Bitcoin = Millenial Gold

We have created REDOT Insights, which is a blog meant for our most devoted users to comment on the markets, latest happenings, and in general express their views. We want to introduce one of our first and most loyal users, DAOCAT, who used to be in the pits of one of the busiest exchanges in the world where he screamed, waved his hands and wore a funny jacket

(this is not a real picture to protect the innocent), then he wore out a few dozen suits at half a dozen investment houses, and now wears exclusively ripped jeans and t-shirts while trading his own PA both directionally via derivs, and sometimes he arbitrages. We agreed that from time to time we will feature his thoughts, mind you they’re solely his, and not ours, and aren’t advice to buy or sell anything.

===

Bitcoin — Millennial Gold

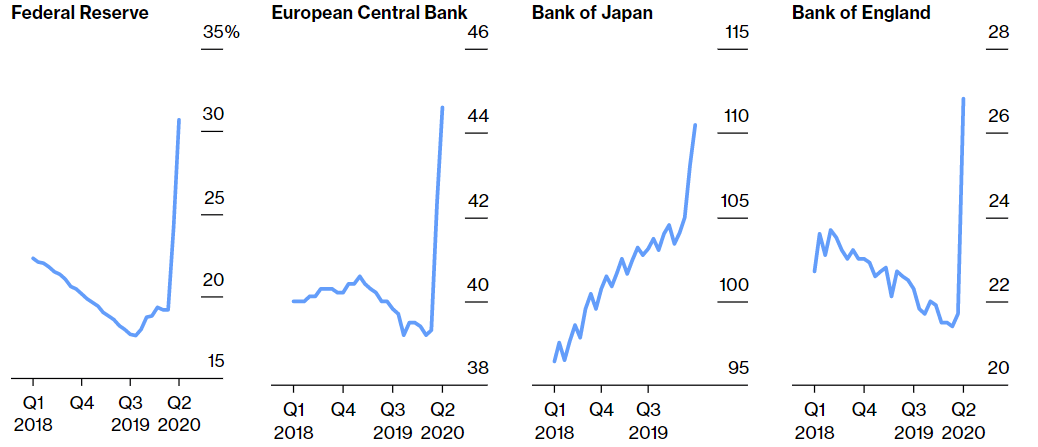

Pandemic unleashed the mother of all money printing globally and it does not seem like there’s anything that can stop it in the short term. Governments worldwide faced with locked borders, dwindling tax revenues, and shrinking GDPs threatening 1930s style Great Depression, certainly can’t do much aside from leaning on the printing press. Short sighted politicians in countries where there are elections don’t care about the next policy maker who inherits the mess. To some extent you can’t really blame them, as entire industries are shattered, and defaults/unemployment are spiking, so is social unrest, the only thing most economies are going on is public spending right from the printing press. Below is a bleak picture of the hockey-sticks happening in the first world.

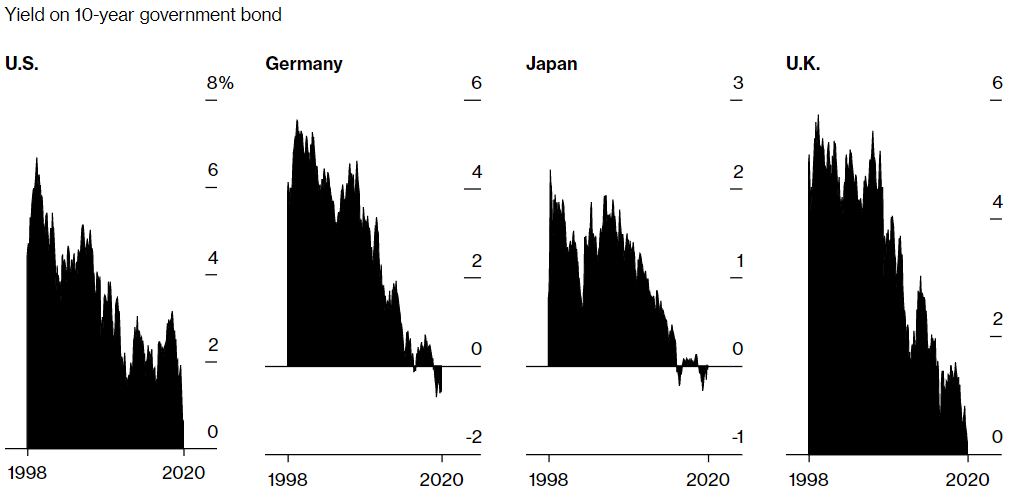

Wealth gathered over generations is being eroded in two ways — the purchasing power of national currencies is degrading, and at the same time, interest rates in bank accounts have plunged to or below zero. One way to test how bad it is — go to your corner bank and ask for a safety deposit box — if they tell you that there’s a minimum deposit, waiting list or they’re sold out, you know where people are stashing their dough instead of their checking accounts.

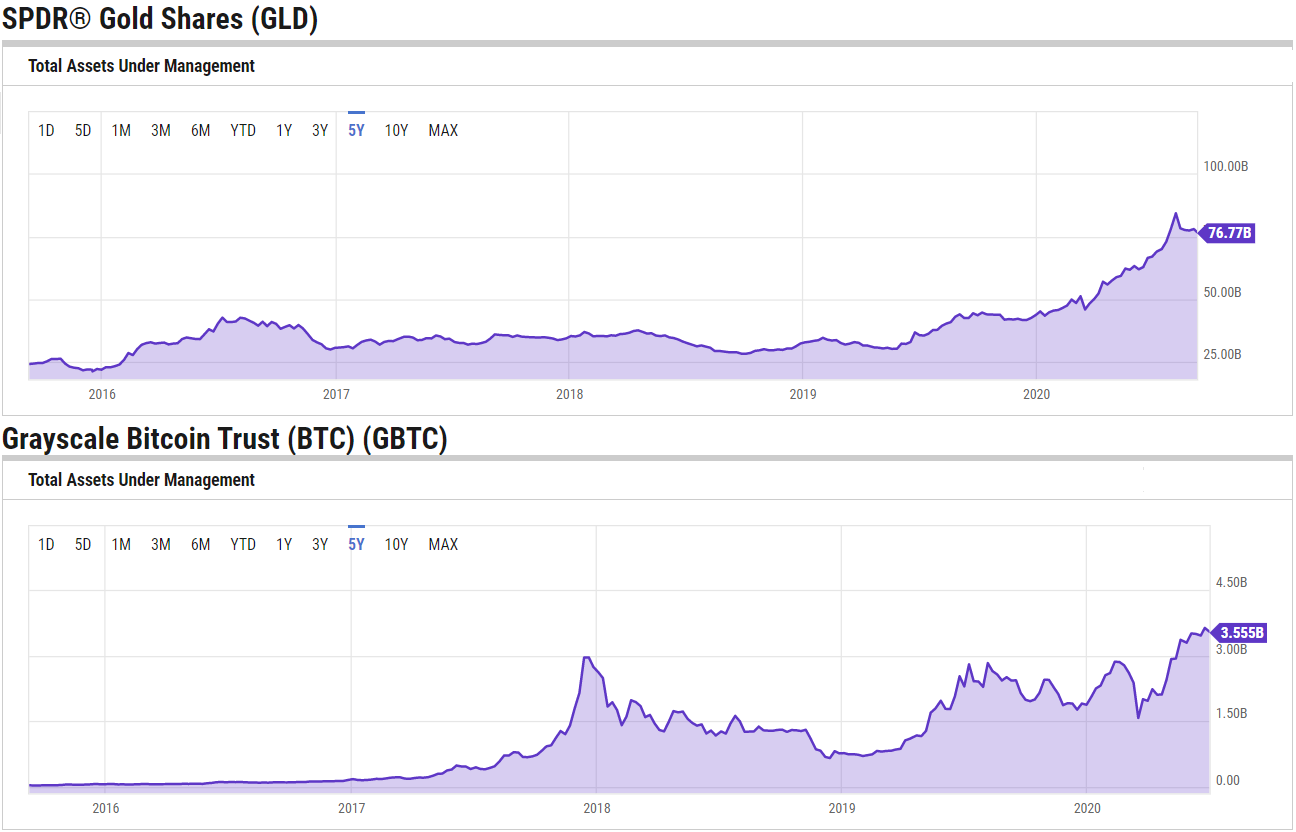

So you might ask why do I care about this, and what does it have to do with Bitcoin or say gold? Well, the other thing that they’re doing aside from stashing paper fiat is buying gold bars and you guessed it — Bitcoin. While it’s somewhat hard to track how much of that is stashed away in private wallets and vaults one might take a look at GLD ETF and GBTC Bitcoin Trust, which while an imperfect instrument, is used by many retail investors to get long BTC. Below are total assets under management, which is short for how much money has been invested in each tracker. As we see, the numbers aren’t trivial, standing at $77 billion for gold, and $3.6 billion for GBTC, which now is 1.8% of all Bitcoin in existence!

It’s pretty evident that we’re at 5 year highs in exposure for both of these indicating flight to safety from the currencies central banks “can print”. The price of both assets keeps appreciating as well with the primary rationale for buying both being the same: limited supply, store of value, and really they’re some of the few resistant to quantitative easing currency-like instruments.

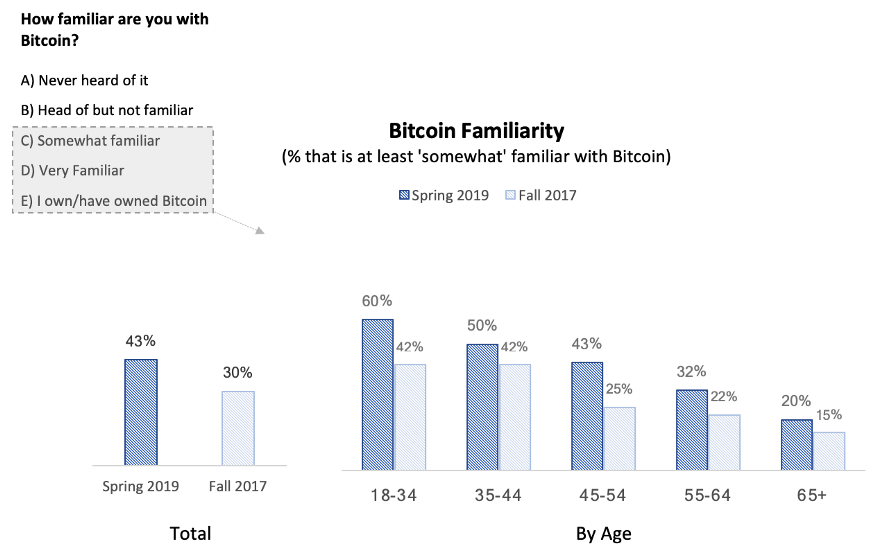

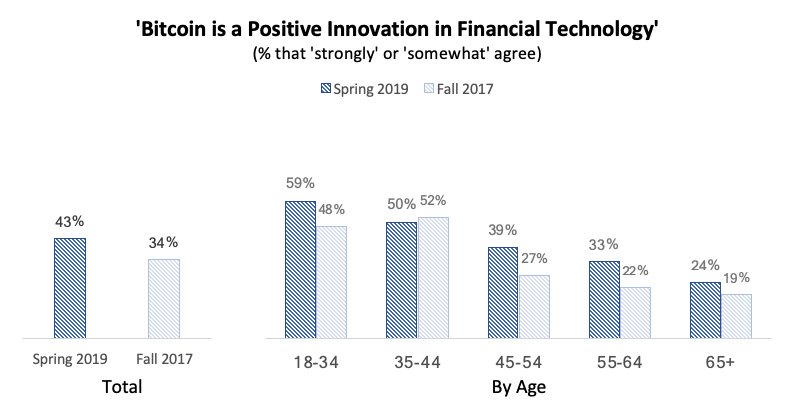

JPMorgan put out a piece of research this week analyzing this trend and came to the conclusion that there’s a generational split in terms of flight to safety asset. “The two cohorts show divergence in their preference for ‘alternative’ currencies,” Nikolaos Panigirtzoglou wrote, “the older cohorts prefer gold while the younger cohorts prefer bitcoin.” This is not new as various online polls including the latest Harris Poll, have pointed out that people within 18 to 34 years of age were three times more likely to have familiarity with Bitcoin as compared to those over 65 and twice as likely as those between 55 to 64 years old, moreover, 59% of millennials had a positive opinion about Bitcoin.

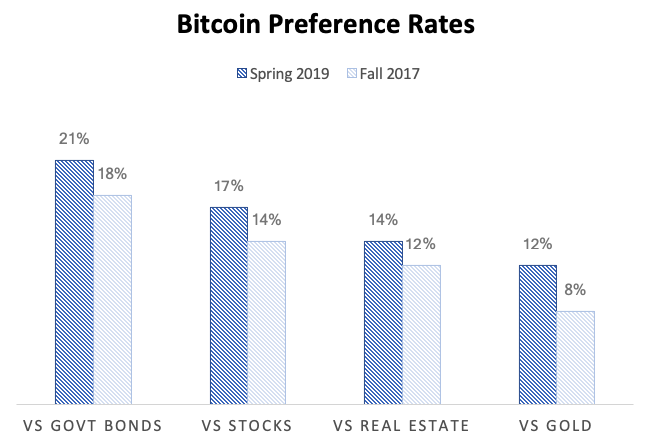

Further focusing on millennials, it’s clear that not only are they aware of Bitcoin, and prefer it to Gold but they prefer it to just about every single asset class.

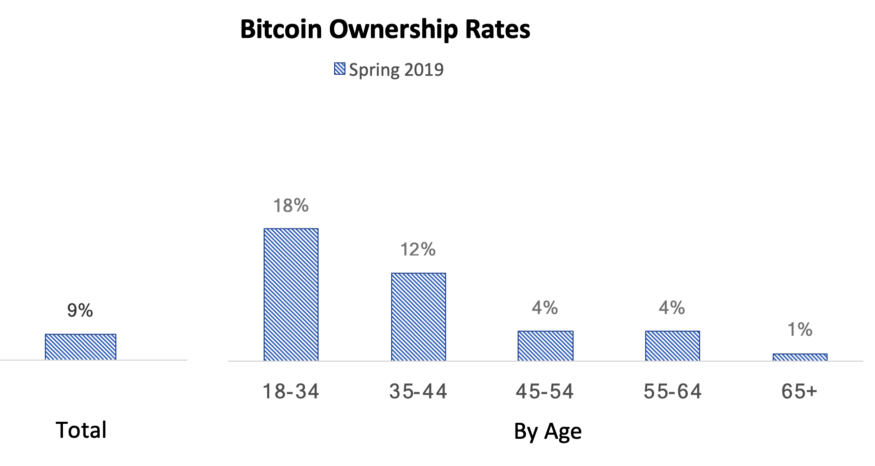

And reasonably so they’re the largest holders.

I guess I’m trying to preach to the choir here, but given all of above — the ugly fiscal backdrop, maturing millennial generation in the prime of their investment age (albeit from their parent’s basement), in the words of Blockchain Capital, it seems that Bitcoin is a demographic mega-trend. If you don’t yet have a 10–15% allocation in your portfolio I’d think long and hard about how overvalued all other assets are in comparison and take a plunge, well at least a little one.

So if you got this far without falling asleep, I do have to give a plug to the venue where I trade, REDOT.COM, a pretty handy exchange, on the go for when I only have my mobile, yet it has a professional Bloomberg like interface on the desktop. Happy trading boys and girls, and hope you like reading my ramblings from time to time.