How to Buy Bitcoin and Ether at 30% Discount

Stock market prices of Grayscale Bitcoin Trust and Grayscale Ethereum Trust imply a 30% discount on their net asset value (NAV). Grayscale Bitcoin Trust and Grayscale Ethereum Trust are closed-end funds traded OTC in the US at tickers GBTC and ETHE, respectively. Both trusts are passive funds investing solely in the respective cryptocurrency and are relatively large (other funds provided by Grayscale may also be cheaper than their NAVs but are smaller and less liquid). Assets under management of Grayscale Bitcoin Trust are $19.2 billion. Assets under management of Grayscale Ethereum Trust are $5.5 billion. Both GBTC and ETHE can be purchased via most US retail brokers.

How is it possible? In short, because both trusts are closed-end funds, not ETFs.

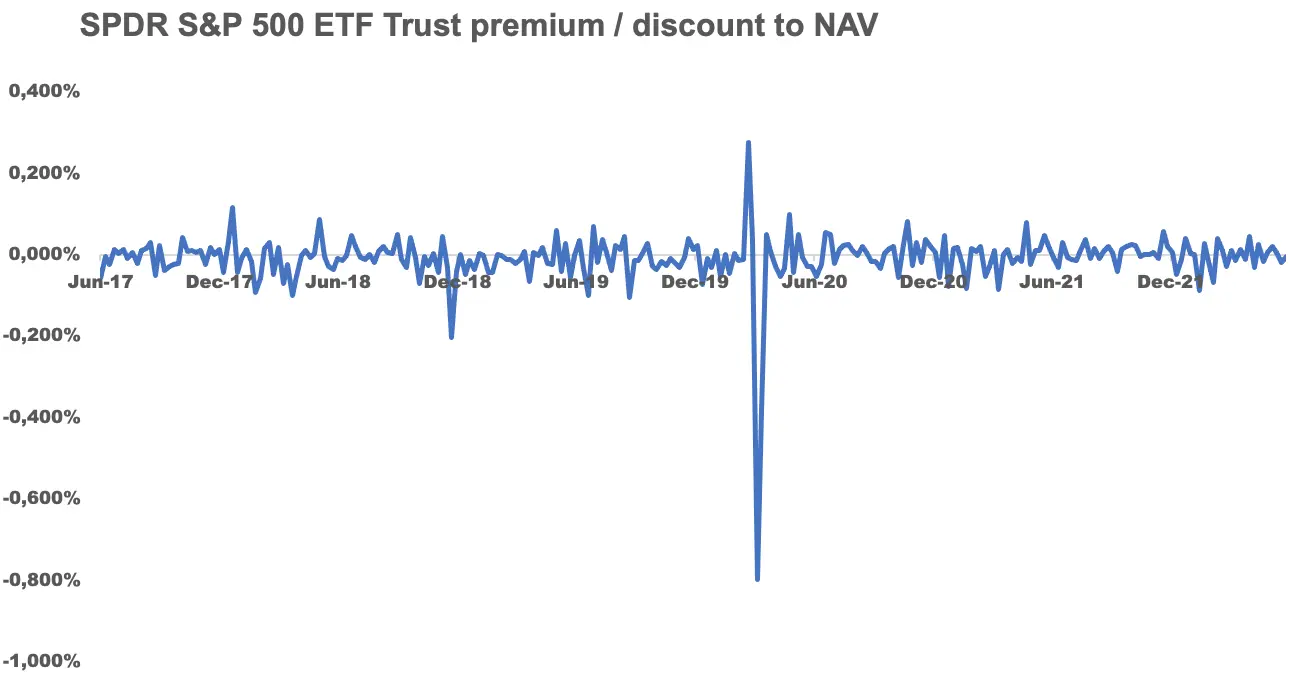

Funds traded on stock exchanges are usually ETFs. The most distinctive feature of ETFs is in-kind redemption, allowing authorized participants to exchange their shares of ETF for ETF’s holdings. Although in practice, ETFs often prefer to settle redemptions in cash, the possibility of exchanging fund’s shares for its assets keeps the price of the fund’s shares very close to its NAV. For example, the chart below shows that the price of SPDR S&P 500 ETF Trust (the world’s largest ETF) has never deviated from its NAV by more than 1% during the last five years. The typical difference between the price and NAV of this ETF is below 0,1%.

To be precise, prices of certain ETFs often deviate from their NAVs, which is usually explained by the lower liquidity of ETF’s assets compared with the ETF itself. In these cases, ETF is a primary price discovery tool. It is typical for many ETFs investing in corporate and emerging markets bonds.

Unlike ETFs, closed-end funds lack in-kind redemption. Therefore, there is no mechanism to glue a fund’s price to its NAV. Difference between price and NAV still creates arbitrage opportunities, but they are far more difficult to exploit.

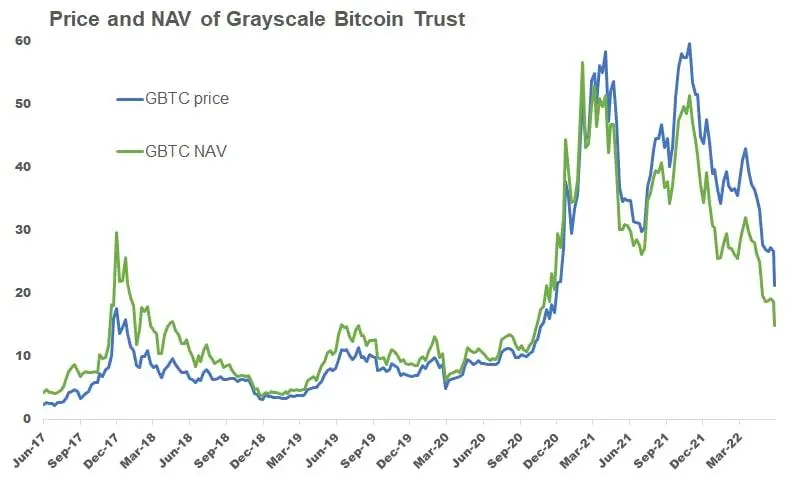

Prices of closed-end funds reflect supply and demand in the stock market. Until February 2021, Grayscale Bitcoin Trust traded with a premium to NAV. In September 2017, the premium was as high as 100%!

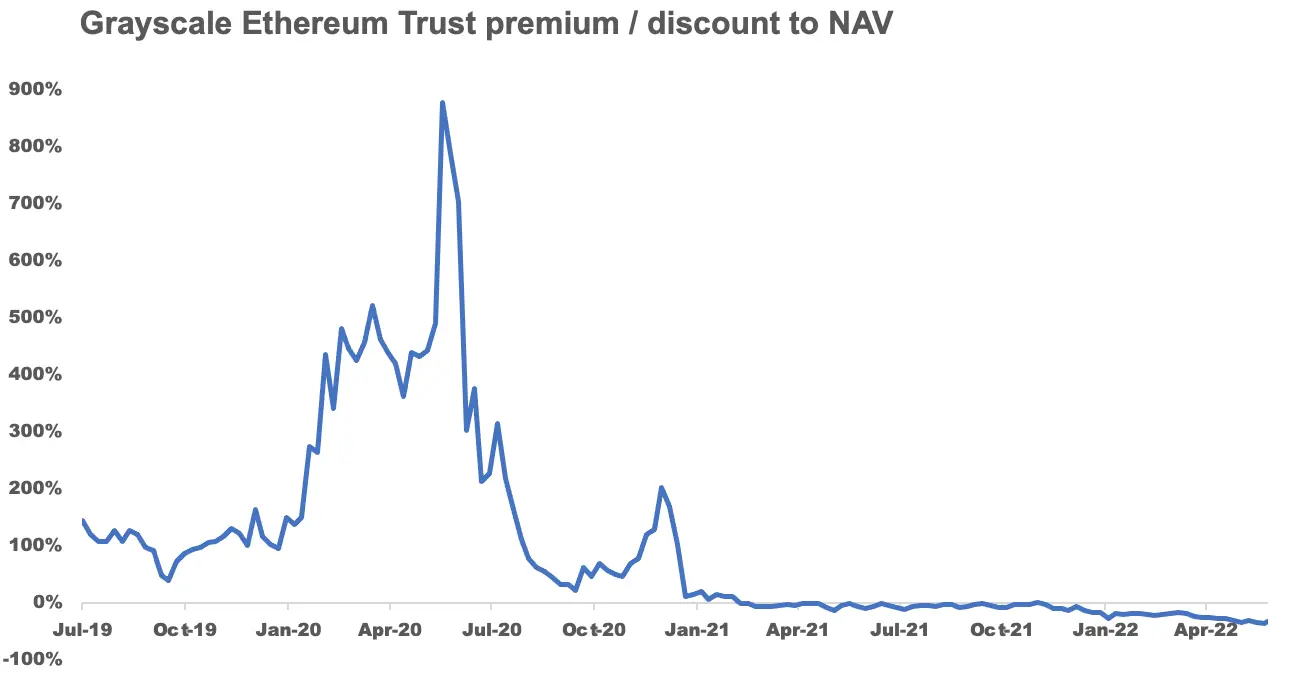

Those who bought Bitcoin at the local high in December 2017 now enjoy a 45% gain, but those who bought at the same time Grayscale Bitcoin Trust now have a 32% loss! Investing in Ethereum in the first half of 2020 earned by now 400-800% depending on timing, but buying Grayscale Ethereum Trust with a very inflated premium would destroy that huge gain.

Inefficiencies in the pricing of Grayscale Ethereum Trust are even more severe. Frankly, we don’t understand who and why had bought the fund in March-June 2020 at prices 5-10 times (!) more than its worth.

Investing in Ethereum in the first half of 2020 earned by now 500-1000% depending on timing, but buying Grayscale Ethereum Trust with a very inflated premium would destroy that huge gain.

The current situation is the opposite. Instead of premium in 2020 and before, Grayscale Bitcoin Trust and Grayscale Ethereum Trust are traded with about 30% discounts. That makes the trusts a compelling choice for long-term investors in Bitcoin and Ethereum. The discounts can provide a cushion in further crypto correction or an additional upside in recovery. Moreover, Grayscale actively works to transform its funds into ETFs. If it succeeds, the discounts will probably shrink rapidly.

The discounts also provide a lot of arbitrage opportunities. The simplest strategy is to buy one of the trusts and sell the respective cryptocurrency in size equal to NAV (to match the exposure of both positions). However, history shows that deviations between price and NAV may persist for a prolonged period and reach an absurd level, so investors should carefully calibrate their exposure to ensure no margin call risk.

To avoid the possibility of a margin call, investors can combine the trusts with out-of-money put options on the respective cryptocurrency. The notional size of the put options should be about the same as the NAV of the purchased trust in order to match exposure. This is particularly compelling for those seeing the risk of significantly lower crypto prices in the near term. For example, buying December 2022 put options with a $20,000 strike in the size equal to 10% of position in Grayscale Bitcoin Trust can hedge from a correction bigger than 12% until year-end (pricing as of June 14). We think that combinations like this offer great risk-reward exposure to Bitcoin or Ethereum. Advanced investors may also consider more difficult combinations. For example, investors can buy one of the trusts and sell call options or call spread on the respective cryptocurrency.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.