What Is Ampleforth? And How Does This Cryptocurrency Work?

Cryptocurrencies are nothing new and are becoming more mainstream by the day. Bitcoin, Ethereum, and Litecoin are probably some of the most widely-known cryptocurrencies, but they're certainly not the only ones.

A growing number of other digital currencies (or altcoins) are vying to become even more popular, and one of them is Ampleforth. This cryptocurrency stands out from the rest with a unique approach in the crypto space. This guide will cover exactly what Ampleforth (AMPL) is and how it works.

What is Ampleforth?

Ampleforth is a cryptocurrency platform that uses the Ether blockchain to create and trade value, assets while helping you earn some AMPL. It’s software running on Ethereum that attempts to incentivize a network of users to maintain a target price for the AMPL token, which is close to the USD value.

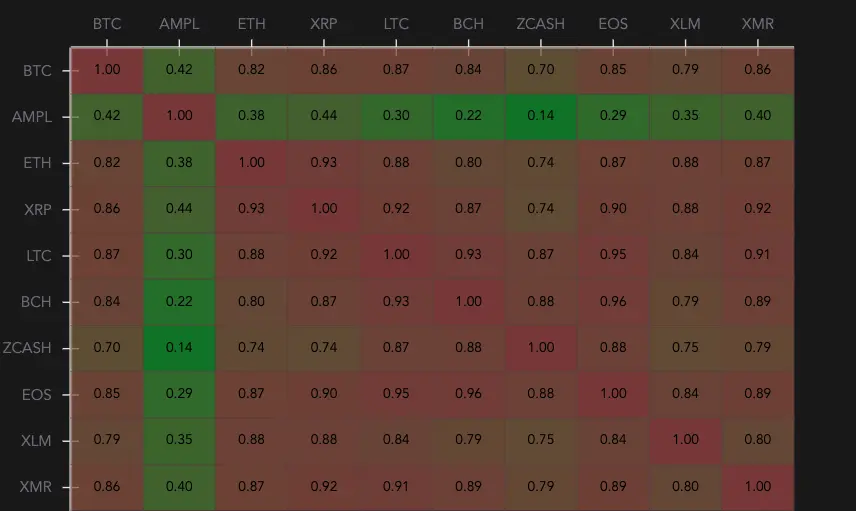

The low correlation of Ampl to all major crypto assets makes it potentially a good hedge

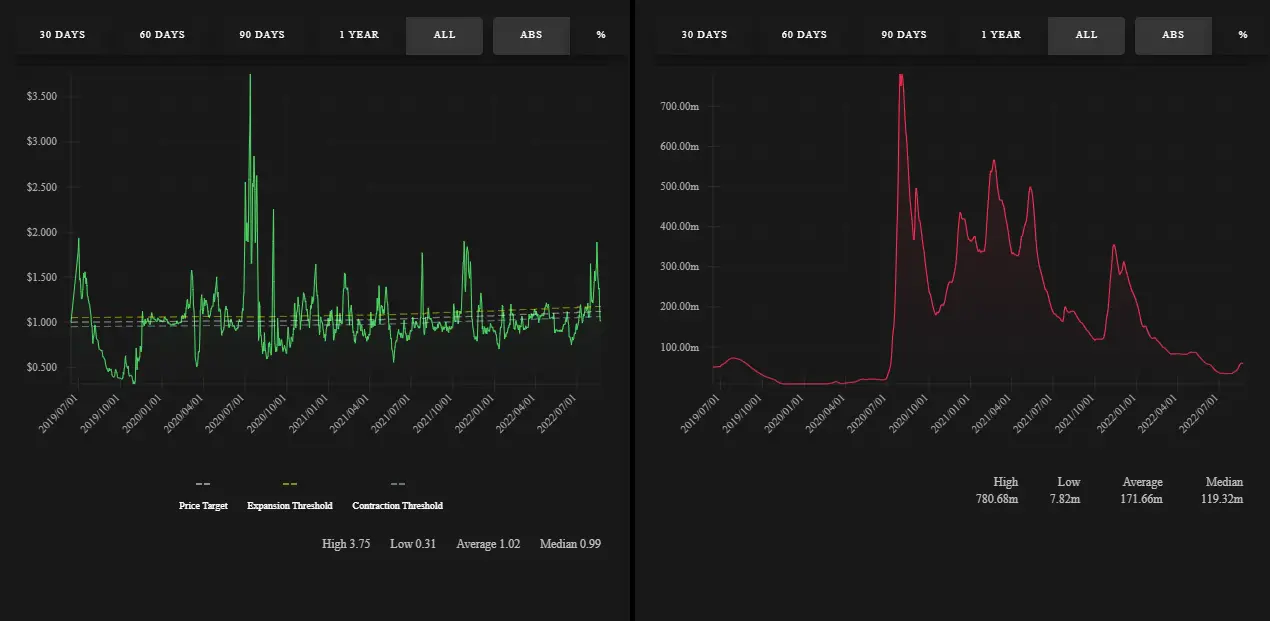

The Ampleforth protocol regulates the supply of AMPL tokens in circulation to minimize the token's price volatility. For example, when the price of AMPL exceeds its target price, the protocol creates new tokens and distributes them to holders of the currency, thus increasing the supply.

On the other hand, if the price of Ampleforth is below average, tokens get burned- thus reducing the supply.

The supply of fiat currencies is elastic. Therefore, the central bank can increase money supplies by adding liquidity to the markets or removing it, depending on its goals and strategy.

On the other hand, Bitcoin has a limited supply and accommodates the demand by a fluctuation in price. As a result, continuous price fluctuations are difficult, especially when the currency is used to denominate things such as services, debts and contracts.

When central banks increase the supply of money in circulation, it dilutes, negatively impacting the economy. Ampleforth follows a similar path but through a pre-programmed protocol that guarantees there won’t be any surprise inventions. Stability is attained by applying supply and demand adjustments across every investor's balance.

The Goal of Ampleforth

Ampleforth's goal is to provide a new type of money that is digital, global, and easy to use. Unlike other digital assets, Ampleforth does not have a fixed supply. Instead, it is designed as an inflationary currency: with each transaction, enough funds are created to support the economic growth of society.

With a finite supply of tokens and a circulating supply that contracts and expands based on demand, it operates more like a central bank than most cryptocurrencies. This also means that its value should remain stable over time rather than subject to swings in value as we see with other cryptos such as BTC and Ethereum.

Ampleforth could serve as a replacement for fiat currencies without the hard limitations imposed by commodities. The goal of the digital asset is to create an alternative currency that is flexible and adaptable to shock.

How Does Ampleforth Work?

Ampleforth's algorithm adjusts supply in real-time based on demand. If the price of AMPL is too high, new tokens are minted and added to the circulating supply. If the price is too low, tokens are burned.

This process ensures that each AMPL token maintains a relatively stable price of around $1.00. As a result, Ampleforth coins can be used as a rather stable asset for everyday transactions. Investors will see the balance in their wallets fluctuate slightly with changes in the market.

Since the supply adjustment happens automatically, there's no need to sell or buy Ampleforth when prices fluctuate like other cryptocurrencies.

The Technology Behind Ampleforth

Ampleforth coin uses a unique algorithm to adapt its supply in response to changes in demand. This means that the price of AMPL tokens stays stable, even when other cryptocurrencies fluctuate. It also allows investors to invest in digital currencies due to the fear of volatility to enter the market and realize gains as prices rise and vice versa.

Finally, it's important to note that these two features work together and help protect against sudden spikes in token prices.

Ampleforth protocol is implemented as a contract on the ETH blockchain. The AMPL token implements the ERC-20 Standard and is traded on most decentralized exchanges.

Further, it is expected that AMPL tokens and the protocol itself will go multichain shortly.

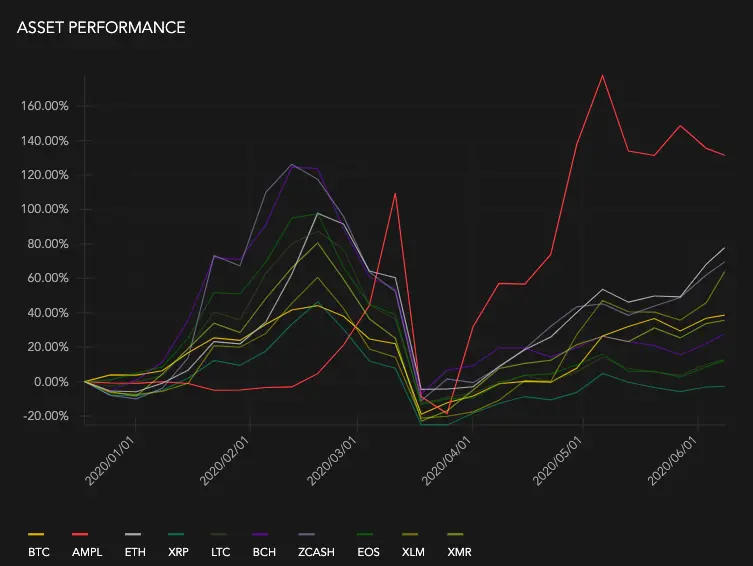

In the short term, Ampleforth aims to diversify cryptocurrency by showing less correlation to the price of Bitcoin, unlike most cryptocurrencies.

Ampleforth vs Stablecoins

Notwithstanding the argument that AMPL has similar features to stablecoins, some might wonder how it differs from Bitcoin and other fixed-supply fiat currencies if there is a fluctuation. In addition, some others might wonder why AMPL is a better choice than alternative stablecoins such as, DAI, PAXG or GUSD.

The short answer is that the ethos of decentralization creates a financial ecosystem that can remain untroubled by governmental interference or control. Fiat and Commodity-backed stablecoins rely heavily on traditional banks. Similarly, debt-marketplace-derived stablecoins cannot function in a free market economy that occasionally requires bailouts.

In addition, with AMPLEFORTH, the asset requires no lender of last resort or centralized collateral.

Use Cases of Ampleforth

- The Ampleforth protocol provides a unique opportunity for investors who wish to diversify or hedge their cryptocurrency portfolios because the price of AMPL tokens is slightly correlated to the price of other digital assets like ether(ETH) and BTC.

- Additionally, the AMPL token is a stable and effective form of collateral often used in decentralized finance (DeFi).

- To increase the adoption, Ampleforth crypto protocols are used to incentivize on-chain liquidity via the Geyser program. Geyser provides AMPL token rewards to liquidity providers (LPs) willing to stake their tokens on Geyser, allowing them to receive additional AMPL tokens as rewards.

- The non-dilutive and elastic nature of the Ampleforth protocol represents a unique feature within the ecosystem. In addition, compared to other stablecoins, it relies less on legacy financial systems.

Final Thought

Ampleforth is a cryptocurrency that uses a unique algorithm to adjust supply in response to demand. Unlike other cryptocurrencies, Ampleforth does not have a set supply; instead, the total amount of tokens in circulation expands and contracts as people buy and sell them. This makes Ampleforth an elastic currency, which could potentially offer more stability than other cryptocurrencies.

It might have some unique approach to how it works, but that alone doesn't necessarily make Ampleforth a better option than any others.

At its core, it's still a cryptocurrency that can be bought and sold and used just like any other currency of its type—but perhaps, in time, it will grow its following and become more widely adopted.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.