What Is Bitcoin Halving: How It Works & Why It Matters

Halving is a crucial event which lies at the core of Bitcoin's decentralized blockchain architecture and its deflationary economic model. This event, occurring about every four years, has profound implications not just for miners and investors, but for the broader financial ecosystem.

Understanding halving is essential for anyone looking to grasp the nuances of Bitcoin's economic model, its supply constraints, and its potential long-term value. As we delve deeper into this topic, we'll uncover the mechanics of halving, its historical significance, and its potential future impact.

Key Takeaways

- Bitcoin halving, an event hard-coded into the Bitcoin protocol, ensures that the total number of bitcoins in existence never surpasses 21 million.

- This event, occurring roughly every four years, directly affects the rewards miners receive for their efforts.

- Historically, halving events have been closely watched by investors due to their potential influence on Bitcoin's market price.

- The idea of halving is strongly connected to the supply and demand principle, the concept of scarcity, and inflation management.

Basics of the Bitcoin Network

Bitcoin's architecture is fundamentally anchored in a decentralized paradigm, setting it distinctly apart from traditional fiat currencies. This unique design functions on a peer-to-peer network, a vast interconnected web of nodes.

Each of these nodes plays a crucial role in validating and verifying transactions, employing sophisticated cryptographic methods to ensure authenticity and prevent fraud.

In contrast to centralized financial systems, where a single entity, typically a central bank or a governing body, exercises control, Bitcoin operates on a principle of distributed authority. This means that no single node or entity can unilaterally dictate or alter the network's operations. Such a design is pivotal in eliminating single points of failure and potential manipulation.

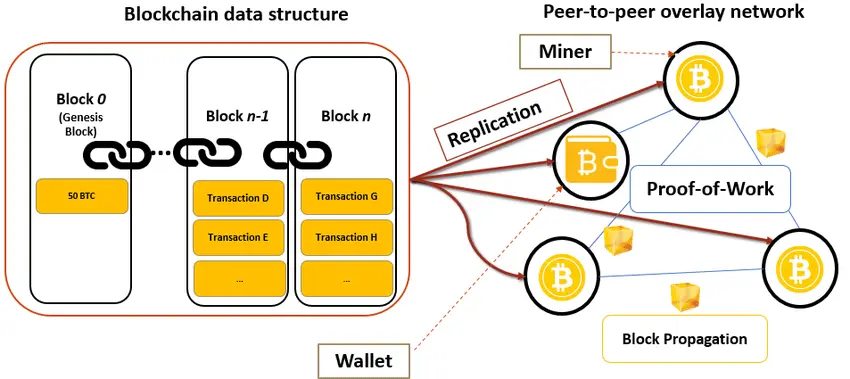

Every transaction executed within the Bitcoin network is recorded on a digital ledger called “blockchain”. The blockchain is a sequential chain of blocks, with each block containing a list of transactions.

Once a block is added to the blockchain, it becomes virtually irreversible, thanks to the cryptographic links between blocks and the consensus mechanism of the network.

This permanence ensures that every transaction is transparently accessible to anyone on the network, fostering trust and security. Moreover, the immutability of the blockchain ensures that past transaction records cannot be altered or tampered with, further bolstering the network's integrity and reliability.

Basics of Bitcoin Mining

Mining is essentially a process of adding new transaction blocks to the public ledger. As a result of this activity, new BTC enter the existing circulation.

At its core, mining involves participants, known as miners, who use significant amounts of computational power to solve intricate mathematical puzzles. These puzzles are essential for validating and recording transactions on the Bitcoin blockchain.

Miners play a crucial role in the decentralized consensus mechanism of the network. By solving these complex problems, they compete for the opportunity to add a new block to the blockchain. The first miner to successfully solve the puzzle earns this right. This competitive nature ensures that the network remains resistant to malicious attacks and fraudulent activities.

For their efforts and the resources they commit, miners receive newly created coins. Initially, the reward for adding a block was set at 50 BTC. However, once in four years, the reward amount is halved.

What Is Bitcoin Halving?

Halving Bitcoin is not just a technical event; it's a testament to the cryptocurrency's deflationary nature and its underlying philosophy of scarcity.

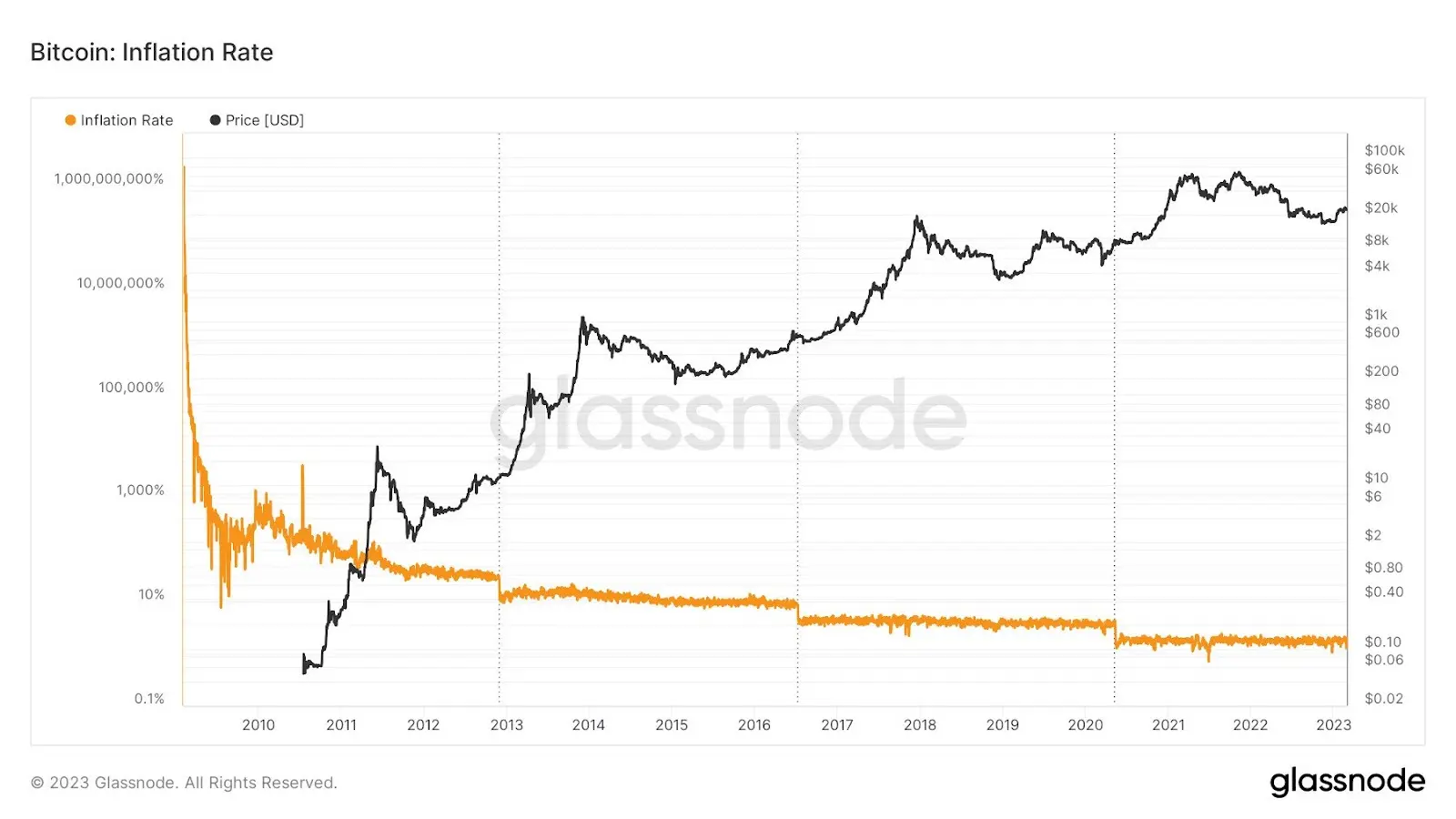

The term “halving” refers to the periodic reduction of the miners' reward, which happens approximately every four years or, to be more precise, every 210,000 blocks. This mechanism was embedded into Bitcoin's protocol by its mysterious creator, Satoshi Nakamoto, to ensure that Bitcoin remains a deflationary asset. The idea is to reduce the influx of new bitcoins into the market, thereby controlling inflation and preserving the purchasing power of the cryptocurrency.

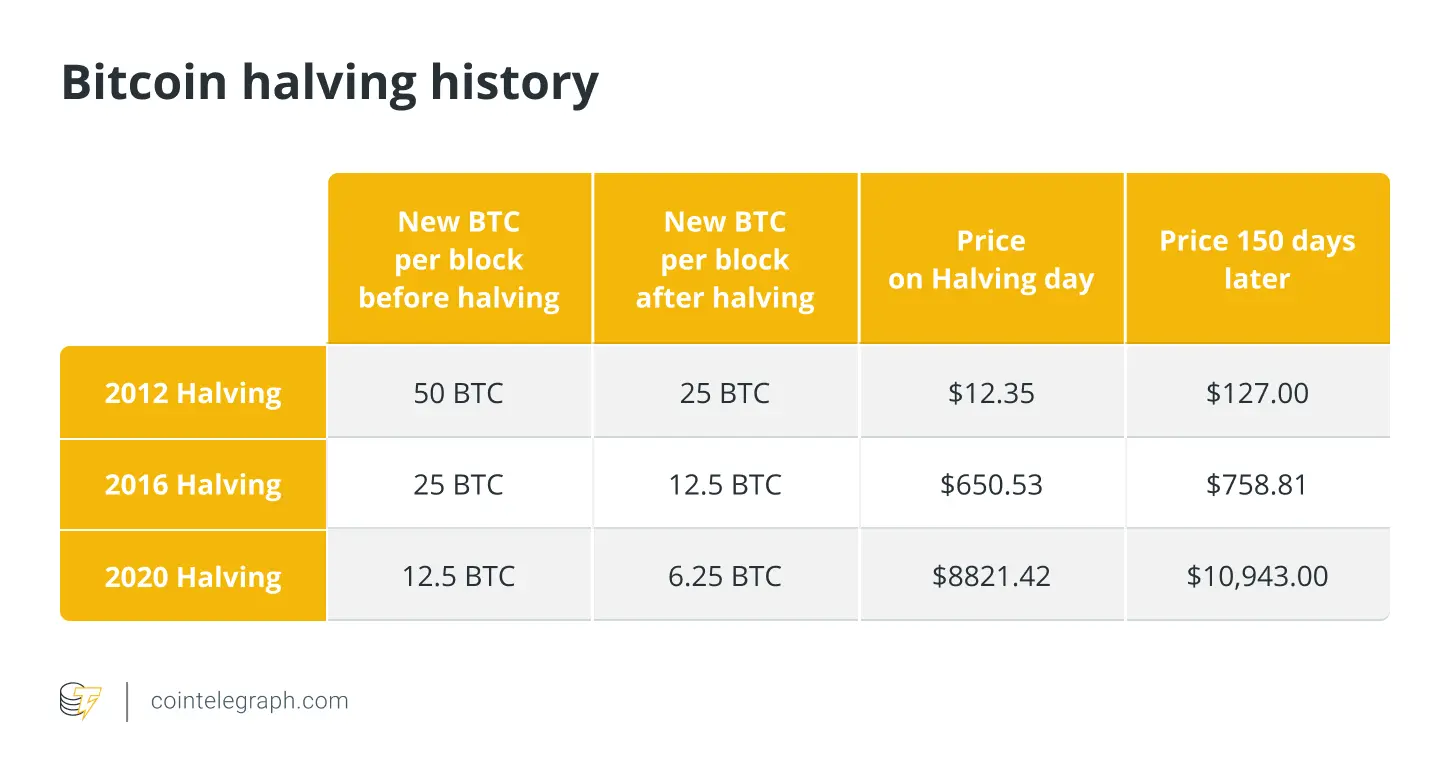

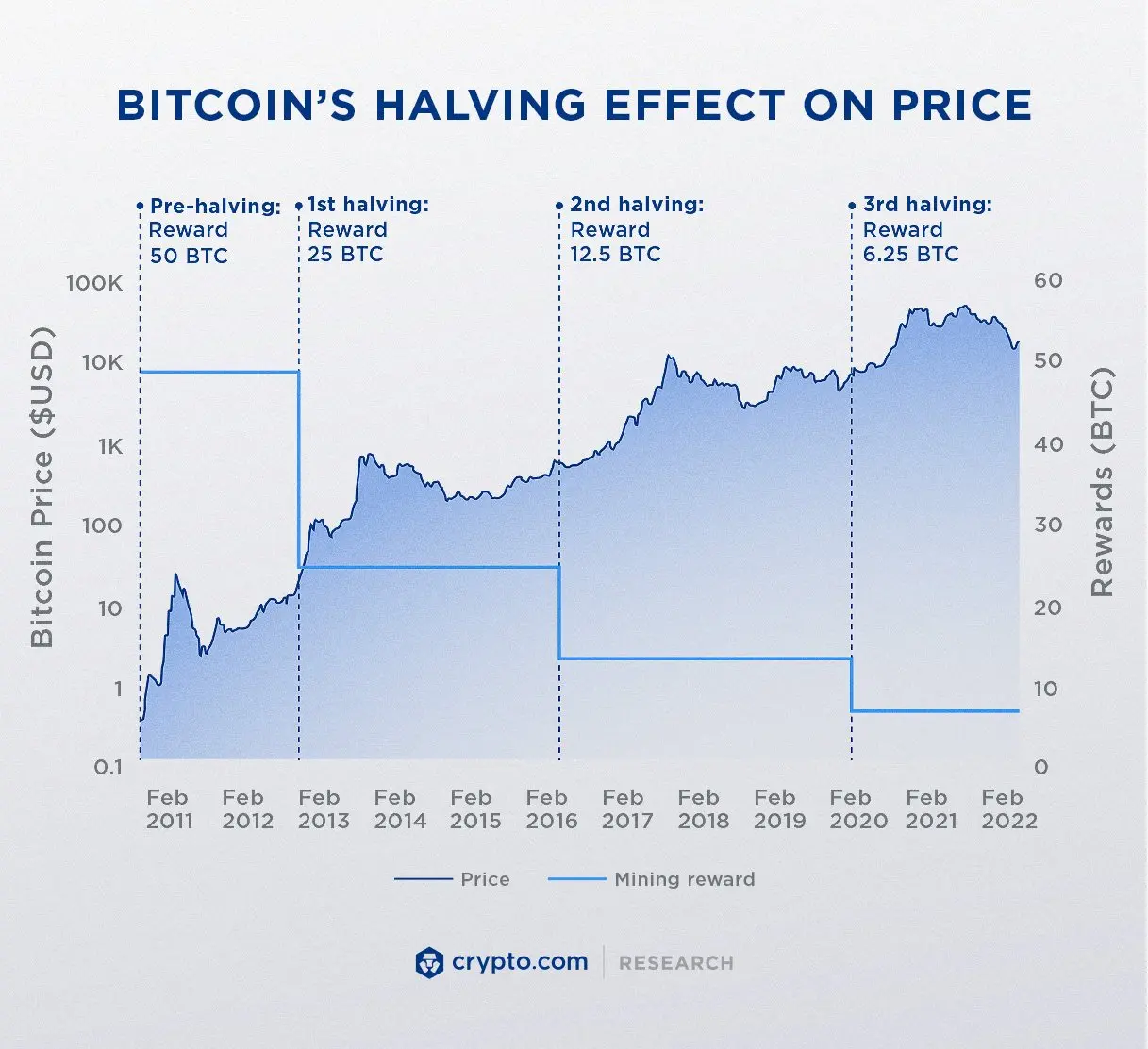

When Bitcoin was first introduced to the world in 2009, miners who successfully added a block to the blockchain were rewarded with 50 bitcoins. This was the case until 2012 when the first halving event occurred, slashing the reward to 25 bitcoins. The cycle continued, and in 2016, the reward was further halved to 12.5 bitcoins. The most recent halving in 2020 brought the reward down to 6.25 bitcoins.

And the next bitcoin halving date is expected to be April 2024, when the rewards will be down to 3.125 BTC.

Why Does Bitcoin Halving Happen?

Bitcoin's design is rooted in the principles of scarcity and decentralization. Halving is a mechanism to ensure that Bitcoin remains scarce and valuable over time. But why is this event hard-coded into the Bitcoin protocol?

Scarcity and Controlled Supply

Bitcoin was conceptualized by its anonymous creator, Satoshi Nakamoto, with a clear intent: to establish a decentralized digital currency that stands resilient against the centralized control of banks and governments.

A foundational pillar of this vision is the principle of scarcity, mirroring precious commodities like gold, which derive value from their limited supply. To embed this scarcity within Bitcoin's DNA, Nakamoto coded the halving mechanism into the Bitcoin’s protocol. This mechanism ensures that the rewards miners receive for validating transactions and adding new blocks to the blockchain diminish by 50% approximately every four years.

By doing so, the rate at which new bitcoins are minted and introduced into circulation is systematically reduced, reinforcing Bitcoin's scarcity.

Furthermore, this design ensures that the total number of bitcoins that will ever be created is capped at 21 million, further emphasizing its scarcity value.

The halving isn't just a technical nuance; it's a deliberate economic strategy to bolster Bitcoin's value proposition, ensuring its relevance and stability for decades to come.

Inflation Control

One of the significant challenges with traditional fiat currencies is their vulnerability to inflation. Governments and central banks have the authority to print additional money, leading to a decrease in purchasing power over time.

Bitcoin, in its ingenious design, offers an antidote to this issue. With a predetermined supply and the halving mechanism in place, Bitcoin's protocol ensures a reduction in the rate of new coins entering the market. This design inherently resists inflationary tendencies, making Bitcoin a potential store of value in the face of devaluing fiat currencies.

Market Forces and Economics

The dynamics of supply and demand are fundamental to the functioning of any economic system. In the context of Bitcoin, as the rate of new coin issuance decreases due to halving events, and if demand either remains steady or sees an uptick, there's a potential for the price to appreciate.

Historical data from previous halving events indicate a pattern where reduced supply, combined with sustained or increased demand, has influenced Bitcoin's price trajectory.

Price Impact

Bitcoin's price has always been a subject of intrigue and speculation. Halving events, in particular, have historically been precursors to periods of notable price volatility. While several factors influence Bitcoin's market price, the anticipation and aftermath of halving play a significant role in shaping market sentiment.

Investors, traders, and the broader crypto community often look to halving as a potential catalyst for price movements, making it a focal point in the cryptocurrency's market cycle.

Why Does Bitcoin Halving Matter?

Bitcoin halving is not just a programmed event; it's a philosophical embodiment of what Bitcoin represents in the financial world. At its core, Bitcoin challenges the conventional financial systems and their susceptibility to inflation, centralized control, and monetary interventions. Halving serves as a periodic reminder of this challenge.

The halving mechanism is a clear demonstration of Bitcoin's commitment to maintaining its scarcity, a key factor in its value proposition. In traditional economies, central banks have the authority to print additional currency, leading to inflation and the potential devaluation of money over time. Bitcoin, on the other hand, operates on a deflationary model.

With a fixed supply of 21 million coins and a decreasing rate of new coin issuance, Bitcoin is designed to combat the inflationary tendencies of traditional currencies.

Furthermore, halving events often draw significant attention from both the crypto community and mainstream media. This increased attention can lead to greater adoption, awareness, and, in some cases, price volatility. It serves as a periodic milestone that reiterates the unique economic model of Bitcoin, distinguishing it from fiat currencies.

In essence, every halving event reinforces Bitcoin's foundational principles: decentralization, scarcity, and resistance to traditional economic pressures. It's a testament to Bitcoin's unwavering dedication to preserving and potentially enhancing its value in the long run.

How Does Bitcoin Halving Work?

Bitcoin halving is an intrinsic part of the Bitcoin protocol, and it's not manually controlled by any individual or entity. Instead, it's an automated process governed by the underlying code of the Bitcoin software. Let's delve deeper into the technicalities and explore the components directly connected to halving:

- Bitcoin source code. There is a predefined value for the block reward in the Bitcoin code, which started at 50 bitcoins. The code also contains a specific rule that dictates the halving mechanism.

- Block height check. The Bitcoin software keeps track of the number of blocks mined, known as the “block height”. Every time a block is added to the blockchain, this block height increases by one.

- Automated halving trigger. When the block height reaches a multiple of 210,000 (e.g., 210,000, 420,000, 630,000, etc.), the software automatically triggers the halving event. This is done by a simple modulo operation in the code. If the block height modulo 210,000 equals zero, the block reward is halved.

- Adjustment to block reward. The software then programmatically reduces the block reward by 50%. This new reduced reward is what miners will receive for each subsequent block they mine, until the next halving event.

- Decentralized consensus. The halving process is recognized and adhered to by all nodes in the Bitcoin network. Every node running the Bitcoin software follows the same rule, ensuring network-wide consensus. This decentralized agreement ensures that no single entity can alter the halving mechanism or the block reward.

What Happens When Bitcoin Halves?

When a Bitcoin halving event occurs, it's not just the miners' rewards that are affected. The halving has a ripple effect on various aspects of the Bitcoin network and its ecosystem. Here's a detailed breakdown of the technical events and implications:

- The halving event reduces the block reward that miners receive for successfully adding a block to the blockchain. If the reward before the halving was 12.5 bitcoins, post-halving, it becomes 6.25 bitcoins. With the reward halved, miners earn fewer bitcoins for the same amount of work. This can influence the profitability of mining, especially for miners with higher operational costs. Some less efficient miners might exit the network, leading to a temporary decrease in the network's total hash rate.

However, as block rewards decrease with each halving, transaction fees become a more significant portion of miners' income. This shift ensures that even when all 21 million bitcoins are mined, miners still have an incentive to secure the network.

Notably, Bitcoin also has a built-in mechanism to adjust the difficulty of mining, ensuring that blocks are added approximately every 10 minutes. If many miners exit the network post-halving and the hash rate drops, the difficulty will decrease to maintain the 10-minute block time. Conversely, if more miners join due to rising Bitcoin prices, the difficulty will increase.

- From a supply perspective, fewer bitcoins entering circulation can lead to a decrease in the selling pressure in the market. If demand remains constant or increases, this reduced supply can exert upward pressure on the price.

- Historically, halving events have been closely watched by traders, investors, and the broader cryptocurrency community. The anticipation and reaction to halving can lead to increased trading volume and price volatility.

When Did the Bitcoin Halvings Happen?

Bitcoin has undergone several halving events since its inception. The Bitcoin first halving occurred in 2012, followed by subsequent halvings in 2016 and 2020. Each event has been closely watched by the crypto community for its potential impact on Bitcoin's price and the broader market.

When Is the Next Bitcoin Halving?

Based on the current pace of block creation, the next Bitcoin halving is expected to occur in 2024. As with previous halvings, this event will likely be the subject of much speculation and analysis.

Why Are the Halvings Occurring Less Than Every 4 Years?

While halvings are designed to occur approximately every four years, the exact timing can vary. This is because the time taken to mine 210,000 blocks isn't fixed. Factors like increasing computational power and the number of miners can influence the rate at which blocks are added to the blockchain.

What Happens When There Are No More Bitcoins Left?

Once all 21 million bitcoins have been mined, no new coins will be introduced into the system. Miners, however, will still be compensated through transaction fees. This shift will ensure that the Bitcoin network remains secure and operational even after the last coin has been mined.

The Bottom Line

Bitcoin halving is more than just a technical event. It embodies the cryptocurrency's core principles of decentralization, scarcity, and resistance to inflation. As we approach future halving events, understanding their significance will be crucial for both seasoned investors and newcomers to the crypto space.

FAQ

Does Bitcoin Halving Increase the Price?

Historically, halving events have been associated with price increases. However, many factors influence Bitcoin's price, and it's challenging to attribute price movements solely to halving.

Is Bitcoin Halving Good or Bad?

Halving is a fundamental part of Bitcoin's design. While it can lead to short-term market volatility, in the long run, it underscores Bitcoin's principles of scarcity and value preservation.

What Is the Price of Bitcoin After 2024

Halving? Predicting future prices is inherently speculative. While past halvings have seen price increases, external market factors will also play a role in determining Bitcoin's value post-2024 halving.

How Many Bitcoin Halvings Are Left?

Given that there will only ever be 21 million bitcoins and the current supply is over 18 million, only a few halving events remain before the maximum supply is reached.

When Is Bitcoin Halving Going to Happen Next Time?

The next Bitcoin halving is expected to occur in April 2024.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.