Crypto Winter Comes to US Banks

The recent failure of SVB is explained by rate bets going sour, but did SVB management imagine themselves as great macro traders or did they just incorrectly estimate future deposits by crypto and other venture firms? I think the latter is true, and that shows how crypto and broader venture capital downturn starts to affect the US banking system and the economy.

SVB Story

Silicon Valley Bank (SVB) was the 16-largest bank in the US, having $212 billion in assets as of the end of 2022. The bank was focused on servicing venture funds and new businesses, particularly in technology (including crypto firms) and biotech. Its website says that “nearly half of U.S. venture-backed technology and life science companies bank with SVB” and “44% of U.S. venture-backed technology and healthcare IPOs in 2022 bank with SVB.”

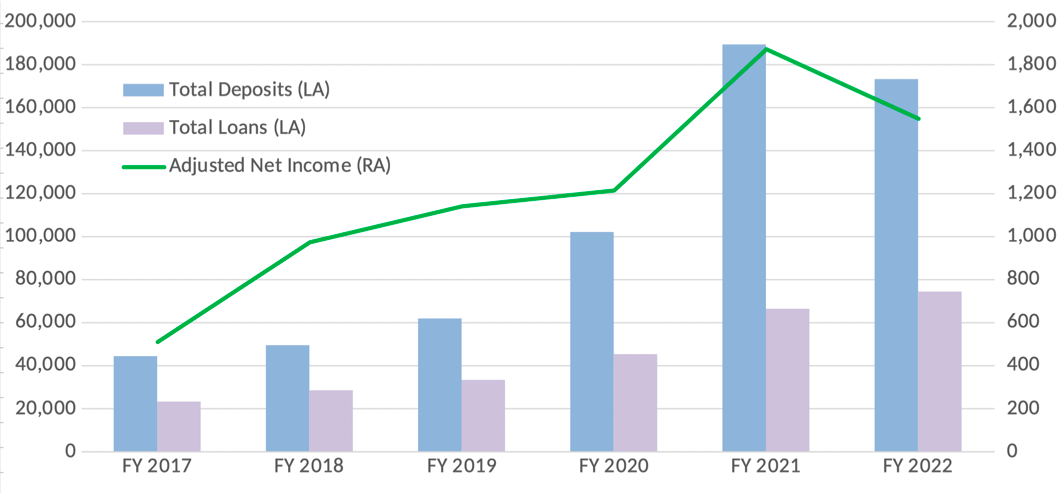

A venture capital boom of the last few years was very positive for SVB business. Until 2022, its clients were awash with cash and placed a significant part of it into their main bank, making SVB one of the fastest-growing regional banks in the US. Facing a wall of money, the bank was not able to use all new deposits for loans and instead increased investment in securities.

SVB Financials (USD million)

Higher interest rates in 2022 were once considered good for SVB since banks tend to improve a net interest margin in a high-rate environment. Thus, SVB shares almost doubled in 2022 even after rising by about 60% in 2021 on the back of the venture boom of 2021. In 2023 the shares zeroed in one of the most spectacular crashes in recent history.

SVB Stock Price (USD)

Too Lazy to Read

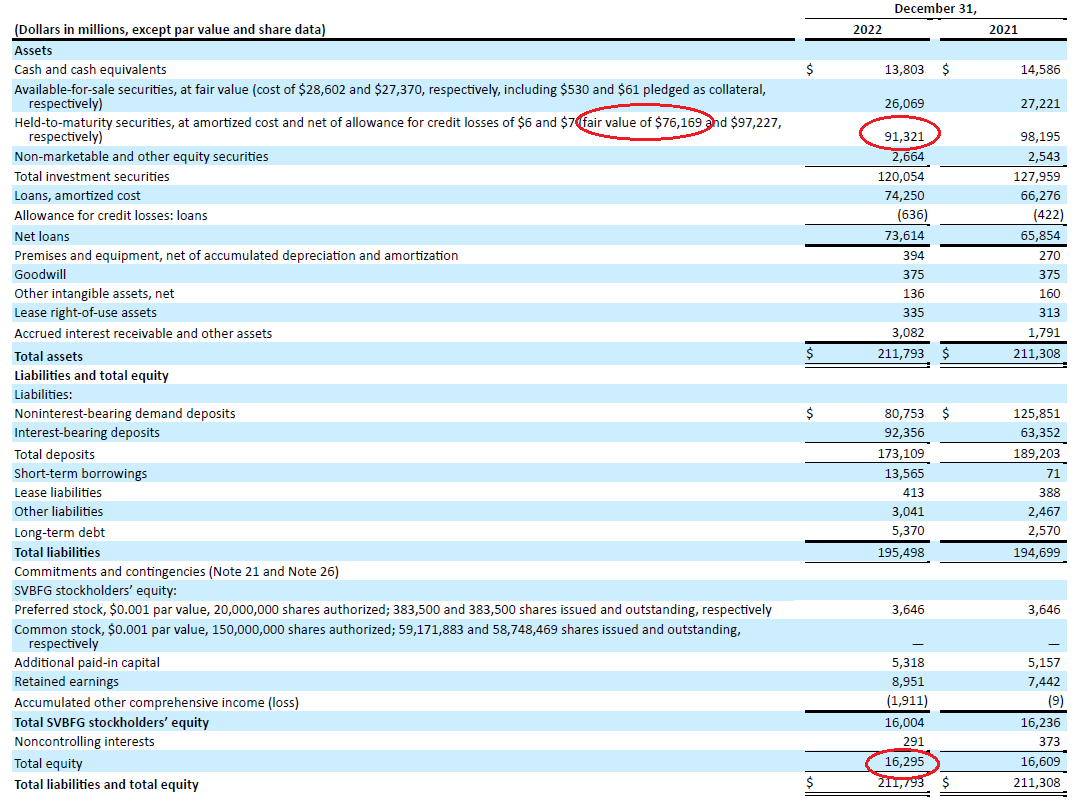

The most amazing part of the SVB story is that its problems were plainly disclosed in a financial report. The balance sheet of SVB as of end-2022 clearly stated that the losses on held-to-maturity securities had erased virtually all its equity. The annual report for 2022 was published on January 19. I’m stunned that it had not been noticed by most analysts of bulge bracket banks or promptly assessed by rating agencies. It looks like the rating agencies privately discussed with management a possible rating downgrade, but at the time of failure, SVB was still having a respectable investment grade rating both from Moody’s and S&P.

SVB balance sheet (USD million)

Held-to-maturity securities are accounted for at an amortized value without taking into consideration their actual market prices. For example, a company buys a 5-year bond at a $100 price with about a 1% yield. If the next day the market yield rises from 1% to 2%, the bond price will drop to about $95, but the company will still account for the bond at $100 if the bond has been recognized as held-to-maturity.

As of end-2022, SVB's balance sheet showed that held-to-maturity securities accounted for $91.3 billion were actually worth just $76.2 billion. That implies a $15.2 billion shortfall to the bank’s reported equity of $16.3 billion, wiping out 93% of the reported equity.

Did SVB management imagine themselves as great macro traders and placed a too-big bet that rates will not rise very much? Maybe, but I think that the management just expected a continuation of very fast deposit growth in 2022 like in the previous years, and preemptively bought more longer-term bonds at seemingly favorable prices in order to hedge the risk of lower interest rates when new deposits arrive. The problem is that the new deposits did not arrive, because in 2022 crypto and other technology companies did not get large new investments like in the previous years. Thus, the crypto winter and a broader decrease in venture financing are likely reasons for SVB's failure.

Effect on the US Economy

SVB story has led to some kind of banking panic, as the market starts to question the credit quality of other small and mid-size banks (as well as the balances and earnings quality of top-tier banks). The Federal Reserve effectively guaranteed all deposits at SVB, but shareholders will be wiped out and bond investors will have a big loss, so why not sell other banks’ shares and bonds? SPDR S&P Regional Banking ETF (traded under KRE ticker) has plunged by 28% so far in March.

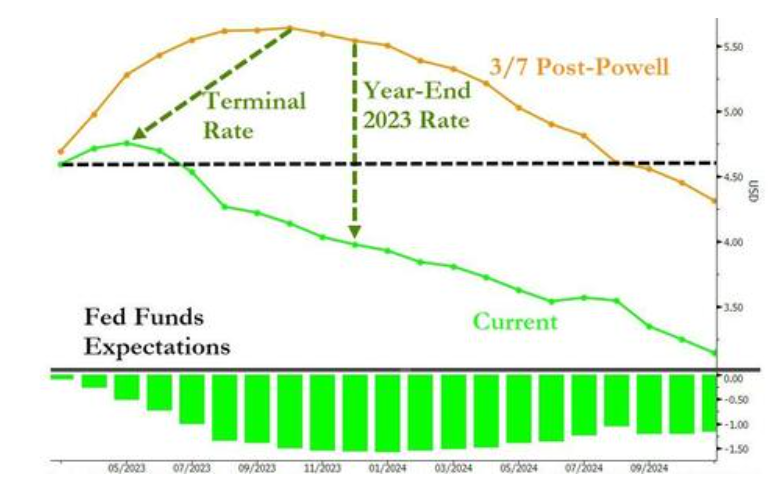

Bank fears translated into a broad risk-off. That has led to a profound change in market expectations for the US monetary policy, suggesting much lower rates ahead. The chart below shows a huge difference between the expected rate paths on March 7 and March 13. The market now sees the Federal Reserve aggressively slashing rates in the second half of 2023 and in 2024, likely reacting to a recession in the US economy.

Market Expectations for the Fed's Rate Trajectory

Conclusion

SVB failure may be a signal that crypto and broader venture capital downturn starts to affect the US banking system and the economy. Thus, the crypto winter may trigger a recession in the US, implying likely a further risk-off, but also lower rates and better liquidity ahead.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.