Cheaper Bitcoin Volatility on the Stock Market

Arbitrage traders might enjoy the fact that Bitcoin options on Deribit are sometimes priced differently than on the stock market (via BITO ETF), creating trading opportunities.

BITO ETF

ProShares Bitcoin Strategy ETF (ticker BITO) is traded on the US stock market and provides exposure to Bitcoin. It invests in cash-settled, front-month Bitcoin futures, traded on the Chicago Mercantile Exchange (CME). BITO ETF was incepted on October 19, 2021 (ironically, its launch almost coincided with a Bitcoin price historical high).

The options on BITO ETF are liquid, but it’s important to note that spreads are wider than on Deribit. BITO ETF options are usually priced approximately in line with Bitcoin futures options traded on CME, with ETF options being far more accessible for retail investors.

Implied volatility may differ

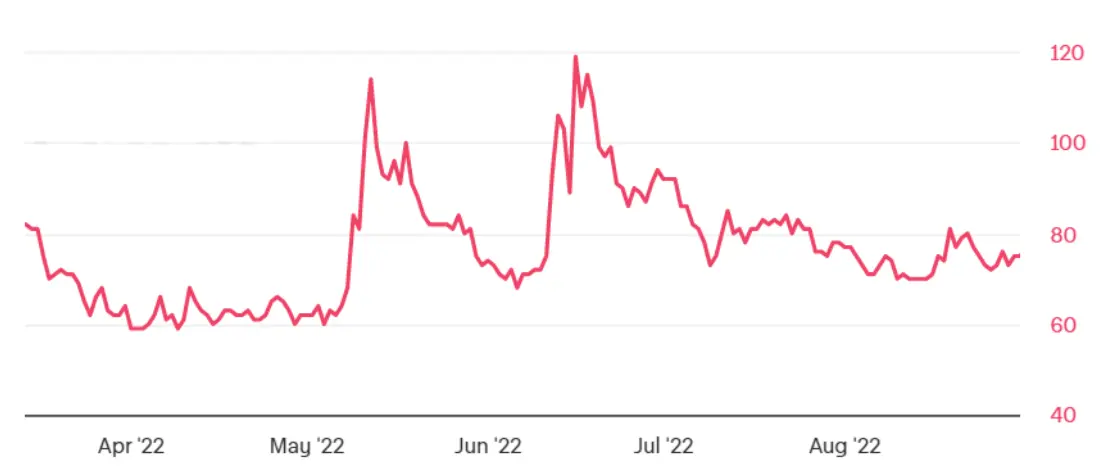

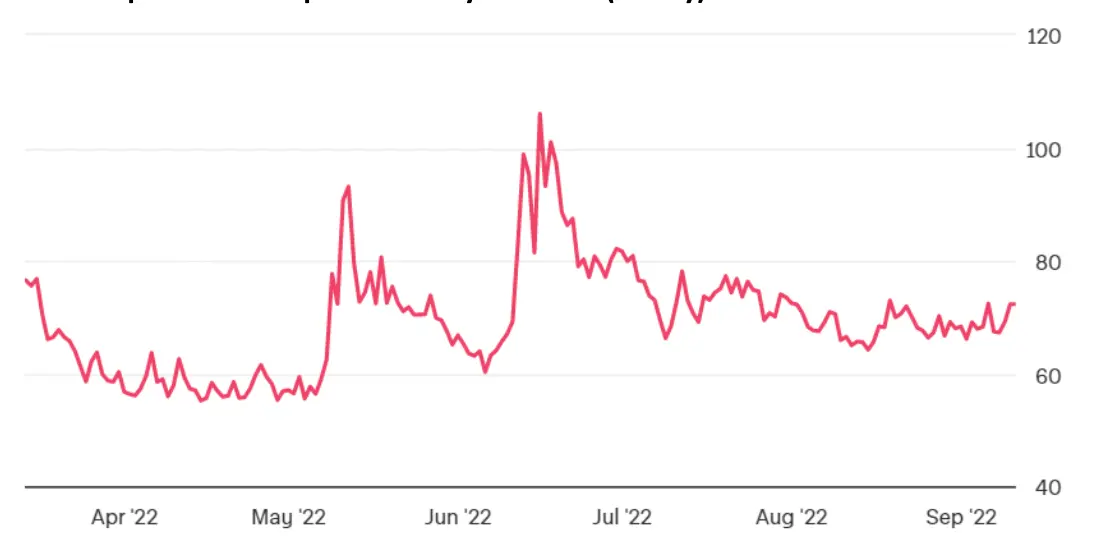

The charts of the implied volatility of options on Deribit and on BITO ETF show broadly the same patterns, but with notable price deviations. For example, the index of Bitcoin options implied volatility on Deribit (DVOL index) in June renewed its May high, and the 30-day at-the-money (ATM) implied volatility of Bitcoin options on Deribit reached a new high more distinctly.

DVOL index

Bitcoin options ATM implied volatility at Deribit (30-day)

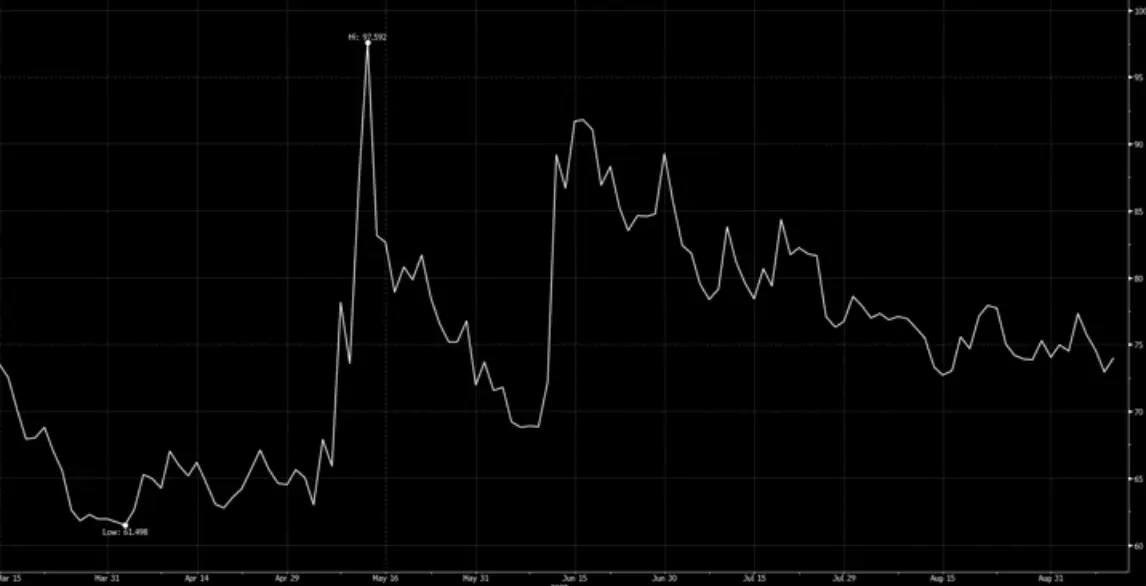

However, in June, the 30-day ATM implied volatility of BITO ETF options, which is directly comparable to the 30-day ATM implied volatility of Bitcoin options on Deribit, was below its May high.

ATM implied volatility of BITO ETF options (30-day)

Also, absolute levels of 30-day ATM implied volatility sometimes differs between Deribit and BITO ETF even for similar chart patterns. May peak of the implied volatility was about the same for both markets, but the figure provided by Deribit was lower during the volatility at the beginning of June.

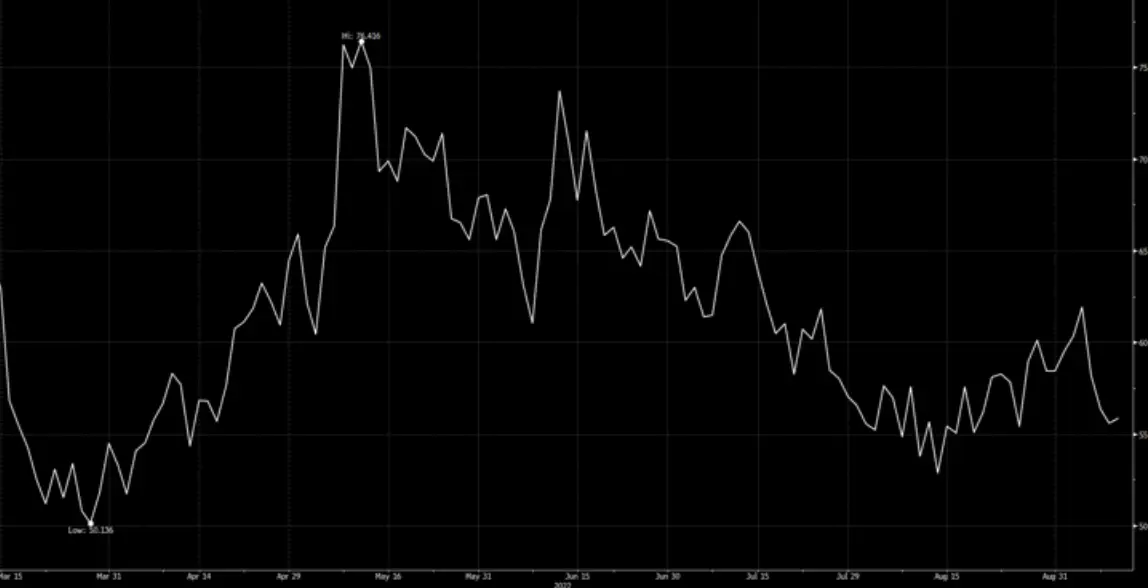

BITO ETF implied volatility was likely relatively muted in June compared to Deribit because the implied volatility of the crypto’s closest peer on the stock market (the high-risk tech) trended down since a May peak.

ATM implied volatility of ARK Innovation ETF options (30-day)

Recent example

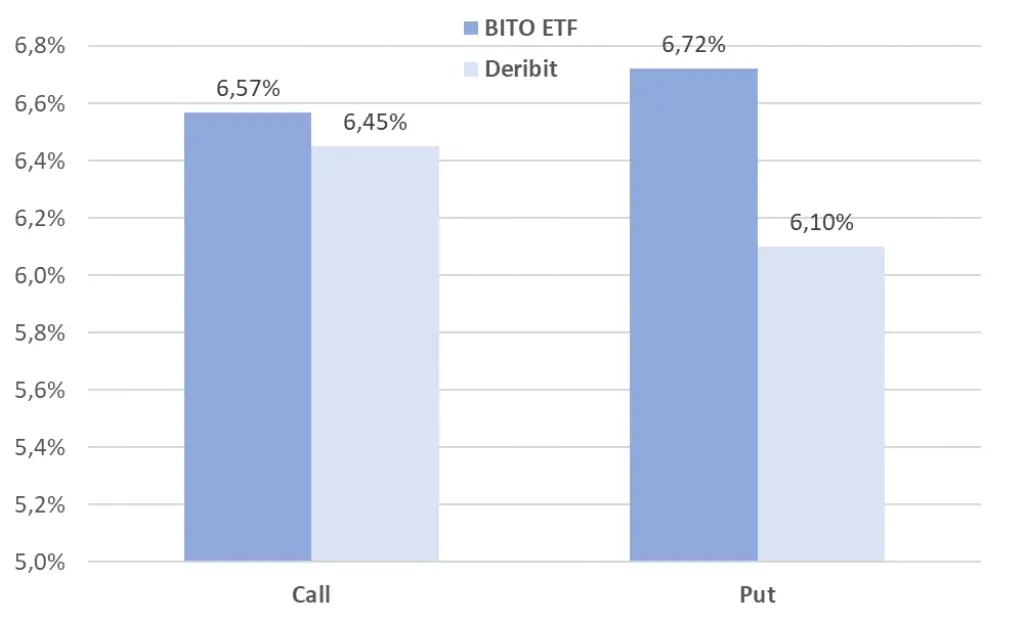

Like implied volatility, options skew sometimes differs between the markets too. For example, as of last Friday (September 9) calls were priced roughly in-line, but puts were 5-10% cheaper on Deribit compared to puts on BITO ETF. The chart below shows ATM figures, but that was a broad feature across multiple strikes and expiration dates.

Bitcoin ATM options premium (%) as of September 9

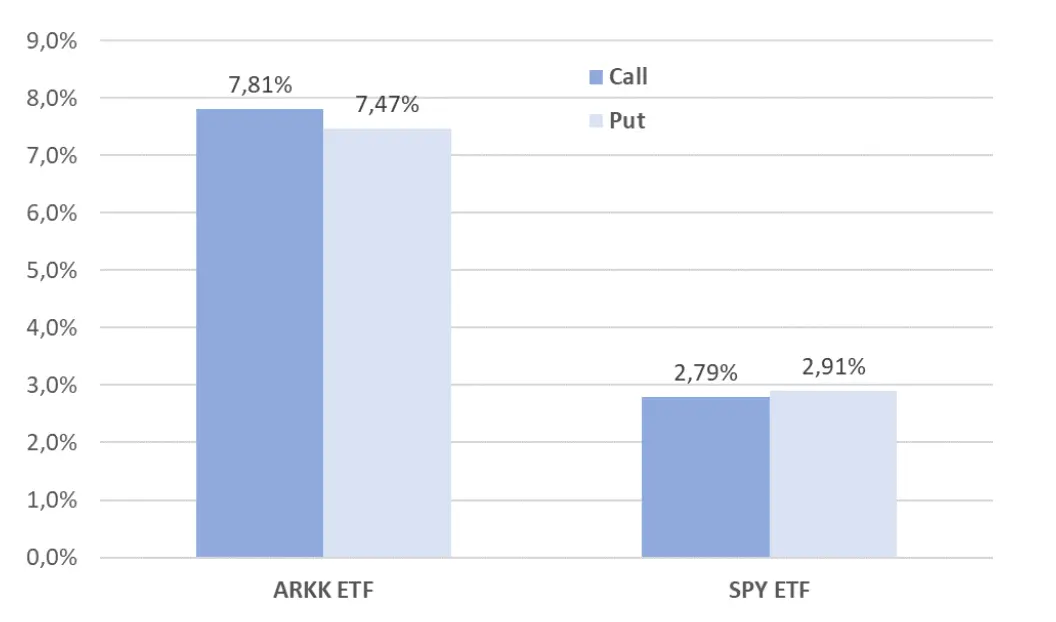

I think the difference between options pricing on Deribit and BITO ETF is down to a general put-call balance on the stock market. ATM put and call prices were approximately equal for both the crypto’s closest peer (the high-risk tech represented by ARK Innovation ETF) and the broad stock index (represented by SPDR S&P 500 ETF Trust).

ATM options premium (%) as of September 9

As of September 12, this difference largely disappeared, probably reflecting higher demand for calls on the stock market. On September 12, the stock market put-call ratio dropped to the lowest since mid-August, seemingly because of bearish institutional investors seeking upside protection.

Conclusion

The difference in Bitcoin options prices between Deribit and BITO ETF sometimes creates trading opportunities. Given Deribit credit risk, I’m not sure if they are exploitable for arbitrage on a cost-effective basis (depending on how much one trusts this exchange), but at least investors and traders can look across both markets for better prices for natural flows.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.