Is Bitcoin ETF a Game Changer?

In the last two weeks, several major ETF providers filed documents to launch a physical Bitcoin ETF, potentially opening their clients a gateway to crypto. How significant are potential new flows into Bitcoin?

ETF Is an Entry into the World of Big Money

Recent applications come from Blackrock, Invesco, and WisdomTree. The scale of these companies is staggering. Blackrock is the largest asset manager in the world with $9 trillion under management. Invesco is a top-20 player with 1.5 trillion. WisdomTree is a far smaller company, specializing in niche ETFs, but still has a respectable $93 billion under management. For comparison, Bitcoin's market cap is just about $600 billion.

The largest asset-managing companies in the world (as of March 31, 2023)

A Bitcoin ETF may become a gateway for clients of these companies into the crypto world. Crypto infrastructure is hard to use for institutional investors, while ETFs are familiar and convenient investment vehicles.

Anticipating a large future flow from traditional finance, investors poured $199 million into existing crypto investment products last week, which is the highest since July 2022 (according to Bloomberg). Futures-based BITO (ProShares Bitcoin Strategy ETF) has had the largest weekly inflow this year.

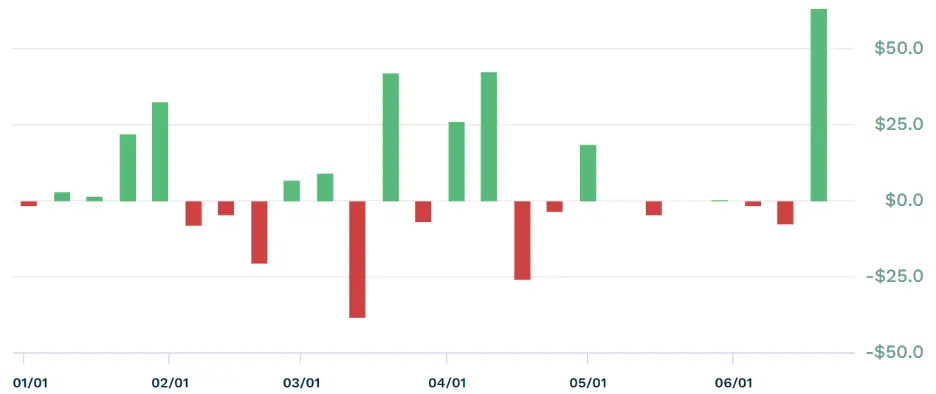

Year-to-date weekly flows into ProShares Bitcoin Strategy ETF (BITO)

The ETF world

Is this optimism justified? Let’s take a look at the ETF world.

ETFs are dominated by instruments focused on US stocks. The three largest ETFs are passive funds investing in the S&P 500. The fourth-largest and fifth-largest funds also consist predominately of US large-cap stocks. I think that investors in stock and bond funds are unlikely to diversify into a future Bitcoin ETF, and the Bitcoin ETF is better compared with gold funds. The two largest gold ETFs have combined assets of $86 billion, which looks small in the ETF world but big compared with crypto. I also note that there are many other smaller ETFs focused on gold and gold producers, so the total amount of gold-related ETFs is likely above $100 billion. For example, the largest gold-mining ETF (VanEck Gold Miners ETF) has $12 billion under management.

The largest ETFs in the US

Source: ETF Database

I believe that a physical Bitcoin ETF may take a bite from gold ETFs, because investors may consider diversification into a potential “digital gold” instead of the traditional metal. If so, $199 million added to crypto investment products last week is a very modest amount compared with $86 billion held by just the 2 largest gold ETFs. More generally, the gold market cap is more than 20 times larger than the Bitcoin market cap, so even a tiny reallocation from gold to Bitcoin is likely to have a substantial effect on Bitcoin price.

However, we should not expect staggeringly huge new flows into crypto because of a Bitcoin ETF. In the US stock market ETFs are very big and hold a very significant percentage of total stocks existing, but gold ETFs hold a much smaller share of all gold. I estimate that all gold-related ETFs, including mining, have a market cap equivalent to just about 2% of the gold market cap. It looks like investors in gold prefer to keep it in a physical form if possible and generally do not trust financial instruments. The same may relate to crypto, particularly given that storage costs for crypto are way lower than for gold.

The 2% figure is for an established asset, and for a relatively new asset the same percentage should be much lower. I think that something like 0.5-1.0% is more relevant for Bitcoin, which is about $4.5 billion. This amount relates to all ETFs including existing funds.

Existing Exchange-Traded Products

Currently, the largest crypto ETF is ProShares Bitcoin Strategy ETF (BITO). The fund is tiny compared with gold ETFs, having a market cap of just above $1 billion.

The ETF is based on CME futures rather than spot Bitcoin, so it has both advantages (like great liquidity) and disadvantages (like carry costs) of futures. “BITO provides a familiar way to gain exposure to bitcoin-linked returns with the liquidity and transparency of an ETF. BITO can be bought and sold through a brokerage account, eliminating the need for a cryptocurrency exchange account or wallet”, – the ETF provider (ProShares) advertises the ETF on its website.

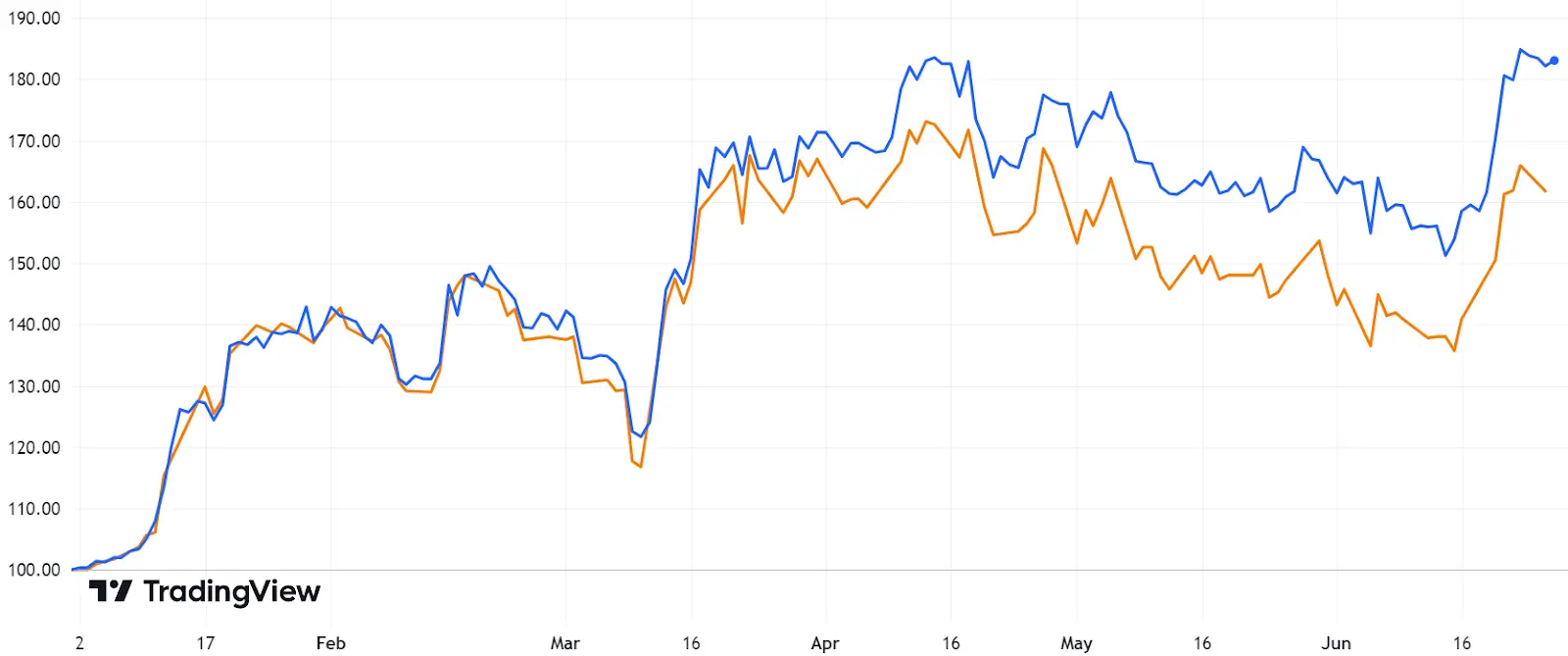

In practice, BITO is a convenient vehicle for trading but not for investment. Futures-based funds may significantly differ from underlying assets, and in the long-term usually in the wrong direction. This year BITO has trailed Bitcoin performance a lot, rising by about 60% compared with about 80% provided by spot Bitcoin.

The year-to-date performance of Bitcoin (blue) and BITO ProShares Bitcoin Strategy ETF (orange)

If a spot Bitcoin ETF is approved, BITO will likely become less popular. “While BITO benefited from the spot filings, if approved, they’ll likely take business from the ETF,” wrote an analyst at Bloomberg Intelligence.

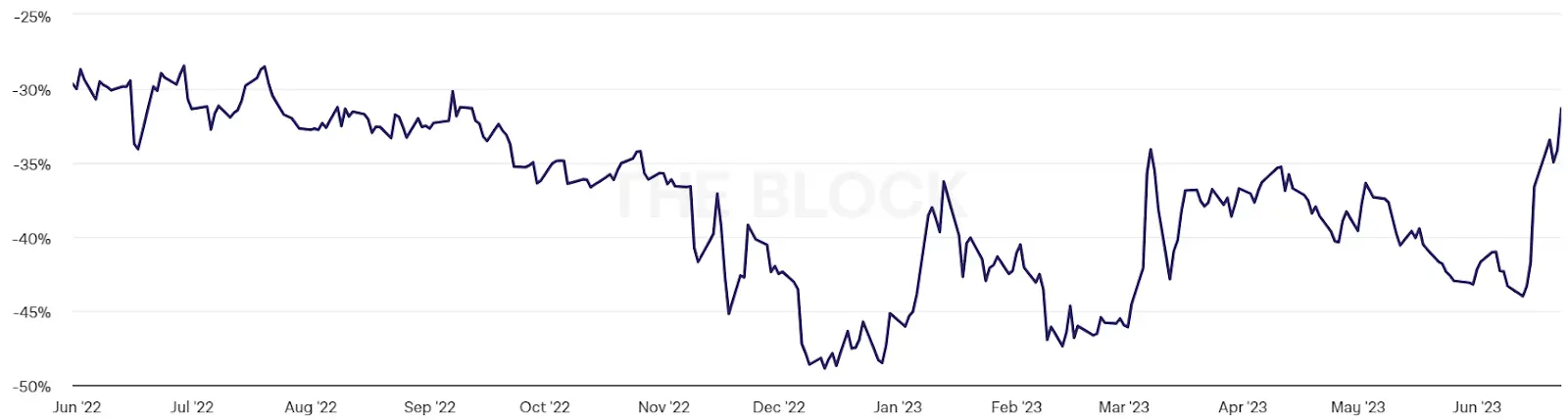

Although it’s not an ETF, Grayscale Bitcoin Trust (GBTC) should also be noted as another major exchange-traded product linked to crypto. The trust is huge, having $19 billion under management (market cap is much lower), but its specifics make it too different from conventional ETFs. The fund is very opaque, trades OTC, and is managed by a crypto-focused company which is likely not trusted by most institutional investors. GBTC trades with a very large discount to its net asset value, reflecting the lack of the in-kind redemption embedded in most ETFs. The fund manager can reduce the discount, selling its Bitcoin holdings and buying GBTC shares, but it is too greedy to do it because that would lead to lower assets under management and so lower fees. Major investment managers like BlackRock are far less likely to be so greedy, having a very large and diversified business based on investors’ trust.

Interestingly, the GBTC discount rose on the news of Bitcoin ETF filings by major investment companies, hinting at a possible future outflow from the trust into new ETFs.

Grayscale Bitcoin Trust (GBTC) discount to its net asset value

Conclusion

I believe that a physical Bitcoin ETF may take a bite from gold and particularly gold ETFs, because investors may consider diversification into a potential “digital gold” instead of the traditional metal. The scale of the ETF world is staggering, but it’s dominated by funds focused on US stocks. Gold ETFs are big compared with crypto, but represent just about 2% of all gold.

Based on comparison with gold, I think a physical Bitcoin ETF would attract around $4-5 billion, and a significant part (I guess something like 30-50%) of this amount may be covered by outflows from existing products, particularly GBTC. This potential new inflow to Bitcoin may be equivalent to about 0.5% of the Bitcoin market cap. All in all, that’s a large flow into crypto, but probably not a game changer.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.