Is Inflation Threat to Crypto Over?

Monetary tightening by the Federal Reserve, caused by high US inflation, decimated crypto and most other assets last year. However, core inflation peaked in September 2022, and recent inflation news has been encouraging. Does this signal an all-clear for crypto now?

Inflation Slowdown

High US inflation was a primary reason for the crypto plunge last year, compelling the Federal Reserve to raise interest rates from near-zero levels in 2021 to over 5% now. This led to a widespread drop in most assets, including bonds, stocks, and cryptocurrencies. However, the situation has changed.

US core CPI peaked last September, approximately at the same time as stocks hit their lowest point, and it steadily declined thereafter. The slowdown in inflation is now supporting most assets, and it is no coincidence that stocks bottomed out when core CPI peaked. A recent example of this correlation was last week when there was a euphoric rally in both stocks and bonds, thanks to positive US inflation data. US core CPI came in lower than expected, falling below 5% in year-over-year terms for the first time since November 2021. The headline CPI was even lower, dipping slightly below 3%.

These developments raise the question of whether inflation is no longer a significant threat to most assets, including cryptocurrencies.

In my view, the short-term inflation picture does support the narrative of inflation returning to the target, even if it's a bit slower than desired by the Federal Reserve.

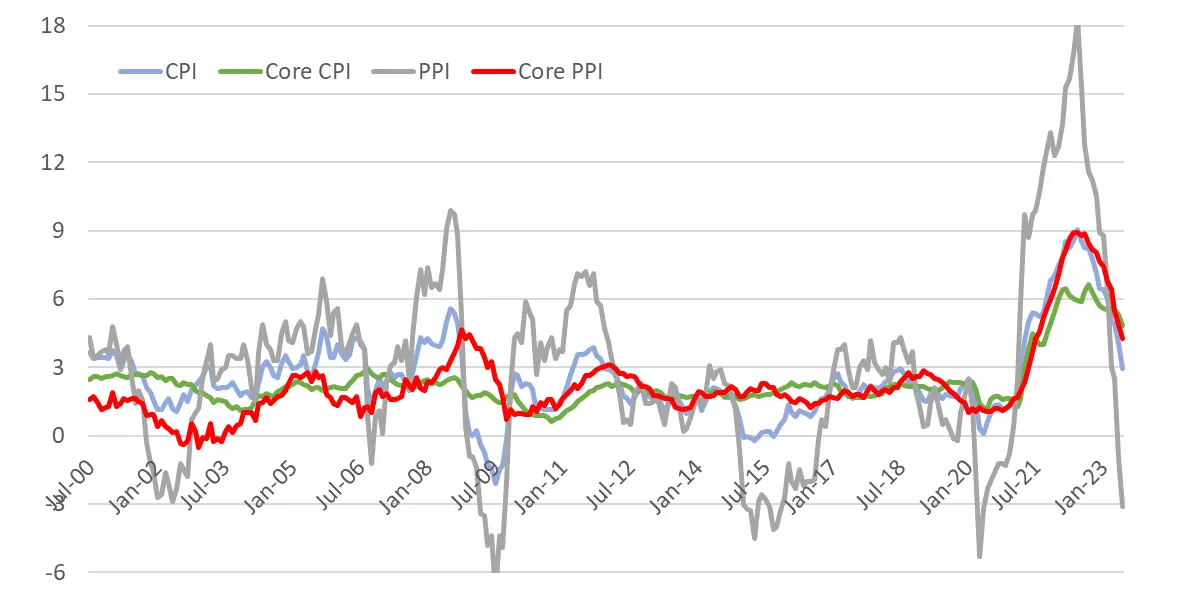

Headline CPI is too dependent on volatile oil prices, and though core CPI has been resilient, the decline in producers' prices is very pronounced, reducing input cost pressure on consumer prices. Core PPI has returned to mid-2021 levels, and the headline PPI has dropped to its lowest point since the Covid crisis.

US CPI, core CPI, PPI, and core PPI (YoY, %)

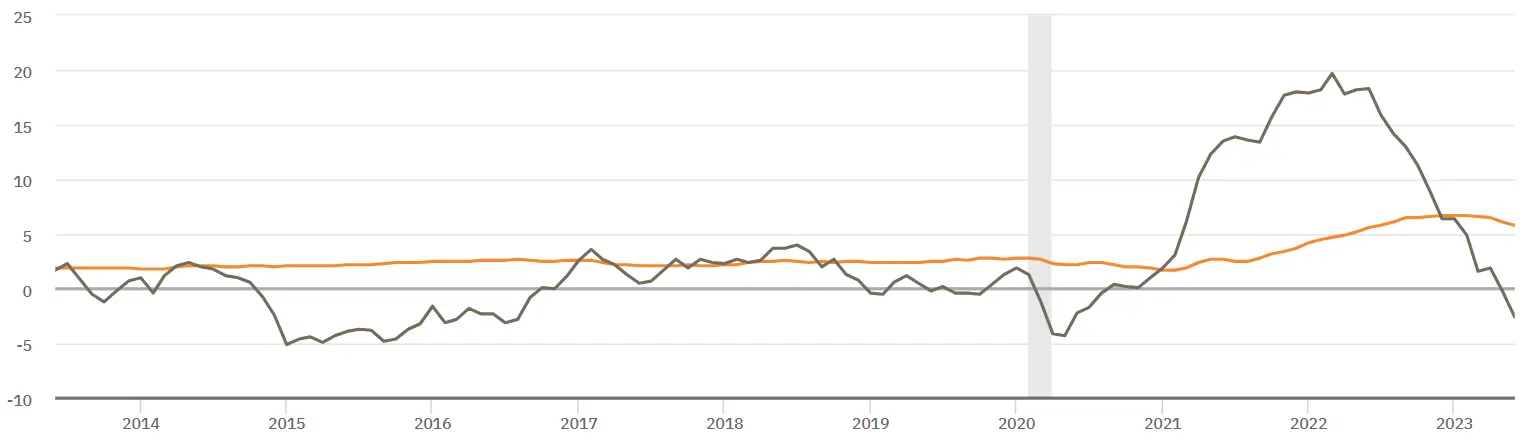

Additionally, the Federal Reserve Bank of Atlanta has conducted an insightful analysis that is frequently used by bond analysts and traders. The bank provides two types of consumer price indexes (CPI): sticky-price CPI and flexible-price CPI.

The sticky-price CPI reflects the behavior of consumer prices that change infrequently or remain fixed for a certain period, such as rents or long-term contracts. On the other hand, the flexible-price CPI considers consumer goods and services whose prices change frequently and quickly, like gasoline or groceries. These two measures help us understand inflation dynamics, as sticky-price CPI can indicate sluggish adjustments, while flexible-price CPI provides insights into short-term fluctuations in consumer prices.

The flexible-price CPI calculated by the Federal Reserve Bank of Atlanta is the lowest since May 2020, suggesting momentum for lower CPI in the next few quarters. Historically, the faster-moving flexible component of the CPI tends to peak before the slower-moving one.

Sticky-price CPI (orange) and flexible-price CPI (black), YoY, %

The caveat is that lower inflation is good for crypto (as well as other assets) as long as it leads to lower long-term yields. However, long-term yields are currently near this year's highs (meaning that prices of long-term bonds are near lows) and appear vulnerable from a technical analysis perspective.

iShares 20+ Year Treasury Bond ETF (TLT)*

Upside Risks to Inflation

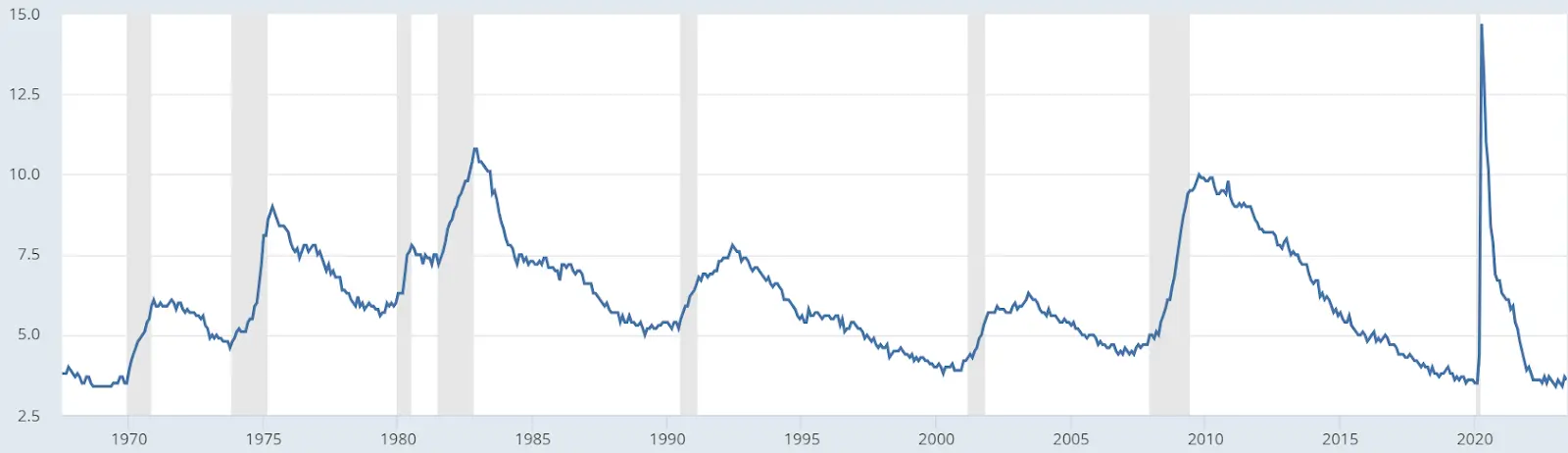

I think that the bond market is relatively pessimistic because it sees longer-term risks regarding the current inflation slowdown. The US labor market remains exceptionally strong, and if the US economy experiences a soft landing rather than a recession, the reacceleration of inflation may become a question of a few quarters. In mainstream macroeconomics, a tight labor market suggests upward pressure on prices through higher wages. The current US unemployment rate at 3.6% remains close to the lowest ever, nearly matching the rates of 3.4% in 1969 and 3.5% in 2019.

US unemployment rate (%)

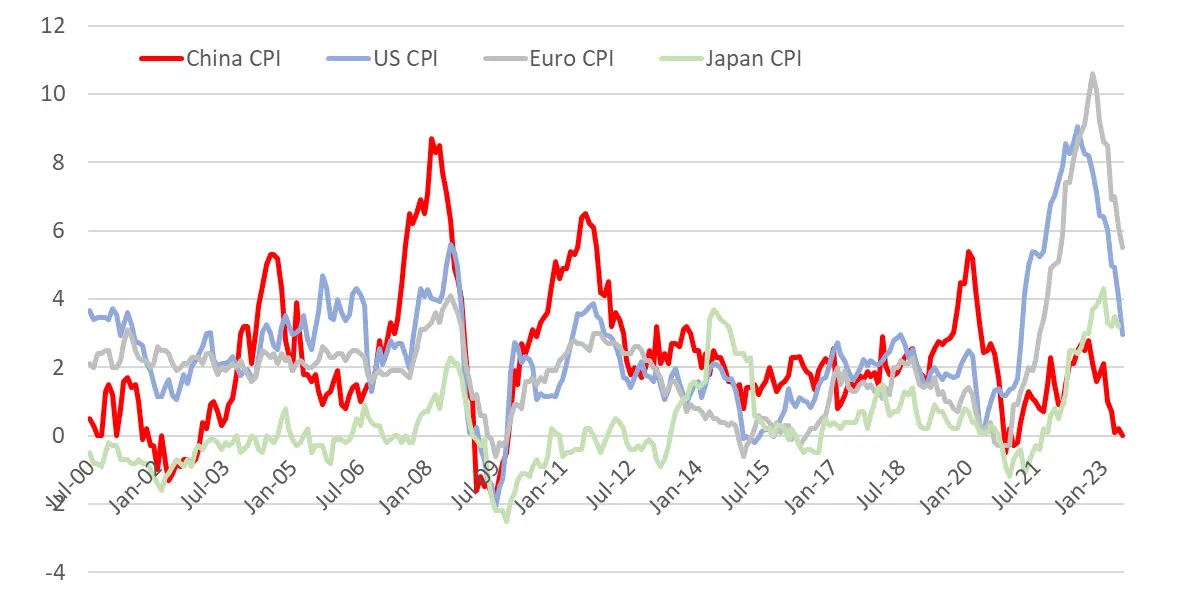

Another concern lies with commodity prices. Headline YoY inflation figures in the US have been suppressed by much lower prices for oil and other commodities due to last-year's economic slowdown in China, caused by a zero-covid policy that decreased global commodity demand (conveniently for the US).

Now, the macroeconomic situation in China suggests the possibility of new monetary and fiscal stimulus, which is likely to increase commodity prices. So far, the Chinese government has resisted the calls by major investment banks for a large-scale stimulus, but it increasingly appears to be a matter of time before the government finally heeds the advice.

Unlike the US and most other countries, China faces a deflation threat rather than too-high inflation. China's CPI was zero in YoY terms in June, which is the lowest among major countries. Even Japan, which battled deflation for decades, now has higher inflation than China.

CPI in China, US, Euro area and Japan (YoY, %)

A weakening dollar provides another argument in favor of the stimulus. The US dollar has fallen against major currencies to its lowest level since April 2022, alleviating devaluation worries for the yuan and other emerging market currencies (as the stimulus suggests a larger money supply, potentially cheapening the currency).

US dollar index vs. major currencies (DXY)

Conclusion

In my view, the short-term inflation picture does support the narrative of inflation returning to the target, but the longer-term outlook is more complicated. The markets increasingly price in a soft-landing scenario, suggesting that the inflation slowdown is likely temporary. Moreover, commodity prices, which contributed to the inflation slowdown this year, may recover if the Chinese economy improves.

Upcoming macroeconomic data may continue to support the thesis of inflation slowdown, but the bond market already views lower inflation as a temporary situation. When the stock market becomes less obsessed with artificial intelligence, it will likely account for the prospects of reaccelerating inflation as well. In my opinion, crypto may react faster than the stock market.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.