Crypto to Ride a Chinese Deflation Wave

I believe that the next significant macro factor is Chinese yuan devaluation. Short-term, this scenario is likely negative for most risk assets including crypto, but long term, it may drive crypto prices much higher and possibly even turn crypto into a mainstream asset.

Macro story

According to Bloomberg Intelligence estimates, this year the US economy may grow faster than China’s economy for the first time since 1976. Bloomberg Intelligence is more pessimistic on China than most economists, but the consensus forecast still implies a lower growth trajectory for China. The primary factor is the Covid Zero policy, which requires lockdowns when even minor virus outbreaks occur. US, Europe, and most other countries manage to live with coronavirus, but China’s authorities fail to do that.

Another issue is a real estate bubble, which has popped this year with falling home prices and multiple insolvencies of real estate development companies. The Chinese economy is far more dependent on real estate than the US or other major countries. The Chinese construction sector has been one of the most important drivers of global economic growth in the last decade. In order to understand the magnitude of the bubble, let’s consider 2 facts.

1. Value of Chinese residential real estate is higher than the market capitalization of the S&P 500.

2. Median apartment prices in Shanghai are approximately the same as in New York City, but average personal income in Shanghai is 4-5 times lower than in NYC (according to Numbeo). Exact numbers are subject to discussion, but the residential real estate in China is obviously extremely overvalued relative to income.

Apartment prices and salaries in New York City and Shanghai (in USD and CNY)

While the US Federal Reserve is determined to reduce inflation via higher rates and quantitative tightening, Chinese authorities decrease rates and contemplate how to further stimulate the economy. Interest rates in the US have become significantly higher than in China. This divergence of monetary policy makes the case for a weaker currency.

2-year government bond yields in the US and China

Importantly, the Chinese central bank can afford to reduce rates because inflation is not a problem in China (unlike the US and most other major countries).

Inflation in the US, Euro area and China

Also, yuan has been remarkably strong this year compared to euro, Japanese yen, and most other major currencies. China’s economy is still export-oriented (despite the government’s measures to rebalance it), and its relatively expensive currency makes the export less competitive.

Chinese yuan* vs USD, EUR, JPY

* At offshore market

Effect on crypto

If we’re to believe that China is to devaluate its currency, in the short-term, it’s likely to be negative for most risk assets including crypto. Crypto is highly correlated with technology stocks, which will probably drop in this scenario. However, a longer-term effect (maybe in a few weeks or months) looks very positive for crypto.

First, the Chinese will likely move a part of their savings into crypto. Currency instability usually makes crypto popular, Argentina and Turkey are primary examples. China has long-established and relatively tight forex exchange controls limiting capital outflows via traditional finance even for individuals (and not only large companies), so the Chinese may particularly rely on crypto.

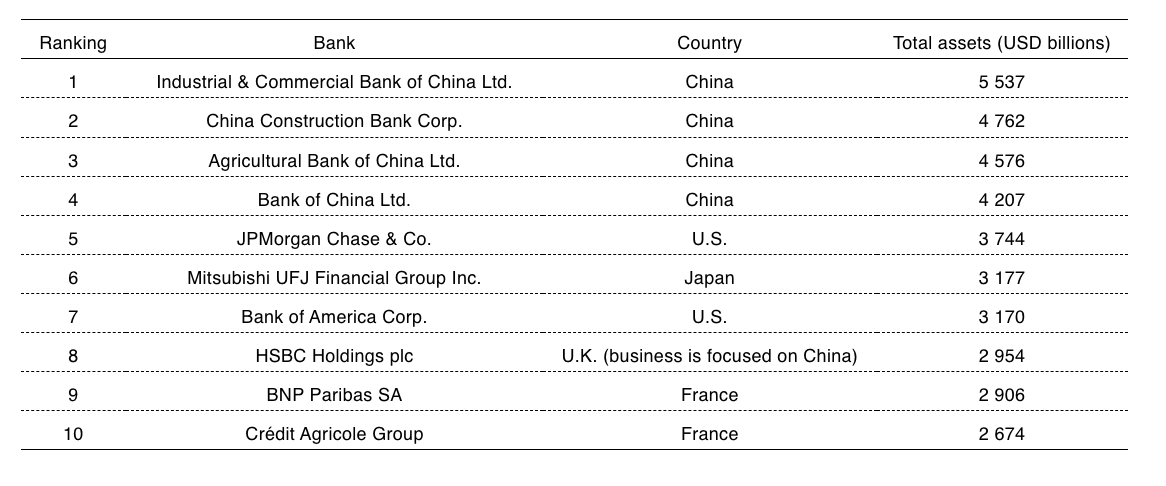

Unlike Argentina and Turkey, China is large enough that its flows will probably move crypto prices. I think China is so huge that it can drive crypto prices much higher and may even turn crypto into a mainstream asset. China is the second largest economy in the world by nominal GDP and is more leveraged than the US or other major economies. Just look at the list of the world’s largest banks by assets.

10 largest banks in the world by total assets (as of December 31, 2021)

Second, a lower yuan exchange rate will translate into cheaper China export prices in the US and other major countries in terms of their own currencies. Basically, China will align inflation in the US and other major countries closer to its domestic inflation (and the current difference is huge, see the inflation chart above). Lower inflation will allow the US Federal Reserve and other major central banks to relax monetary policy.

Thus, yuan devaluation will be a deflation wave for the US and Europe, depressing long-term and real rates and supporting long-duration assets including crypto (given its high correlation to technology stocks). Bitcoin was inflated to its 2021’s record high by the long period of declining real rates, and this year higher real rates were the primary reason for Bitcoin’s drop.

Bitcoin (left axis) and iShares TIPS Bond ETF (inverse proxy of real rates, right axis)

How to trade

Possible yuan devaluation is not easy to prepare or hedge (at least if you are not in China), because yuan is not freely convertible and even offshore market has significant limitations. I believe crypto investors should just prepare to view a possible market risk-off due to China issues as an epic buying opportunity.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.