Introduction to Theta in Options Trading

In the exciting, yet complex world of options trading, understanding specific terminologies is the key to navigating the choppy waters of the financial market. One such essential term is “Theta”, a concept that is often overlooked but is highly critical to the dynamics of options trading. In this comprehensive guide, we will shed light on Theta, its intrinsic characteristics, and its implications for trading. As we journey through this subject, remember that we will consider Bitcoin as the base asset, currently standing at a market value of $20,000.

What Is Theta?

Theta signifies the rate at which a contract's value decreases with the passing of time, provided all other conditions remain static. This phenomenon, known as “time decay” or “Theta decay”, plays an instrumental role in determining the value of a contract.

How Does Theta Behave?

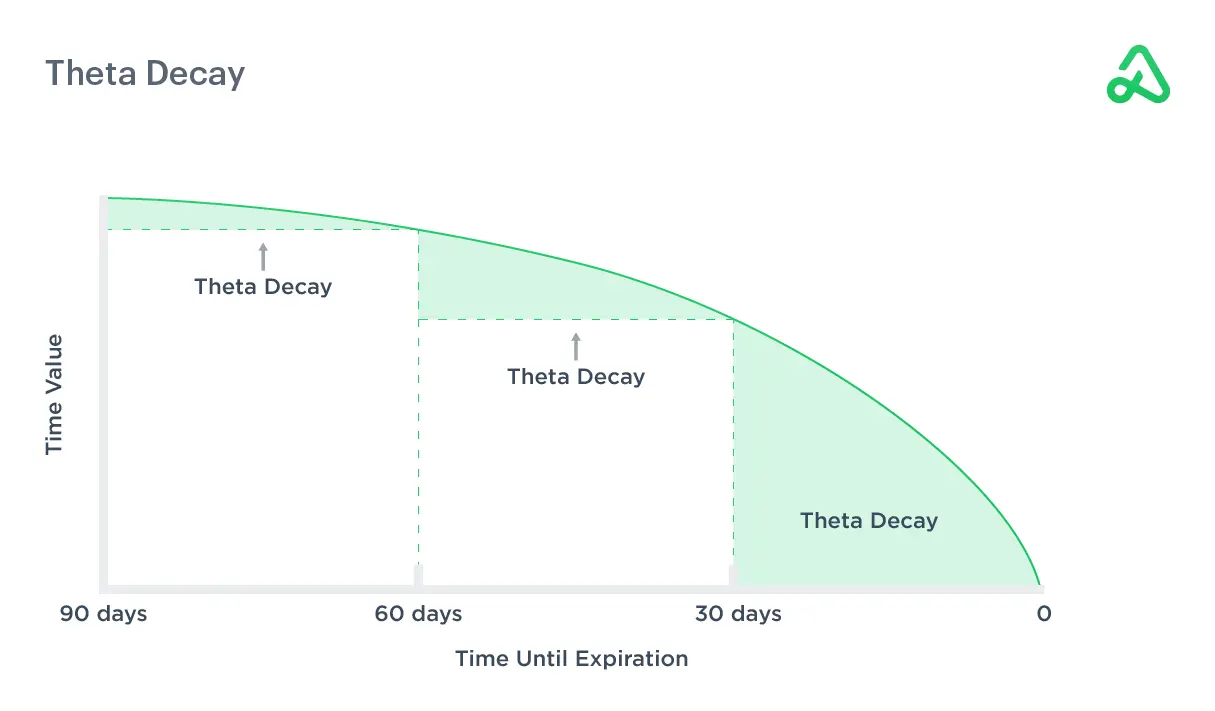

Theta, often referred to as the silent killer in the realm of options trading, is not as static as one might presume. As a contract moves closer to its expiration date, the rate at which its value erodes, or Theta decay, accelerates. This phenomenon is particularly notable in the last 30 days before expiration. Traders frequently refer to this acceleration as “Theta burn”. It's a crucial aspect to consider, particularly in the case of Bitcoin options trading. The reason is that, unlike traditional markets, cryptocurrency markets operate 24/7. This means that Theta decay also occurs over the weekends, potentially leading to higher Theta burn.

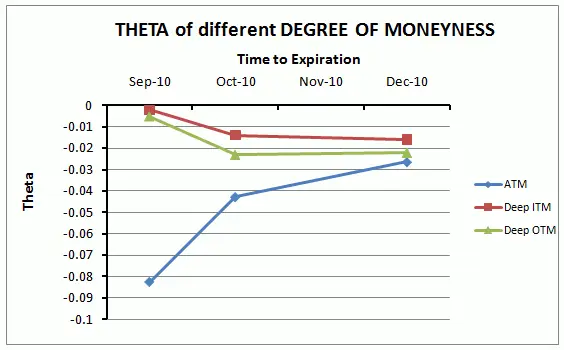

Additionally, Theta's behavior is impacted by the moneyness of the option. In-the-money (ITM) and out-of-the-money (OTM) contracts have lower Theta, meaning their time value decays at a slower pace. At-the-money contracts (ATM), however, exhibit the highest Theta and thus decay at the fastest rate.

Extrinsic Value and the Dynamics of Options Theta

The dynamics of options Theta are deeply intertwined with the concept of extrinsic value. Extrinsic value, also known as time value, is a critical component of an option's total premium. It represents the part of the option's price that isn't accounted for by its intrinsic value.

Extrinsic value is influenced by various factors, including the time remaining until the option's expiration, the volatility of the base asset, interest rates, and dividends. However, the two factors that often play the most significant role are time and implied volatility.

As mentioned in the previous section, the Theta of a contract provides a measure of the rate at which the option's extrinsic value decays over time, assuming all other factors remain constant.

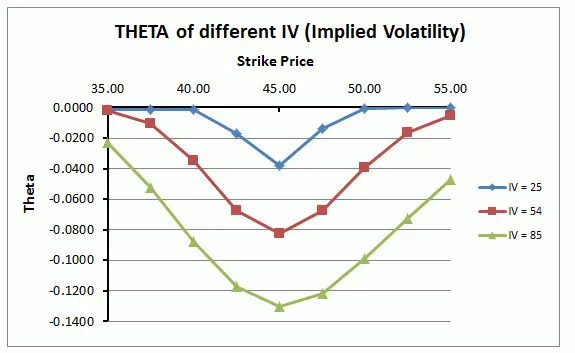

Implied volatility also plays a significant role in the extrinsic value of an option. The higher the implied volatility, the greater the extrinsic value. The reason behind is that higher volatility increases the likelihood of the contract becoming in-the-money by expiration, making it more valuable.

Thus, it's important to note that while increasing implied volatility increases a contract's extrinsic value, it also increases Theta, leading to faster time decay. This dynamic interplay between extrinsic value, Theta, and implied volatility is a crucial aspect of options trading that traders need to understand and monitor.

How to Calculate Theta

Theta is usually calculated using complex mathematical models like the Black-Scholes Model or the Binomial Option Pricing Model, which consider various factors like the Bitcoin price, strike price, time until expiration, risk-free rate, and volatility.

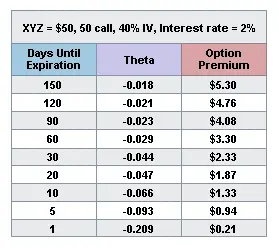

However, for the ordinary market participant, it's not necessary to delve into these complex calculations. Most trading platforms provide Theta values for each contract. It's also important to note that Theta is typically expressed as a negative number for long contracts. It signifies the rate at which the contract's value will decay with each passing day, all else being equal.

For instance, a Theta of -0.01 for a Bitcoin call option means that the contract's theoretical value will decrease by $0.01 per day, assuming no changes in the Bitcoin price or volatility.

How Moneyness Impacts Theta Decay

The condition of “moneyness”, which refers to the relationship between the Bitcoin price (the base asset) and the strike price (the agreed price at which the option can be exercised), has a profound impact on Theta decay.

When a contract is “at the money” (ATM), implying that the Bitcoin price equals the strike price, Theta is at its maximum. However, if a contract is “in the money” (ITM) or “out of the money” (OTM), Theta tends to be lower. Understanding these dynamics can significantly enhance decision-making in options trading.

What Are Other factors to consider?

Decay Rate

Theta decay has a fascinating characteristic – it is not linear, but accelerates as the option nears its expiry date. This means that the decay rate is slower at first but quickens as the expiry date approaches, which is often referred to as the “Theta curve.” This curve is a visual representation of the accelerating nature of time decay, an essential aspect to consider when making trading decisions.

Theta Absolute Value

A quick detour into Theta's absolute value – it tends to increase for options that are ATM and decrease for options that are either ITM or OTM. The absolute value of Theta gives us an idea of how much value the contract is likely to lose each day, all other things being equal.

Premium

The concept of premium is integral to options trading. It's the price that the buyer of a contract pays to the seller. The premium is directly affected by Theta. As the expiry date approaches, all else being equal, the premium of the option decreases due to Theta decay. This can be a boon for buyers but a bane for sellers.

Implied Volatility & Price Movement

It's important to remember that Theta shouldn’t be considered in isolation. Other factors, like implied volatility and price movement, also play pivotal roles. Implied volatility can inflate the option premium, which can potentially offset some losses from Theta decay. Conversely, price movement of the base asset, here Bitcoin, can alter a contract's intrinsic value, thereby influencing the Theta.

Theta in Different Options Positions

Now, let's see how Theta behaves in various options positions. Theta's nature changes based on the type of options position held – it's like a chameleon adapting to different environments.

Single-Leg Position Theta

In the world of options trading, a single-leg position refers to a situation where you hold just one call or put contract. Here, Theta behaves in a straightforward manner. If you purchased the contract (long position), your position has negative Theta, implying that time decay is working against you. But if you initially sold the derivative (short position), your position enjoys positive Theta, which means time decay is working in your favor.

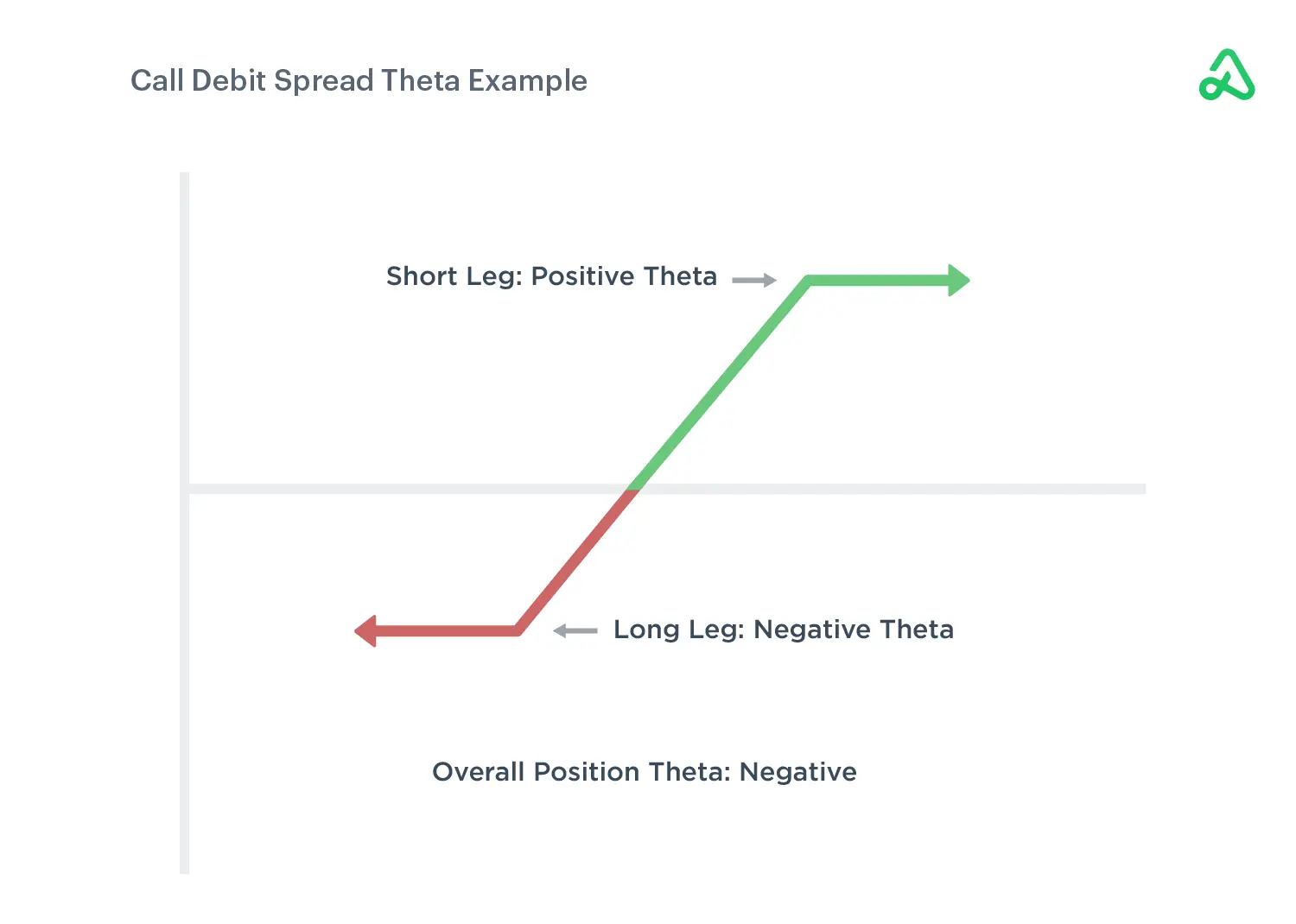

Credit and Debit Spread Theta

Moving on to the credit and debit spreads, the Theta dynamics change. Credit spreads, which involve selling a higher premium option while simultaneously buying a lower premium option, generally have positive Theta.

In contrast, debit spreads, where you purchase a higher premium option while selling a lower premium one, usually have negative Theta.

Multi-Leg Position Theta

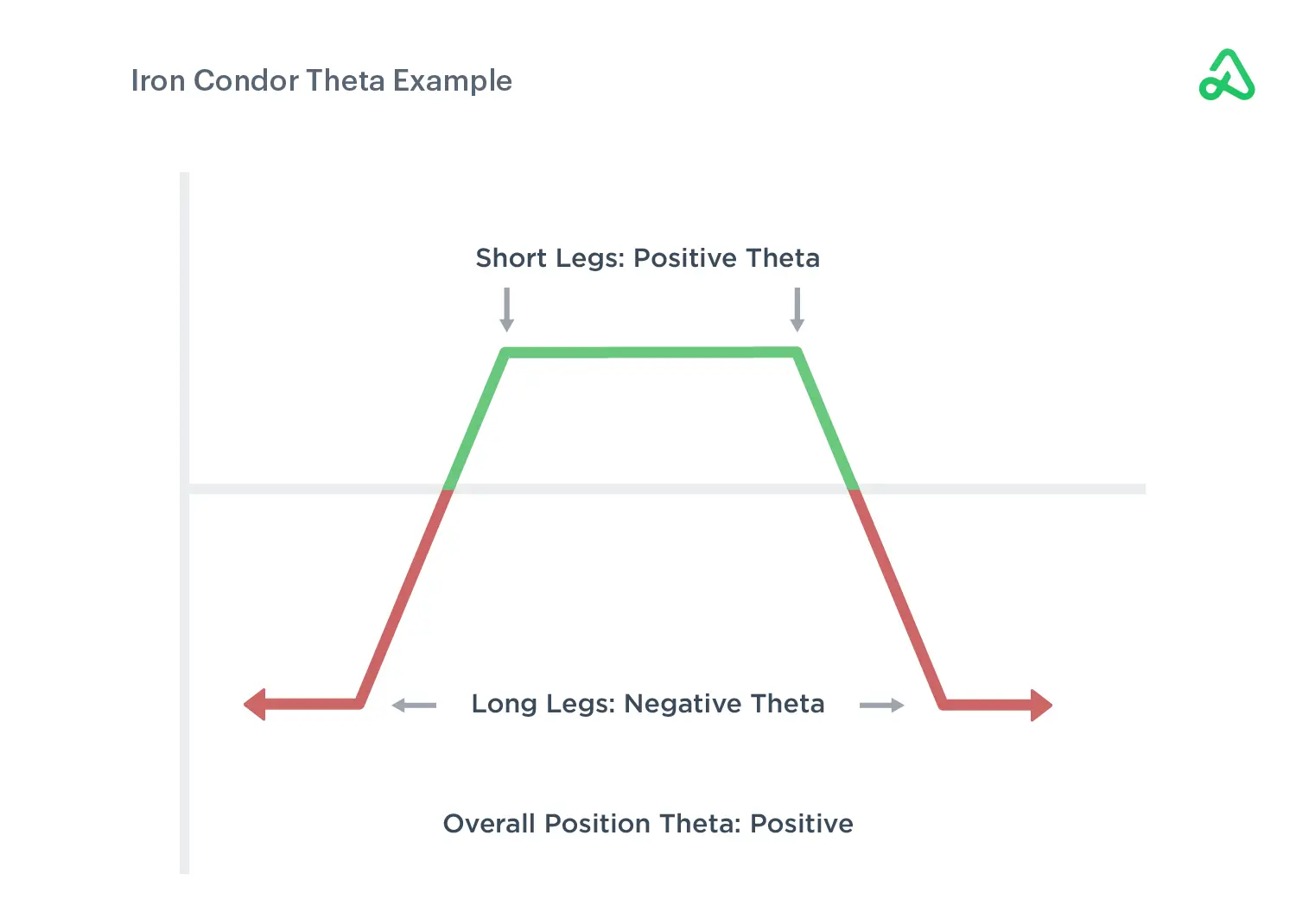

Multi-leg options strategies involve opening positions with multiple options contracts across different strike prices, expiry dates, or even different base assets. Examples of multi-leg strategies include iron condors, butterflies, and straddles.

The effect of Theta, or time decay, on these strategies can be complex because each leg of the strategy might have a different Theta. In some cases, the Theta of the entire position could be positive, meaning that the position benefits from time decay. In other cases, it could be negative, meaning that the position loses value as time passes.

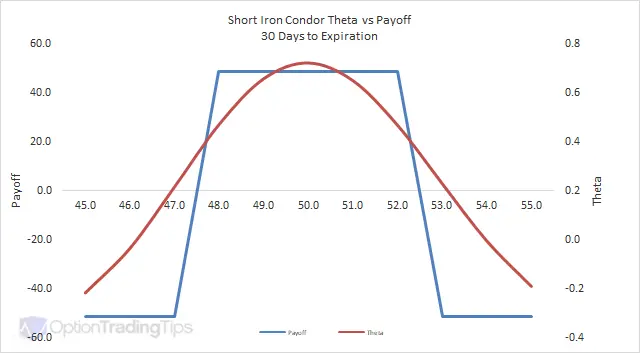

For instance, in an iron condor strategy, the trader sells an out-of-the-money (OTM) call and an OTM put, while simultaneously buying a further OTM call and put for protection. The short options have a higher Theta and therefore decay faster than the long options. This makes the overall position Theta positive, meaning the trader benefits from time decay.

In a nutshell, understanding Theta's impact on multi-leg strategies is crucial for optimizing potential returns and managing risk in options trading.

Long Options and Theta

For long contracts, Theta often plays the villain. The longer you hold onto your option, the more value it loses due to time decay, unless other factors like an increase in the base asset's price or implied volatility manage to offset this loss.

Short Options and Theta

In contrast, short contracts are usually friends with Theta. As an options' seller, you'd typically want the option you sold to decrease in value, which is precisely what Theta ensures as time progresses.

Positive Theta

Positive Theta indicates that the value of an option position increases over time due to Theta decay. This is typically beneficial for derivatives sellers or those holding credit spreads or short contracts. This phenomenon is frequently regarded as a tailwind, pushing the market participant's position towards profitability.

Negative Theta

On the flip side, negative Theta signifies that the value of an option position decreases over time due to Theta decay. This is typically detrimental to derivatives buyers or those holding long contracts or debit spreads. It's like a headwind that makes it more difficult for the trader to reach their profitability goals.

Theta-based Options Strategies

While Theta might seem intimidating, many strategies revolve around manipulating Theta to one's advantage. Let's delve into a few strategies that market participants frequently employ.

Short OTM Vertical Spread

A short out-of-the-money (OTM) vertical spread is an options' strategy that involves selling an OTM contract and simultaneously buying a further OTM contract on the same base asset with the same expiry date.

In terms of Theta, or time decay, this strategy is generally beneficial. The option you sell (closer to the money) will have a higher Theta than the option you buy (further from the money). This means the value of the sold contract will decay faster than the purchased one as time passes, benefiting the trader.

In other words, a short OTM vertical spread is a Theta-positive strategy. However, other factors such as changes in the base asset's price and implied volatility can affect the position's profitability. Hence, it's crucial to monitor all these factors when using this strategy.

Short Call Vertical

The short call vertical strategy involves selling a call contract at a lower strike price while buying another call at a higher strike price. Both options have the same expiry date. This approach is implemented when one expects minor decreases or no significant movement in the price of the base asset. The market participant profits primarily from the Theta decay of the sold call contract.

Short Put Vertical

Conversely, a short put vertical strategy is employed when a trader anticipates minor increases or no significant movement in the price of the base asset. It involves selling a put contract at a higher strike price and buying another put at a lower strike price. Here, too, the market participant profits from the Theta decay of the sold put contract.

Iron Condor

An Iron Condor, a more advanced strategy typically favored by experienced traders, involves four different options with the same expiry date but different strike prices. This strategic position comprises a combination of a short call vertical spread and a short put vertical spread. The beauty of this strategy lies in its design, which allows for a wide range of prices where the position can potentially be profitable. The key profit generator in this case is Theta decay. However, it's important to note that the maximum profit is limited to the net premium received for selling the contracts spreads.

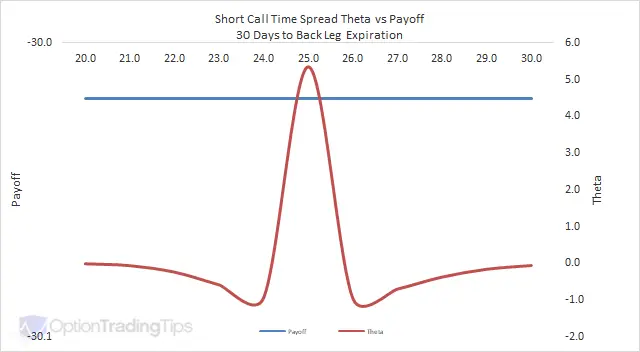

Calendar Spread

A calendar spread, also known as a horizontal spread or a time spread, involves buying and selling two contracts of the same type and strike price but with different expiry dates. The strategy is typically designed to take advantage of differences in time decay between the two contracts. Usually, the near-term contract is sold to benefit from its faster Theta decay, while the longer-term contract is bought.

With a solid understanding of these strategies, you're better equipped to navigate the financial markets. Nevertheless, it's crucial to remember that each strategy carries its own risks and rewards, and it's essential to choose one that aligns with your financial goals and risk tolerance.

Portfolio Theta and Next Steps

Portfolio Theta

When considering an entire options portfolio, the cumulative Theta of all the options within the portfolio is defined as the “Portfolio Theta”. This value provides a snapshot of the potential impact of time decay on the overall portfolio.

A positive Portfolio Theta suggests that the portfolio's value might increase due to time decay, while a negative Portfolio Theta implies a potential decrease in the portfolio's value.

In a well-diversified options' portfolio, it is not unusual to see both positive and negative Thetas. The aim should be to balance these out to manage the overall risk and potential reward.

Theta Tailwind

In trading, a “Theta tailwind” refers to a situation where Theta decay works in favor of the trader, generally when the market participant holds short options or utilizes strategies that benefit from time decay.

A trader with a positive Theta is said to have a Theta tailwind, as time decay is working in their favor. It's like having the wind at your back, pushing you towards your destination of profitability. Understanding and effectively using this concept can make a significant difference in the success of a market participant's options strategies.

Next Steps

Having developed a comprehensive understanding of Theta and its implications, it's time to apply this knowledge to your trading strategies. Consider your risk tolerance, examine the market conditions, and choose the strategies that best suit your objectives.

Conclusion on Options Theta and Decay Strategies

Understanding the concept of Theta and its impact on options trading is a pivotal part of any investor's journey. We hope that Theta explained in this guide will help you to make more informed decisions while trading options.

While Theta decay can be a detriment to contract buyers, it can also serve as a powerful ally for contract sellers. By comprehending the intricacies of Theta, traders can enhance their ability to make informed decisions, potentially boosting their profitability in the process.

FAQs

How Is Option Theta Calculated?

Option Theta is calculated using options pricing models, such as the Black-Scholes model. It represents the rate at which the contract price changes with respect to time.

How Does Time Value Affect Options?

Time value is a critical component of a contract's price. As the expiry date approaches, the time value of a contract decreases due to Theta decay, which can significantly influence the profitability of an options position.

What Is a Good Theta for Options?

The concept of a “good” Theta is relative and depends on whether you're buying or selling derivatives. For buyers, a lower absolute Theta value could be desirable, as it means the contract's price is less sensitive to time decay. On the other hand, sellers might prefer options with a higher absolute Theta, indicating a more significant time decay, which could lead to higher potential profits.

How Do You Calculate the Time Value of an Option?

The time value of a contract can be calculated by subtracting the option's intrinsic value from its market price. This value represents the premium that market participants are willing to pay for the possibility of further profits before the contract's expiration.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.