What are Hyper Deflationary Tokens?

Before diving into the specifics of hyper deflationary tokens, it's essential to understand two fundamental concepts: tokens and deflation.

In the realm of digital currencies, a token represents a unit of value issued by a project. Think of it as a coin in the traditional financial world, but existing only in the digital space. Tokens are often used within a specific blockchain ecosystem, serving various purposes from representing assets to facilitating transactions.

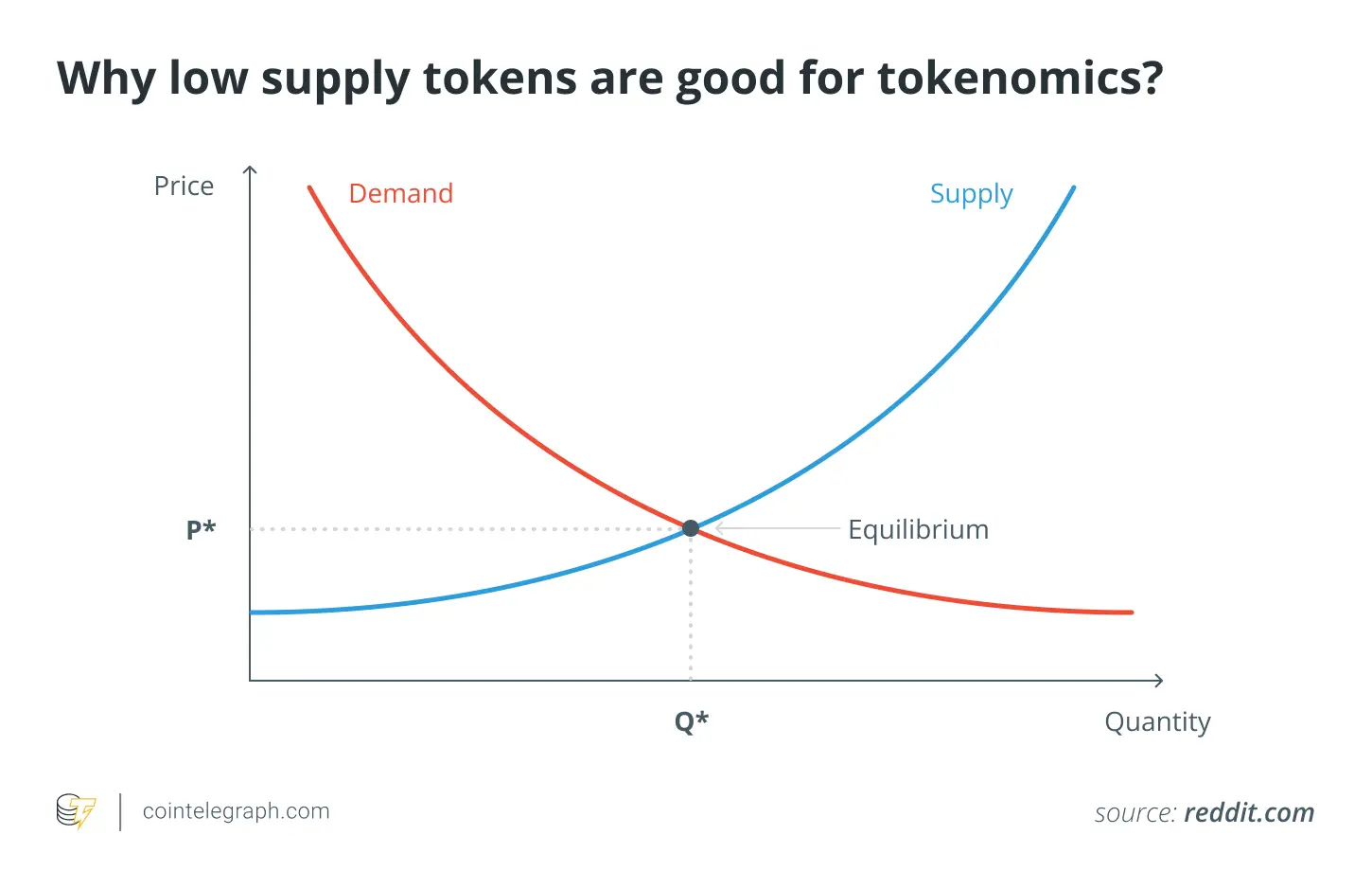

Deflation, on the other hand, is an economic term that describes the reduction in the supply of money or assets, leading to an increase in their value. In simpler terms, when there's less of something available, its value tends to rise due to increased demand for the limited supply.

Now, combining these two concepts, we arrive at hyper deflationary token. In the ever-evolving world of crypto, hyper deflationary token has emerged as a noteworthy concept. These tokens, distinct in their design, incorporate mechanisms that systematically reduce their total supply. This intentional reduction aims to induce scarcity, potentially driving up the token's value over time.

Key Takeaways

- Hyper deflationary tokens are designed to systematically reduce their total supply, aiming to increase their value over time.

- Hyperdeflation refers to a rapid reduction in the total supply of a token, potentially increasing its value.

- Common methods of achieving hyperdeflation include burning tokens (removing them from circulation) and imposing transaction fees where a fraction of tokens is destroyed or redistributed.

- Deflationary spiral is a potential risk where rapid token supply reduction prompts users to hoard tokens, expecting their value to rise.

- Opposite of deflationary crypto, inflationary tokens increase their supply over time, diluting the value of each token but encouraging spending and network participation.

- Challenges associated with hyper-deflationary tokens include potential hoarding, leading to reduced liquidity and the misalignment of supply and demand.

What Is Hyperdeflation?

Hyperdeflation, as the name suggests, is an intensified form of deflation. In traditional economics, deflation refers to a decrease in the general price level of goods and services, often caused by a reduction in the supply of money or credit. However, in the context of cryptocurrencies, hyperdeflation pertains to a rapid and significant reduction in the total supply of a particular token.

Contrast this with inflation, a scenario where there's an increase in the general price level of goods and services over time, usually associated with an increase in the supply of money. In the cryptocurrency world, inflation would mean an increase in the number of tokens available, which could potentially dilute its value.

Hyperdeflation aims to counteract this potential dilution. By deliberately and drastically reducing the number of tokens in circulation, the inherent value of each token may rise. This result is due to the basic economic principle of supply and demand: as supply decreases and demand remains constant or increases, value tends to go up.

Understanding Hyperdeflation

Hyperdeflation is a strategic approach to tokenomics, the economics of tokens. While the basic premise revolves around reducing the supply, the intricacies lie in how this reduction is achieved and sustained over time.

At the heart of hyperdeflation is the cryptocurrency's underlying code or protocol. Developers design these tokens with built-in mechanisms to ensure that the supply doesn't just decrease once but continues to do so at predetermined intervals or under specific conditions. This is where the concept becomes multifaceted.

One common method is the “token burn”. Here, tokens are intentionally and irreversibly removed from circulation, effectively reducing the total supply. This is often done by sending a portion of tokens to a designated “burn” address, from which they can never be retrieved.

Another approach involves transaction fees. Instead of the usual fee structure where tokens are transferred to miners or validators, a fraction of the tokens involved in the transaction is destroyed or redistributed. This approach not only reduces the circulating supply but also ensures that every transaction contributes to the hyperdeflationary process.

In essence, hyperdeflation is a proactive and continuous effort to bolster a token's value and scarcity by leveraging various mechanisms that are hard-coded into the cryptocurrency's design.

Example of Hyperdeflation

Let's visualize the hyperdeflationary process with a practical example. Consider a new cryptocurrency named “DeflateCoin” that launches with an initial supply of 10 million tokens. The unique feature of DeflateCoin is its built-in mechanism to burn 0.01% of tokens involved in every transaction.

Now, suppose Alice decides to send 1,000 DeflateCoins to Bob. With the 0.01% burn rate, 0.1 DeflateCoins (1,000 * 0.01%) will be burned or removed from circulation. After this transaction, the total supply of DeflateCoin will be reduced to 9,999,999.9.

As more and more transactions occur on the network, this burn rate will consistently chip away at the total supply. For instance, if there are 10,000 transactions of 1,000 DeflateCoins each, a total of 1,000 DeflateCoins (10,000 * 0.1) will be burned.

Over time, as the number of transactions multiplies, the supply of DeflateCoin will keep decreasing, even if the individual transaction amounts are small. This continuous reduction in supply, driven by regular transactions, pushes the DeflateCoin ecosystem towards a state of hyperdeflation. The result? A progressively scarcer token, which, if demand remains steady or increases, could see its value rise.

This example illustrates the power and impact of hyperdeflationary mechanisms in the world of cryptocurrencies.

Deflationary Spiral

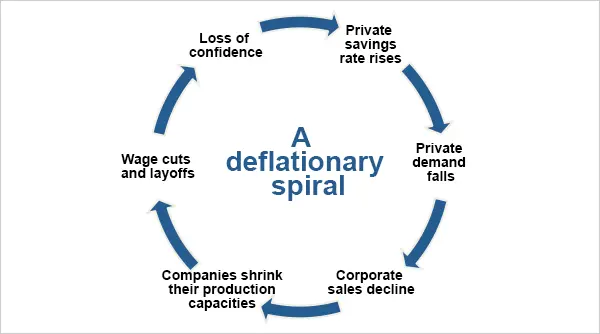

In the context of traditional economics, a deflationary spiral is a concerning phenomenon where decreasing prices lead to lower production, which in turn results in higher unemployment rates, further pushing down demand and prices. This cycle can be detrimental to an economy, causing stagnation or even recession.

When applied to the realm of crypto, the concept takes on a slightly different nuance. A deflationary spiral in the cryptocurrency industry can occur when the supply of a token decreases at such a rapid rate that it prompts users to hoard or hold onto their tokens. This behavior is driven by the expectation that the token's value will continue to rise as its supply dwindles.

While holding assets in anticipation of increased value is a common investment strategy, it can pose challenges for cryptocurrencies aiming for widespread adoption and use in daily transactions. If a significant portion of users are hoarding a token and not using it for transactions, it can stifle the token's liquidity and active circulation. This can lead to reduced transaction volumes and hinder the token's primary utility, especially if it's meant to be a medium of exchange.

Moreover, if a token becomes too scarce, it might deter new users from adopting it, fearing they might not be able to acquire enough of it for practical use or fearing extreme volatility due to its limited supply.

In essence, while hyperdeflationary mechanisms aim to increase a token's value by reducing its supply, it's crucial to strike a balance. If not managed carefully, extreme deflation can lead to a deflationary spiral, potentially undermining the token's broader goals and utility.

What are Inflationary Tokens?

Before we proceed to the hyper-deflationary tokens, we need to examine the concept of inflationary tokens.

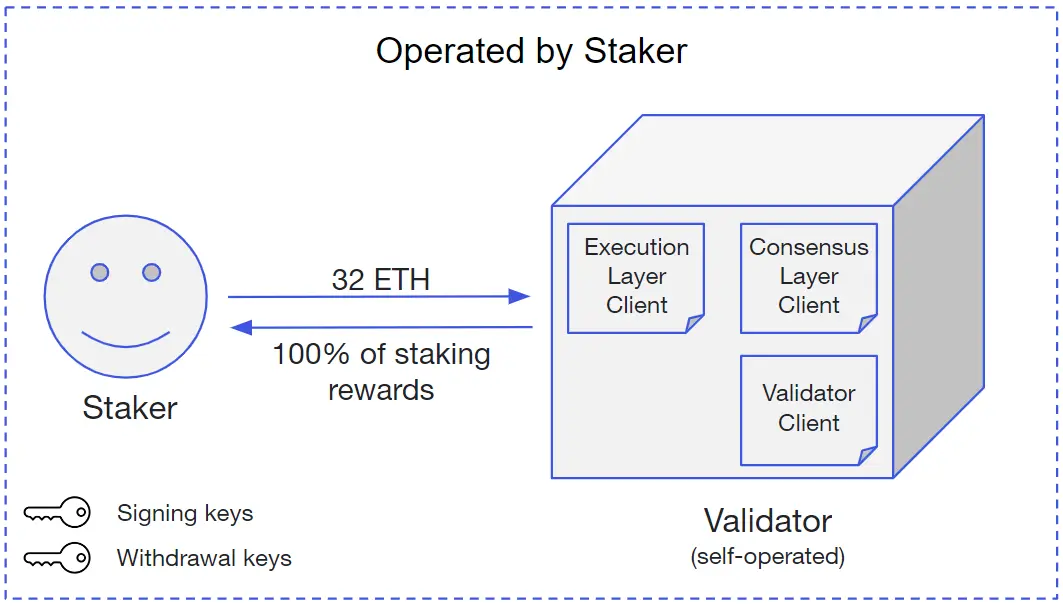

Inflationary tokens stand in stark contrast to their deflationary counterparts, embodying a different economic principle in the cryptocurrency space. Instead of reducing supply to boost value, inflationary tokens intentionally increase their supply over time. This increase can be achieved through various mechanisms embedded within the cryptocurrency's protocol, such as mining or staking rewards.

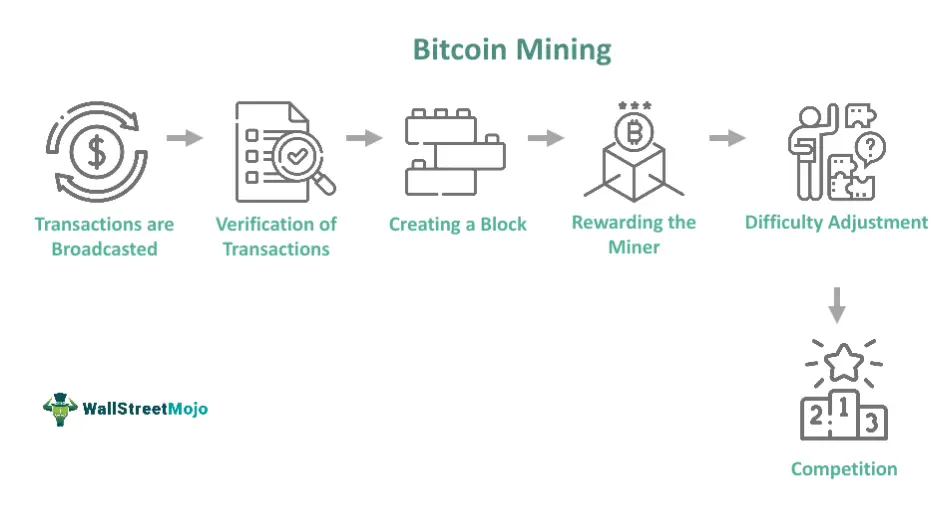

Mining involves validating transactions and securing the network. In return for this work, miners are often rewarded with newly minted tokens, thereby increasing the overall supply. One of the examples is Bitcoin mining, which gradually increases the supply of bitcoins until it reaches the hard cap of 21 million coins.

Similarly, staking involves participants locking up their tokens to support network operations like block validation. These participants, or stakers, are typically rewarded with additional tokens, further contributing to supply expansion. Ethereum is the prime example of coins deploying a staking mechanism. Redot also offers ETH staking, which you can check here.

The underlying philosophy of inflationary tokens is somewhat akin to fiat currency systems, where a steady inflation rate is targeted to encourage spending and investment instead of hoarding money. With inflationary tokens, the perpetual increase in supply can gradually dilute the value of each token, especially if the rate of demand doesn’t keep pace with the rate of supply expansion.

This potential for value dilution is intended to incentivize users to spend, use, or stake their tokens rather than merely holding them. It encourages active participation in the network, whether through transactions, staking, or other utility-driven activities, thereby fostering a vibrant and dynamic ecosystem.

Inflationary tokens can play a pivotal role in decentralized finance (DeFi) platforms, decentralized applications (dApps), and other blockchain-based ecosystems where a continuous, stable supply of tokens is necessary to support ongoing activities and reward network participants.

What are Deflationary Tokens?

The next important question is what is a deflationary token? Deflationary tokens are a subset of crypto designed to decrease their supply over time, albeit at a moderate pace.

Unlike their hyper-deflationary counterparts, which aggressively reduce supply, deflation crypto deploys a more balanced approach. Their design aims to create a sense of rarity, potentially driving up value, while still maintaining enough circulation to ensure the token's practical utility. This balance ensures that the token remains functional for transactions and other use-cases, without the supply dwindling too rapidly.

What are Hyper-Deflationary Tokens?

Taking the deflationary principle to the extreme, hyper-deflationary tokens are designed for rapid and significant supply reduction. Their primary goal is to quickly enhance scarcity, which, in theory, could lead to substantial value appreciation. To achieve this, hyper-deflationary tokens often incorporate aggressive mechanisms, such as high burn rates or substantial transaction fees.

Popular Hyper-Deflationary Tokens

Let's delve into some notable hyper-deflationary tokens:

Bitcoin

While Bitcoin may not be hyper-deflationary in the strictest sense, it embodies certain deflationary characteristics that are worth noting.

One of the most prominent features of Bitcoin is its capped supply of 21 million coins. This means that there will never be more than 21 million Bitcoins in existence. Additionally, over the years, many Bitcoins have been lost due to various reasons, such as forgotten passwords, discarded hard drives, or even deliberate burns. These lost Bitcoins effectively reduce the circulating supply, further accentuating its deflationary nature.

The combination of a capped supply and the inevitable loss of tokens ensures that Bitcoin's available supply will gradually decrease over time.

Binance Coin (BNB)

Binance Coin is a prime example of a token with intentional deflationary mechanisms. It has committed to regularly conducting “token burns”, where a certain number of BNB tokens are permanently removed from circulation.

This process is designed to reduce the total supply of BNB over time, making it scarcer and potentially more valuable. These scheduled burns, combined with the utility and demand for BNB within the Binance ecosystem, align it closely with hyper deflation.

Cronos (CRO)

Cronos also exhibits deflationary characteristics. Similar to BNB, Cronos has integrated mechanisms that aim to reduce its total supply over time. By including features that curtail its circulating supply, whether through token burns or other means, Cronos positions itself as a deflationary token within the crypto market.

Risks and Challenges Associated with Hyper-Deflationary Tokens

The prospect of holding a hyper-deflationary token that could potentially appreciate due to its inherent scarcity is undeniably attractive to many investors. However, like all investment vehicles, hyper-deflationary tokens come with their own set of challenges and risks:

1. Hoarding and Reduced Liquidity.

One of the primary concerns associated with hyper-deflationary tokens is the potential for hoarding. As users anticipate the token's value to rise due to its decreasing supply, they might be inclined to hold onto their tokens rather than use them.

This behavior can lead to reduced liquidity in the market, making it difficult for new investors to buy or existing holders to sell their tokens. A lack of liquidity can stifle the token's growth and utility, especially if it's intended to be used within a specific ecosystem or platform.

2. Misalignment of Supply and Demand.

For a hyper-deflationary token to increase in value, the demand for the token must at least remain constant, if not increase, as the supply diminishes. However, if demand does not keep pace with the reducing supply, the anticipated increase in value might not materialize. In worst-case scenarios, if demand drops significantly, the token's value could even decline, despite its decreasing supply.

3. Over-reliance on Deflationary Mechanisms.

Some projects might focus excessively on their token's deflationary features at the expense of its actual utility and value proposition. A token's value should ideally be derived from its utility, use-case, and the ecosystem it supports, rather than solely its deflationary nature.

4. Market Manipulation.

Given the scarcity and potential value appreciation of hyper-deflationary tokens, they could become targets for market manipulation. Whales, or large holders of the token, might artificially inflate prices by hoarding and then dumping tokens, leading to price volatility.

5. Regulatory Concerns.

As the crypto space evolves, regulatory bodies worldwide are paying closer attention. Hyper-deflationary mechanisms, especially if they are perceived as schemes to artificially inflate prices, might come under regulatory scrutiny, potentially impacting the token's adoption and growth.

Conclusion

By design, hyper-deflationary tokens aim to increase value through a diminishing supply, offering a distinct economic model compared to traditional assets. Their potential for value appreciation has garnered attention, making them a topic of interest for many investors.

However, the allure of these tokens should be tempered with caution. Their unique mechanism, while promising, also brings forth certain challenges and risks. It's essential for potential investors to delve deep, understanding not just the deflationary aspect but also the broader utility and market dynamics of the token.

In essence, while hyper-deflationary tokens present a fresh perspective in the crypto arena, a balanced and well-informed approach is vital for anyone considering an investment in this space. As the crypto market continues to evolve, the role and impact of these tokens will undoubtedly be a focal point of discussions and analyses.

This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.