Gamma Squeeze Explained for Beginners

Understanding Gamma Squeeze

In the intricate labyrinth of option trading, a set of tools known as the “Greeks” play a vital role. These Greeks – delta , gamma, theta, vega, and rho – are essential metrics used by traders to assess risk and strategize their options trading. While each Greek has its specific purpose, our focus in this article will be on one particular phenomenon that stems from them: the gamma squeeze.

Decoding Gamma Squeeze

This term defines a unique phenomenon occurring in the stock and options market. Its implications can be extended to the domain of cryptocurrency as well. Herein, we'll unravel the gamma squeeze meaning.

A gamma squeeze relates to options trading and transpires when the price of the underlying asset, say Bitcoin priced at $20,000, witnesses a swift escalation due to an influx of option buying.

When a lot of call options are bought, the market makers (who sell these options) may hedge their risk by buying the underlying stock. An increase in demand for stocks may lead to the stock price to go up. The increasing prices force market makers to buy even more of the underlying stock to stay hedged, causing the stock price to rise even further – a phenomenon known as a Gamma Squeeze.

How Does a Gamma Squeeze Work

Now that we've introduced the gamma squeeze definition, let's delve into the mechanism behind this phenomenon. Here's a step-by-step breakdown of how a Gamma Squeeze works:

- Options trading begins. An investor or a group of investors starts purchasing a large volume of call options for a specific stock. A call option is a financial contract that gives the holder the right to buy a stock at a predetermined price before the contract expires.

- Market makers hedge their bets. Market makers, who are typically institutions or individuals that provide liquidity to the market by buying and selling securities, are often the entities selling these options. To hedge their risk, they purchase the underlying stock in the open market. They do it because if the stock's price increases, they'll need to have the stock on hand to fulfill their obligations.

- Stock price begins to increase. This initial purchase of the underlying stock by market makers can cause the stock's price to rise.

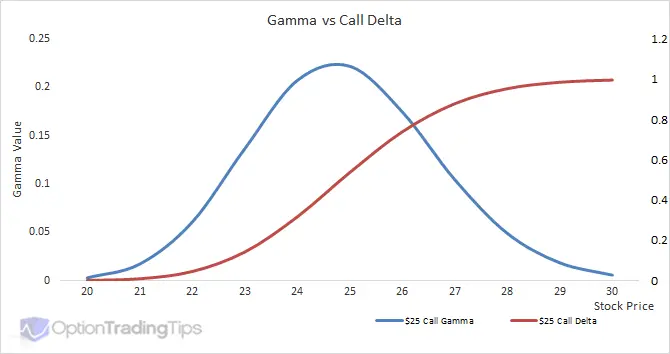

- Gamma comes into play. As the stock's price increases, so does the delta of the options. Delta is a measure of how much the price of an option changes if the underlying stock's price changes by $1. Gamma, on the other hand, is a measure of how much delta changes if the underlying stock's price changes by $1. So as the stock's price rises, gamma causes delta to increase as well.

- Market makers need to buy more stock. As the delta of the options increases due to the rising stock price, market makers need to buy more of the underlying stock to stay hedged. This additional buying can cause the stock's price to increase even further.

- The feedback loop. This creates a feedback loop where the rising stock price increases the delta of the options, which causes market makers to buy more stock, which pushes the stock's price up even more. This is the gamma squeeze.

- Squeeze ends and prices often fall. After the options expire or when the buying slows down, the market makers can stop buying the stock. It typically leads to a decrease in demand for the stock, and the stock's price falls as a result.

- It's important to note that a gamma squeeze is a high-risk event that can result in significant volatility. It's not a common occurrence, but when it happens, it can lead to dramatic price swings in a short amount of time.

Gamma Squeeze vs. Short Squeeze

It's worthwhile to distinguish a gamma squeeze from a short squeeze. While both can cause dramatic price surges, they differ in their mechanics.

In a short squeeze, bearish investors who have borrowed and sold Bitcoin are forced to buy it back if the price increases dramatically. This buying pressure accelerates the price ascent, causing a short squeeze.

On the other hand, a gamma squeeze revolves around options contracts and market makers' need to hedge their positions, resulting in a rapid escalation of the underlying asset's price.

What Causes a Gamma Squeeze?

The causes of a gamma squeeze are primarily tied to the dynamics of the options market. The chief trigger of gamma squeeze is a significant volume of option buying, specifically call options betting on the price increase of an asset.

As previously explained, when these call options are purchased in large volumes, market makers must hedge their risk by buying the underlying asset, leading to a gamma squeeze. The gamma, which represents the rate of change of the delta, exacerbates this buying frenzy, thereby causing a swift ascent in the asset price.

How Delta and Gamma Greeks Interconnect?

In options trading, Greek letters are used to denote various aspects of the options' price behavior. Among them, delta and gamma play a big role in our discussion.

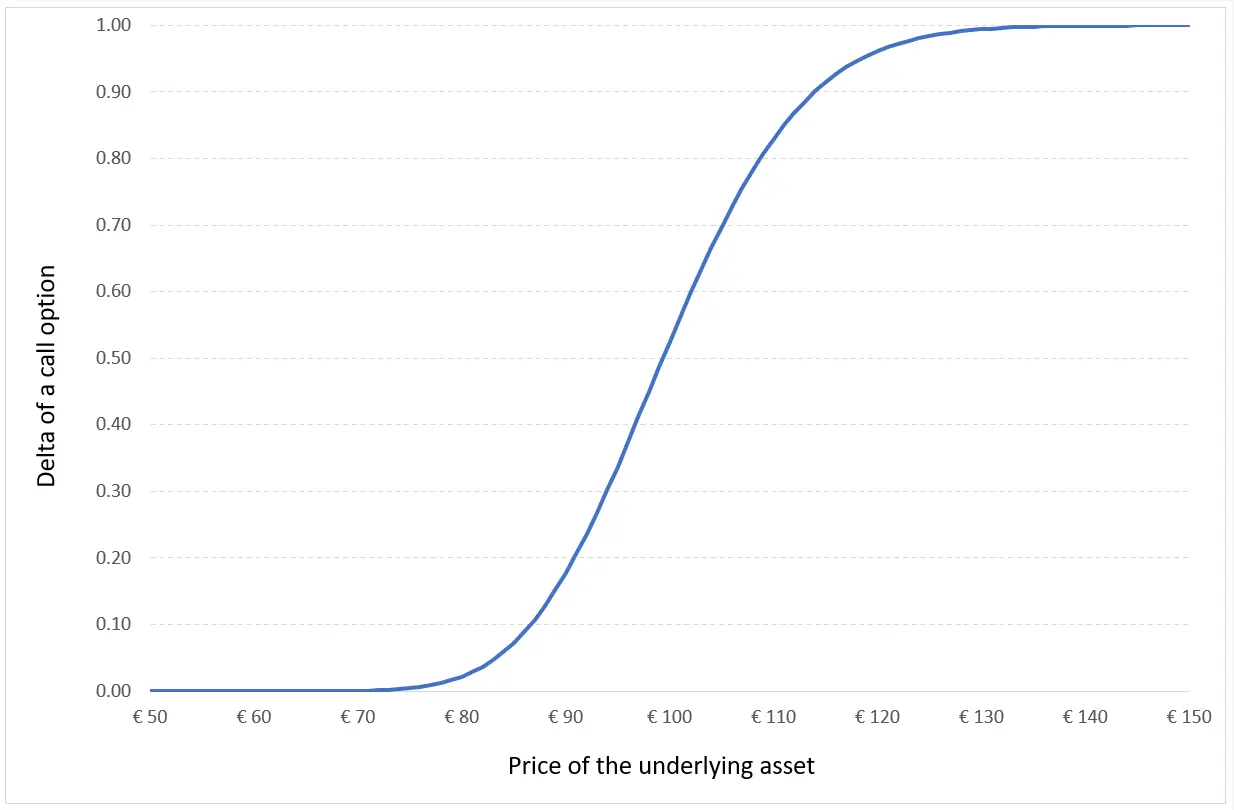

Delta illustrates how much an option's price changes for a $1 change in the price of the underlying asset. As the price of Bitcoin rises, the delta of a call option also increases, necessitating the market maker to buy more Bitcoin to stay hedged. Below, there is a gamma squeeze chart example.

Gamma, on the other hand, signifies the rate of change in delta. A high gamma implies the market maker must adjust their hedge frequently, leading to more buying of the underlying asset and a potential gamma squeeze.

How Does a Stock Go Up With a Gamma Squeeze?

In the case of Bitcoin or any other underlying asset, a gamma squeeze pushes its price upward. This price boost results from the extensive buying of the underlying asset by market makers in response to substantial call options activity. The ensuing domino effect — extensive option buying, subsequent hedging by market makers, increased demand for the asset, and price appreciation — collectively contributes to this rise.

When Does a Gamma Squeeze Happen?

Gamma squeeze can happen when several conditions align:

- High options activity. A gamma squeeze is more likely when there's high trading activity in a stock's call options. It is often driven by speculation or high investor interest in a stock.

- Significant short interest. A gamma squeeze can also be triggered when there's significant short interest in a stock. If a stock has many short sellers betting against it, they might be forced to buy the stock to cover their positions if the price starts rising, contributing to the upward pressure on the stock price.

- Market makers hedging. Market makers play a significant role in a gamma squeeze. As more options are bought, market makers, who frequently sell these options, hedge their risk by buying the underlying stock. This pushes the stock's price up, setting the stage for a potential gamma squeeze.

- Nearing expiration dates. As the expiration dates approach, activity related to the options can increase, leading to more stock buying and potentially a gamma squeeze.

How Long Does a Gamma Squeeze Last?

The duration of a gamma squeeze hinges on multiple factors. Primarily, it depends on the market sentiment, the volume of options in play, and the market maker's hedging activities. Additionally, factors such as news, events, or fundamental changes in the underlying asset can influence its duration. It might last from a few hours to a couple of days, but it typically subsides once the options expire or the market makers have adjusted their positions accordingly.

Examples of Major Gamma Squeezes

Although the following examples aren't directly related to Bitcoin, they illustrate how a gamma squeeze can impact a market.

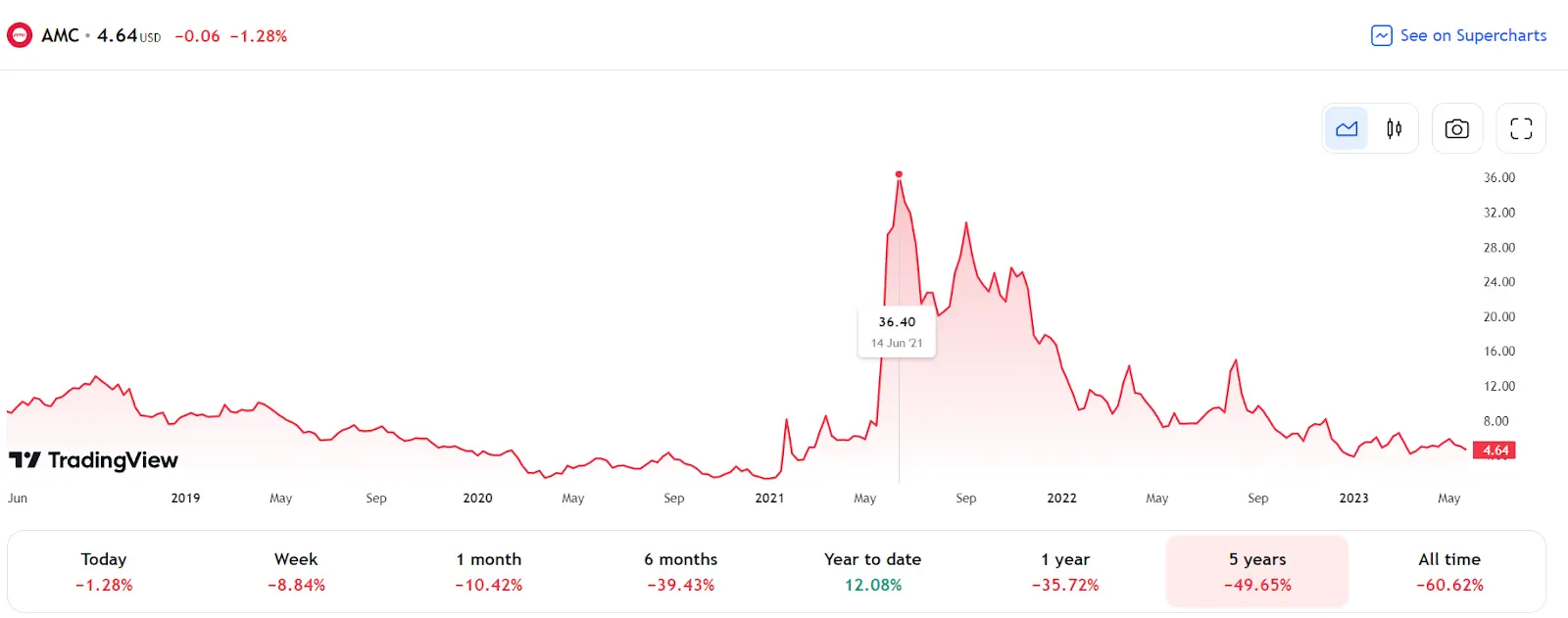

AMC Gamma Squeeze Example

There was a situation in June 2021 when investors forecast a steep rise in AMC's stock price and purchased a significant volume of call options. As the stock price inched towards the strike price, market makers scrambled to hedge their positions by buying more AMC stocks. This increased buying pressure, combined with high gamma, led to a rapid price surge — a gamma squeeze.

GME Gamma Squeeze Example

In a similar vein, the GameStop episode early in 2021 saw retail investors buying massive quantities of call options, expecting the stock price to rise. The corresponding hedging activity from market makers, driven by high gamma, set off a buying frenzy, resulting in an explosive GME price appreciation, another instance of a gamma squeeze.

Gamma Squeezes and Market Maker Positioning

Market makers, also referred to as dealers, play a pivotal role in the unfolding of a gamma squeeze. Their obligation to hedge their positions against significant options activity and the associated changes in delta and gamma can trigger a buying frenzy that spirals into a gamma squeeze. Therefore, their positioning and responsiveness to market dynamics remain integral to the development and progression of a gamma squeeze.

Strategies for Trading a Gamma Squeeze

Crafting an effective trading strategy during a gamma squeeze demands an astute understanding of market trends and meticulous risk management.

One approach is to monitor large options trades, as these can potentially lead to a gamma squeeze. Traders can also employ a straddle strategy, buying a call option and a put option at the same strike price, to benefit from the heightened volatility during a gamma squeeze. However, these strategies are fraught with risk and should be employed judiciously.

How Can Investors Capitalize on Gamma Squeezes?

With the right knowledge and timing, investors can potentially capitalize on gamma squeezes. Observing high call option volumes and large trades can hint at an impending gamma squeeze. By purchasing the underlying asset before its price surges or by acquiring options that would benefit from the rise in volatility, savvy investors can ride the wave of a gamma squeeze.

Risks and Considerations of Gamma Squeezes

A gamma squeeze can lead to rapid and significant increases in a stock's price, but it also comes with considerable risks. Possible risks include:

- Temporary price boost: the stock price surge from a squeeze is typically short-lived and often followed by a sharp drop.

- Prediction challenge: timing and anticipating the magnitude of a gamma squeeze are difficult, adding to the risks.

- Liquidity risk: stocks can become highly illiquid during a squeeze, making it hard to buy or sell at desired prices.

- Margin call risk: increased volatility could lead to margin calls for those trading on borrowed money.

Understanding these risks is critical before participating in trades associated with a gamma squeeze.

Are Gamma Squeezes a Double-Edged Sword?

Although gamma squeezes can offer profitable opportunities, they can also be unsafe. They're typically characterized by volatile price swings, leading to substantial financial risk, especially for option sellers. Additionally, traders banking on the continuation of the squeeze may find themselves at a loss if the asset's price abruptly plummets post-squeeze. In this sense, gamma squeezes can indeed be a double-edged sword.

How to Avoid the Negative Impact of a Gamma Squeeze

The best way to hedge the adverse impact of a gamma squeeze is through diligent risk management and sound understanding of market trends. Monitoring the options market for notable activities, setting appropriate stop-loss orders, and not investing more than you can afford to lose are prudent measures. Furthermore, diversifying your investment portfolio can also help mitigate potential losses.

The Bottom Line

A gamma squeeze, while a complex financial phenomenon, can offer unique opportunities for savvy investors. At the same time, the associated volatility and risk underscore the need for cautious trading and astute market analysis. Whether in the realm of Bitcoin or stocks, understanding the gamma squeeze meaning can equip traders and investors with valuable insights to navigate the unpredictable waters of financial markets.

Frequently Asked Questions

What Is a Gamma Squeeze in the Stock Market?

A gamma squeeze in the stock market denotes a swift upsurge in a stock’s price due to the increase in options trading activity. This scenario unfolds when there is an influx of investors buying call options for a particular stock. The entities known as market makers, who bear the responsibility of ensuring market liquidity, undertake risk mitigation measures by acquiring the stock in question. This action propels the stock's price upward. As the price increases, more options move into the money, causing market makers to buy even more of the stock to hedge, further pushing up the price. This chain reaction is the gamma squeeze.

What Is the Duration of a Gamma Squeeze?

The lifespan of a gamma squeeze varies based on several factors, including the size of the options trade, market sentiment, and underlying asset volatility. It might endure for a few hours to several days, but generally subsides once the options expire or market makers have effectively hedged their positions.

What Is a Gamma Squeeze Vs Short Squeeze?

Although both can result in rapid price surges of an underlying asset, a gamma squeeze and a short squeeze are fundamentally different. A gamma squeeze is primarily driven by options trading and the hedging activities of market makers, whereas a short squeeze transpires when short-sellers scramble to cover their positions due to an unexpected price rise.

Is a Gamma Squeeze Market Manipulation?

While gamma squeezes can significantly impact market prices, they are typically a byproduct of legitimate market activities, not intentional manipulation. However, they can be exploited by well-informed traders or large investors, so understanding their mechanics can provide a competitive edge in the tumultuous domain of investing.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.