT is correct and in which it is wrong are good for Bitcoin. Suppose that the MMT economists are wrong and the monetarists are right. In that case, the United States is setting itself up for a terrible economic future. In this situation, the printing of money by the government will lead to inflation and economic turmoil. However, the difference between more mainstream monetarists and the anarchists and libertarians is that more mainstream monetary theory would expect a repeat of the 1970s rather than a complete collapse of the economic and political system. It will be bad for Western economies. However, the political system will self-correct and not completely collapse, and after a lost decade or two, the politicians will put the monetarists back in charge of economic policy.

This environment will be good for Bitcoin. If we look at the turmoil of the 1970s, hard assets such as gold and real estate were good investments to protect capital against inflation. Unlike the 1970s, we now have a new asset class that functions much like real estate or gold but which you can carry in your pocket. The limited amount of Bitcoin further makes it a perfect inflation hedge, making Bitcoin an ideal investment should the new MMT economists be wrong, and the traditional monetarist economists right.

Conversely, if the MMT theorists are right, then Bitcoin would still be a good investment. In that scenario, printing money would not lead to higher inflation but would lead to economic growth while at the same time the vast amount of money that is being printed would keep interest rates low. In this world, the economic boost provided by MMT policies would cause a demand for Bitcoin, increasing the value of Bitcoin.

Final Thoughts

While the outcomes for each scenario would be very different, in both the MMT and monetarist world, Bitcoin would likely do well. Why is this true? The fundamental reason is that both the MMT economists and classical monetarists believe that the massive printing of money will result in low or negative real interest rates. The monetarists believe this will cause inflation and create economic chaos, whereas the MMT economists believe this will generate economic growth. Regardless of whether you think the general economy will benefit from MMT policies, the fact that Bitcoin is an established store of wealth or value matters most. In an anarchist/libertarian world, governments should collapse from their current economic policies. In a more classical monetarist world, current economic policies should lead to financial turmoil similar to the 1970s. In an MMT world, current economic policies should lead to prosperity through infrastructure creation.

In conclusion, we have three very different possible futures, but it seems that it is to the reader’s advantage to buy Bitcoin now, in any of the possible outcomes.

This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.