How to Trade Ethereum Options Imbalance

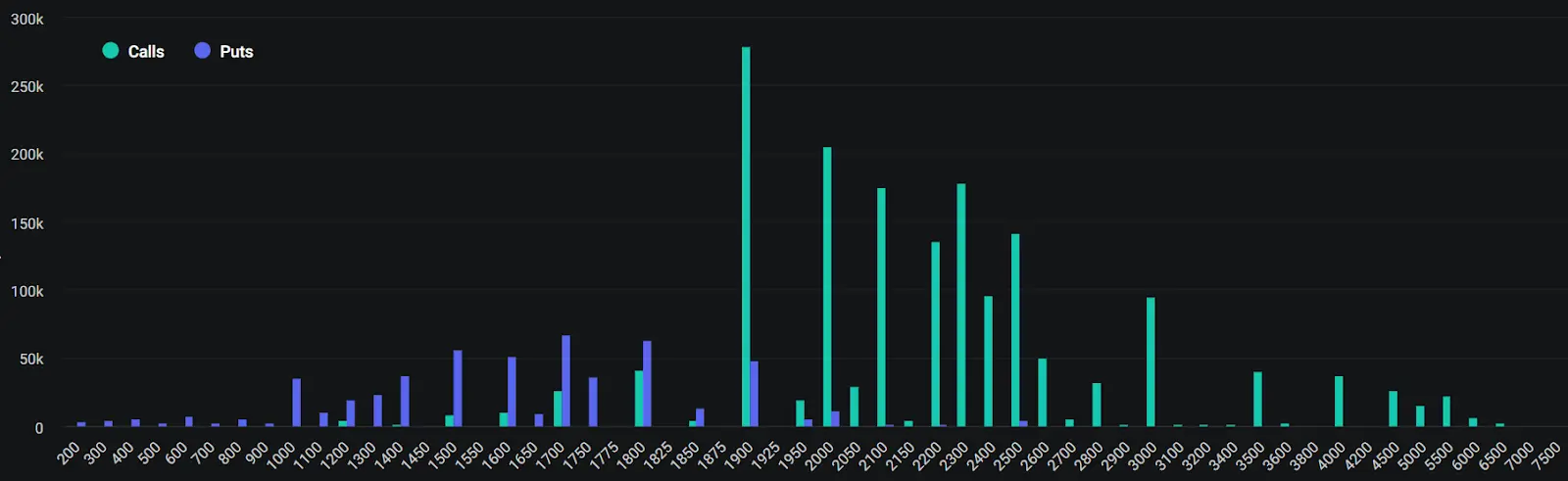

I noticed an unusually large amount of Ethereum call options at the $1900 strike. I think that the position of such size is more likely to be a covered call selling rather than a speculative bet, so dealers may be long calls. It suggests a dampening effect on prices and volatility because dealers will sell the spot if the price rises and buy if the price declines.

Wall of $1900 Call Options

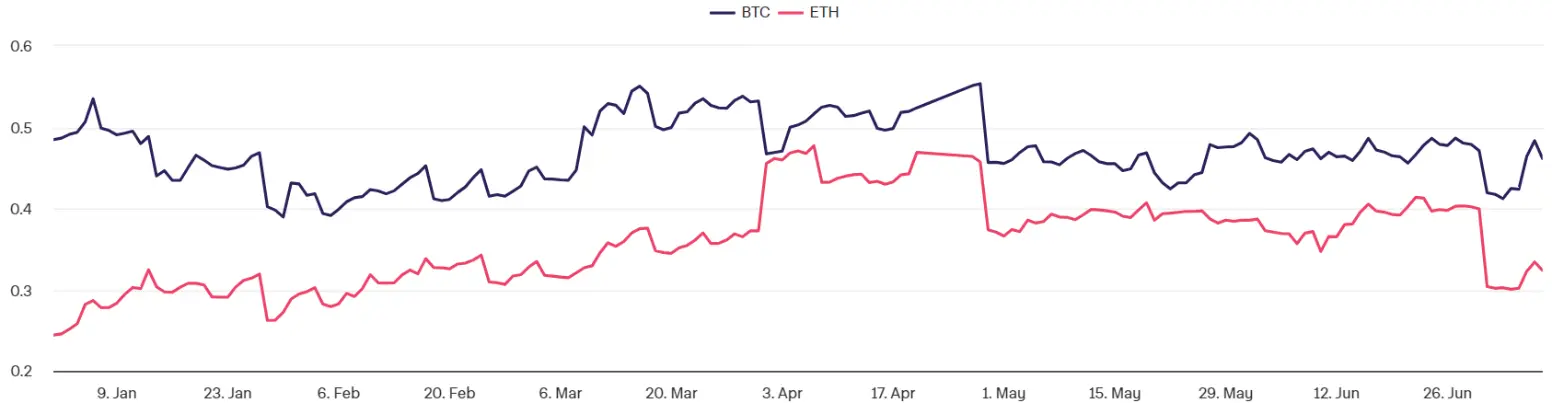

After a June 30 expiration, Ethereum open interest put/call ratio plunged to February levels, indicating a strong preference for calls. This is a phenomenon specific to Ethereum only, as the same ratio for Bitcoin swiftly recovered after the expiration and remained around the year-to-date average level.

Open interest put/call ratio

A primary reason behind this imbalance is the wall of calls with a $1900 strike price. Ethereum option open interest is dominated by $1900 calls, having a $522 million notional value. Most of these calls have a relatively long period until expiration. The largest expiries of these calls are September 29 ($180 million notional value) and December 29 ($151 million notional value).

Ethereum options open interest

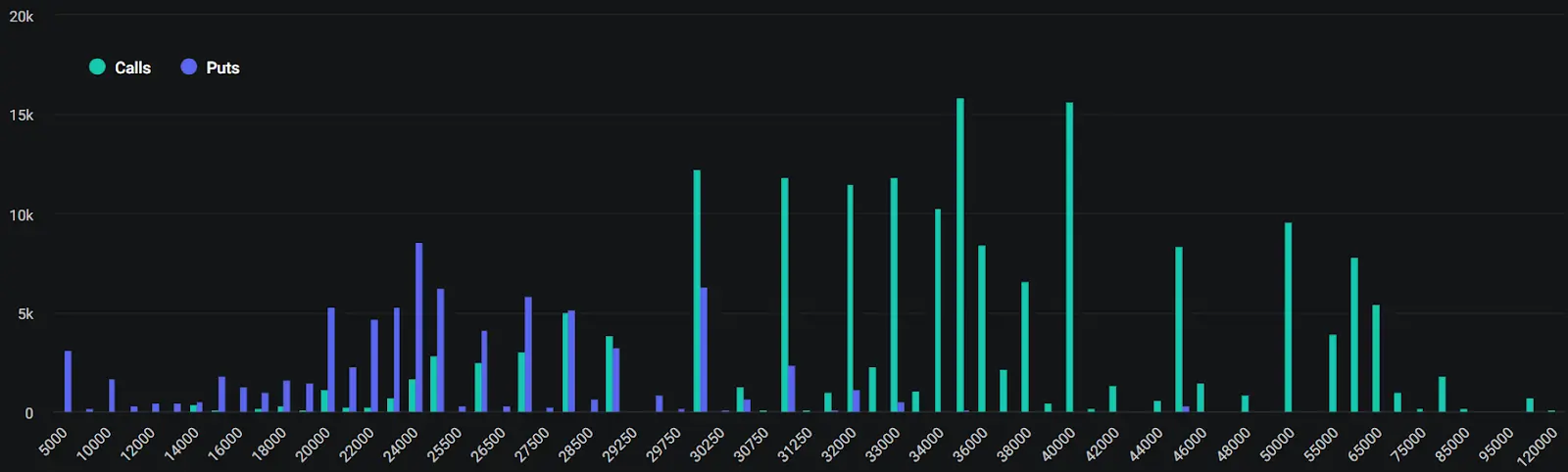

This wall of calls is specific to Ethereum, as Bitcoin option open interest is balanced across different strikes.

Bitcoin options open interest

Effect on Volatility and the Spot Price

I think that a position of such size is more likely to be a covered call selling rather than a speculative bet. Buying high-delta calls (with a strike price close to a spot price) instead of a spot seems a bit strange, particularly given that spot Ethereum has no counterparty risk (unlike a position on Deribit) and may provide a staking yield. Like every other crypto exchange, Deribit has a very significant credit risk. On the contrary, covered call selling could enhance a staking yield if an investor sees no upside potential, and Deribit is a natural choice for an execution of such a trade.

The very suppressed implied volatility of Ethereum may be an argument in favor of my hypothesis (although the implied volatility is determined by many more factors). Ethereum DVOL index is near an all-time low and is below the same index for Bitcoin, indicating lower implied volatility for Ethereum than for Bitcoin.

Ethereum DVOL index

If I’m right, dealers are long $1900 calls as they have bought covered calls that were being sold. As a part of market-making activities, they provided a bid for the calls, take the calls, and delta-hedge the position thereafter. To remind readers less familiar with options trading, delta hedging is a strategy used by investors to manage risk when trading options. Delta measures the sensitivity of an option's price to changes in the underlying asset's price. Delta hedging involves taking offsetting positions in the underlying asset to neutralize the impact of price movements. For example, if you buy a call option, which increases in value as the underlying asset price rises, you would sell a portion of the underlying asset to balance out any potential losses. This helps maintain a more stable overall position, minimizing the impact of price fluctuations on your position. Delta hedging allows investors to protect themselves from adverse market conditions.

Option market makers typically use dynamic delta hedging, constantly rebalancing a position in order to keep it relatively immune to spot moves (i.e., with only a small gamma). For $1900 Ethereum call holders, it means buying when spot decreases and selling when it rises (as long as the spot price remains not very far from $1900).

Ethereum (ETH/USD)

An actual dealer strategy is more complicated, and the threshold between buying and selling spot is unlikely to be exactly at $1900. However, I think it’s safe to say that dealers will generally buy on weakness and sell on strength at least in the $1700-$2000 range. The diapason is not symmetric, because the $1900 strike is very close to being in the money. Thus, a potential spot upside risk is probably hedged much more than a potential downside risk, making dealers more inclined to buy on weakness than to sell on strength.

How do You Trade It?

I’m making 4 main trading points based on my observations.

- The large dealer positions in $1900 calls suggest spot trading within a range and a dampening effect on both realized and implied volatility. I think the range is approximately at $1700-$2000.

- The spot price should be well-supported on any downside move as dealers will close their spot short position, which balances calls sold.

- There may be a potentially strong resistance level somewhere around $1900-2000 as dealers will add to their hedges if the spot rises. However, much of a dealer upside risk is probably already hedged, so a related flow should be weaker than on a down move.

- Like with any other range trading, breaking out of the range may be a strong trading signal. In this case, breaking out of the range suggests that a related option flow is exhausted. A potential upward move above $2000 (if any) looks like a particularly strong signal, as a dealer hedging activity has probably strained previous attempts to move up, contributing to Ethereum's underperformance vs. Bitcoin.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.