Is Uniswap too Cheap to Ignore?

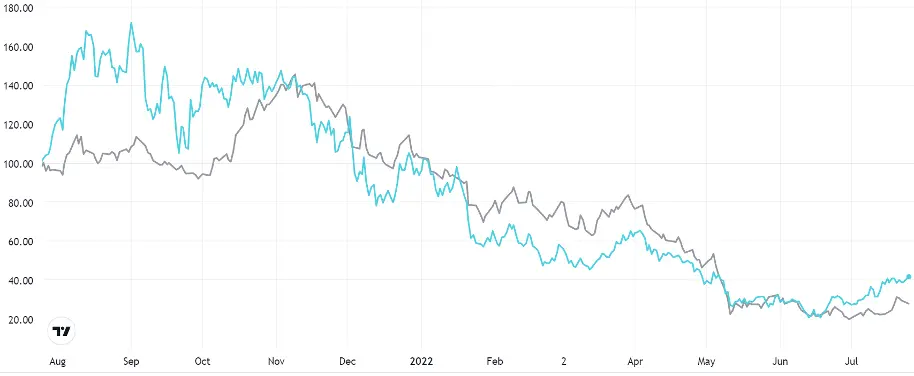

Uniswap token price has declined almost as much as Coinbase stock price since a year ago. Both Coinbase and Uniswap are large crypto exchanges, so their prices are expected to be correlated. However, Coinbase has been gradually losing its market share while Uniswap’s trading volume has been far more resilient.

Uniswap token price and Coinbase stock price (indexed at 100 as of July 26, 2021)

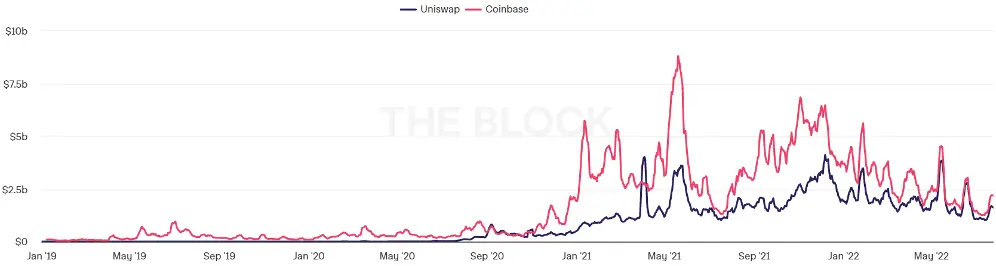

Uniswap was 2-4 times smaller than Coinbase by trading volume in 2021 but now is comparable to Coinbase.

The daily trading volume of Uniswap and Coinbase (7 day moving average, USD)

Why is Uniswap different

Uniswap is an automated market maker and the largest decentralized crypto exchange by trading volume.

Largest decentralized exchanges by monthly trading volume (USD)

Unlike centralized crypto exchanges or traditional financial intermediaries, it matches traders with pooled liquidity (automated market makers) rather than a bid-offer order book. Price integrity is ensured by the open-source algorithm.

Compared to centralized crypto exchanges, Uniswap has no counterparty risk and does not require potential customers to open an account. That is particularly advantageous in the current situation when many crypto platforms have implemented withdrawal limits. The disadvantage is higher transaction cost, depending on the network conditions.

Since Uniswap is based on open-source software it can be copied rather easily. In fact, some of its biggest competitors among decentralized exchanges are just slightly modified clones (like SushiSwap). From an investor’s view, it may seem strange to own a business everyone can duplicate, but I don’t see an issue here. While it’s technically feasible to make a copy of Tide detergent or Coke soda, its producers enjoy the power of brand and a scale economy. Uniswap dominates decentralized exchanges and so has liquidity unmatched by competitors.

If anything, it looks far easier to grab a large market share from centralized exchanges than to take over Uniswap leadership among decentralized ones. Also, Uniswap slightly deviated from the original license with its v3 release last year introducing a “business source license” acting as a time delay against future copycats.

How to value Uniswap token

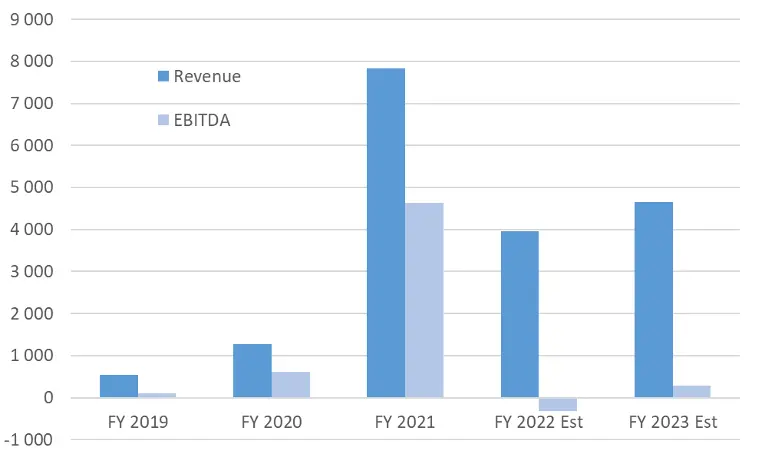

I see it only natural to compare Uniswap with Coinbase, which is the only crypto exchange traded on the US stock market. It’s easier said than done, however, because Coinbase’s business is extremely volatile. Revenue is expected to drop by 2 times this year compared to 2021 and the company will probably make an operational loss this year after a stellar profit in 2021.

Coinbase revenue and EBITDA (USD million)

* EBITDA is “earnings before interest, taxes, depreciation, and amortization” and reflects the company’s operating income

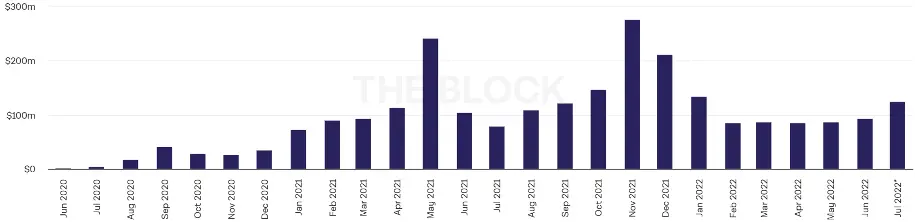

Similarly to a trading volume, Uniswap’s revenue has been far more stable compared to Coinbase.

Uniswap monthly revenue (USD)

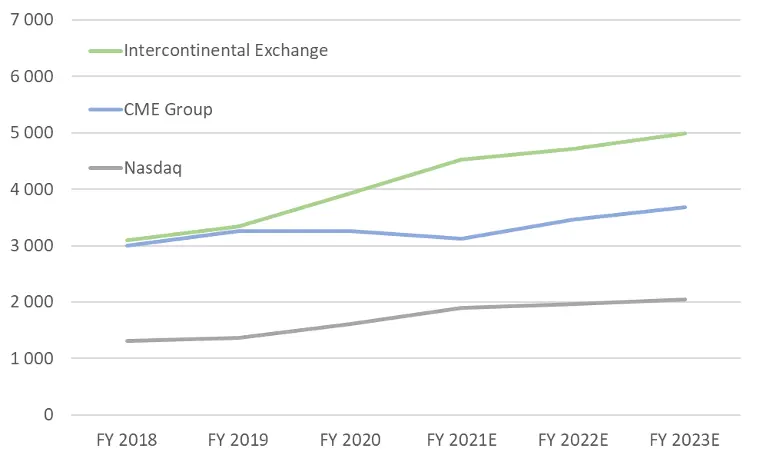

Exchanges operating in traditional financial instruments usually represent a relatively stable business. In the last 5 years, the three largest exchanges traded on the US stock market have not seen negative EBITDA and generally exhibit slow but steady growth.

EBITDA of Intercontinental Exchange, CME Group, and Nasdaq (USD million)

* EBITDA is “earnings before interest, taxes, depreciation, and amortization” and reflects the company’s operating income

How to compare such different businesses? The table below depicts variables reflecting how their market prices correspond with different financial metrics.

Financials of major US exchanges, Coinbase and Uniswap

Source: Yahoo Finance, CoinGecko

Most multiples lie in a very wide range except for the Price-to-Book ratio. As described above, extreme volatility makes it tough to compare Coinbase with traditional exchanges or Uniswap based on revenue, EBITDA, or net income. According to the Price-to-Book ratio, Nasdaq has a premium valuation but the figures for CME, Intercontinental, and Coinbase are very close at 2.4-2.7. Besides, in the stock market, financial companies are usually valued using the Price-to-Book.

In the crypto world, total value locked (TVL) to market capitalization is a direct analog of the Price-to-Book ratio. Based on CoinGecko data, the fully diluted market cap (assuming maximum supply) of Uniswap equals about 1.2 its TVL, so Uniswap's “Price-to-Book” is 1.2. Coinbase is traded at 2.4 Price-to-Book. Hence, Uniswap seems to be undervalued by about 100%.

Conclusion

To me Uniswap looks too cheap compared with Coinbase and also promising in the long-term because of its unique market position. Needless to say, that comes with high risks typical of investing in crypto assets. I would particularly highlight a regulatory risk because Uniswap seems to have even less control against illegal activities (like money laundering) than other crypto exchanges.

Thus, I regard the Uniswap token as a high-risk and potentially high-reward opportunity.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.