Bitcoin IRA: What Is It and How It Works

Bitcoin IRAs represent a fusion of the traditional financial world with the rapidly evolving realm of cryptocurrencies. As the digital currency landscape continues to expand, many investors are exploring ways to incorporate assets like Bitcoin into their retirement strategies. A Bitcoin Individual Retirement Account (IRA) offers a unique avenue for such investments, allowing individuals to harness the potential of digital currencies within the structured environment of a retirement account.

The rise of Bitcoin and other cryptocurrencies has revolutionized the financial industry, introducing a new asset class that operates independently of traditional banking systems. With its decentralized nature, Bitcoin offers a level of transparency and security that is often unmatched by traditional currencies. This has piqued the interest of forward-thinking investors who see the potential for significant returns in the crypto market.

However, investing in cryptocurrencies comes with its own challenges. The volatile nature of the market can lead to rapid fluctuations in value, making it a high-risk investment. This is where Bitcoin IRAs come into play. By incorporating Bitcoin into an IRA, investors can take advantage of the tax benefits associated with retirement accounts, while also gaining exposure to the dynamic world of cryptocurrencies.

Furthermore, as regulatory frameworks around cryptocurrencies continue to develop, the legitimacy and acceptance of Bitcoin as a viable investment option are growing. Financial institutions, once skeptical of digital currencies, are now exploring ways to integrate them into their offerings. This shift in perception underscores the potential of Bitcoin and its role in reshaping the investment landscape.

Incorporating Bitcoin into a retirement strategy is not a decision to be taken lightly. It requires a thorough understanding of the market, the risks involved, and the potential rewards. However, for those willing to navigate the complexities of the crypto world, a Bitcoin IRA can offer a unique and potentially lucrative investment opportunity.

Key Takeaways

- Bitcoin IRAs provide a bridge between the conventional retirement savings landscape and the innovative world of digital currencies.

- These specialized accounts offer tax advantages similar to traditional IRAs but are tailored for cryptocurrency investments.

- While the potential for high returns is alluring, it's essential to be aware of the associated risks and market volatility.

- As with any investment, due diligence, research, and understanding the intricacies of the cryptocurrency market are crucial before diving into Bitcoin IRAs.

What Is a Bitcoin IRA?

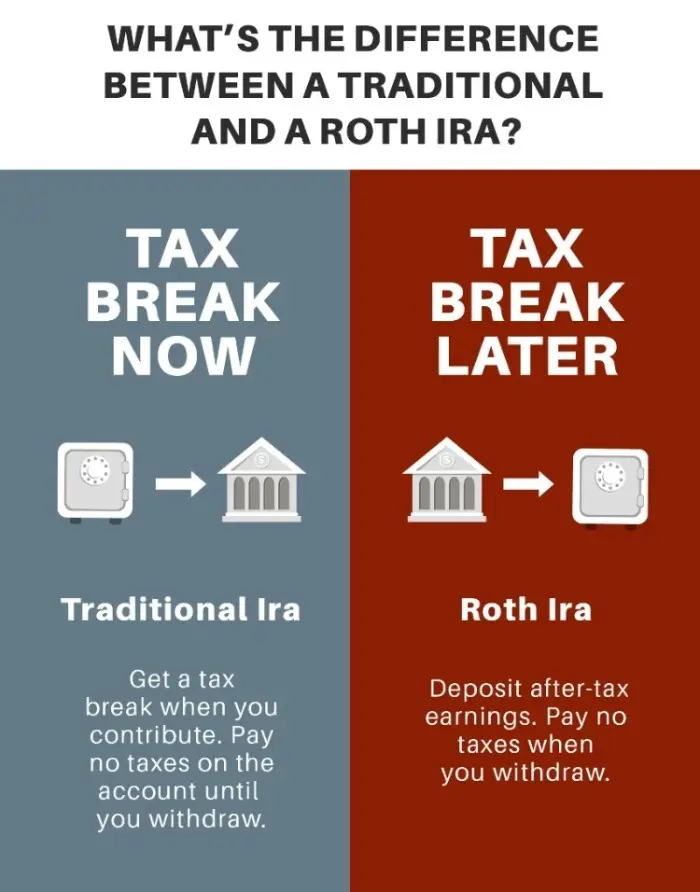

To truly grasp the essence of a Bitcoin IRA, it's crucial to first understand the fundamental concept of an Individual Retirement Account (IRA). An IRA is a tax-advantaged account that individuals in the U.S. use to save and invest for retirement. The primary allure of an IRA is its ability to offer tax breaks, either upon deposit or withdrawal, depending on the type of IRA. Traditional IRAs, for instance, allow individuals to make tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement.

As the financial landscape has evolved with the advent of digital currencies, the need for more diverse and modern investment vehicles has become evident. The Bitcoin IRA is a specialized retirement account which seamlessly marries the age-old concept of IRAs with the revolutionary world of cryptocurrencies.

A Bitcoin IRA, event the name suggests Bitcoin investment, is not limited to just bitcoins. It can encompass a range of digital currencies, including Ethereum, Litecoin, and many others. This flexibility offers investors a chance to diversify their retirement portfolio, hedging against potential downturns in traditional markets.

The rise of blockchain technology and its promise of decentralized finance sparked significant interest in digital assets. Investors began to see the potential of blockchain not just as a technology, but also as a means of wealth generation. Cryptocurrencies, being the most prominent application of blockchain, naturally became the focal point of this investment surge.

The allure of a cryptocurrency IRA lies in its ability to offer the best of both worlds. On one hand, it provides the tax benefits and structured savings approach of traditional IRAs. On the other, it grants investors access to the dynamic and potentially lucrative world of cryptocurrencies. This combination makes Bitcoin IRAs an attractive option for those looking to diversify their retirement savings beyond traditional assets.

However, while the potential for high returns is tempting, it's essential to approach Bitcoin IRAs with a balanced perspective. While crypto assets offer substantial upside potential, they also come with inherent risks. As with any investment, due diligence, research, and consultation with financial professionals are paramount.

How Does a Bitcoin IRA Work?

Much like its traditional counterparts, a Bitcoin IRA functions as a vessel for retirement savings. However, instead of being tethered to conventional assets like stocks or bonds, it's anchored in the digital realm of cryptocurrencies.

At its essence, a Bitcoin IRA mirrors the foundational principles of standard retirement accounts. Investors allocate funds to their account, which are then channeled into asset acquisition—in this scenario, digital currencies such as Bitcoin, Ethereum, or Litecoin. But this is where the similarities end and the unique characteristics of Bitcoin IRAs come to the fore.

Given the digital and decentralized nature of cryptocurrencies, they demand specialized storage and management solutions. This is where dedicated custodians come into play. Unlike traditional financial institutions that oversee standard IRAs, Bitcoin IRA custodians possess the expertise and infrastructure to securely manage digital assets. Their role is pivotal in ensuring that the cryptocurrencies within the IRA are shielded from cyber vulnerabilities and unauthorized access. Qualified custodians are typically provided by your chosen IRA platform.

Once an individual initiates a Bitcoin IRA, the next step involves directing their chosen custodian to acquire specific cryptocurrencies from a crypto exchange. This acquisition is based on the investor's preferences, market research, and investment strategy. Post-purchase, these digital currencies are safely ensconced in a fortified digital wallet, designed to thwart potential cyber threats and unauthorized breaches.

The value of a Bitcoin IRA is inherently tied to the volatile cryptocurrency market. As the prices of the held digital currencies oscillate, the IRA's value experiences corresponding shifts. This dynamic nature underscores the importance of informed decision-making and periodic portfolio reviews.

When the golden years of retirement dawn, investors are presented with choices. They can liquidate their digital assets, converting them into traditional fiat currency. Alternatively, for those who envision a future where digital currencies reign supreme, they can opt to retain their cryptocurrencies, accessing them directly from their digital wallets.

In essence, while a Bitcoin IRA borrows foundational elements from traditional retirement accounts, it carves its niche by offering a gateway into the promising yet volatile world of digital currencies.

Advantages of Bitcoin IRAs

Bitcoin IRAs offer several benefits that make them an attractive option for investors.

- Diversification of an investment portfolio with a unique asset class, which potentially reduces risks.

- Potential for high returns, typical for cryptocurrencies.

- Tax-deferred growth or tax-free growth for Roth IRAs.

- Protection against inflation, preserving the purchasing power of their savings.

- Self-Directed IRA: Bitcoin IRAs are typically self-directed, giving investors more control over their investment choices.

Disadvantages of Bitcoin IRAs

While Bitcoin IRAs offer numerous advantages, they also come with their own set of challenges.

- High volatility of cryptocurrencies, which can lead to significant losses.

- Regulatory uncertainty, which can introduce additional risks for investors.

- Security concerns: while IRA custodians implement security measures, there's always a risk of hacks or unauthorized access.

- Limited track record compared to traditional assets, making long-term performance predictions challenging.

- High fees: some cryptocurrency IRA providers charge higher fees compared to traditional IRA providers.

High Risks & High Costs

Investing in a Bitcoin IRA, while promising, is accompanied by a set of inherent risks and costs that potential investors should be well-aware of. The cryptocurrency market, in its essence, is known for its volatile nature. For instance, in November 2021, Bitcoin's price reached an all-time high of nearly $70,000, only to drop to around $15,000 by November 2022.

This kind of unpredictability can be daunting for those who are looking for a stable and secure retirement investment.

Moreover, the cryptocurrency landscape is still in its nascent stages. While it has made significant strides over the past decade, it remains susceptible to market manipulations. For example, the “pump and dump” schemes where large players artificially inflate the price of a cryptocurrency only to sell it off at its peak. External factors such as regulatory changes, like when China banned crypto in 2021, geopolitical tensions, and technological vulnerabilities, such as Ronin Network hack (the stolen funds amounted to 173,600 ETH) can introduce additional layers of risk that are not typically associated with traditional investments.

High Fees

One of the more tangible challenges of investing in a crypto IRA is the associated fees. Given the specialized nature of these accounts, the costs involved in setting up and maintaining a Bitcoin IRA can be considerably higher than those of a conventional IRA.

For instance, some providers might charge a setup fee of up to $50, annual account maintenance fees of $100 or more, storage fees of 0.05% to 1% for securely holding the digital assets, and transaction fees of 1% to 5% for buying or selling the cryptocurrencies. It's imperative for potential investors to thoroughly scrutinize the fee structures of various Bitcoin IRA providers to ensure they are not being overcharged and that the costs are justified by the services provided.

Limitations

Bitcoin IRAs, despite their innovative approach to retirement savings, come with their own set of limitations. For starters, not all cryptocurrencies might be available for investment through every IRA provider. This can limit the diversification options for investors who might be interested in newer or less popular digital currencies like Chainlink or Polkadot. Additionally, there might be caps on the maximum and minimum amounts one can invest in a crypto IRA, such as a minimum of $5,000 and a maximum of $1 million.

Some providers might also enforce longer lock-in periods, during which investors cannot access or liquidate their assets without incurring penalties, sometimes as high as 10% for early withdrawals. It's crucial for investors to be fully aware of these limitations and choose a provider that aligns with their investment goals and strategies.

How to Open a Bitcoin IRA

Opening a cryptocurrency IRA account is a process requires due diligence and careful consideration at each step. Here's a step-by-step guide based on practices observed between 2021 and 2023:

- Research and choose a provider:

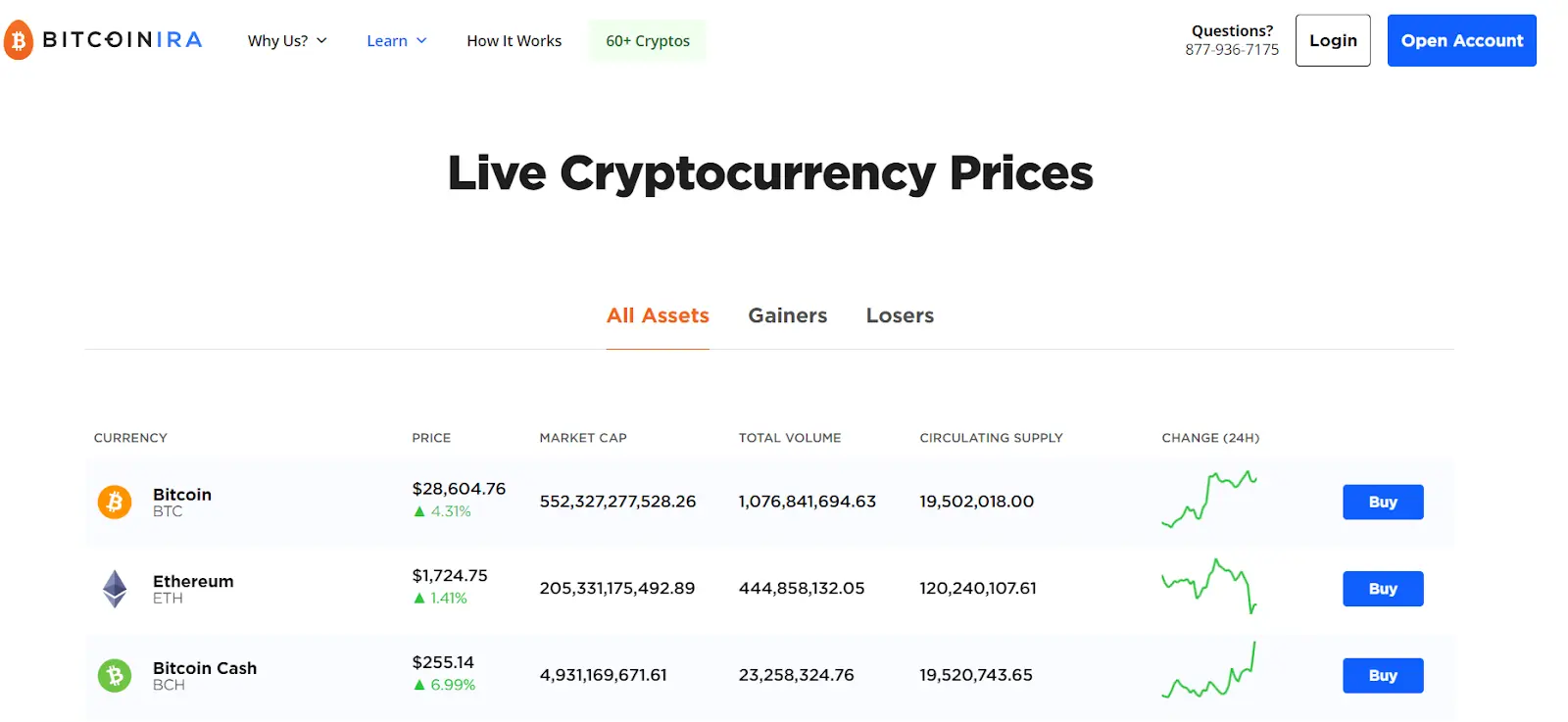

- Examples: BitcoinIRA, BitIRA, and CoinIRA are considered to be among the top providers.

- Considerations: look for providers with positive customer reviews, a history of secure transactions, and transparent fee structures. For instance, in 2022, BitcoinIRA was praised for its user-friendly crypto platform, while BitIRA was known for its robust security measures.

- Understand the fee structure:

- Examples: as of 2022, BitcoinIRA had a one-time service fee ranging from 10-15%, depending on the investment amount. BitIRA, on the other hand, had a tiered fee structure based on the type of digital currency and total investment.

- Complete the paperwork:

- This is similar to opening a traditional IRA. You'll need to provide personal information, financial details, and specify your investment preferences. Some providers, like CoinIRA in 2021, offered digital forms, making the process quicker.

- Fund your account:

- Methods: traditional bank transfers, rollovers from existing IRAs, or transfers from 401(k)s were common methods. For instance, in 2023, BitIRA introduced a feature allowing direct deposits from paychecks.

- Select cyptocurrencies:

- While Bitcoin is the most popular choice, many IRAs offer other cryptocurrencies like Ethereum, Litecoin, and Ripple. In 2022, BitcoinIRA expanded its offerings to include newer cryptocurrencies like Polkadot and Chainlink.

- Regular contributions and portfolio management:

- Just like with traditional IRAs, you can make regular contributions. Some providers, like CoinIRA in 2021, even offered automated monthly contributions.

- Adjust your portfolio based on market conditions. For instance, during the crypto boom of late 2022, many investors diversified their portfolios to include a mix of established and emerging cryptocurrencies.

- Stay updated:

- Given the dynamic nature of the crypto market, it's essential to stay updated. Many providers offer educational resources, webinars, and market analysis. For example, BitIRA's “Crypto U Content Library” became a popular resource for many investors in 2023.

Conclusion

Bitcoin IRAs are a modern and innovative approach to retirement savings. They offer a unique blend of the traditional and the contemporary, allowing investors enjoying the benefits of a cryptocurrency retirement account. However, like all investments, they come with their own set of challenges.

The high risks, costs, and potential limitations mean that they might not be suitable for everyone. It's essential for potential investors to conduct thorough research, understand the intricacies of the cryptocurrency market, and consult with financial professionals before making a decision. While the allure of high returns is tempting, it's crucial to approach Bitcoin IRAs with caution, knowledge, and a well-thought-out strategy.

FAQ

Can I Withdraw Bitcoin From Bitcoin IRA?

Yes, upon reaching the eligible retirement age, investors can choose to withdraw their assets from their Bitcoin IRA. They can either sell their cryptocurrencies for fiat currency or take possession of the digital coins.

What Are the Risks of a Bitcoin IRA?

The primary risks associated with Bitcoin IRAs are market volatility, regulatory changes, potential cyber threats, and the relatively new and untested nature of the cryptocurrency market.

What Is the Benefit of Bitcoin IRA?

Bitcoin IRAs offer tax-deferred growth, potential for high returns, diversification, and exposure to the cryptocurrency market within the structured environment of a retirement account.

Is Crypto Better Than 401K?

It's not a matter of one being better than the other, but rather about diversification and risk tolerance. While 401Ks typically invest in traditional assets, adding cryptocurrencies can provide diversification. However, the risks associated with cryptocurrencies are higher, so it's essential to balance potential rewards with one's risk tolerance.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.