$16,100 BTC buy or sell?

Cats typically sleep 70% of their lives, and although I am DAOCAT, not Scottish Fold I have been absent from Redot Insights for nearly a month, resting and reassessing the markets. Incidentally, this has been the best strategy - since my last post Bitcoin - Millenial Gold suggesting you buy some BTC, or as cryptokitties call it HODL BTC, this simple advice yielded +47% to today’s $16,100 on an unlevered basis.

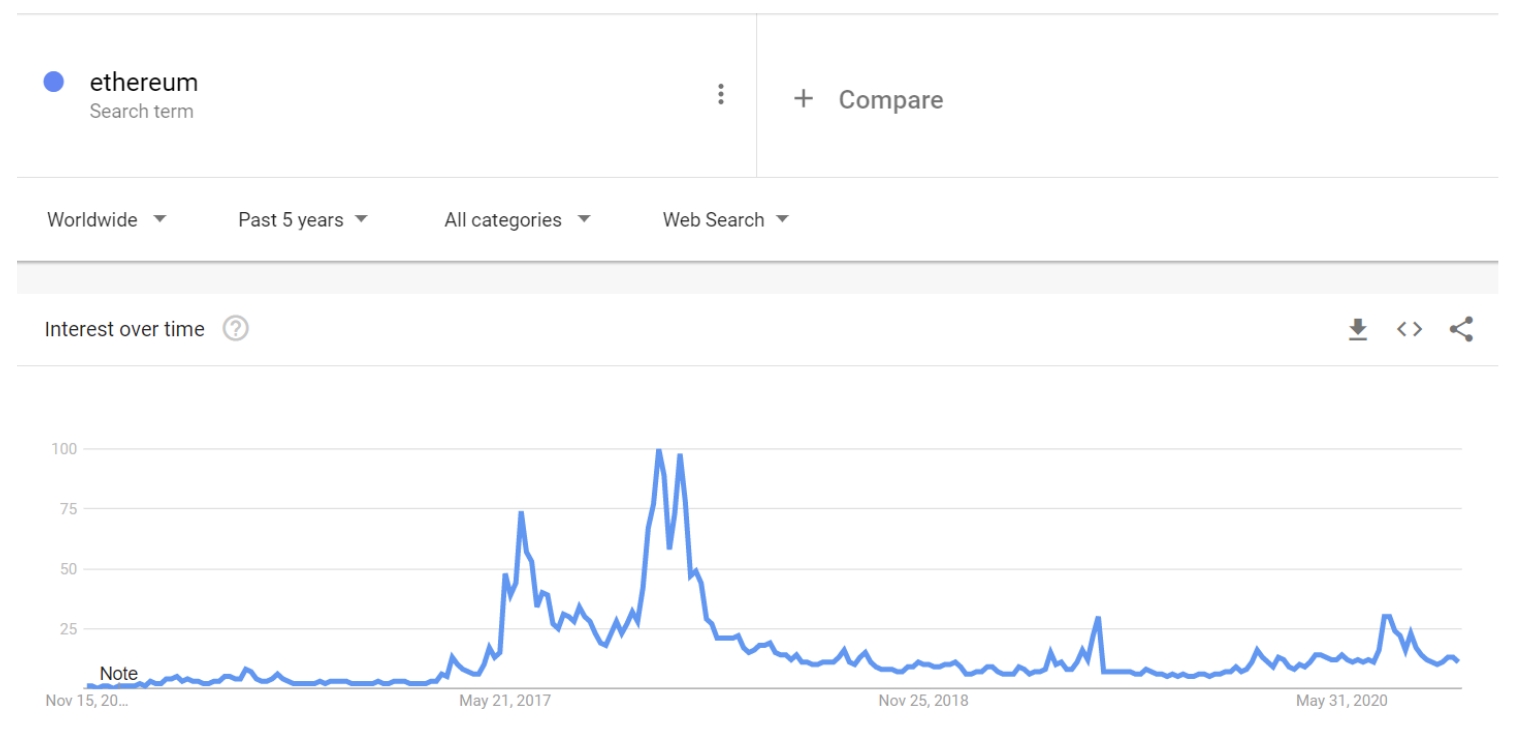

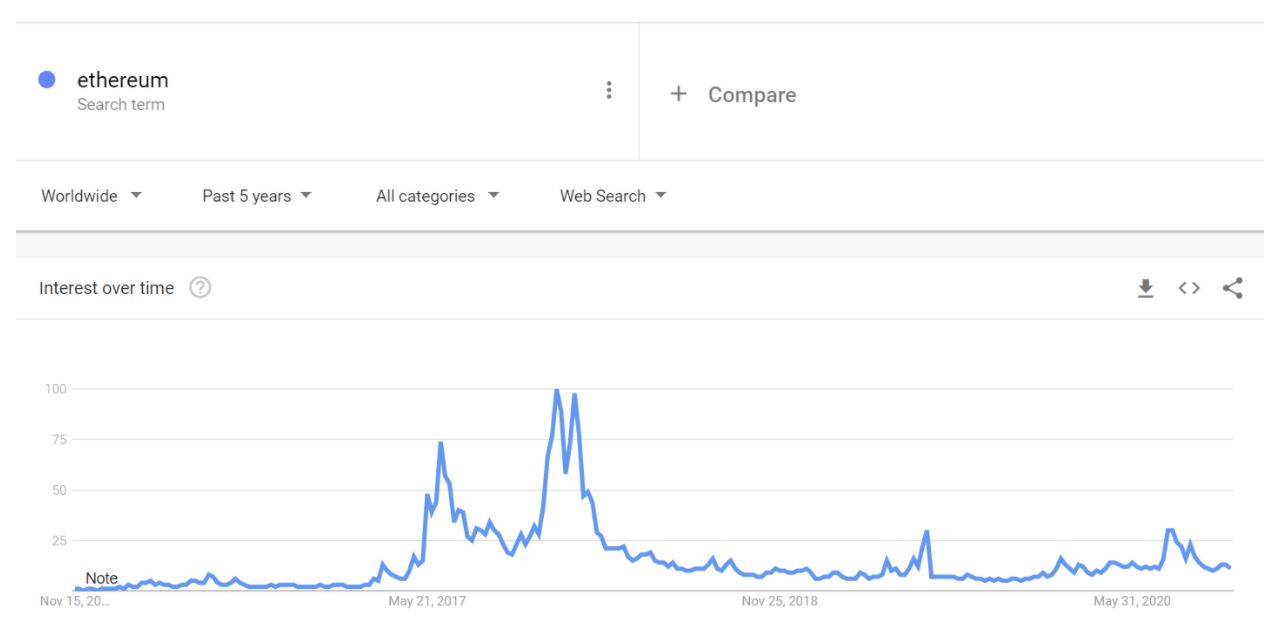

Simply judging by Google Trends, it’s apparent that there is no spike in interest vis-à-vis internet searches either in Bitcoin:

or Ethereum:

and we’re very far away from historical search volume during the 2017-18 ICO mania.

DAOCAT firmly believes in reversals of sentiment - if everyone is piling in, it’s time to sell, if there’s still skepticism maybe there’s still an opportunity to buy. From the trends above we’re clearly still far away from mass-market adoption and I’m not talking about usage, but simply thinking about allocating BTC or ETH as a small percentage of one’s portfolio.

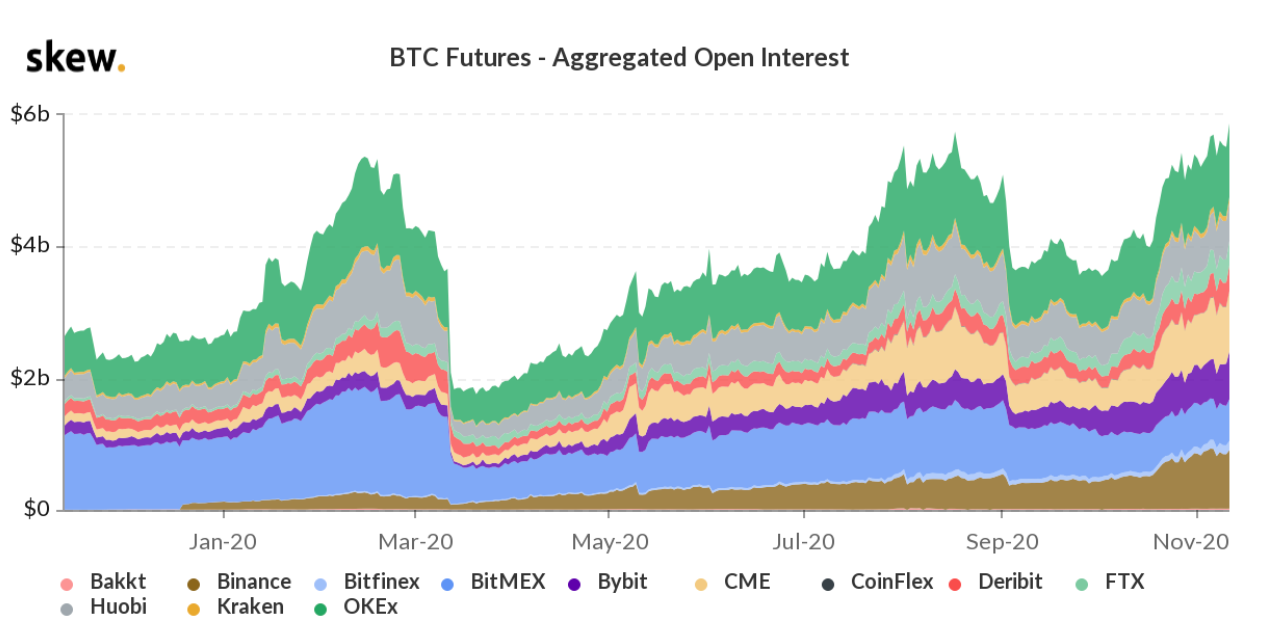

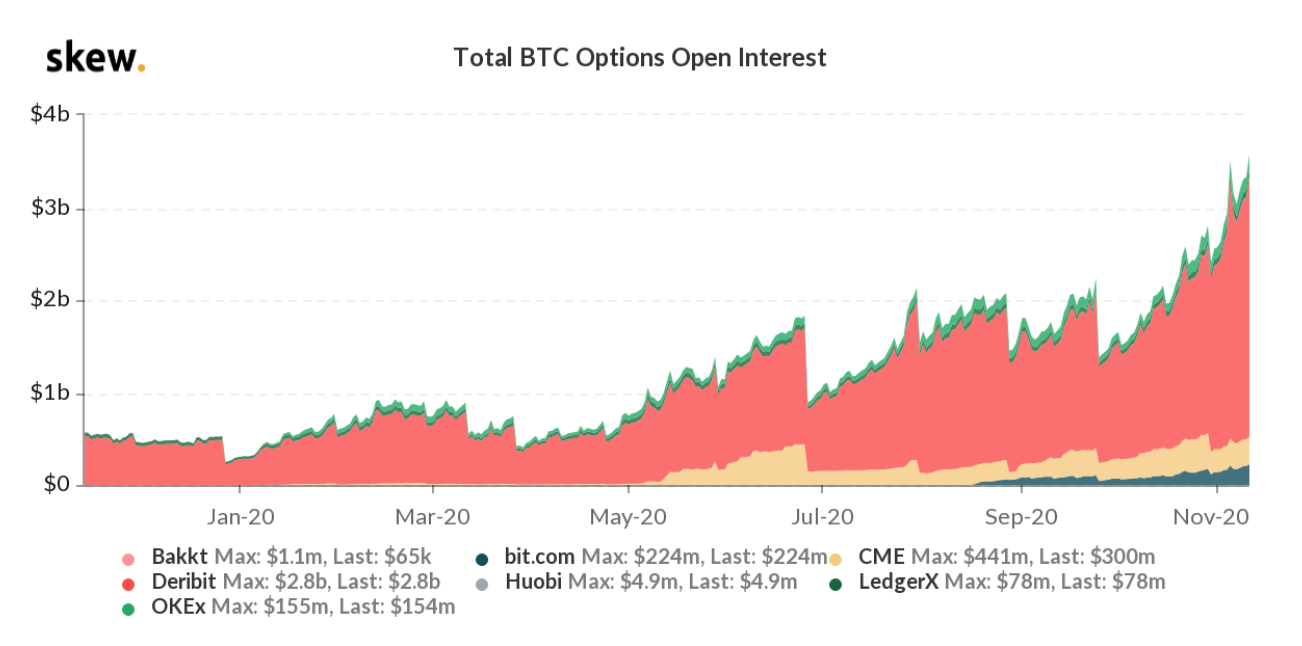

This said, quietly the market is expanding, and while compared to other markets crypto is tiny and nascent, open interest across exchanges in BTC Futures just broke record highs and is approaching $6 billion.

What’s most notable is that the Chicago Mercantile Exchange (CME) keeps expanding market share (in yellow), indicating that institutional investors are taking the asset more seriously. The reason we know that these are institutions is that each lot on CME is 5 BTC, which is fairly prohibitive for an average retail investor, and access to CME futures is only granted via specialized brokers.

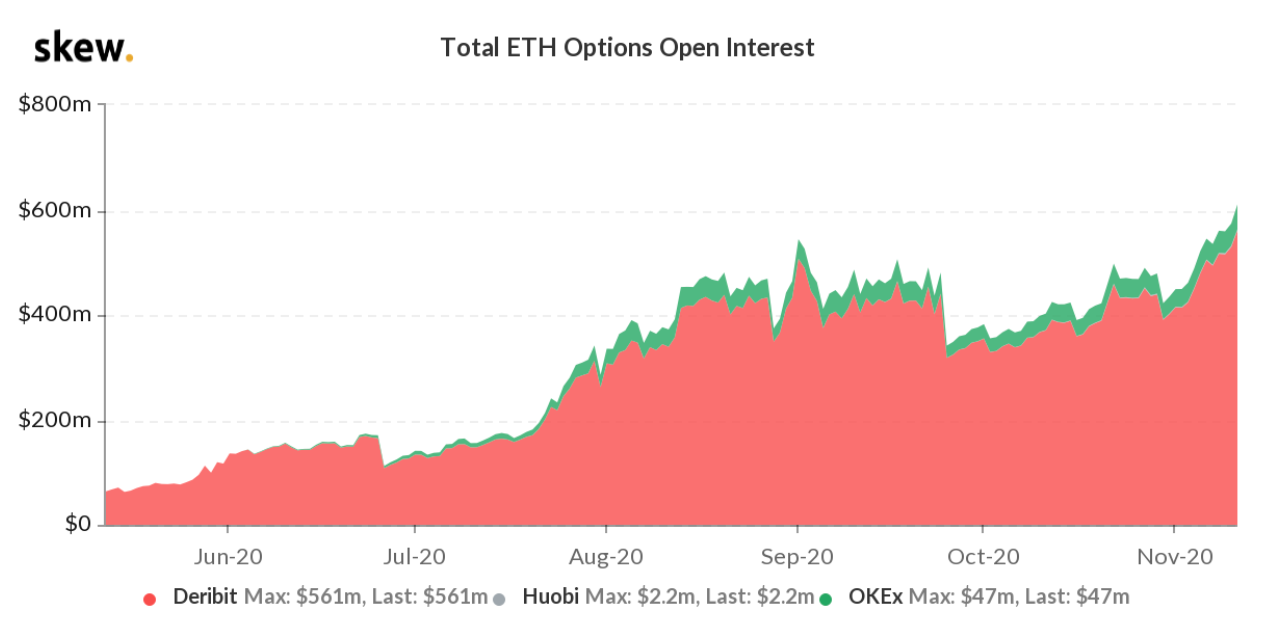

What’s even more remarkable is the options market - open interest is literally going parabolic, with most interest coming from speculative retail via Deribit exchange and already significant but still tepid interest on CME as well. Total positioning at the time of writing has eclipsed $3.5 billion in BTC options and $600 million in ETH options.

DAOCAT’s prediction is that in several years the options market in Bitcoin and Ethereum will outstrip the spot market, with many more exchanges coming into the fray. I would encourage the Redot boys to take note and list options and futures on their exchange ASAP so I can trade everything “under one roof”, not just spot BTC.

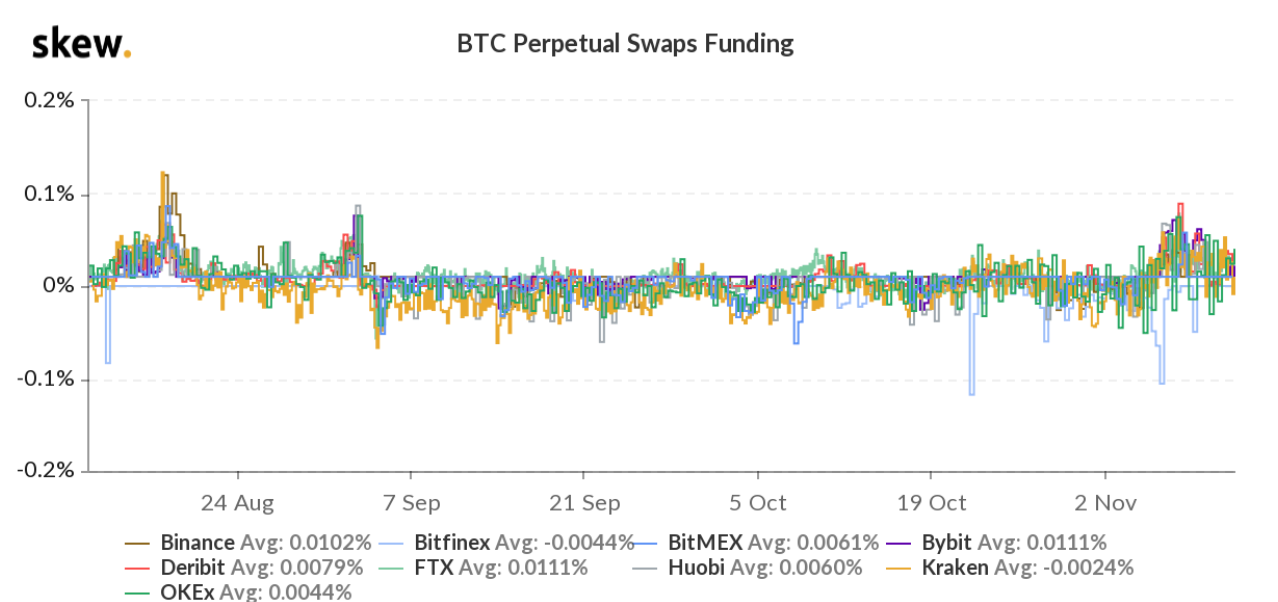

One can’t talk about futures and not talk about basis - what that basically means is the relationship between the spot price of BTC and its futures price. Positive basis is when futures on Bitcoin is trading at a higher price than bitcoin itself, while negative is just the opposite. The mechanism works similarly in regular expiring futures and in perpetual ones, except that in perpetuals, any deviation from the index (i.e. negative or positive basis) results in either the short paying the long or long paying the short every day, depending on which way the basis is. This is a mechanism for the perpetual futures to stick closely to the index price, and not get dragged too far away by short-term supply & demand.

I think that one of the reasons for the sustained rally that we’ve seen this fall has to do with basis and reversals that I talked about earlier. Per the graph below, perpetual funding or basis has not spiked since late August-September, indicating that retail (who for the most part trade this instrument) are not overleveraged (have less of a chance of being REKT), thus we can go higher if you believe the reversals theory. However, if the current spike does not subside, perhaps we’ve reached a short term top.

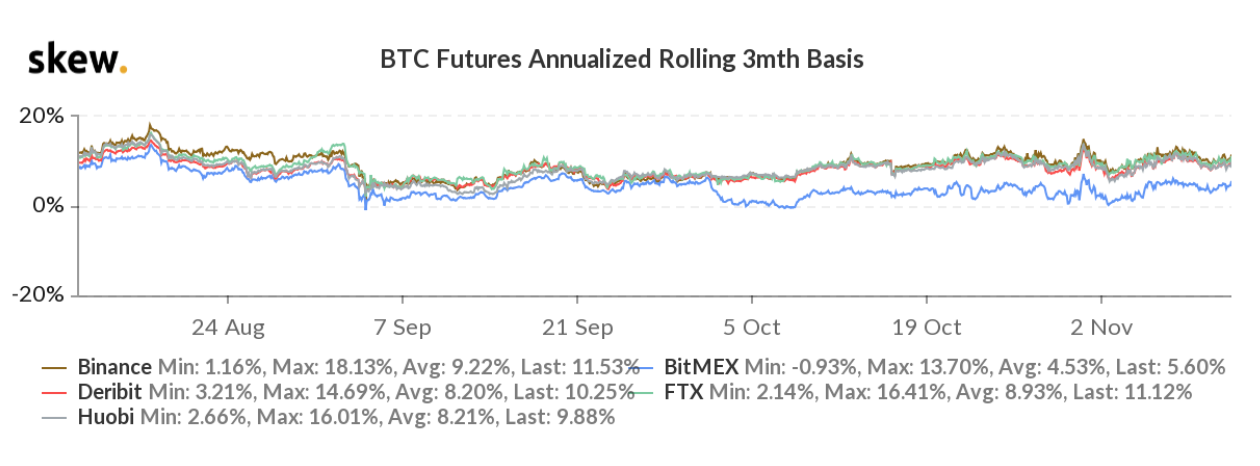

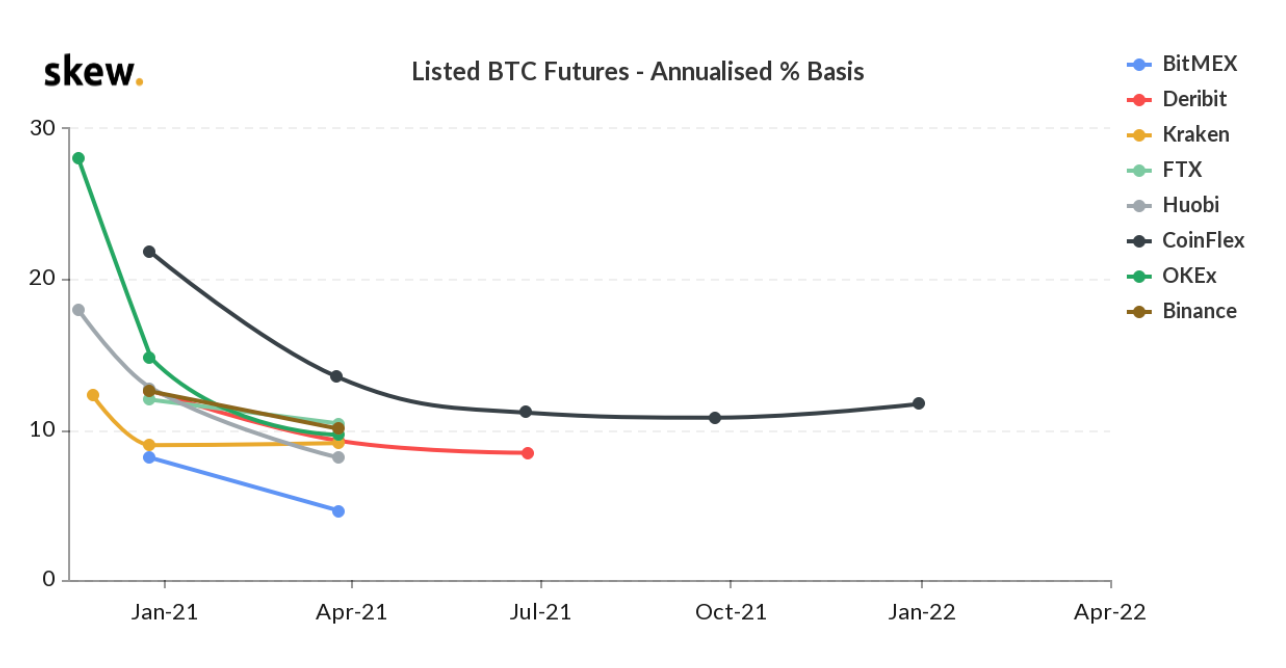

While we’re on the subject, when looking at the basis for expiring futures, (which as the name suggests, expire at the price of the index as opposed to perpertuals) one actually sees an interesting opportunity.

Ignoring the blue line which is BitMex, who obviously have their share of trouble with the Land of the Free, the rest of the exchanges exhibit a huge gap between the futures market and spot market. This can be seen especially clearly if we zoom in and look on a volatile day like today with BTC breaking $16,100.

Since bitcoin unlike markets such as crude oil doesn’t require tankers for storage, or say warehouses for gold, storing it has reasonably little to zero cost. One potential strategy for those savvy enough, but who don’t want to take the leap of just HODL per my advice, or think we’re at a short term top, is to long spot BTC while shorting expiring (non perpetual) BTC futures, in kind. This strategy, if done properly does not contain market risk, with respect to the price of BTC if both of the offsetting positions are held and subsequently simultaneously closed out at maturity of the futures contract. As can be seen in the graph above, annualized basis, or implied P&L if held to maturity is well in double digits, and exceeds most hedge fund hurdle rates for the year. In later posts perhaps we’ll explore this topic in some more detail, as my paws need a rest now.