GBTC Outflows May Dwarf Inflows into Bitcoin ETFs

When a spot Bitcoin ETF is approved, GBTC will likely also be able to convert into an ETF. Investors who have been trapped in GBTC for years, as well as recent buyers betting on a reduced discount to NAV, will have the opportunity to convert their fund shares into coins and sell. This could lead to large outflows from the crypto market.

Spot Bitcoin ETF Is Coming

Grayscale recently achieved a significant victory against US regulators. The U.S. Securities and Exchange Commission (SEC) has chosen not to appeal a prior court decision, allowing Grayscale to convert its Grayscale Bitcoin Trust (GBTC) into an ETF. This decision also clears a path for spot Bitcoin ETFs offered by other asset managers. "I'm quite hopeful that these [ETF] applications will be approved, not least because they ought to be approved under the law. The firms presenting robust proposals for these products and services include some of the most prestigious names in financial services. This, I believe, indicates we can expect progress in the near future," said the Coinbase Chief Legal Officer to CNBC last week.

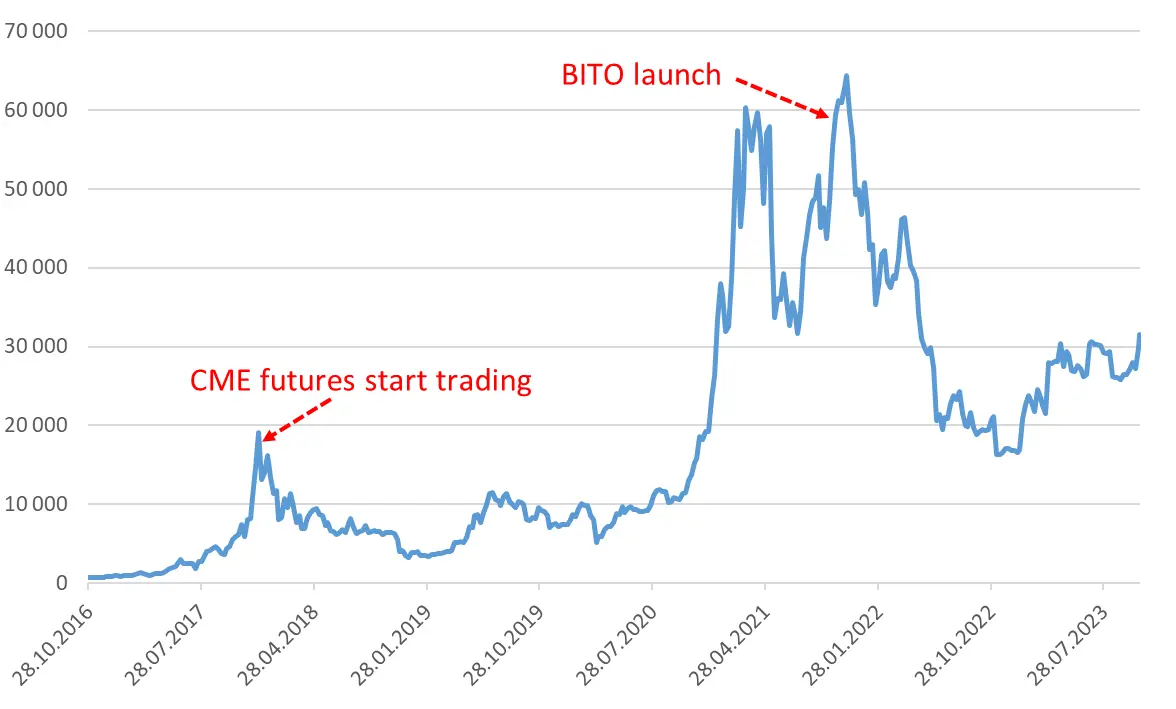

The price of Bitcoin has already increased in anticipation of the ETF's launch, rallying by 28% since October 14, when Reuters reported that the SEC would not appeal the court's decision.

Bitcoin (BTC/USD)

The Problem with GBTC

When a spot Bitcoin ETF gets approved, it's likely that GBTC will also convert into an ETF. However, a major issue arises from the fact that GBTC has been trading at a discount to its net asset value (NAV) for over two years, since March 2021. In 2022, this discount often exceeded 20%. This led to many investors being trapped in GBTC, unable to exit the fund due to the steep discount to NAV. Some of these investors might have attempted to hedge their positions by selling Bitcoin futures against their GBTC holdings.

Starting in June 2023, this discount began to decrease rapidly, most likely in response to news about Grayscale's legal victories against the SEC. This suggests there was speculative activity betting on a reduced or even zero discount in anticipation of a conversion to an ETF. It's plausible that some traders started buying GBTC and hedging partially by selling Bitcoin futures.

GBTC discount to NAV

Once GBTC converts into an ETF or when it trades at a minimal discount to NAV, two groups will probably rush to exit: long-term holders who have been waiting for the right opportunity and recent speculators banking on a reduced discount. For the former group, it's a golden chance. Although Grayscale's apparent unwillingness to close the discount (by selling its Bitcoin holdings and buying back GBTC shares) may push some to exit due to dissatisfaction, these investors are more likely to transfer into new ETFs offered by major asset managers than to cash out completely. This is because closing the discount in such a manner would reduce Grayscale's assets under management, consequently decreasing their fee earnings. For the latter group, the speculators, it'll be time to reap their profits, especially since the potential of further arbitrage opportunities would be diminished.

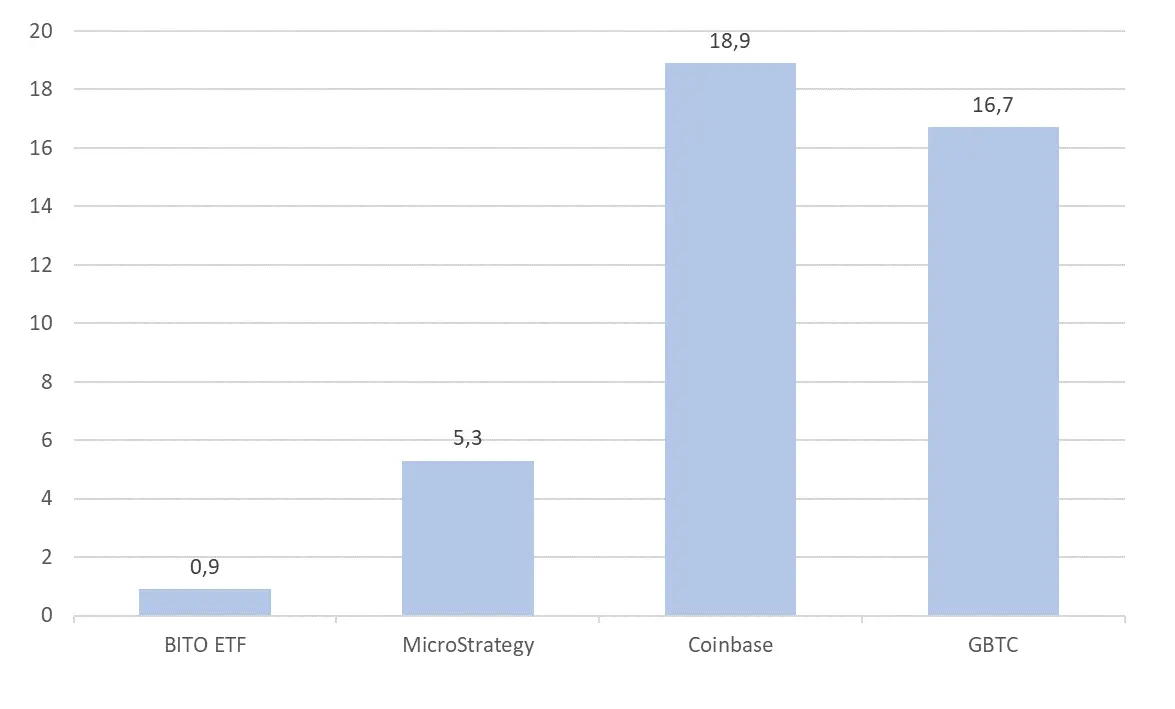

The impending challenge is that GBTC dwarfs both the current exchange-traded products related to crypto and prospective spot Bitcoin ETFs. GBTC's size is a whopping 19 times larger than the biggest pure-play Bitcoin ETF, which is the futures-based BITO (ProShares Bitcoin Strategy ETF). Furthermore, MicroStrategy, which predominantly invests in crypto, is a third of GBTC's size, and Coinbase, the major crypto exchange available on the stock market, is valued just slightly higher than GBTC.

Market cap of selected crypto-related assets (USD billions)

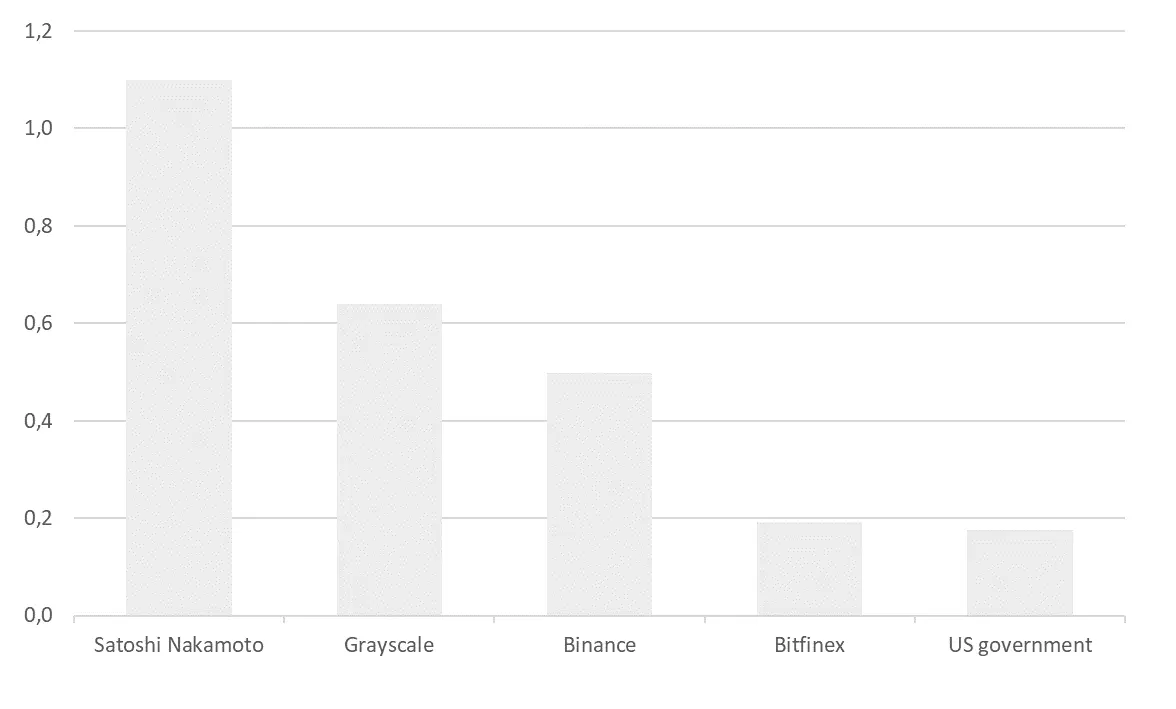

GBTC's market capitalization is determined by its net asset value (NAV) less the prevailing discount, which stood at 11% as of October 20. This distinction makes GBTC a behemoth in the Bitcoin holding landscape, as it holds roughly 3% of all circulating Bitcoins. This positions GBTC as the second-largest Bitcoin holder, surpassed only by the elusive and legendary Satoshi Nakamoto. To put this dominance into perspective, consider the gold market: the largest gold ETF, SPDR Gold Shares (GLD), holds only about 0.4% of the world's total gold. This stark contrast underscores the significant influence GBTC wields in the Bitcoin ecosystem

Largest holders of Bitcoin (BTC million)

Given GBTC's enormous size, it's reasonable to infer that its capital flows, both inflows and outflows, would be substantial. While quantifying the potential outflows from GBTC is challenging due to the variables previously discussed, it's conceivable that we're looking at figures in the realm of hundreds of millions or, more likely, billions of dollars. This scenario prompts a pivotal question: Could the potential outflows from GBTC overshadow the inflows into the anticipated spot Bitcoin ETFs?

In June, I had projected that drawing parallels with gold, a physical Bitcoin ETF could garner attention to the tune of $4-5 billion. Yet, the recent underwhelming performance of the Ethereum futures ETF has tempered expectations. While an Ethereum futures ETF might be seen as a niche offering, its notable failure to gain traction implies a more cautious outlook for new crypto exchange-traded products. Consequently, inflows into upcoming Bitcoin ETFs might very well match the potential outflows from GBTC.

Conclusion

Once GBTC either converts into an ETF or achieves a sufficiently narrowed discount to its NAV, a sizable segment of its investors, both long-standing holders and recent speculators, are poised to make an exit. Given that GBTC holds a significant 3% of all Bitcoins, this exodus could be on par with the capital moving into the awaited spot Bitcoin ETFs.

Historically speaking, the launch of new, large-scale exchange-traded products related to Bitcoin has often coincided with mid-term peaks in the market. Hence, the prospective debut of a spot Bitcoin ETF presents a strategic opportunity for crypto selling.

Bitcoin (BTC/USD)

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.