Is the Lido Token Undervalued Amid Rising Staking Activity?

Lido's total value locked has risen to the highest level since May 2022, but its native token price remains depressed. Is it a buying opportunity for the Lido native token?

Ethereum Staking Boom

Staking is booming despite the 'crypto winter,' thanks in part to Ethereum's transition to a proof-of-stake algorithm. This has enabled large-scale staking of the second-largest cryptocurrency. The Shanghai upgrade, which went smoothly in April, has allowed for the withdrawal of Ethereum coins that were pledged for staking, thereby boosting staking adoption. The total amount of staked Ethereum has significantly increased and is currently at an all-time high.

Total value of staked Ethereum (ETH)

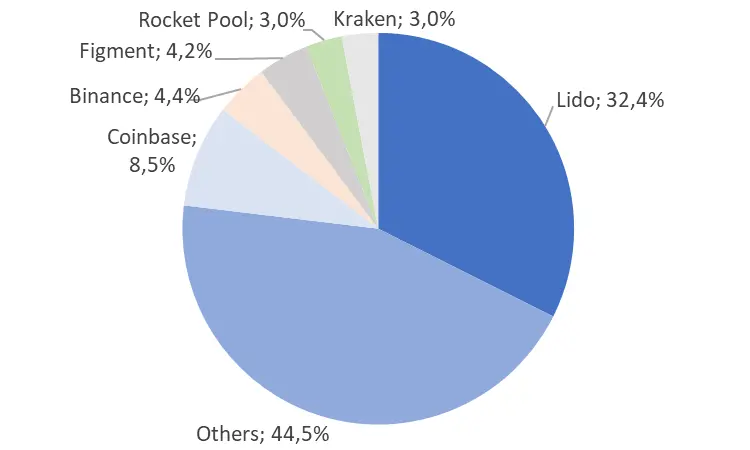

The Lido protocol enables staking of several coins and is the largest Ethereum staking provider by far, handling almost a third of all Ethereum staked.

Ethereum largest stakers

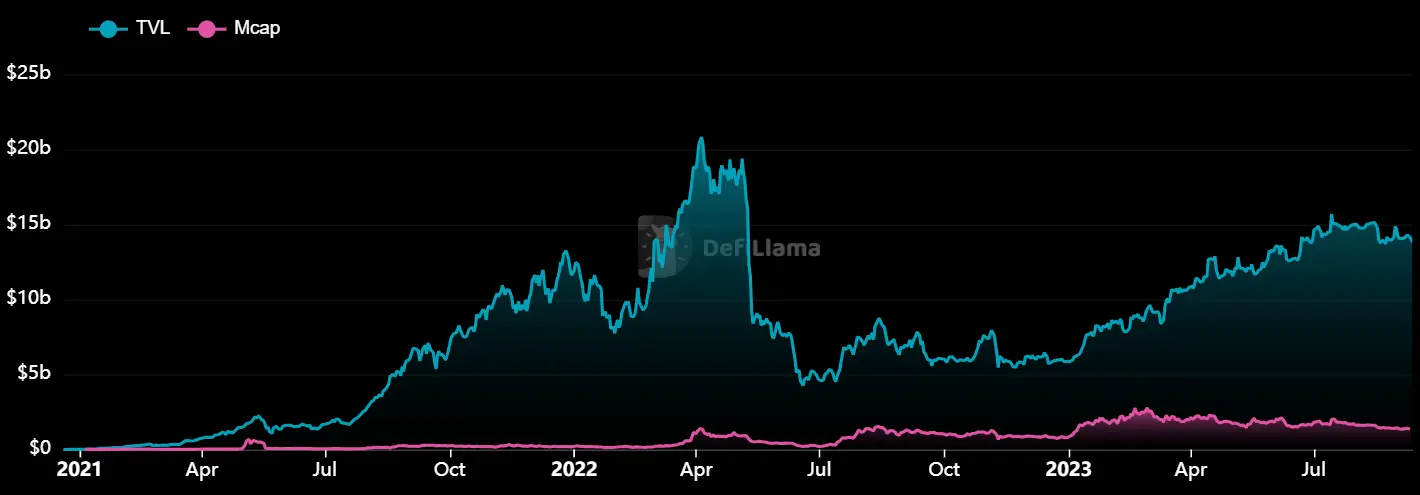

As a result, Lido has been the biggest beneficiary. The total value locked in the protocol has more than doubled this year, reaching its highest level since May 2022 (before the collapse of TerraUSD). However, Lido's market cap has remained stagnant. Drawing a parallel with traditional finance, the situation resembles that of a booming company whose share price fails to reflect its success.

Lido total value locked and market cap (USD)

A Share or a Bonus Coin?

However, whether the Lido token should be considered a share in the business is a subject of debate. Some might argue that it serves more as a bonus coin without any actual property rights. Unlike a conventional business, Lido operates as a Decentralized Autonomous Organization (DAO). According to its website, 'The Lido DAO is a Decentralized Autonomous Organization that decides on key parameters of liquid staking protocols through the voting power of its governance token, LDO.' The LDO token is an ERC-20 token that grants voting rights.

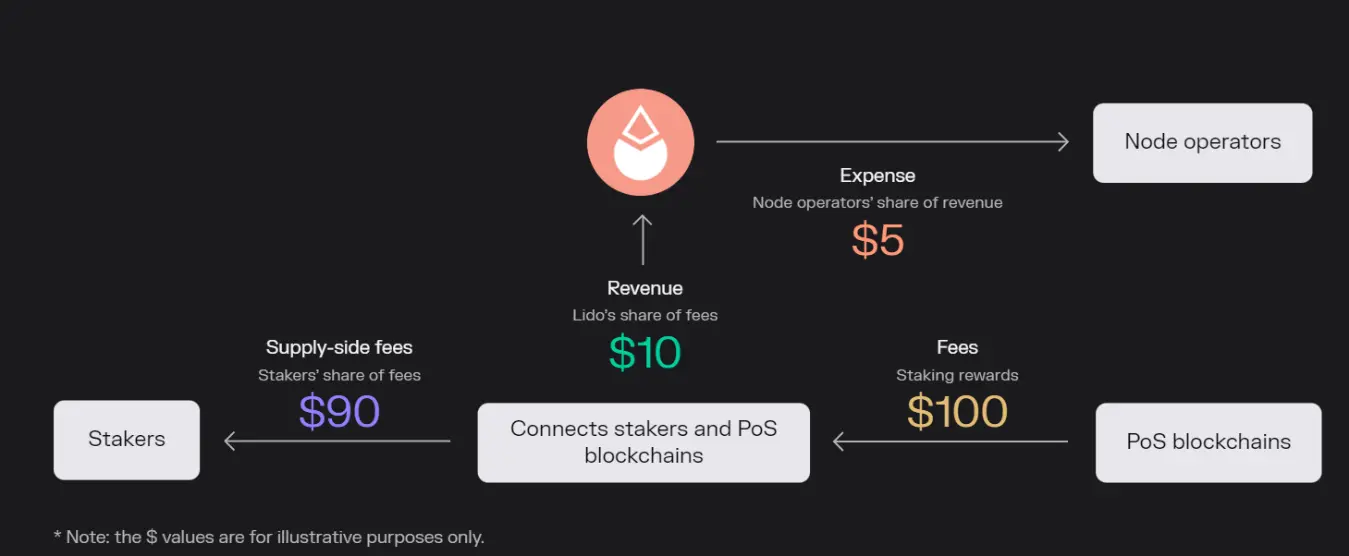

Lido has the potential to generate revenue. It charges a 10% fee on staking rewards, which is then split equally between node operators and the Lido DAO. In this arrangement, the Lido DAO receives 5% of all staking rewards, effectively serving as its revenue. The DAO uses these fees to cover operating expenses, including salaries and liquidity expenses for staked tokens like stETH. If Lido generates free cash flow, it could theoretically be used to reward LDO token holders.

Lido business model

Although LDO token holders have no officially stated property rights, their voting power suggests they can essentially create these rights. The primary difference between LDO tokens and publicly-traded company shares is the lack of legal protections for minority token holders. If someone owns 100% of the tokens, the ownership dynamics resemble that of a conventional company. However, the situation significantly differs for an investor holding just 0.001% of the tokens.

In summary, while the lack of sufficient property rights is a valid concern, it should be viewed as a risk rather than a certainty. In my opinion, LDO tokens are more akin to emerging market stocks that come with minimal investor protection and unestablished corporate governance.

Is the Token Cheap?

A critical question arises: How is the LDO token priced relative to its fundamentals and associated risks? The higher total value locked in the protocol arguably makes the token fundamentally more attractive. However, this doesn't necessarily make it cheap, especially considering the significant governance risks.

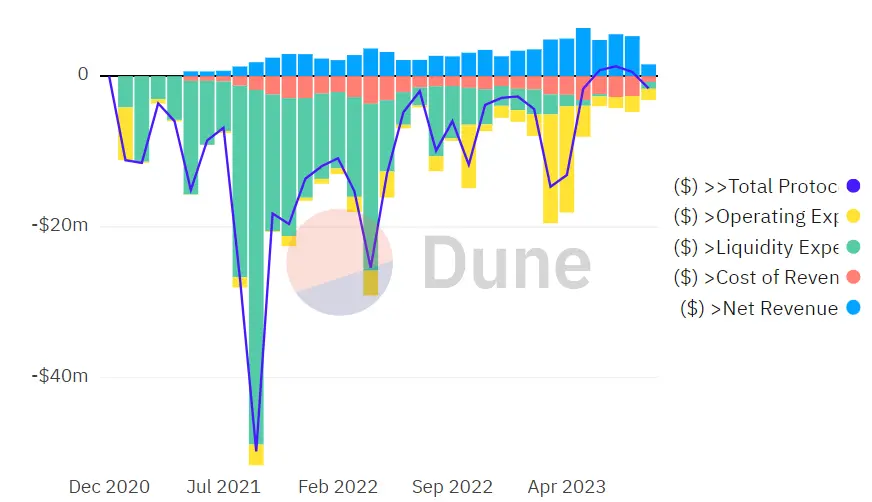

Lido's financials are not publicly disclosed. Stakehouse Financial, Lido's financial adviser, offers some provisional data but advises against using it for decision-making. Despite the lack of clarity on Lido's expenses, the most important factor in its valuation—its ability to generate sustainable cash flow—remains unknown.

Lido profit & loss statement estimate (by Stakehouse Financial)

The primary certitude in Lido's financials is its revenue, which comes from staking fees. Conversely, the exact expenses are speculative and subject to volatility, making long-term projections nearly impossible. This uncertainty casts a shadow over Lido's ability to generate sustainable cash flow, a crucial factor for any company's valuation.

As of now, Lido's market cap is $1.28 billion, with treasury assets worth $228 million, according to figures from Token Terminal. It's unclear how much of these treasury assets are excess and should, therefore, be subtracted from the market cap as an analogue to net cash in traditional finance. Currently, the total value locked in Lido stands at $14.03 billion.

Token Terminal estimates the annualized staking rewards at $604 million, a reasonable figure given the current staking yields of around 4%. Consequently, Lido's annualized revenue could be about $30 million, assuming 5% of staking rewards. Another perspective argues that the total fee Lido receives (10%) should count as the revenue, leading to an annualized revenue of $60 million. This latter estimate aligns with the perspective of Lido's financial adviser, Stakehouse Financial.

Depending on the chosen revenue definition and how treasury assets are treated, Lido's valuation ranges from 17.5 to 42.7 times its annualized revenue. This is a strikingly high multiple, especially when compared to Nvidia, which trades at multiples of 20 to 35. It appears rather irrational for investors to buy into a niche asset like Lido, with substantial corporate governance risks, at multiples comparable to a high-performing stock like Nvidia. This is particularly true if one considers that even Nvidia might not be a prudent long-term investment at these multiples.

Conclusion

Staking has surged despite the ongoing "crypto winter," particularly due to Ethereum's transition to a proof-of-stake algorithm. Lido, as the leading staking provider, has benefited the most. However, while it's tempting to consider the LDO token undervalued given the boom in its staking business, its valuation still appears exorbitant, particularly when factoring in the significant governance risks.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.