When Is the Next Crypto Bull Run?

If you're reading this article, you're likely navigating through the turbulent waves of the 2023 financial markets. Both traditional and digital assets have experienced significant volatility, reflecting the unpredictable nature of global economic conditions. Amidst these fluctuations, the cryptocurrency market has presented both challenges and opportunities. While the current market cycle has allowed investors to acquire cryptocurrencies at a reduced cost, the question that remains at the forefront of every investor's mind is, “When is the next crypto bull run?”

This article will explore what is a bull run in crypto, attempt to predict the timing of the next significant surge, and present various arguments supporting and challenging our thesis. Let's embark on this journey.

Key Takeaway

- Bull markets and bear markets are what make the market healthy. They represent the ebb and flow of investment decisions and the confidence of investors in the market.

- Bitcoin, often referred to as the pioneer of blockchain technology, tends to rise the year after its halving.

- With hazy crypto regulatory oversights across many nations, some swing movements might be in reaction to regulatory news. Banks and central banks are also keeping a close eye on these developments, understanding the potential impact on the global financial system.

- Large crypto holders, also known as whales, have the power to preempt and influence a bull market. Their movements and transactions can significantly sway market directions.

- Generally, a benchmark of at least 20% upward movement is widely accepted as a bull market. This percentage is a testament to the market's health and the positive sentiment of its participants.

What Is a Bull Run in Cryptocurrency?

A bull run in crypto is a term used to describe a continued or abrupt increase in the market price of the crypto asset investments when there is more demand than supply. Although the bull market term applies to all markets, we will explore how it pertains to the cryptocurrency market in particular.

Another way to explain the bull market succinctly is through sustained growth. This often happens when the market sentiment shows optimism in the economy, prices reflect the investors' confidence, and demand is more than supply. The collective investment decision made during this period of time can greatly influence the trajectory of the market.

Investors who believe cryptocurrency prices will increase are called bulls. These investors’ buying decisions could spark positive reactions from other investors, leading to a loop of sustained upward movements.

These upward movements could be sudden or progressive depending on several factors and could last for years. Some circles in cryptocurrency tag a 20% increase in the prices of cryptocurrencies from its most recent low as the accepted range for the start of a bull run.

The opposite of the bull run is called the bear run. Although bear runs can be a great opportunity to invest at lower prices because they provide better insight into risk tolerances and give traders a chance at a better entry price or reduce their average costs, few people can stomach seeing losses on their investments.

Several factors, besides an obvious supply and demand issue, can cause or affect a crypto bull market, but we can categorize them into two: psychological factors (per type of investors) and external factors. Let’s explore some of them.

Under the psychological factors (per type of investors), we have:

Retail Investors

As the crypto ecosystem matures, we are seeing more retail involvement. This is driving crypto market growth and the development of the crypto economy. As earlier said, retail investors, capitalize on fickle market sentiment and media awareness. When there is optimism and increased buyers' confidence that the market conditions favor a cryptocurrency bull run, retail investors start buying. The ripple effect of having many buyers at once makes the price of cryptocurrencies shoot up.

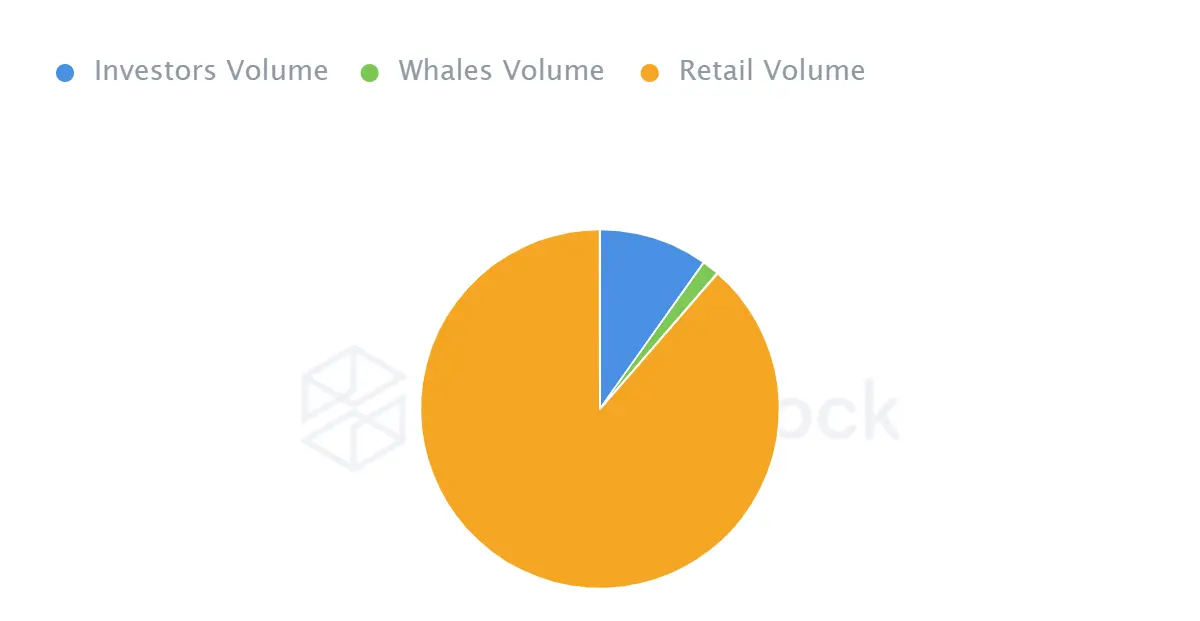

2021 Bitcoin Bull Run is led by

The Activity of Whales

The activity of whales also determines if there will be a bull run or not. Whales are a generic name to describe large cryptocurrency holders. Using complex tools, whales can make sound decisions concerning when to sell or buy. Before, or right into, a bear market, most whales move their tokens from volatile cryptocurrencies to stablecoins or fiat currency. The moment whales start moving into volatile assets, it is perceived that a bull run will soon start. Fortunately, it’s possible to track whales’ activities thanks to the transparent nature of blockchain.

Under the external factors, there are:

Regulations

The cryptocurrency space is largely unregulated, and different countries remain neutral and polarized in their opinions about digital assets. When regulatory decisions favor cryptocurrencies, the market reacts to the news by moving up. A recent example of this can be found in 2021 when China banned crypto mining and related activities. There was a short downturn that reversed once the US SEC accepted the first Bitcoin futures ETF in the country.

Economic Conditions

Inflation is one common fact in countries that see mass adoption of cryptocurrencies. Most countries are experiencing financial crunches, and to protect their capital from the devastating effect of inflation, citizens are saving their money in digital assets. Although cryptocurrencies have not proven to be a hedge against inflation, their volatile nature means they can move up easily as more people buy them, compared to fiat currencies that hardly recover from the effect of inflation.

Scarcity

The Bitcoin halving is a process that occurs every four years (every 210,000 blocks). The relevance of Bitcoin halving is to reduce the supply of new Bitcoins being mined and force the law of demand and supply to take effect. On top of this Bitcoin's maximum supply is capped at 21,000,000 coins, which limits the supply part of the equation.

From history, most Bitcoin bull runs happened the following year after a Bitcoin halving. The cryptocurrency market as a whole reacts positively to Bitcoin’s bull run.

Technological Advancements and Innovations

Blockchain technology is ever-evolving. As developers find new ways to enhance scalability, security, and functionality, these technological advancements can lead to increased adoption and, consequently, a potential bull run. For instance, Ethereum's transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) with its Ethereum 2.0 upgrade has been a topic of interest for many in the crypto community. Such major upgrades can influence investor sentiment and market dynamics.

Adoption of Cryptocurrencies by Mainstream Companies

When major corporations and businesses start accepting cryptocurrencies as a form of payment or invest significant portions of their treasury into cryptocurrencies, it can lead to positive market sentiment. For example, when Tesla announced its Bitcoin investment and its plan to accept it as payment, it created a significant buzz in the market.

Media Coverage and Public Perception

The way media portrays cryptocurrencies can have a profound effect on public perception. Positive news coverage by mainstream media can attract new investors to the market, leading to increased demand. Conversely, negative coverage can deter potential investors, leading to bearish trends.

Integration with Traditional Financial Systems

As cryptocurrencies become more integrated with traditional banking and financial systems, their legitimacy and adoption rates can increase. Banks and financial institutions offering crypto-related products or services, or even integrating blockchain technology into their operations, can be a positive signal for the market.

Development of New Projects and Platforms

The emergence of new crypto projects and platforms, especially those that address real-world problems or offer innovative solutions, can attract attention and investment, often providing substantial rewards. The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) are recent examples of how new concepts and projects can ignite market interest.

Network Security and Decentralization

The security of a cryptocurrency's network plays a crucial role in its adoption and price. If a network is perceived to be secure against attacks, it can lead to increased trust and investment. Conversely, successful attacks or vulnerabilities can lead to decreased confidence and bearish trends.

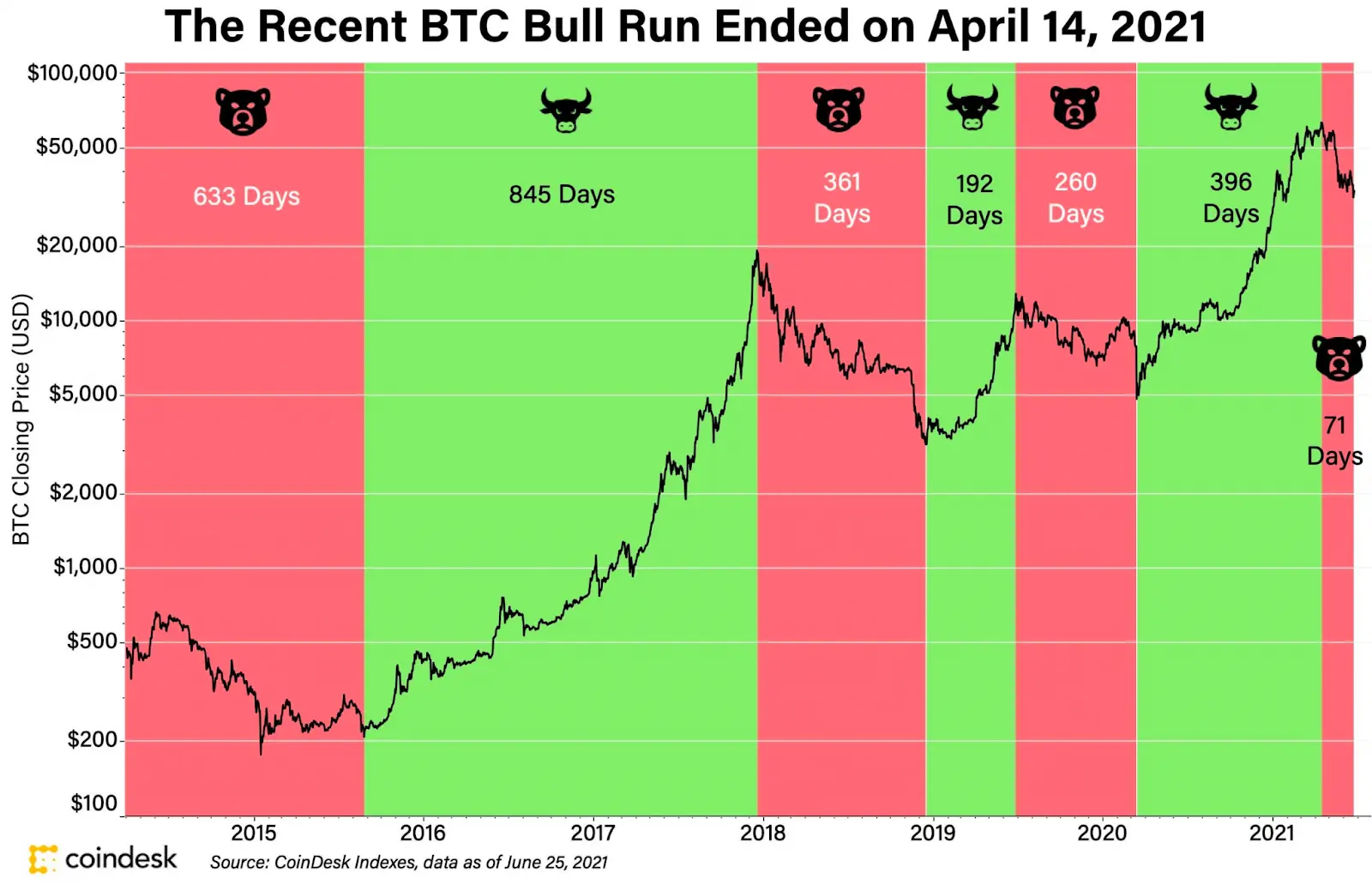

List of Past Cryptocurrency Bull Runs

1. 2010-2012

Bitcoin’s first taste of the bull run occurred between 2010 and 2011. Bitcoin was invented in 2009 to provide an escape route from the spending excesses of the government that led to the 2008 housing crash. The massive bull run would not come until 2011 though when it moved an astonishing 3200% in less than 9 months. The bull run was short-lived, though, as Bitcoin dropped to $2 in November. By a bit of chance, it ended the next year (2012) on a 650% increase from its November 2011 lows. Although the 2011 drop was unexpected, a 650% in 2012 is not one that can be easily seen in commodities or stocks.

2. 2013

By 2013, there was already budding interest in Bitcoin. The price rose from the $100s price to a record-high of $1100. It plummeted to $438 and went through a bear run for the next three years.

3. 2017

A year after the 2016 Bitcoin halving, the cryptocurrency took off from $900 in January 2017 to hit a record $19,783 in December of that same year. Although a few days before Christmas, it saw a 45% dip down to $11,000. Ethereum, created just two years prior, experienced its first bull run from $45 to $1,396.

The bull run of 2017 wasn't just limited to Bitcoin and Ethereum. Many other crypto coins and tokens experienced significant gains, drawing attention from both the crypto community and traditional financial institutions. This period saw a surge in crypto projects, with many startups launching their native token through initial coin offerings (ICOs). These projects promised innovative use-cases for blockchain technology, from decentralized applications to solutions aimed at disrupting various industry sectors.

4. 2018-2019

Post the euphoria of 2017, the crypto market entered a prolonged bear phase. Prices of major cryptocurrencies plummeted, with many tokens losing over 90% of their value. This period, often referred to as the “crypto winter”, was marked by skepticism, regulatory crackdowns, and a general sentiment of pessimism. However, it was also a time when many unsustainable crypto projects folded, while others consolidated, refined their objectives, and built the foundations for future growth. Exchanges became more regulated, and security measures were enhanced, ensuring safer transactions for users.

5. 2020 - 2021

The years 2020 and 2021 saw a resurgence in the crypto market. The global pandemic and the subsequent economic downturn led many to question traditional financial systems. With central banks worldwide printing money to stimulate economies, there was a growing concern about inflation and the devaluation of fiat currencies. This scenario set the stage for Bitcoin, often dubbed “digital gold”, and other cryptocurrencies to rise as potential hedges against economic uncertainty.

Furthermore, the increasing institutional adoption of cryptocurrencies played a significant role in this bull run. Major financial players, banks, and even some countries began to recognize and integrate cryptocurrencies. The rise of decentralized finance (DeFi) platforms, which offer traditional financial services without intermediaries, became a testament to the utility of blockchain technology.

Factors That Might Delay a Crypto Bull Run

The crypto market is unpredictable, and past performance does not always guarantee future returns. It is impossible to time the market accurately, but there are several things investors can look out for in the economy that will point to when a cryptocurrency bull market will happen or when a bear market might be prolonged.

Several factors can contribute to the strength or start of a cryptocurrency bear market; a pandemic, wars, a slow economy, and a bubble are a few of these factors.

The Macro Economy

The crypto market reacts when an economy is slowing because of inflation, poor employment statistics, or low disposable income. With the record-high money printing over the last two years, the central bank has begun a quantitative tightening to curb inflation in the United States. Removal of liquidity from the market has ensured all markets, including the crypto coins one, are experiencing crunches.

Wars

Like it is commonly said, wars don’t determine who is right. They decide who’s left. When large nations fight each other, they impact other countries both politically and economically, due to the globalized nature of the world economy. A good example is the Russia-Ukraine crisis.

Regulatory Backlash

With the general stance on cryptocurrencies still unknown, a nation’s regulatory stance against cryptocurrency can delay the next bull run. For example, China’s ban on crypto mining activities affected the cryptocurrency market.

Security Breaches and Hacks

The cryptocurrency world relies heavily on the perception of security. Major breaches, such as the hacking of cryptocurrency exchanges or wallets, can significantly erode trust in the entire ecosystem. When users and investors fear that their assets aren't safe, they may withdraw or refrain from investing, leading to decreased demand and potential price drops. Past incidents, like the Mt. Gox hack, have shown how such events can have long-lasting effects on market sentiment.

Technological Limitations

Cryptocurrencies promise fast, secure, and cheap transactions. However, when networks face scalability issues, resulting in slow transaction times and high fees, it can deter adoption. For instance, during peak times, networks like Bitcoin and Ethereum have faced congestion, leading to user frustration. If these technological challenges aren't addressed promptly, they can hinder the mass adoption of a particular cryptocurrency.

Market Manipulation

The crypto market, being relatively young, is susceptible to manipulative tactics like pump-and-dump schemes, where prices are artificially inflated to attract unsuspecting investors, only to be sold off for a profit. Such activities can lead to significant volatility and can deter genuine investors who seek stability and genuine growth. The perception that the market can be easily manipulated can delay widespread trust and adoption.

Negative Media Coverage

Media plays a pivotal role in shaping public perception. Prolonged negative coverage, focusing on the risks, frauds, or the speculative nature of cryptocurrencies, can create a hostile environment for potential new investors. A narrative that consistently portrays digital assets as risky or associated with illicit activities can significantly delay a bull run by keeping mainstream investors at bay.

Lack of Institutional Adoption

Institutional investors, such as hedge funds, pension funds, and other large financial entities, bring significant capital into any market. Their involvement can lend legitimacy and stability. If these entities remain skeptical or slow in adopting cryptocurrencies, it can limit the influx of large-scale investments. On the flip side, positive signals, like a major bank offering crypto trading services, can boost market confidence. However, hesitation or reluctance from these institutions can keep the market from realizing its full potential.

Crypto winter

The crypto winter is a term coined for major cryptocurrency crashes. After a sharp bull run, or right before a meteoric bull run, the cryptocurrency market tends to retrace and move sideways for a while.

The first time this term was used was in 2014 when the price of Bitcoin dropped 84% (from $1137 to $184) before starting a meteoric crypto bull cycle the year later. Although this was the fourth time Bitcoin’s price would be suffering a price shock, the duration by which the bear market lasted was what earned it the name ‘crypto winter.’

The second occurrence of a crash of this magnitude was in 2018 after the crypto bull market dropped 65% ($20,000 to $7,700) and went through an eighteen-month bear cycle.

The 2022-23 bear market stands as another significant chapter in the history of crypto winters. During this period, the cryptocurrency market saw a brutal decline, with the total market capitalization shedding a staggering $2 trillion from its 2021 highs.

Factors such as the vulnerabilities introduced by the rise of centralized lending and the boom in decentralized finance (DeFi), the significant drop in Bitcoin's value, and macroeconomic influences like rampant inflation and central bank decisions played pivotal roles in this downturn.

The destabilization of certain stablecoins and the involvement of major financial players with highly leveraged positions further exacerbated the market's decline. This downturn served as a stark reminder of the volatile and unpredictable nature of the crypto industry.

The Next Crypto Bull Run Prediction

After reaching all-time highs in November, prices have since been on a steady decline. This has led to a lot of selloffs and FUD (fear, uncertainty, and doubt) in the space. Is the crypto bull run over? Or when is the next Crypto bull run? This has been the question flying around lately.

As we earlier stated, no one knows when the next bull run in crypto will be. The founder of Ethereum, Vitalik Buterin, has indicated that bear market cycles will benefit the crypto space in the long run because they allow projects to be built with little or no focus on price and speculations.

Some say that we won’t see a bull run in 2023 because of many factors. The optimism in the market is that the Bitcoin halving will signal the start of the bull run in 2024, while some others predict that following history, we would see the next bull run in 2025, a year after the Bitcoin halves.

The majority of the community members seem strongly convinced that there will be another bull run soon and that the bitcoin price prediction of $100k might not be far-fetched.

Institutional adoption of cryptocurrencies by banks and other financial entities could also play a pivotal role in the next bull run. Exchanges offering new rewards and incentives, the rise of utility tokens, and the increasing trust in blockchain technology for secure transactions across the industry are all factors that could influence the next phase of growth in the crypto world.

Preparing for the Next Bull Run

While predicting the exact timing of the next bull run is challenging, investors can take certain steps to be prepared:

- Stay informed. Keeping abreast of global economic conditions, regulatory changes, technological advancements, and market sentiment is crucial. Joining crypto communities and following reputable online community platforms can provide timely insights.

- Diversify: don't put all your eggs in one basket. Diversifying your crypto asset investments across various coins, tokens, and projects can mitigate risks.

- Understand the underlying blockchain technology, its potential applications, and the problems it aims to solve.

- Engage with the community. The crypto world thrives on community engagement. Participate in discussions, attend webinars, join forums, and network with other enthusiasts.

- Secure your investments. Use reputable exchanges, enable two-factor authentication, and consider using hardware wallets for significant amounts.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.