Assessing Ethereum Futures ETF

There is a flurry of recent applications for an Ethereum futures ETF. Is it likely to be approved? How large would it be and would it affect Ethereum price?

The Race for a New ETF

While there is continued obsession with the possibility of a physical Bitcoin ETF, in August, several asset management companies filed to launch an Ethereum futures ETF. Unlike physical crypto funds, this ETF would invest in Ethereum futures traded on the Chicago Mercantile Exchange (CME), one of the world’s largest derivatives exchanges. These futures are fairly liquid, but their performance can slightly differ from the spot price due to financing costs (determined by interest rates) and benefits (such as staking yield).

The primary argument in favor of the approval of the Ethereum futures ETF is that Bitcoin futures ETFs already exist. The largest one is the ProShares Bitcoin Strategy ETF (BITO), with $1.1 billion in assets.

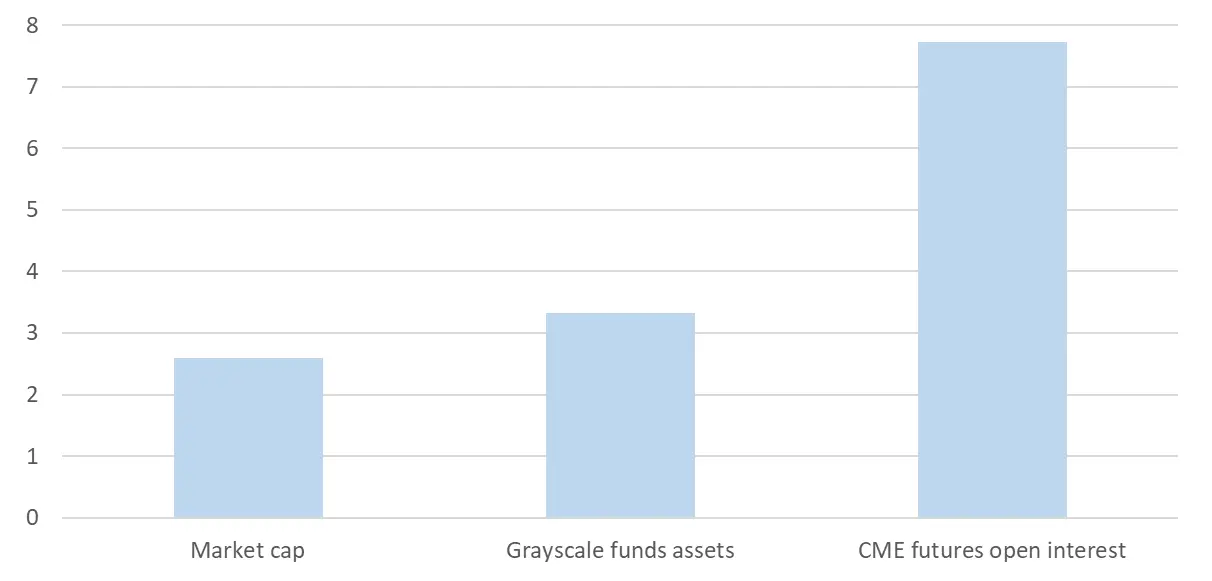

Bitcoin futures ETFs (as of August 11, 2023)

Source: ETF Database, Forbes

Despite the obvious similarities with existing Bitcoin futures ETFs, the US regulator, the SEC, had previously rejected several applications for Ethereum futures ETFs. However, the situation seems to have shifted recently. "According to two sources directly familiar with the latest ether futures ETF filings, the SEC has signaled its readiness to publicly consider such a product. Yet, the regulator’s inclination to discuss ether futures ETFs doesn't ensure their approval," one of the sources noted, as reported by Blockworks. Given that this report from Blockworks coincided with several applications for the ETF, there's little doubt about its veracity.

"In the past, the SEC asked Ether Futures ETF applicants to withdraw 5-6 days after the initial filing. We're now on Day 13 with no withdrawals. While it's not a definitive sign, it's promising. As we predicted, these are likely to hit the market by mid-October," wrote Bloomberg Intelligence analyst Eric Balchunas. While still uncertain, I view the approval of the ETF as the most probable outcome.

How Large Can It Be?

While I don't possess a crystal ball, the potential size of an Ethereum futures ETF can be approximated by comparing it with existing Bitcoin futures ETFs. We can derive a fair ratio between Bitcoin and Ethereum and then use this ratio to estimate the potential market size for the Ethereum ETF based on the current market of Bitcoin futures ETFs.

To determine this ratio, I've identified three viable metrics:

- Directly comparing the market caps of Bitcoin and Ethereum.

- Evaluating the Grayscale funds available for both Bitcoin and Ethereum.

- Analyzing futures data from the CME, which facilitates futures trading for both cryptocurrencies.

These metrics can offer a comprehensive perspective to arrive at a reasonable estimate.

Bitcoin to Ethereum ratio by market cap, Grayscale fund assets and CME futures open interest

Both the market cap and the Grayscale funds are approximately three times larger for Bitcoin than for Ethereum. However, the CME futures open interest shows a more significant disparity.

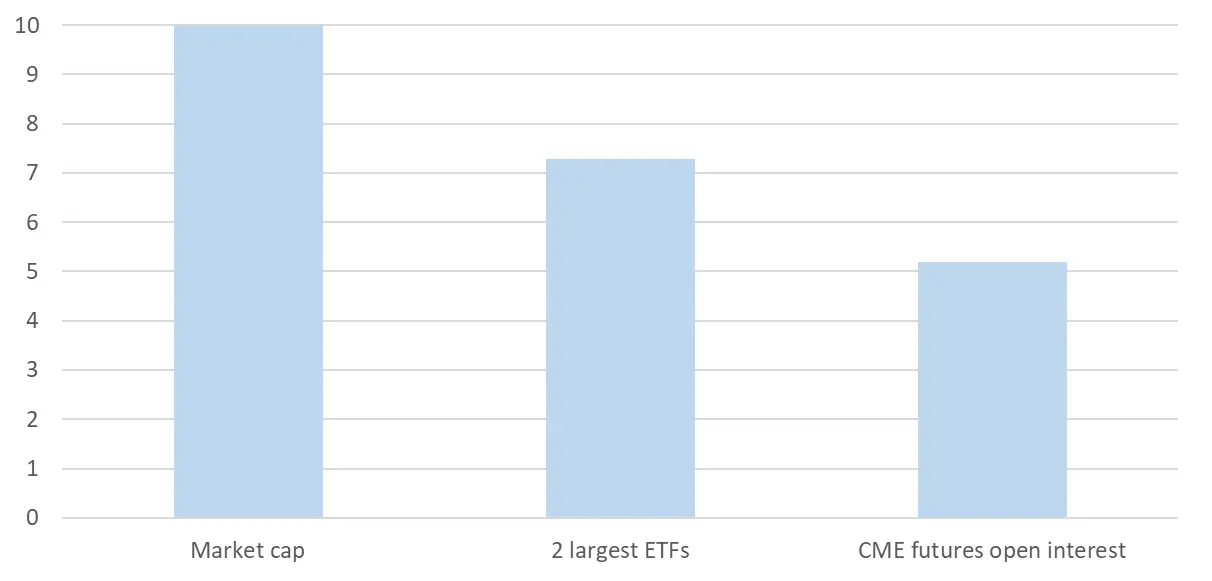

Interestingly, when looking at the ratios for gold and silver, we observe an opposite trend. While it might not be an exact analogy, Bitcoin and Ethereum are often likened to the gold and silver of the crypto universe, respectively. The market cap for gold is ten times that of silver, but the CME futures open interest is only five times larger for gold than for silver. If we consider the combined assets of the two largest gold ETFs (SPDR Gold Trust, GLD and iShares Gold Trust, IAU), they are seven times greater than the combined assets of the two largest silver ETFs (iShares Silver Trust, SLV and abrdn Physical Silver Shares ETF, SIVR). I believe focusing on the two largest ETFs for each metal is the most relevant approach. While there are many smaller ETFs, they complicate the calculation without significantly altering the overall conclusion.

Gold to silver ratio by market cap, 2 largest ETFs and CME futures open interest

The combined assets of the six Bitcoin futures ETFs amount to $1,279 million. In my opinion, the most accurate ratio to compare Bitcoin and Ethereum is based on their respective market caps and the assets in Grayscale funds. This is because Ethereum futures seem underdeveloped when compared to other trading instruments. Using this ratio, we can estimate that the Ethereum futures ETF might attract assets worth $426 million. However, if one believes that the Ethereum futures should be factored into the calculation, the average ratio between Bitcoin and Ethereum, based on all three metrics, stands at 4.55. This would suggest an asset value of approximately $281 million for the Ethereum futures ETF.

Will It Affect Ethereum Price?

My estimation for the new ETF, pegged at $426 million, constitutes a mere 0.19% of Ethereum's market cap. At a first glance, this might suggest it would not significantly influence Ethereum's price. However, there are several factors that hint the actual impact could be more substantial than it initially appears.

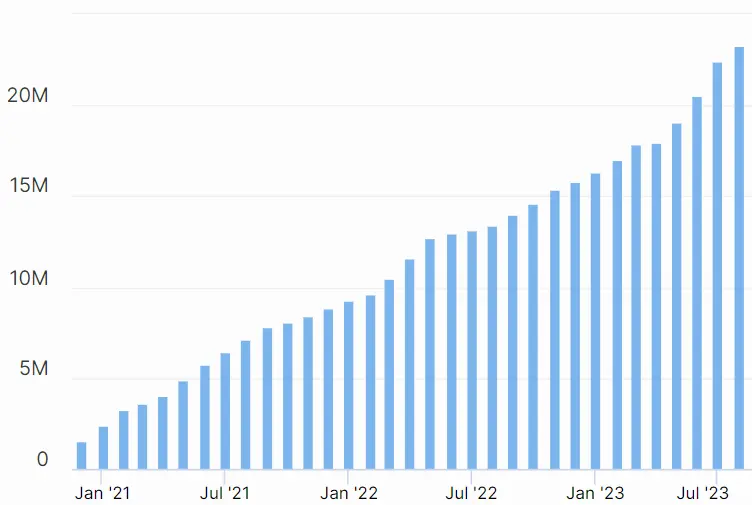

For one, a considerable amount of Ethereum is either staked or utilized in layer 2 blockchains. As per Coinbase's calculations, the staked Ethereum accounts for 19% of the total supply, and this percentage is on the rise. This locked-in supply could magnify the effect of new market developments like the introduction of an ETF.

Staked Ethereum volume

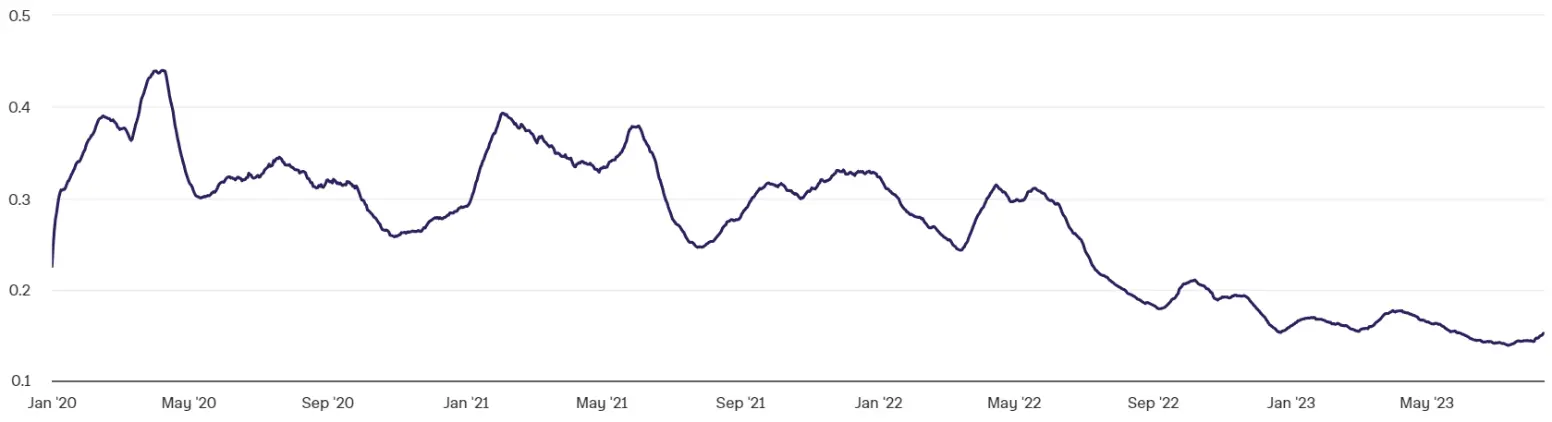

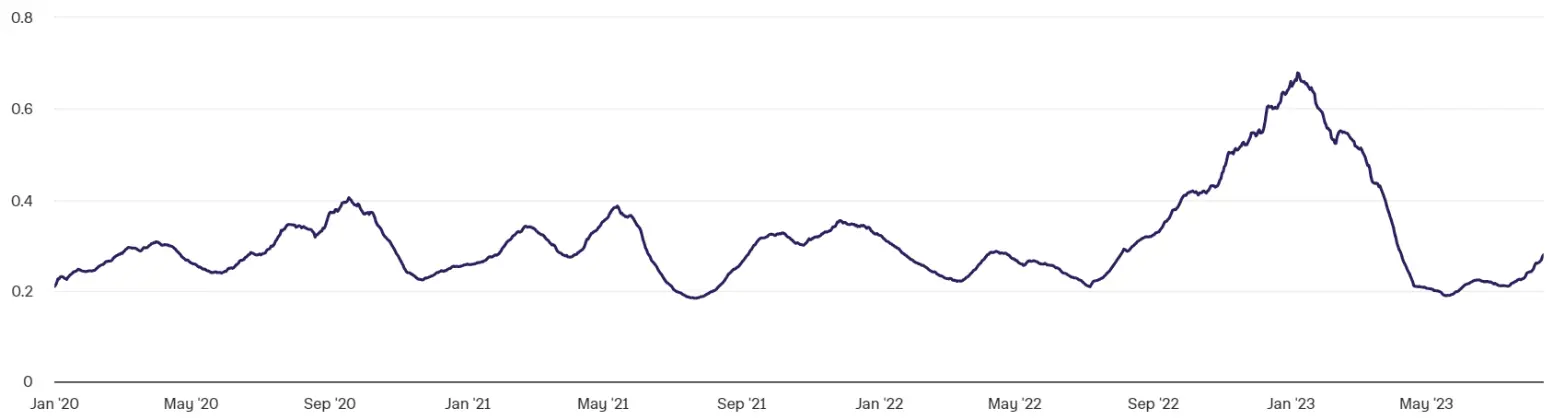

I don't have a definitive figure on the amount of Ethereum being used for layer 2 blockchains, but it's reasonable to assume it's a significant volume given the evolution and adoption of layer 2 solutions. One indicator of Ethereum's decreasing liquidity in its physical form is the diminishing share of spot trading relative to futures on crypto exchanges (excluding the CME). The ratio of Ethereum spot to futures trading volume has been on a decline since June 2022 and is currently hovering around a historical low. This trend might suggest a scarcity of readily available Ethereum, as more of it is either staked or utilized in layer 2 solutions.

Ethereum spot to futures trading volume (30-day moving average)

The same measure for Bitcoin is around the same as previously, and there is no an obvious trend.

Bitcoin spot to futures trading volume (30-day moving average)

Conclusion

Recent developments suggest that the introduction of an Ethereum futures ETF is becoming more probable. According to Bloomberg Intelligence, trading for this ETF could commence as early as mid-October. Drawing parallels with existing Bitcoin futures ETFs, the anticipated Ethereum futures ETF might have assets worth $426 million. At face value, this figure, which accounts for merely 0.19% of Ethereum's market cap, might seem negligible. However, I believe this could be deceptive.

In my assessment, the diminishing proportion of spot Ethereum trading relative to futures points to a scarcity of physical Ethereum that isn't tied up in staking or layer 2 solutions. Consequently, the real impact of the new ETF on the market could be more pronounced than what the initial numbers suggest.

Given the exceptionally low implied volatility currently observed in Ethereum options, one might consider strategically accumulating a moderate position in call options set to mature in November or December. The launch of the new ETF could potentially jolt the market out of its prevailing low-volatility state.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.