Are Crypto Options Too Cheap?

Crypto implied volatility fell to a record low, making options historically cheap. Why did it happen and how to trade it?

Rock-Bottom Implied Volatility

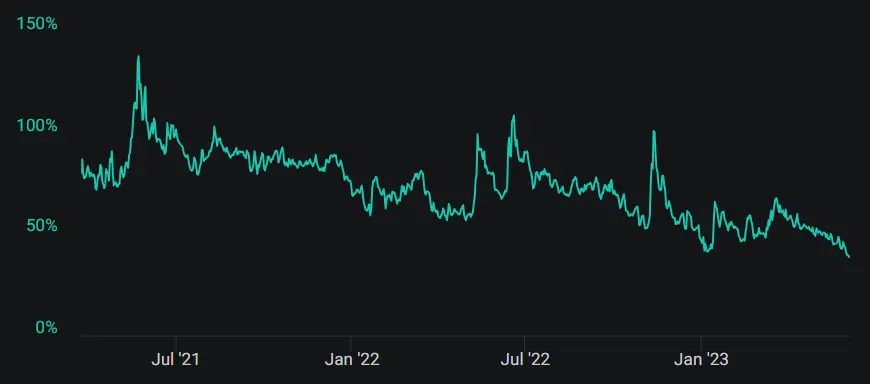

After spiking in November 2022, crypto implied volatility has been in a relentless downtrend, taking down the DVOL indexes of both Bitcoin and Ethereum to record lows around 40. Bitcoin DVOL recently fell below its January low reached during a quiet holiday.

Bitcoin DVOL index

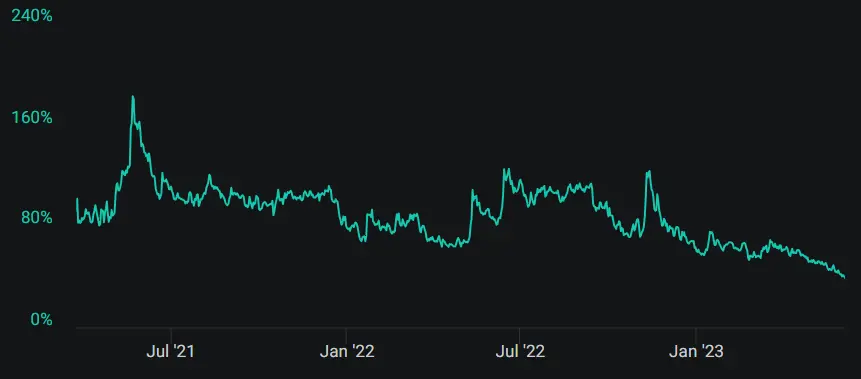

Ethereum implied volatility chart shows an even more consistent downtrend, dropping by more than 3 times since November 2022 only with minor upward corrections. Unlike Bitcoin DVOL, Ethereum DVOL did not significantly rise in March on banking worries. Ethereum implied volatility has become almost the same as Bitcoin’s one.

Ethereum DVOL index

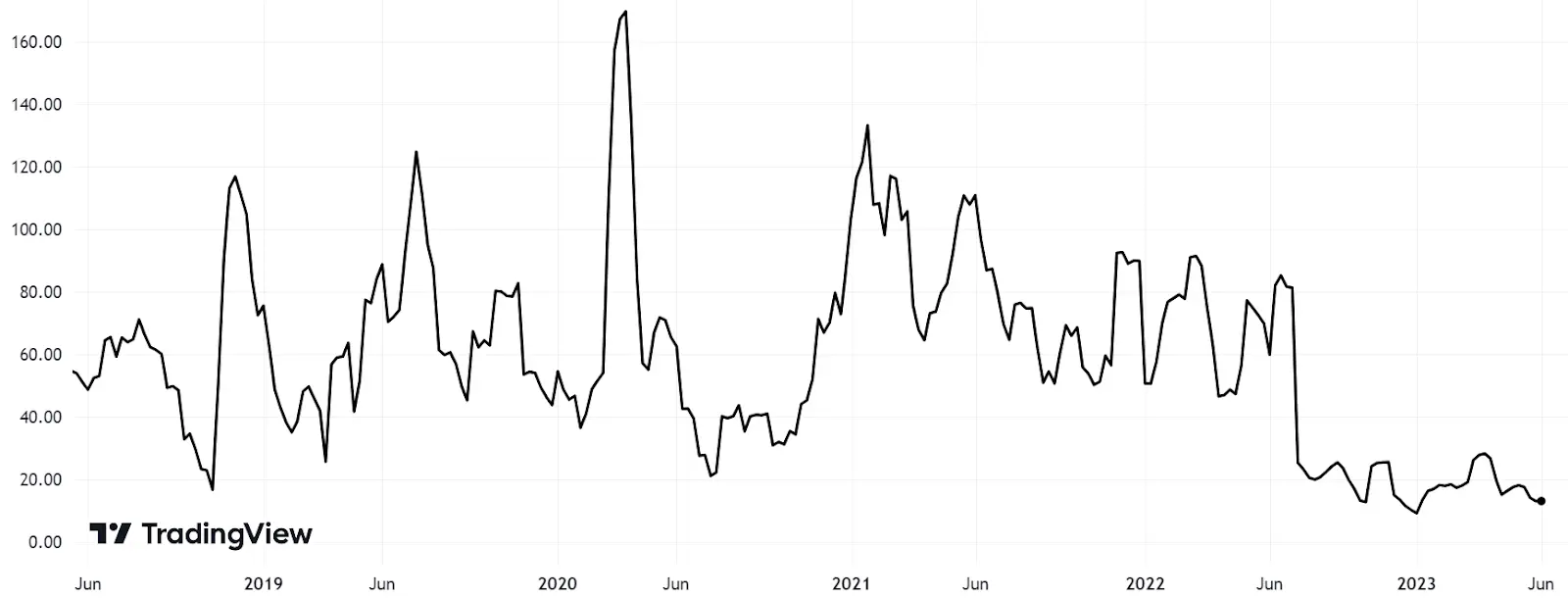

There are two most obvious and most direct explanations for low implied volatility. First, the realized volatility is very low, taking down the implied one too as it’s hard for the IV to deviate too much from the historical volatility. The historical volatility of Bitcoin plunged so much (in terms of the BVOL index, from 45-95 in the first 7 months of 2022 to 10-30 since August 2022) that the implied volatility drop (in terms of the DVOL index, from 50-110 in 2022 to 40 now) looks very modest.

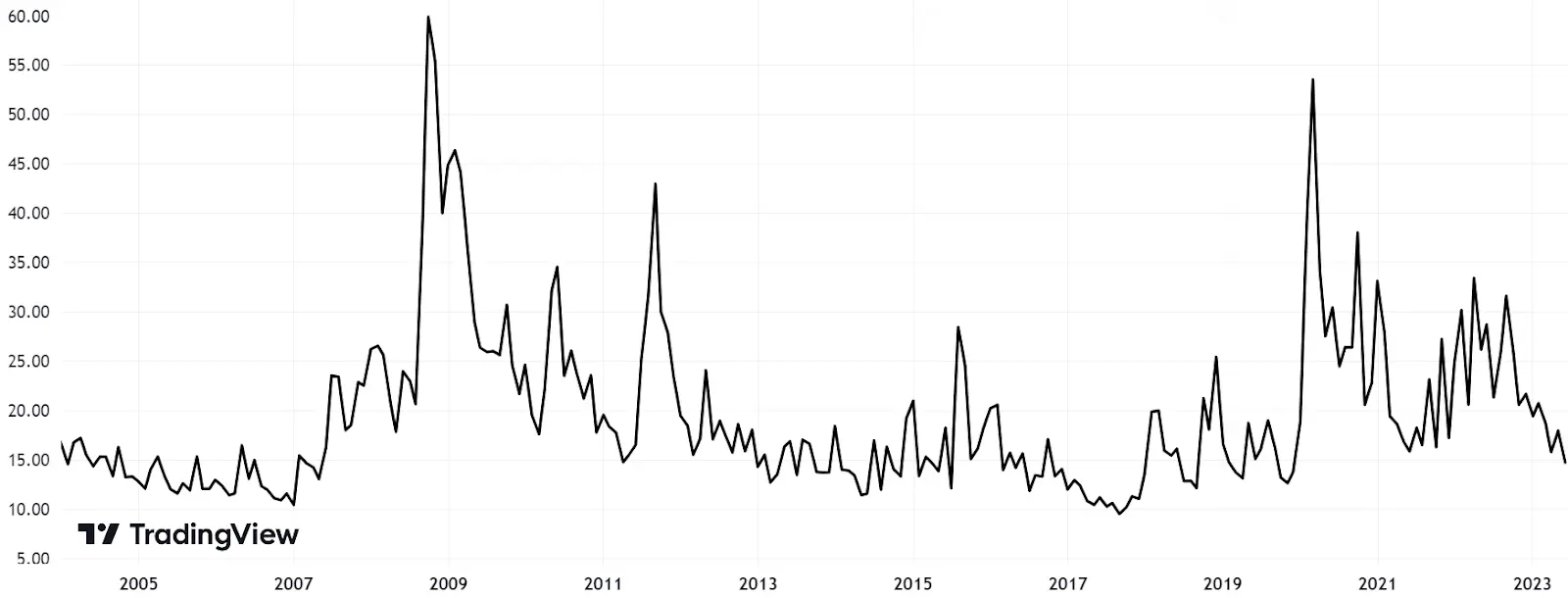

Historical volatility of Bitcoin (Bitcoin BVOL index)

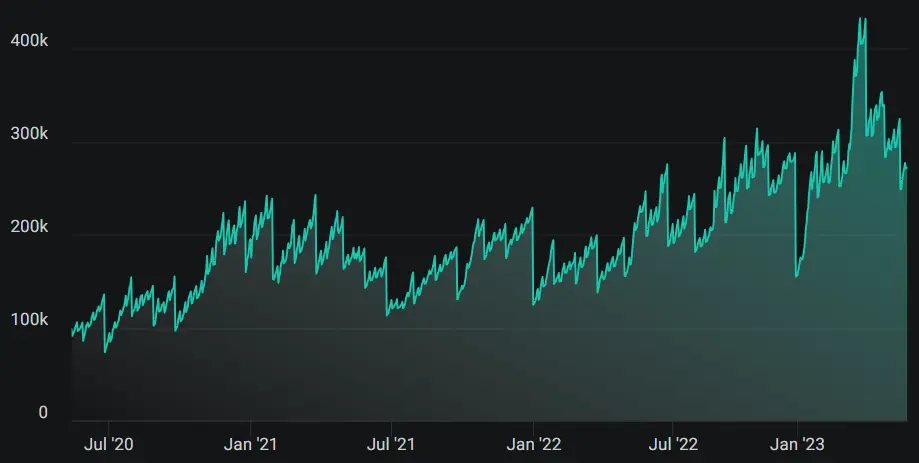

Second, options open interest at Deribit is depressed, suggesting a lack of volatility demand. Bitcoin options' open interest had spiked in March due to banking crisis worries, but later fell back and now is only modestly above the level prevailing in December 2020.

Bitcoin options open interest

Ethereum options' open interest has not recovered after the Merge mania, remaining approximately at the levels of June 2022.

Ethereum options open interest

Given the lack of demand, I think that market makers (or Deribit itself) have to price option premiums lower in order to entice buyers.

Cross-Asset View

The rock-bottom implied volatility of crypto is at odds with other assets. The implied volatility of stocks is muted, hovering around the lowest level since 2019, but is nowhere near a record minimum. The VIX index, which reflects the implied volatility of the S&P 500, is moderately below its long-term average value.

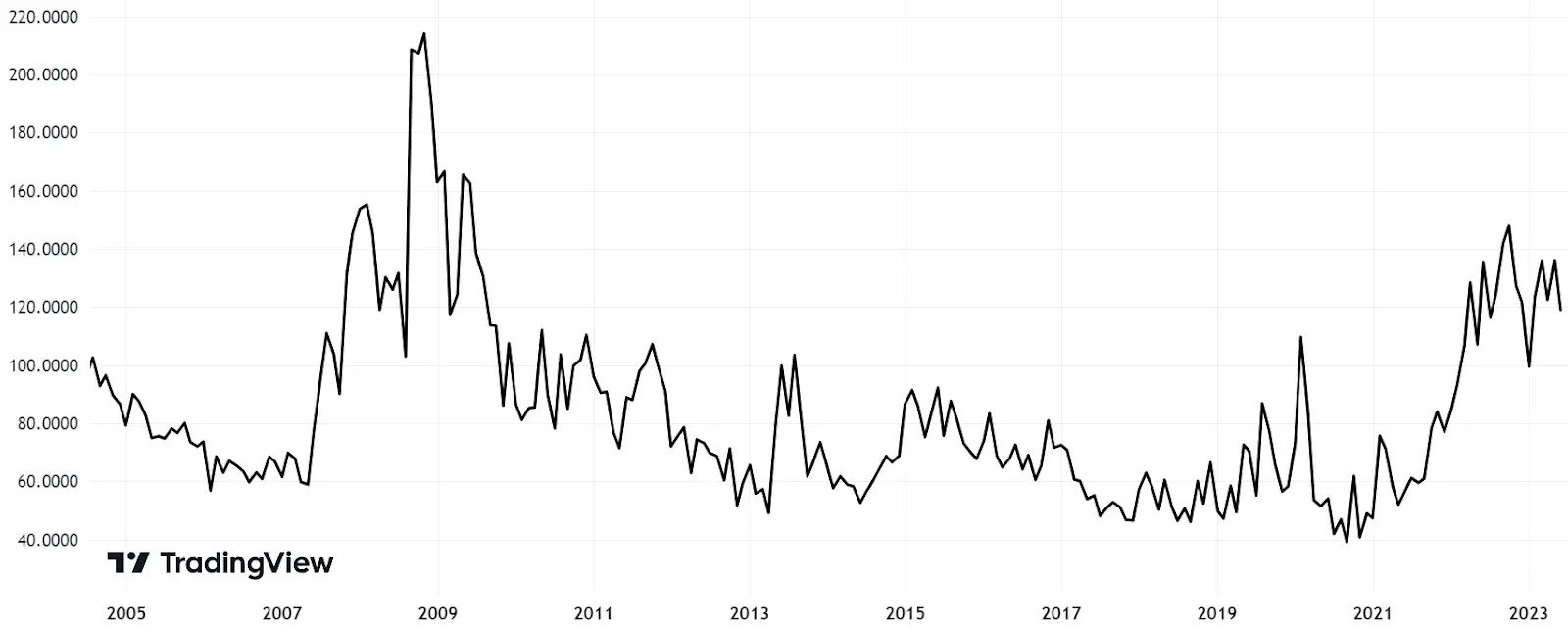

Implied volatility of US stocks (VIX index)

Contrary to both stocks and crypto, the implied volatility of bonds is significantly elevated. The implied volatility of US Treasuries as proxied by the MOVE index is at a decade high and above its 2020 pandemic maximum.

Implied volatility of US Treasuries (MOVE index)

Although the divergence between the MOVE and VIX indexes has been holding for about a year, I do believe that it’s just a question of time when macro uncertainty reflected in bond option prices spills over into other assets. The current monetary policy tightening cycle has been extremely fast compared with most previous cycles, elevating the bond volatility. A tightening effect on the real economy can not be so rapid and is probably delayed.

Mean Reversion or Structural Transformation?

The volatility is famously mean-reverting, so its current record low seems to be a good entry point. However, a very wide spread between implied and realized volatility makes a direct bet on higher volatility (like buying some kind of a strangle) very expensive. A trader betting on higher volatility needs to see a clear catalyst ahead in order to avoid a long period of a high negative carry.

This year marks a change in the crypto correlation with traditional financial assets. Bitcoin and broader crypto usually trade like high-risk technology stocks, but that changed during the banking crisis in March. During the banking crisis, Bitcoin behaved more like a levered gold than high-risk tech. Gold is a low-volatile asset with its implied volatility typically below that of the S&P 500, while high-risk tech has very high volatility, so the correlation change suggests much lower crypto volatility. Crypto may structurally transform from a high-risk tech proxy into a gold proxy, reducing volatility a lot.

Longer-term, I think the argument about structural transformation is very compelling, but in the short term I would rather bet on a mean-reversion. As I wrote previously, the US debt resolution will hugely increase the issuance of the US Treasuries, taking liquidity out of the markets. That makes the case for lower prices of most assets in the next 1-3 months. Both implied and realized volatility of most assets may significantly rise, as prices are usually negatively correlated with volatility. For crypto, the correlation between prices and volatility is less straightforward, but much higher volatility of stocks and other assets still looks like a powerful factor in favor of higher DVOLs.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.