Are Options Traders More Bullish on Ethereum than Bitcoin?

The open interest put/call ratio for Bitcoin is almost twice higher than the same ratio for Ethereum. Seemingly, options traders are more afraid of a possible downside move of Bitcoin than Ethereum or alternatively see a larger upside potential for Ethereum than for Bitcoin. Is it really so or are we merely witnessing some kind of a technical effect?

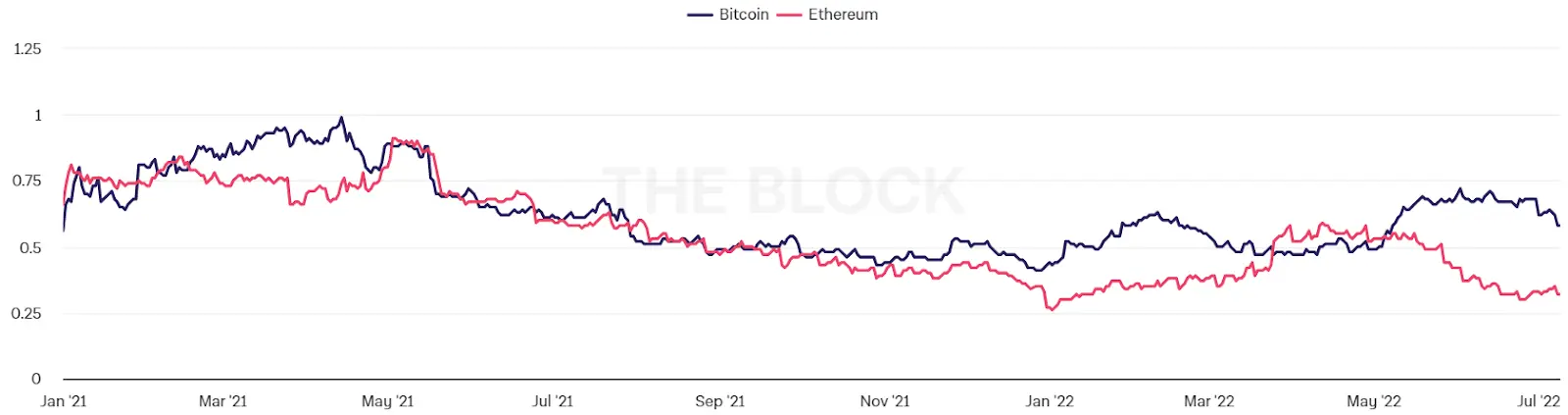

Bitcoin and Ethereum open interest put/call ratio

The difference in the put/call ratios of Bitcoin and Ethereum is mostly explained by calls. Bitcoin options interest is relatively balanced while Ethereum interest is dominated by longer-dated calls.

Bitcoin options interest by expiration date

Ethereum options interest by expiration date

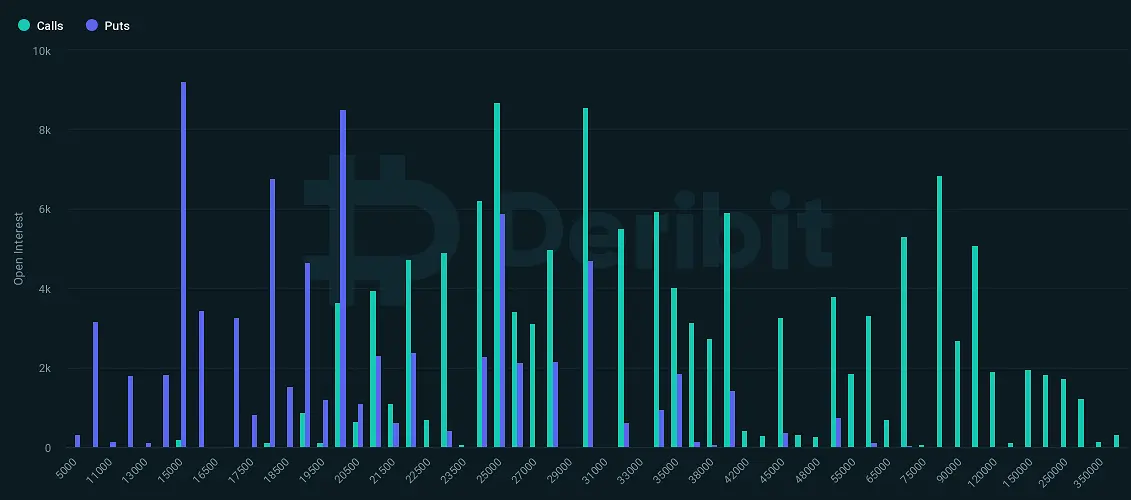

Bitcoin options distribution by strikes does not show a significant preference for any particular strike. The most popular strikes are $15000 put, $20000 put, $25000 call, and $30000 call.

Bitcoin options interest by strike

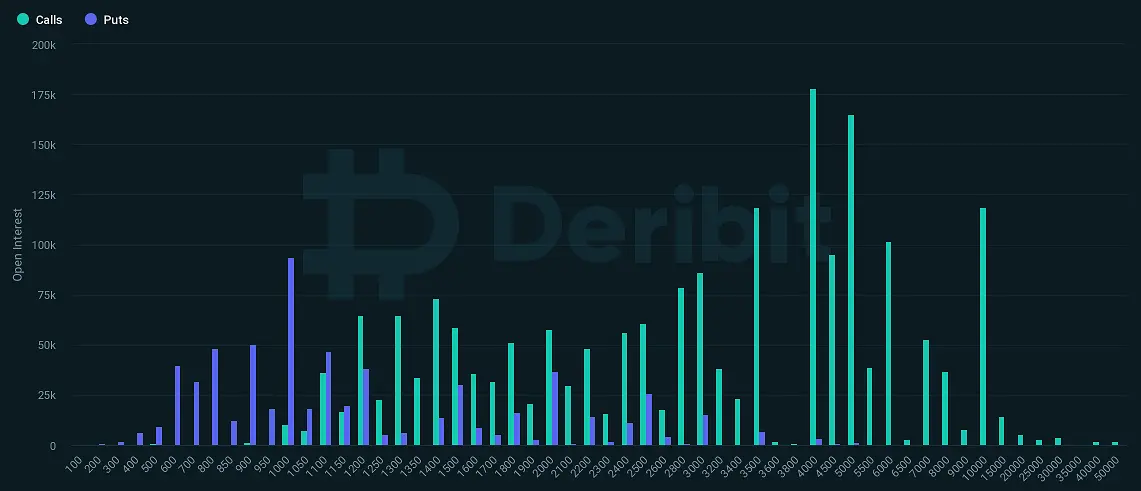

Unlike Bitcoin options, Ethereum options are dominated by the calls with far out-of-money strikes. $4000 and $5000 calls are significantly more popular than other strikes. A highly improbable $10000 call has more open interest than the most popular put which has a $1000 strike and is close to being in the money.

Ethereum options interest by strike

Ethereum has fallen hard this year, so it’s reasonable to suggest that Ethereum far out-of-money puts were monetized while at-the-money calls were held, thus creating the imbalance. Ethereum has decreased by about 70% year-to-date and by about 65% since April 1, so many out-of-money puts have become in-the-money and likely have been sold. On the contrary, calls that were near the money a few months ago have dropped a lot in value and are likely still held by investors. Primary examples of such calls are $4000 and $5000 calls, the ones that happen to have the largest open interest

Ethereum price year-to-date

Bitcoin significantly declined too but less than Ethereum, so the same effects for Bitcoin are less likely than for Ethereum. Bitcoin is down about 55% both year-to-date and since April 1.

Let’s consider this hypothesis in the context of changes in the open interest. Bitcoin options open interest rose by about 50% during 2 months ending June 23, but after June 23 it declined rapidly almost back to April levels. The open interest dynamics suggests that most of the options bought in May and the first half of June were sold or expired without rolling over.

Bitcoin options open interest

Ethereum options open interest rose by about 80% during 2 months ending June 23 and declined after that, but it has stabilized around levels corresponding to the end of May and has remained far above April levels.

Now, this looks interesting! Ethereum has dropped more than Bitcoin, so Ethereum put options should have been monetized even more than Bitcoin puts, but Ethereum options open interest declined less than Bitcoin options open interest. And remember, Ethereum options open interest is currently very skewed in favor of calls. Although not a precise calculation, it does suggest that Ethereum options traders significantly added to calls during the price plunge (unlike in the Bitcoin case). It looks like options traders see a decent chance that the coming shift to proof-of-stake may unleash the upside potential of Ethereum.

Ethereum options open interest

In traditional finance, it’s often assumed that volatility markets are smarter than spot markets. In the last 2-3 months Ethereum spot price declined relative to Bitcoin, but option flows within the same time frame seem to favor Ethereum over Bitcoin. It will be interesting to watch unfold if crypto volatility markets are smarter than spot markets and Ethereum will really outperform Bitcoin.

Investors sharing the volatility markets view may buy Ethereum or replace their Bitcoin holdings with Ethereum. Advanced investors may consider opening a long position in Ethereum vs a short position in Bitcoin.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.