Bitcoin Leads Large-Cap Tech Stocks

This year, Bitcoin has served as a reliable leading indicator for large-cap technology stocks, rallying strongly in the first quarter. In hindsight, this was an excellent entry point for investing in large-cap tech. However, Bitcoin declined during the summer. Why did this happen, and does it suggest trouble for large-cap tech?

Bitcoin Struggles When Big Tech Shines

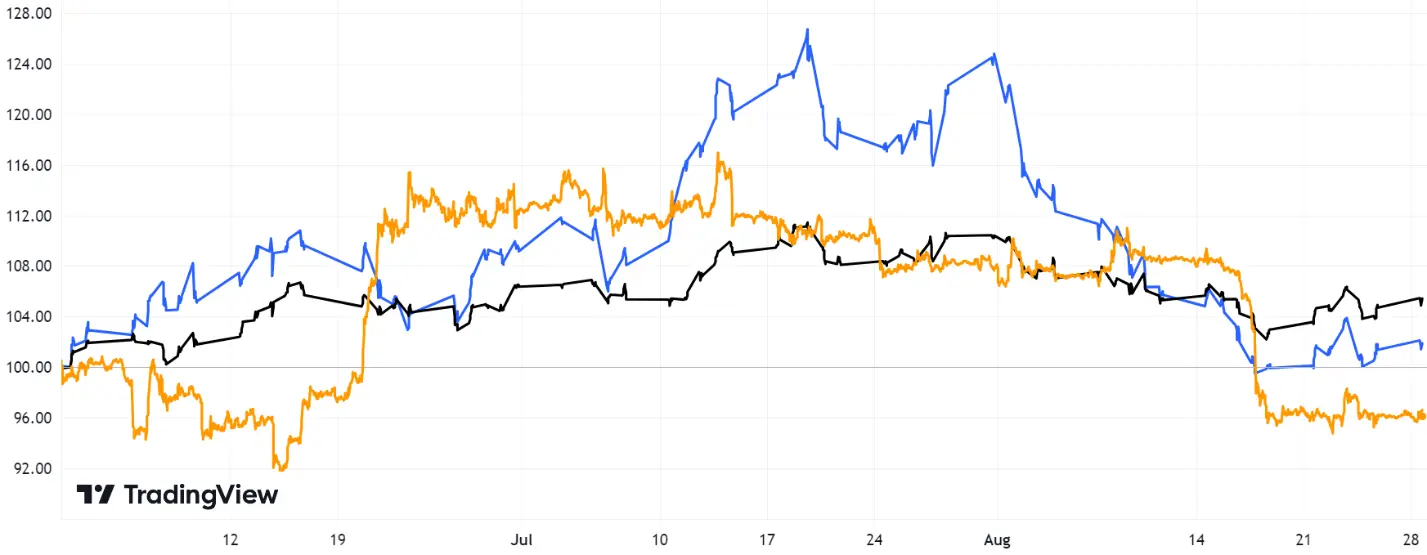

This summer, there has been a divergence between Bitcoin—and the broader crypto market—and large-cap technology stocks, which are usually highly correlated. After spiking in June due to ETF filings, Bitcoin dropped and has remained negative since the end of May. In contrast, the Nasdaq 100 index rose throughout the summer, fueled by ongoing excitement about artificial intelligence (AI). Any corrections to the index in August have been mild so far.

It's not just crypto that's struggling. Unlike more stable large-cap stocks, smaller and riskier technology stocks—as represented by the ARK Innovation ETF—have fallen by almost 20% since their July high, erasing nearly all their summer gains.

3-month performance of Bitcoin (orange), ARK Innovation ETF (blue) and Nasdaq 100 (black)*

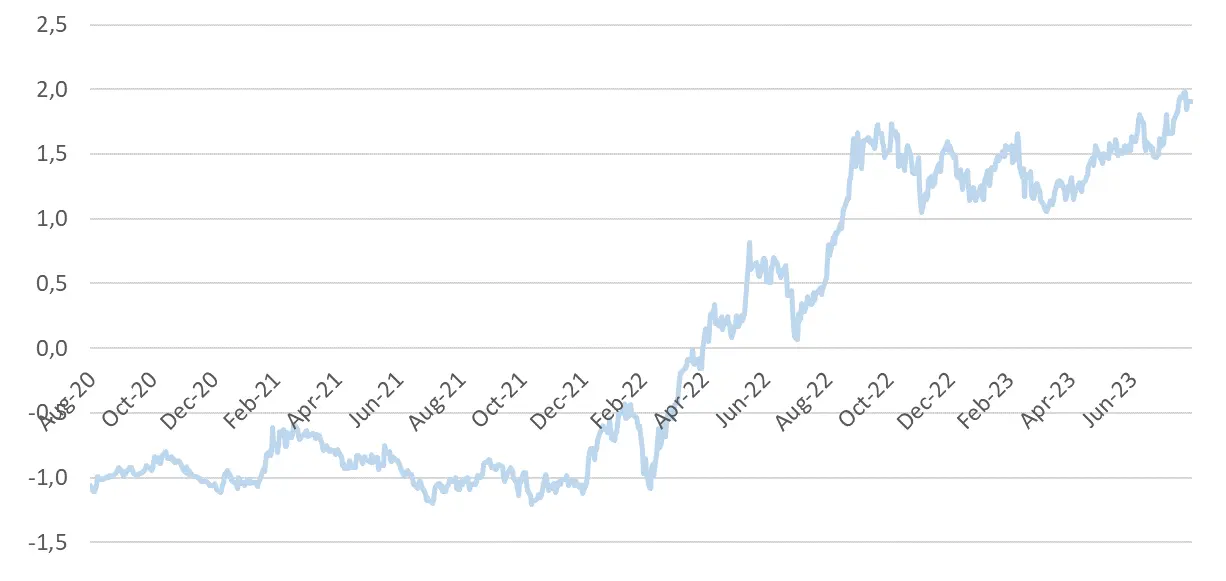

In my view, a primary reason behind the summer downturn in crypto is the renewed uptrend in long-term real interest rates. These yields skyrocketed from March to October 2022, bursting speculative bubbles in both stocks and crypto. However, they remained largely stable from October 2022 to July 2023. This stabilization in real yields helped stocks and crypto recover some lost ground earlier this year. In August, the yields began to rise again, exerting downward pressure on crypto and high-risk tech stocks while also restraining the growth of broader stock indexes.

US Treasury 10-year real yield

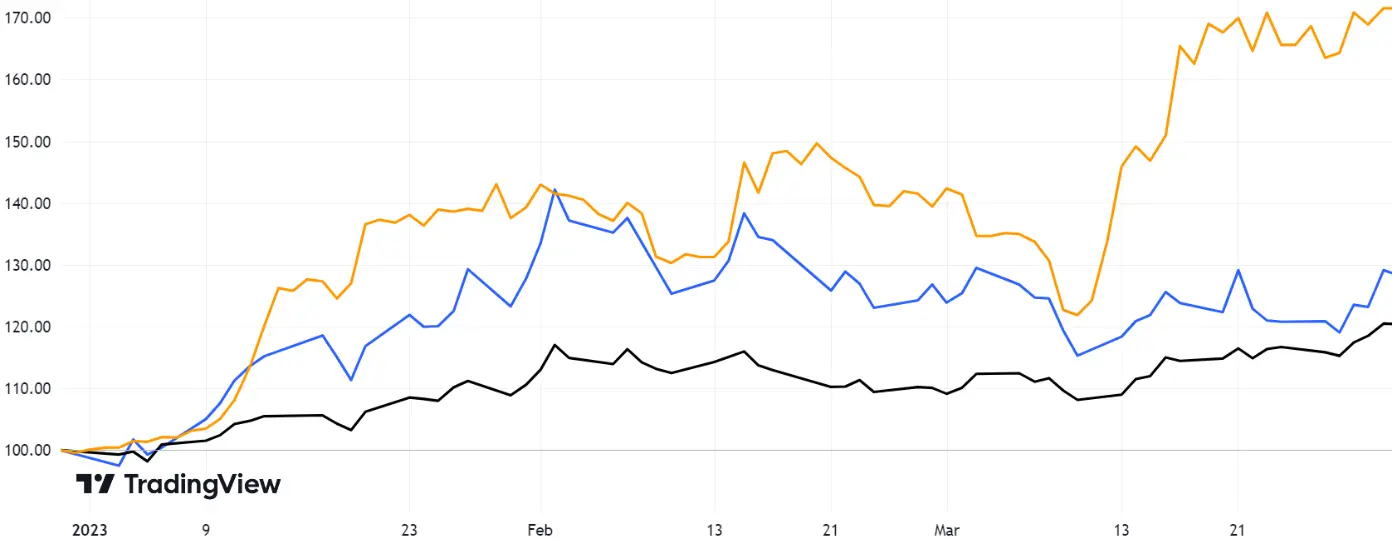

Interestingly, the first quarter of 2023 presented a somewhat opposite scenario: Bitcoin rallied, while big tech showed subdued performance. High-risk tech stocks were particularly strong in the first two months, although they corrected in March. Despite this, they still managed to outperform large-cap stocks for the quarter as a whole. In hindsight, the first quarter was a great buying opportunity for large-cap tech.

Q1 2023 performance of Bitcoin (orange), ARK Innovation ETF (blue) and Nasdaq 100 (black)*

Liquidity Proxies

Crypto is correlated with large-cap tech and stock indexes—where large-cap tech holds significant weight—primarily because both are influenced by global liquidity. Unlike traditional assets, crypto lacks fundamentals like revenues or profits, making it especially sensitive to liquidity flows. Similarly, stock indexes are driven by available liquidity as long as there are no structural shifts in asset allocation—for example, if investors maintain a consistent preference for stocks over bonds. Tech stocks are particularly sensitive to liquidity flows compared to long-established companies because they usually have much higher valuation multiples and are therefore more dependent on forecasts, sentiment, and flows than on their near-term financials.

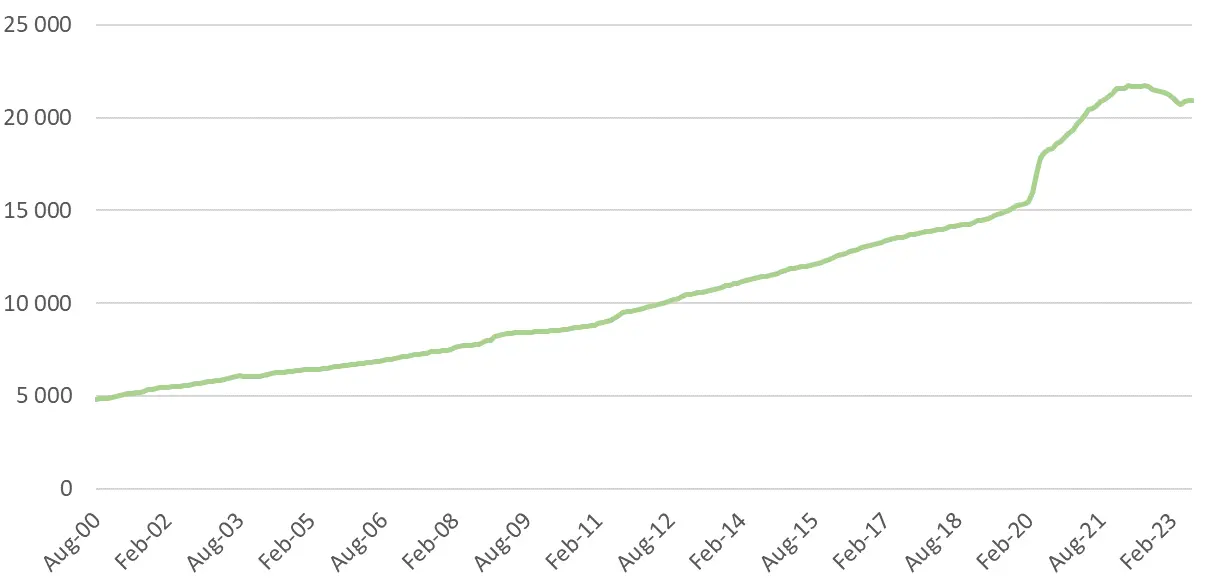

The chart of the U.S. M2 money supply serves as a good illustration of this thesis. The dollar money supply skyrocketed during the coronavirus pandemic, inflating bubbles in both stocks and crypto. It then slightly decreased in 2022-2023, leading to reductions in asset prices. While the M2 money supply is an imperfect measure of available liquidity, it seems that both crypto and stocks have acted as slight leading indicators of M2 money supply changes in recent years.

US M2 money supply (USD billion)

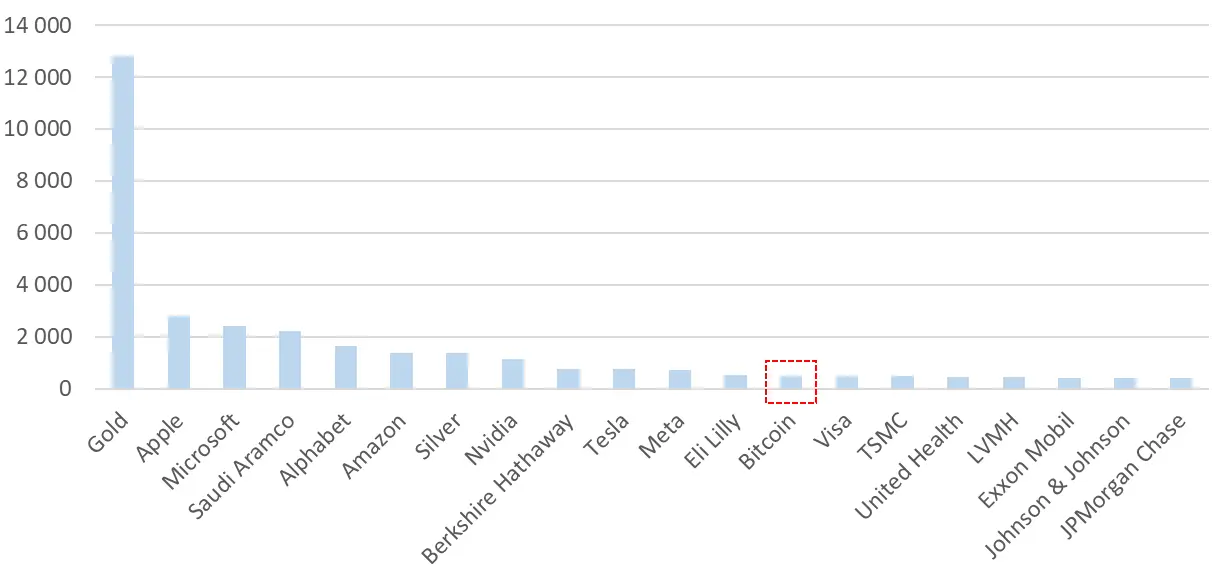

Crypto reacts much faster than stock indexes, largely because it is much smaller in comparison to major asset classes like stocks. Several of the largest components of the Nasdaq 100, such as Nvidia, Tesla, or Meta (formerly Facebook), are each several times larger than Bitcoin.

Largest assets in the world (USD billion)

AI Top?

The recent behavior of Nvidia stock following its quarterly report suggests that the frenzy over AI may be nearing its peak. Nvidia shares rallied in anticipation of the report but failed to climb further after the report was published, despite its stellar results. On the Thursday when the report was released, Nvidia stock closed below its July high, erasing an 8% intraday gain. Now the fifth-largest company in the U.S. by market capitalization, Nvidia serves as a bellwether for the AI boom, making it extremely important for both large-cap tech and broad stock indexes.

Nvidia (USD)

From a fundamental analysis standpoint, the current rapid growth of AI may be cannibalizing future revenues. Nvidia's situation now reminds me of personal computer manufacturers and other companies that benefited from the remote work surge during the coronavirus pandemic. In 2020, when remote work became mainstream due to the pandemic, many people suddenly realized they didn't have enough computers at home. For example, one or two computers might suffice for a family when offices and schools are open, but under a work-from-home regime, each working or studying family member needs their own computer. Demand for computers skyrocketed, but much of this demand likely represented future consumption that had simply been pulled forward. Once offices and schools reopened, many families found themselves with an excess of computers, depressing demand for new ones.

Similarly, many large corporations are currently fixated on the AI chips produced by Nvidia, aiming to win the AI training race regardless of the cost. The question then arises: Will these companies need even more chips in a few years, in line with consensus forecasts for Nvidia's revenues and profits? Or will they discover they've already purchased more chips than they actually need?

What Next?

If I'm correct and large-cap tech experiences a correction similar to crypto, this could have a significant impact on the U.S. economy and may prompt the Federal Reserve to loosen its monetary policy. Such a move would likely improve global liquidity, reduce long-term real interest rates, and provide support for crypto. Consequently, a bursting of the Nasdaq bubble—if and when it occurs—could present a good buying opportunity for Bitcoin and other digital assets.

For advanced traders holding large positions in crypto, adding a small hedge through Nasdaq 100 put options could make sense. This is particularly true given that the implied volatility for the Nasdaq 100 is much cheaper compared to crypto.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.