There Are No Bailouts in Free Market

Crypto Market Week in Review (18 June 2022)

Market

This week was brutal for crypto investors (and most other assets as well). Bitcoin lost more than 20% last weekend on the news of a withdrawal pause at Celsius, one of the biggest crypto lending platforms. Crypto drop was synchronized with traditional financial assets. US inflation figures published on June 10 were higher than expected, implying a faster trajectory of Fed rate hikes and painful correction of both stocks and bonds.

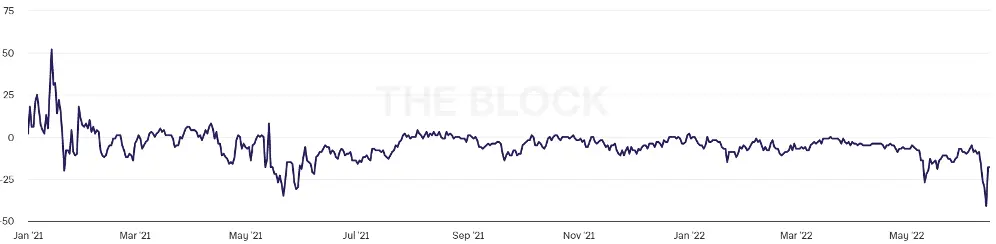

Interestingly, market participants should have been well informed about Celsius problems since the Celsius token had already plunged by 3 times in May.

Celsius Token Price (CEL/USD)

The implied volatility of Bitcoin options as measured by DVOL index is near the top of the recent range but looks relatively contained compared with this week’s outsized move down.

Bitcoin Spot Price and Volatility Index (DVOL)

Ethereum implied volatility shows more anxiety but remains in the recent range too.

Ethereum Spot Price and Volatility Index (DVOL)

However, Bitcoin investors’ willingness to pay for short-term protection vs upside reached a recent record this week.

Bitcoin 7-day Option Skew Delta 25

There is a lot of chatter about margin calls. News agencies mentioned possible margin calls of MicroStrategy, Three Arrows, and Celsius clients or Celsius itself. These reports may not be completely true, but given the number of publications by reputable news (like Bloomberg), we suspect there is no smoke without fire. If we are right, volatility and downside protection may remain supported.

Celsius Crash: What Happened?

A few months ago, we experienced the Luna/UST crash. Now, with Celsius, another big player is on the edge of failing. These are two different projects with the same problem - collateral.

In a tweet on June 13, Celsius announced it was pausing all withdrawals, transfers, and swaps so it can meet all future withdrawal obligations. How did we get here? And what does this mean?

Celsius Network has always boasted of its many-sided approach to getting yield. A strategy that comprises lending to institutional clients, Bitcoin mining, and participation in various DeFi protocols as both depositor and lender has been called out by many community members considering this approach unsustainable.

While Celcius jealously guards its involvement with institutions, DeFi’s transparency allows us to see a part of how Celsius Network gets returns.

Apparently, Celsius has been involved in many different strategies when trying to secure unbeatable yields, such as depositing crypto received from users in protocols like Compound and Aave to get returns. Those deposits were then used as collateral to get stablecoins which were then lent to institutions. Even though this approach didn’t seem to be what caused its recent crash, the yields provided by Celcius still appear to be unjustified.

What weighted on Celcius the most seems to have been their gamble on wrapping stETH yields as if they were ETH yields. Even though one can be exchanged for another, they aren’t the same thing per se. Why? stETH isn’t as liquid as ETH, even though it’s yield-bearing, which could theoretically make it more attractive, provided that the investor doesn’t need to claim it anytime soon.

But the moment stETH depegged from ETH in the ratio of 0.96/1, people started to panic resulting in a bank run on Celcius. Given how Celcius (did not) manage its risk exposure, they weren’t solvent enough to pay out all users interested in withdrawing the funds, ultimately blocking all withdrawals.

The community first noticed when Celsius withdrew 50,000 Ether and 7,000 WBTC collateral from its Aave position in one of its core DeFi wallets. 6,000 WBTC and 20,000 Ether (so far) have been sent to FTX. In return, FTX gave a $169 million USDC bag into the crypto lending platform. Apparently, the Network is borrowing from FTX against this collateral to move their leverage off-chain.

Before that, a Twitter user with the pseudonym, yield chad, revealed how only 27% of Celcius ETH position is liquid. The rest is supposedly either in Lido’s staked ETH or directly in ETH 2. The money lender deposited 288,465 Ether in ETH 2 and while the contract will not yield until around a year (at best), Celcius still pays its regular 4% interest on its Ether loans.

How is Celsius able to pay its almost 221 ETH yield consistently? Especially given the current market conditions? The math does not add up.

Apart from the company’s unprofitable business model, its hiring seems to be off the charts. The company’s Head Of Institutional Lending, Jennifer Khater was actively involved in the adult film industry before being hired by Celcius and its former CFO was arrested on the basis of fraud (an allegation he later denied).

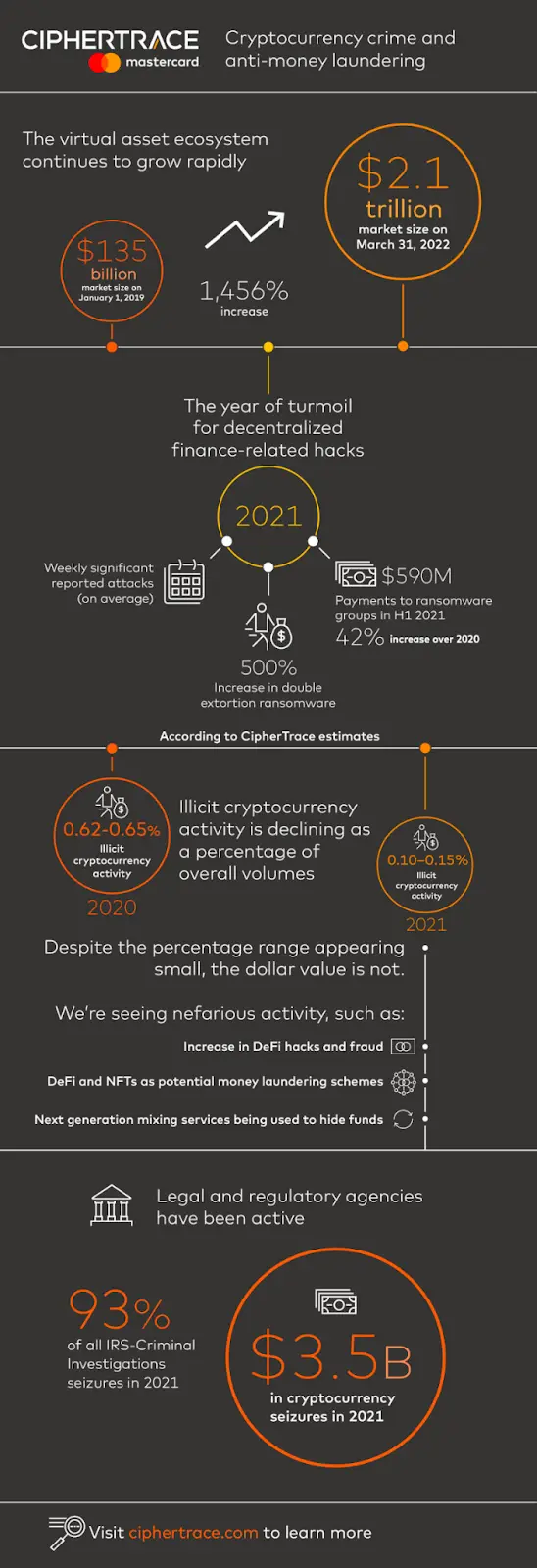

Illicit Crypto Usage as a Percent of Total Usage Has Fallen

A Cryptocurrency Crime and Anti-Money Laundering report from blockchain forensic firm, Ciphertrace revealed that the percentage of illegal activities to the total cryptocurrency activities had reduced more than six times from its 2020 highs.

The percentage of illegal crypto activities, which stood at an average of 0.62% in 2020, is now 0.10% from the 2021 statistics. Checking the amount lost to scams in the crypto space, over $2.4 billion was lost in 2021 and the first quarter of 2022, and half of that figure came from two projects. The first is the $610 million loss on the Poly Network, most of which has been returned by the anonymous hacker, while the other is the Ronin Bridge hack in March 2022, where $650 million was lost.

Although there has been a decrease in crypto illicit activities, it has also attracted the prying eyes of regulators. Several nations are taking an interest in regulating cryptocurrency.

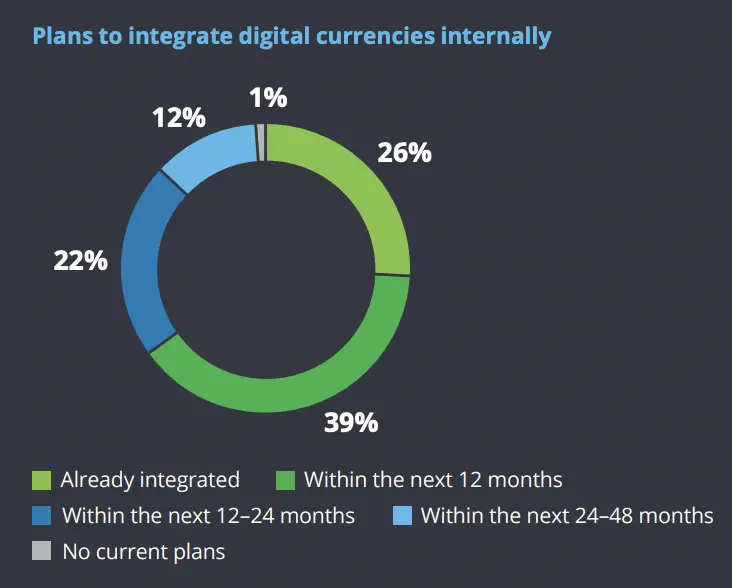

Deloitte Survey: 85% of US Merchants Says Enabling Crypto Payments Is High Priority

According to a Deloitte report published last week, four-fifth of the crypto interviewed retailers plan to accept cryptocurrency payments within the next 24 months.

While global cryptocurrency adoption has experienced several hiccups along the way, the Deloitte report showed the overwhelming enthusiasm among younger generations implies that retailers who do not prepare to accept cryptocurrency payment may face an uphill task in the coming years.

The study was done in collaboration with PayPal and surveyed 2,000 executives from major retail companies. The main details from the report indicated that 60% of the respondents' companies have at least half a million dollars to spend on cryptocurrency payment infrastructures in the coming year.

This does not mean the companies will hold cryptocurrencies themselves. 52% indicated that they would convert the crypto to fiat almost immediately.

FINRA May Hire Employees Terminated from Crypto Firms

A Tuesday Reuters report revealed that the United States Financial Industry Regulatory Authority, FINRA, plans to add to its existing 3,600 staff from crypto companies.

In a bold statement about its goal of monitoring crypto, the body’s CEO, Robert Cook, said anyone who is getting laid off from a crypto firm and would relish working with the FINRA should give him a call.

With the market downturn and extreme volatility, major crypto exchanges like Gemini and Coinbase have announced plans to reduce their staff's strength. The layoff mania is not limited to US crypto companies alone. Crypto.com, a Singapore-based crypto exchange, announced that over 260 staff would be relieved of their roles in a bid to ensure long-term sustainability.

This seems to be an opportunity for FINRA to hire capable individuals. Cook said that FINRA was working on a technology to improve digital asset verification techniques and ensure cross-market monitoring on several blockchains.

3AC in Trouble? Reports All Point to One Thing

Popular crypto hedge fund Three Arrows Capital, also called 3AC, is in the headlines for liquidation fears. It was a major part of Lido’s stETH de-pegging after it sold 30,000 stETH ($33.7 million).

With the recent crypto boom, a large amount of leverage was involved, and 3AC played a role in that. I.e. the $10 billion crypto company was accused by a business partner, 8BlocksCapital, of using $1 million of its funds without authorization.

After asking to leverage 3AC’s influence to get lower trading fees, 8BlocksCapital’s deal with 3AC went through in 2020. However, breaches began to surface in May 2022. Its CEO, Danny Yuan, tweeted:

“Our agreement with them was: we withdraw whenever we want. 100% of the PNL belongs to us. They are never to move our funds without permission… and in return, we pay them fees for their service.”

Despite the agreement, 3AC used around $1 million of 8BlocksCapital capital to avoid margin calls.

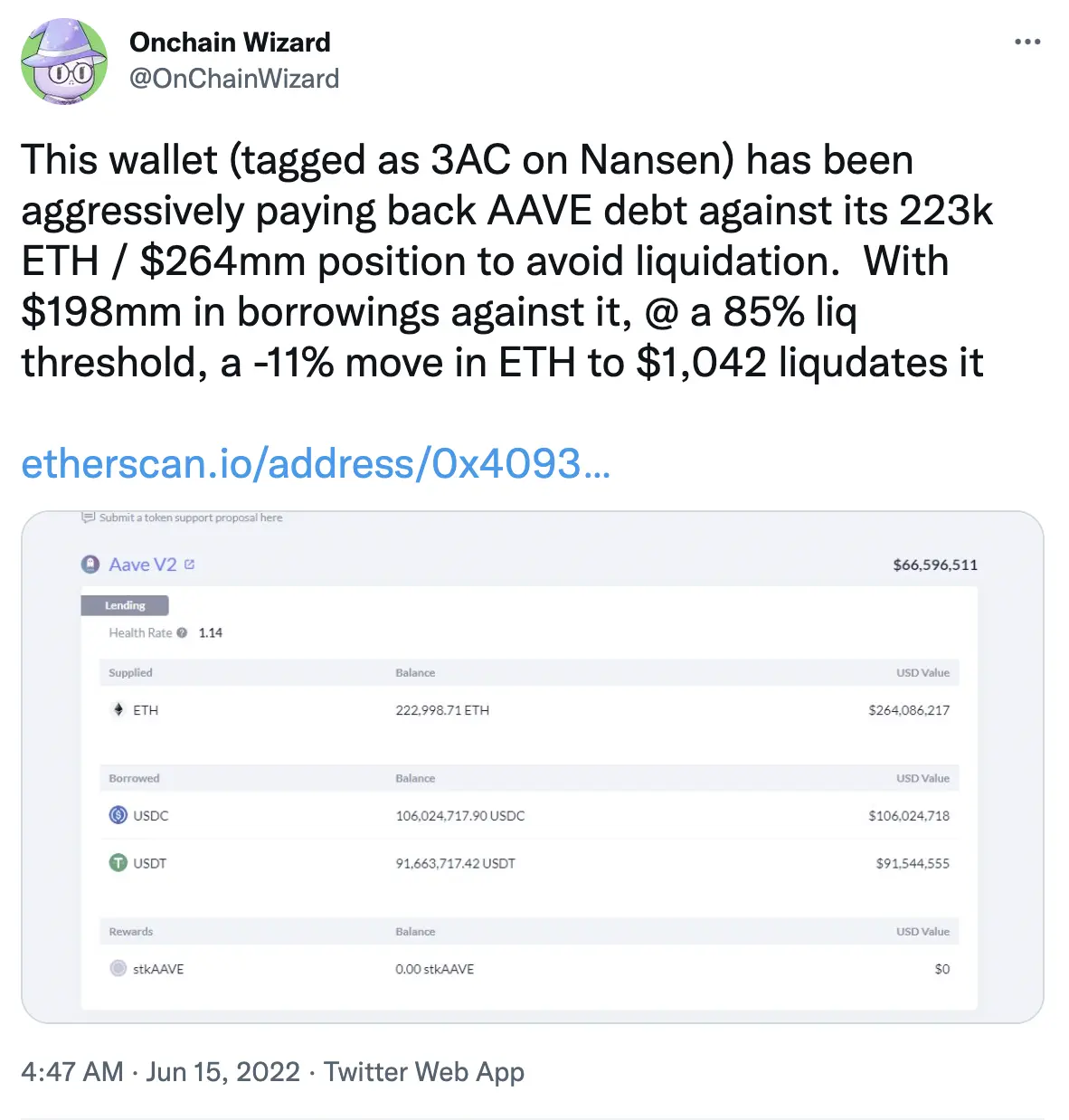

Twitter analysts have explained that 3AC is trying to avoid liquidation on its $264 million Aave and $35 million Compound loans.

A Twitter user with the pseudonym Moon Overlord posted a screenshot explaining that 3AC has exchanged 30,000 stETH in the last week and opined that 3AC's CEO, who deleted his Instagram account and has not tweeted for days, was suspicious.

Another crypto analyst, Onchain Wizard, shared data from Nansen, a blockchain data platform. According to the tweet, 3AC’s loan will be liquidated if ETH drops to $1,042.

With the rumours that the wallet with the loans belongs to 3AC, the company has not come out to support or refute the claims.

The CEO, Zhu Su, posted a cryptic response to the rumours flying. In his tweet on Wednesday, he said the company is communicating with relevant parties to resolve the issue. It’s clear that they got into trouble but we are yet to understand the extent of 3AC’s failure and implications for the wider crypto markets.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.