What Is MINA

Mina protocol has three main goals: making blockchain lightweight, controlled by participants, and enabling blockchain interaction with the internet while maintaining its privacy. The protocol, like any blockchain technology, was built to satisfy all the original intentions of decentralization, scalability, and security.

The Mina project ultimately tackles a blockchain limitation that affects most crypto projects as they grow. So What is Mina protocol?

Why Is Mina Important?

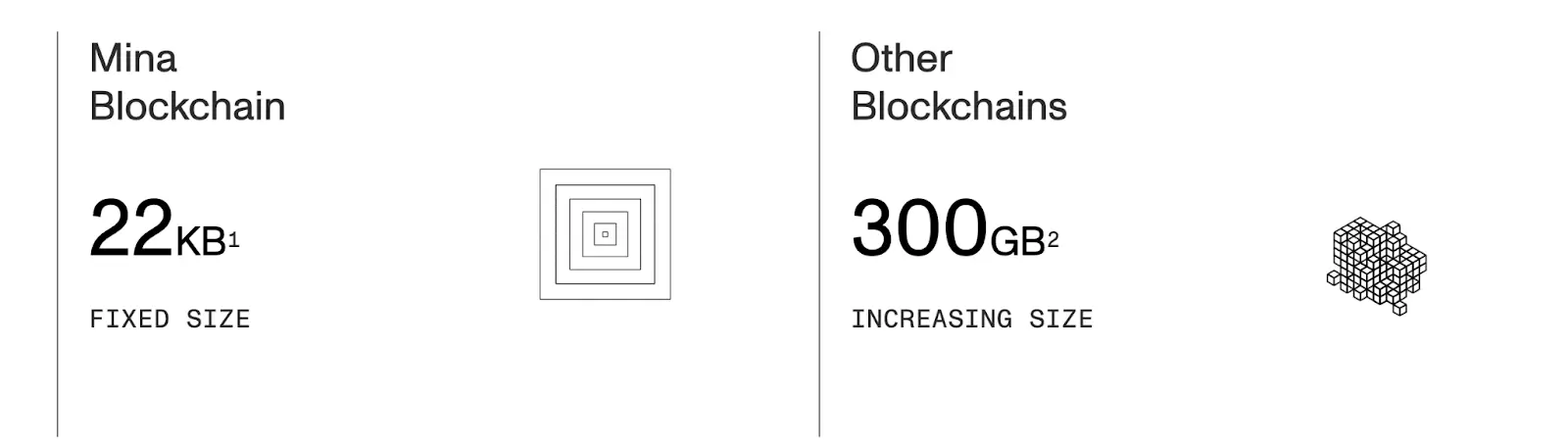

The concept of blockchain aims to promote decentralization—giving control to its users. Due to Mina's lightweight 22kb blockchain, it’s seamless to connect peer-to-peer and validate transactions like a full node, making it censorship-resistant and secure.

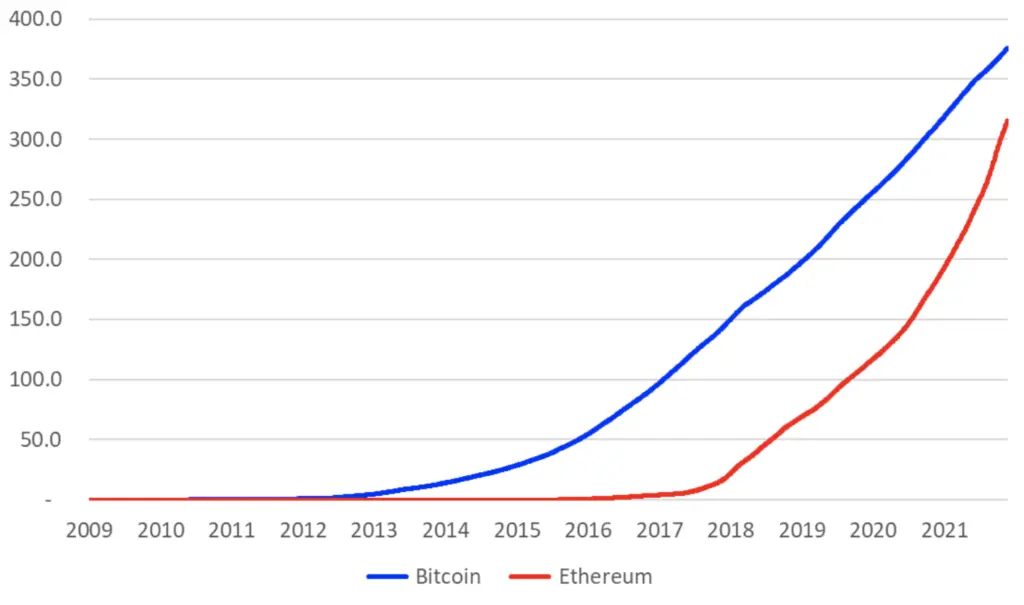

Most existing blockchain technology projects have faced enormous block size issues. Using Bitcoin and Ethereum as a case study, the Average Bitcoin block size ranges from 80kb - 1.5Mb, while for Ethereum it is between 80kb - 4Mb in a ten minutes period. The blockchain size of both networks has grown significantly over time and will continue to grow as the number of transactions on their networks increases.

As of 2012, the Ethereum blockchain was only 5 gigabytes large, and today, it has expanded to nearly 1Terabyte— due to the significantly increasing number of transactions stored on the network.

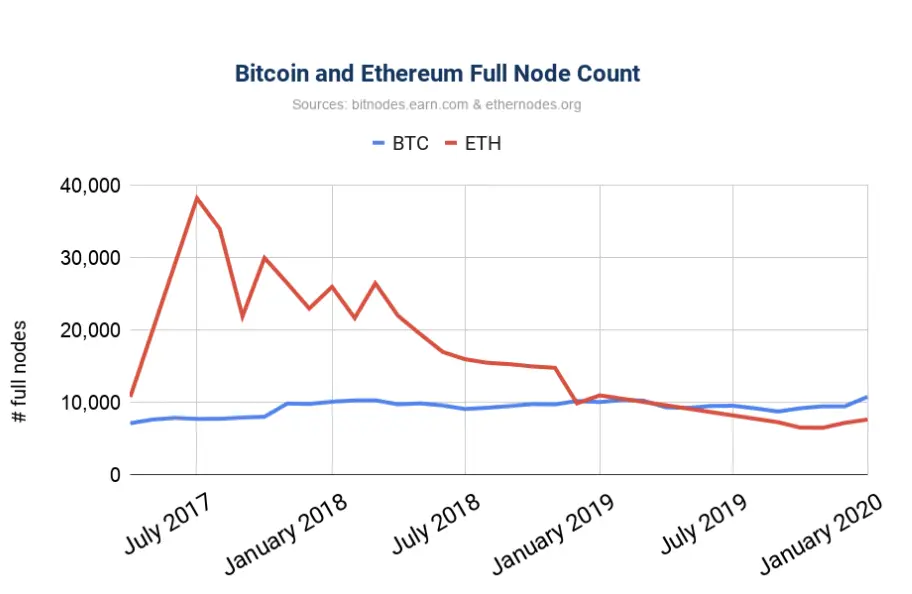

This means to partake in validating transactions on these networks, users have to download the entire gigabytes of data containing the block header and transaction. However, most users cannot afford the computing power needed to verify these heavy chains. Thereby making validators intermediaries, establishing an imbalance in control.

From another perspective, running a blockchain node (say Bitcoin) requires expensive hardware, an certain amount of electricity, and could be time-consuming.

Mina claims to have truly fulfilled the original promise of decentralization. An average person with a smartphone can sync and verify the network in seconds.

What Is Mina and What Does It Do?

Known initially as Coda Protocol, before its rebranding in 2020, Mina is a lightweight blockchain with a size of just 22kb, irrespective of the number of transactions carried out on the network. Its small size enables users to operate a node and validate transactions on the network without requiring complex computing power or hardware. Mina uses a succinct proof-of-stake consensus mechanism known as the Ouroboros Samasika—a mechanism designed to help uphold the blockchain’s decentralization.

Furthermore, blockchains typically do not interact with the internet; this means internet information is off-limits to blockchain applications, limiting their capacity and usage. However, with Mina’s zkApps, users can access verified online data and websites on-chain without compromising privacy. Privacy and user control are fundamental to Mina and in line with the goal of Web 3.0, where users are in charge of their data.

The Protocol's native token is used to carry out transactions and distribute fees among users on the network. Also, holders can trade MINA like any other crypto or choose to stake their MINA token, and earn on the protocol. It has a market capitalization of $374.73M and a current price of about $0.65.

How Does Mina Protocol Function?

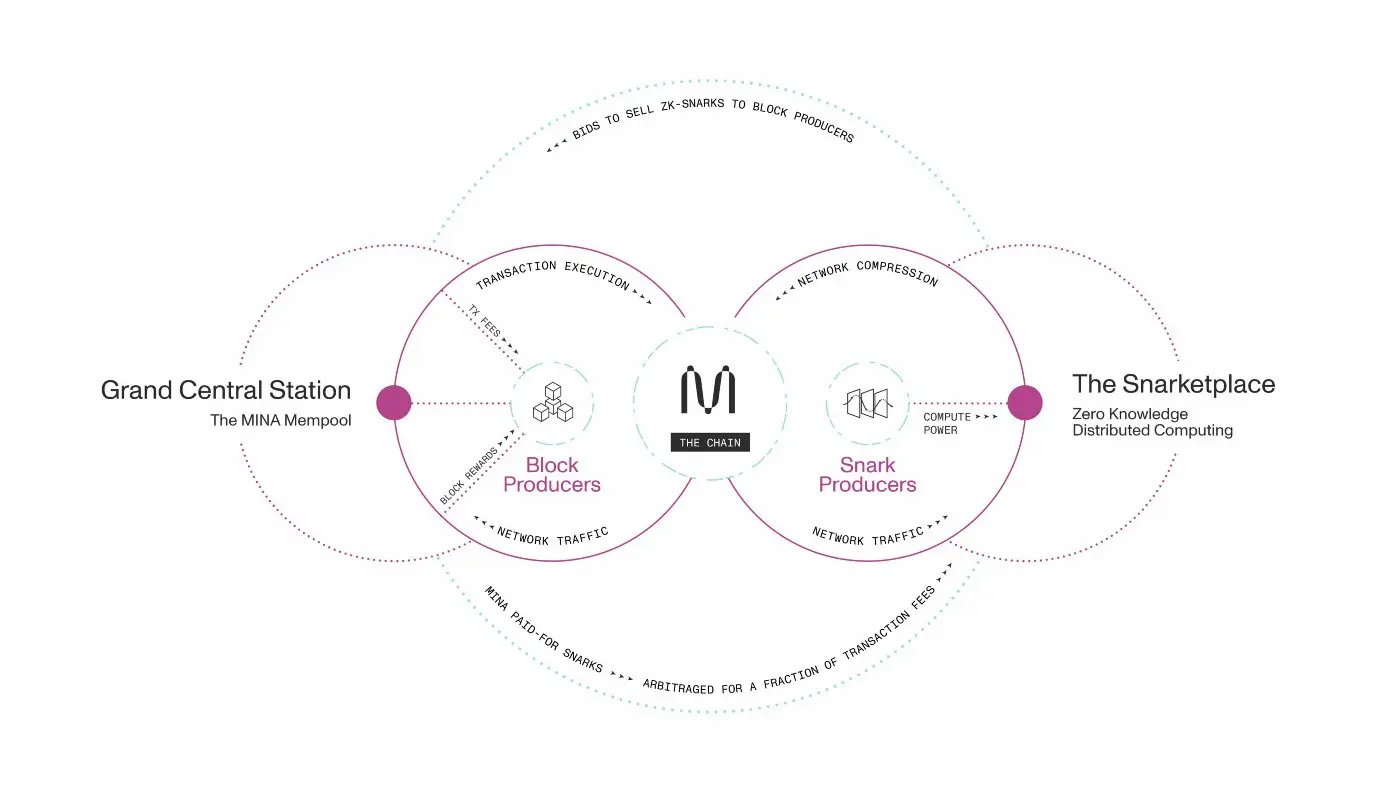

Mina was created using a cryptographic technique known as zk-SNARKs— Zero-Knowledge Succinct Non-Interactive Argument of Knowledge. zk-SNARKs is a cryptographic proof construction that allows one user to prove possession of specific information or data. However, it does not disclose the data which means no risk of personal data leaks between both parties (the prover and the verifier).

This cryptographic technique creates a structure that doesn't require each node to record the entire transaction history. This way, more users in the protocol can run nodes and validate transactions, creating more nodes. The network becomes more decentralized and secure—all without complex computing power.

Built on a consistent-size cryptographic proof, the size of the blockchain remains significantly small even as the project scales to thousands and millions of users.

With Mina crypto, users can participate in the proof-of-stake consensus, gain access to censorship resistance, and participate in keeping the blockchain secure.

How to Invest in Mina

There are a lot of exchanges where one can trade cryptocurrencies. You can buy your MINA from any cryptocurrency exchange that supports MINA and store it in your crypto wallet. A few exchanges with wallets include Binance, Coinbase, and many others.

Step 1. Sign up For An Account On Your Preferred Exchange

Either download the exchange app or access it via browser to start your sign-up process. Fill in your details and the required identification to verify your account and keep it secure.

Step 2. Choose a Payment Method

You can pay via bank transfer, Debit/credit card, and bank deposits to fund your account, depending on the exchange. There are extra options you could consider, such as the third-party payment channels and the p-2-p payment service option where you can buy MINA directly from another user.

Step 3. Buy MINA

Search for and select MINA on the list of crypto assets on the exchange. Then enter the amount of MINA you want to purchase.

Step 4. Confirm Your Purchase

Cross-check the details of your purchase and confirm your purchase. Once your order gets filled, store MINA in your crypto wallet.

Is MINA a Good Investment

Mina protocol appears to be a good investment with the potential to do amazingly well in the future, considering its concept and introduction of new technology. Also, many experts seem to agree that the Mina coin price could be profitable in the long term.

MINA is potentially a great investment option and should be on the list of top crypto to buy; however, before you buy MINA crypto, do your due diligence.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.