How to Invest in Bitcoin and Make Money

What Is Bitcoin, and How Does It Work?

Bitcoin became the first digital cryptocurrency to rival the dominance of fiat currencies, and for crypto-curious individuals, it is likely your first contact with the cryptocurrency market. It operates like normal fiat currencies, but differs in its use of peer-to-peer systems and anonymity. Bitcoin is at the intersection of cryptography and money, and it works without the governing oversight of centralized institutions.

As for the underlying technology, Bitcoin operates on a system known as blockchain technology. It makes the recording of transactions secure and transparent, which is an attractive feature for many crypto investors.

There are a lot of things to know about Bitcoin, especially how it works, and a good place to start is with the two addresses that form the backbone of the technology.

To use Bitcoin, you will need two keys; a public key and a private key. The public address (key) is what you send out to receive payments, while the private key needs to be kept safe if one wants to retain their Bitcoin holdings.

In terms of security, the private key is akin to the password to your digital wallet. Losing this key can result in the loss of your Bitcoin holdings, which is why many investors opt to store their keys in a secure digital wallet or hardware wallet.

Every Bitcoin transaction is recorded on a public ledger called the blockchain, and even pending transactions can be viewed in the Bitcoin mempool. This public ledger makes it impossible for counterfeited Bitcoins to exist, as the history of every coin can be traced.

This transparency is one of the key advantages of Bitcoin and other digital assets. It allows for a level of consumer protection not typically seen in traditional assets.

What Do You Need to Invest in Bitcoin?

There are two different ways you can invest in Bitcoin. You can either buy the cryptocurrency through a centralized exchange or a decentralized exchange.

The choice between a centralized and decentralized exchange often comes down to personal preference and your specific investment strategy. Centralized exchanges, like Robinhood or Redot, offer a more user-friendly interface and are typically easier for beginners. On the other hand, decentralized exchanges offer more privacy and control over your transactions.

Investing Through a Centralized Exchange

The major things you will need before investing through a centralized exchange are

- An internet-enabled device

- A valid means of identification

- Bank information

Many centralized exchanges scrutinize the transactions and identities pertaining to the exchange accounts in order to perform KYC/AML monitoring.

This is a crucial step in ensuring the security of your investment and protecting against fraudulent activities. However, it's important to note that while these measures provide a level of consumer protection, they also mean that the exchange has a certain level of control over your assets.

Investing Through a Decentralized Exchange

Unlike investing through a centralized exchange, buying crypto assets through a decentralized exchange (DEX) requires a crypto wallet. Since decentralized exchanges are run by smart contracts, there is no need for verification or identification. Setting up a crypto wallet and connecting it to the exchange can be done in as fast as two minutes. The only caveat here is that you are responsible for the safety of your wallet. Hence, you need to keep your private key and mnemonic phrase safe.

In the world of decentralized exchanges, you are your own bank. This means that while you have full control over your assets, you also bear the full responsibility for their security. This is why many crypto investors opt to use a hot wallet for daily transactions and cold wallet for long-term storage.

However, it's important to note that there are no decentralized exchanges on Bitcoin's own blockchain. Instead, you can purchase a wrapped version of Bitcoin on the DEX of other blockchains. A wrapped Bitcoin is a token on another blockchain that represents Bitcoin and is backed 1:1 with actual Bitcoin. This allows Bitcoin to interact with the smart contracts and DApps of other blockchains.

Another key aspect to consider when using DEXs, especially those on the Ethereum network, is transaction fees. These fees, often referred to as “gas fees”, can vary significantly based on network congestion and other factors. Ethereum, in particular, is known for its high transaction fees during periods of heavy network use.

Things to Consider Before Investing in Bitcoin

Investing in Bitcoin is not risk-proof. There are pitfalls you need to know and avoid before buying Bitcoin. Some of them include

Don’t Invest More than You Can Afford to Lose

It is not good practice to invest all your savings in buying Bitcoin. Sometimes, the market gets very irrational and could result in significant losses. You should only invest money you can forgo if the market turns sour.

This is a fundamental principle of any investment strategy, not just for Bitcoin or other crypto investments. The volatile nature of the cryptocurrency market means that prices can fluctuate wildly in a short period, which can lead to significant losses if you're not careful.

Play the Long-term

If you’re a newbie in the cryptocurrency market, buying for the long term might be your best bet. Don’t buy with the money you might need soon, hoping a miracle rally will happen. It could likely happen, but your timing might be wrong.

Learn as You Earn

Apart from playing the long term, you can decide to trade Bitcoin and profit from the market’s inefficiency. This requires lots of learning and practice, as chart patterns might confuse newbies. Learning how to identify opportunities and practicing them (both on your demo account and real account) will help you become a better trader.

And also, it's important to remember that trading involves a significant amount of risk, and it's not suitable for everyone. If you're interested in trading, consider starting with a demo account and learning as much as you can about technical analysis and market trends before risking real money.

Practice Good Risk Management

If it looks too good to be true, it most likely is. Imbibe a habit of preserving your capital no matter the market timing. This might involve setting stop losses and take profit targets, minimizing leverage used, or reducing the amount of capital per trade.

Good risk management is crucial in any investment portfolio. This includes not only setting stop losses and take profit targets but also diversifying your investments to spread the risk. This can include investing in a mix of different cryptocurrencies, as well as other types of assets.

Why Has Bitcoin Dropped?

Bitcoin’s rise or drop depends on several reasons, which can be categorized into demand and supply factors. Some of these reasons include

Sentiment

Opinions and social media chatter influence people’s perception of Bitcoin. Influential people can move the price of the cryptocurrency several times.

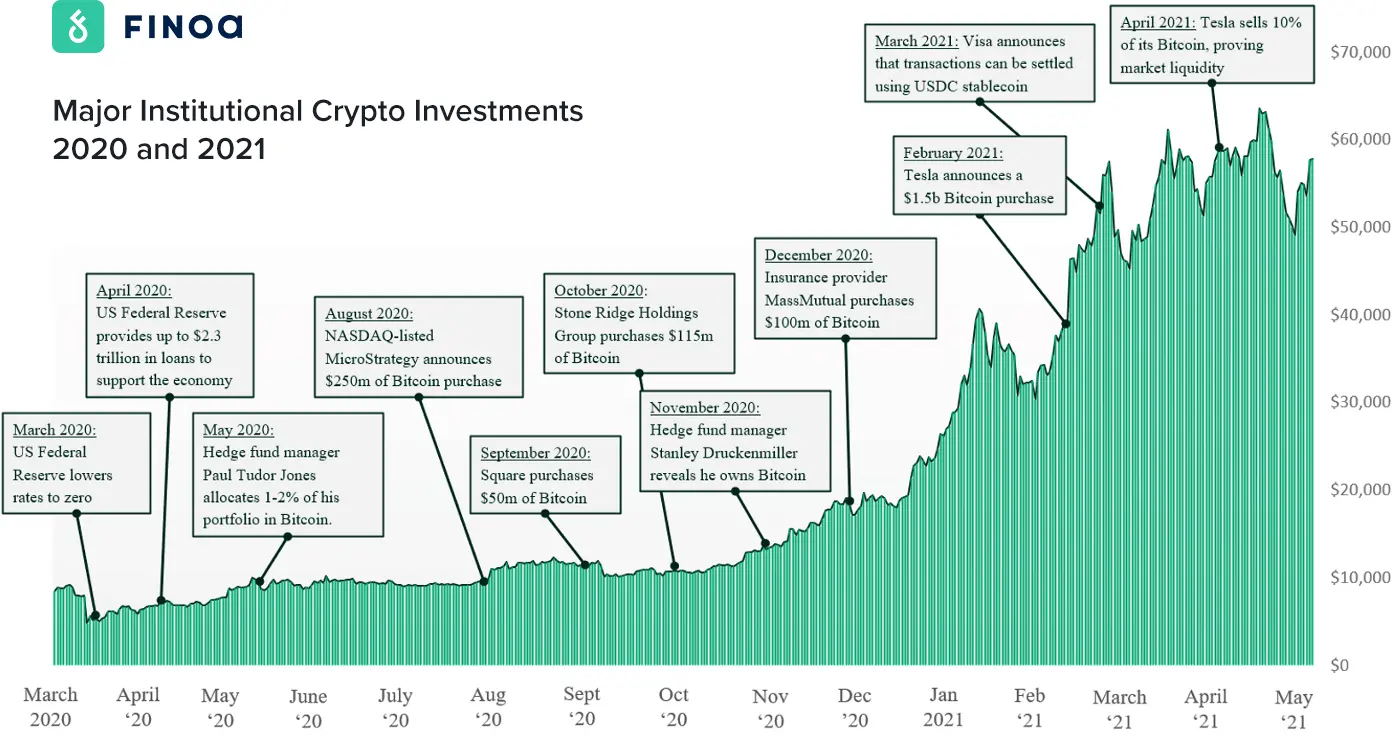

Institutional Adoption

When traditional companies accept Bitcoin as a payment method, the market accepts it as growing institutional adoption. When they discontinue Bitcoin payments, it also influences the price of Bitcoin. A recent example is Elon Musk citing environmental issues for Tesla to stop accepting Bitcoin.

Government Regulation

Bitcoin is currently unregulated in most countries, and nations’ decision on either integrating, regulating, or rejecting cryptocurrencies impacts the price of cryptocurrencies. China banned every cryptocurrency activity in 2021, and this caused a short slump in Bitcoin prices.

Government regulation is a double-edged sword in the world of cryptocurrency. On one hand, regulation can provide a level of consumer protection and legitimacy that can boost investor confidence and potentially lead to higher prices. On the other hand, overly restrictive or negative regulation can lead to decreased demand and lower prices.

Contagion

When other cryptocurrencies capitulate, it can have a contagion effect on Bitcoin. For example, after the Terra Luna crash in May, Bitcoin and Ethereum dipped. The ICO bust is another example of how other activities in the crypto space can affect the price of Bitcoin.

Will Bitcoin Go Back Up?

Although it is believed that past performance does not guarantee future returns, Bitcoin has shown resilience since its inception. Bitcoin hit a record-high of $69,000 at the tail end of 2021, but then spiraled down. That was not the first time it has dipped, though. In 2011, 2013, and 2018 Bitcoin’s price corrected by 56%, 83%, and 84% consecutively, and every single time, it bounced back to hit record highs.

So, by the early summer of 2023, Bitcoin had already regained some lost value. Its quotes broke above $30,000. While being still a significant decline from its all-time high, it proves that Bitcoin can bounce back even after significant drops.

Should I Invest in Bitcoin?

Whenever there is a Bitcoin price correction, one major question that flies around is, “How do I invest in bitcoin?” There are a few things you need to answer, which will ultimately give you answers to the question. Some of them are

- Do I understand what Bitcoin is and how it works?

- How long am I willing to invest in Bitcoin?

- Do I understand the risks involved? If yes, am I willing to take the risk?

- How much will I invest in Bitcoin?

- How to purchase bitcoins. Buying a Bitcoin ETF? Investing in derivatives or buying for the long term?

The Ups and Downs of Bitcoin

Volatility is the norm when investing in cryptocurrency, and Bitcoin is no exception. Subject to the asset you are comparing it with it, Bitcoin can be extremely volatile. The cryptocurrency has experienced drawdowns of more than 80% thrice since its inception in 2009, and corrections of roughly 20% are commonplace.

This volatility can be both a blessing and a curse for investors. On one hand, it can provide opportunities for high returns. On the other hand, it can also lead to significant losses. This is why it's important to have a clear investment strategy and to be prepared for the ups and downs of the market.

The 83% crash in December 2013 happened because China banned Bitcoin mining - the first of many bans from the Asian country- while the 2018 crash of 84% signaled the ICO mania's end.

Still, Bitcoin’s volatility makes it an interesting asset to buy, as a good understanding of market timing can help traders consistently take advantage of volatility.

Can You Lose All Your Money in Bitcoin?

Well, although it is almost impossible for Bitcoin to go to zero, you can lose heart-wrenching amounts by investing in Bitcoin.

How to Make Money by Investing in Bitcoin

How To Invest in Bitcoins

If you want to start investing in Bitcoin, there are a few ways to get started.

Buy Bitcoin

This is perhaps the easiest way to gain exposure to Bitcoin. You only need to open a wallet with a crypto exchange like Redot and buy your first Bitcoin. You can either buy Bitcoin for market price or submit a limit order if you want to buy for a price lower than the market.

Buying Bitcoin directly gives you full control over your investment. You can choose when to buy and sell, and you can benefit from any increases in the price of Bitcoin.

Buy Shares in Bitcoin-related Companies

One way of investing in Bitcoins is by buying shares in a Bitcoin-related company. This can either come through blockchain companies or traditional companies that have incorporated Bitcoin payments.

Investing in Bitcoin-related companies can be a good way to gain exposure to the cryptocurrency market without having to buy Bitcoin directly. These companies can benefit from the growth of the cryptocurrency market, and their share prices can increase as a result. However, it's important to remember that these companies also carry their own risks, and their share prices can go down as well as up.

Bitcoin ETFs

If you want a more regulated way to buy Bitcoin, you can buy a Bitcoin ETF. ETFs offer a way to invest in Bitcoin without having to buy the cryptocurrency directly. They can provide a level of regulation and security that can be appealing to more conservative investors. However, it's important to remember that the price of Bitcoin ETFs is tied to the price of Bitcoin, and they can go down as well as up.

They can be purchased on traditional stock exchanges like TSX (Toronto Stock Exchange). Although the United States’ SEC has not approved Bitcoin spot ETFs, you can purchase them on other countries’ stock exchanges. Nonetheless, if you’re in the US and don’t want exposure outside your country, you can still purchase some Bitcoin futures ETFs. How to buy Bitcoin stocks in the US includes buying Proshare Bitcoin Strategy ETF (BITO) and VanEck Bitcoin Strategy ETF, amongst others.

Bitcoin Options

Bitcoin Options are contracts that give you the right to buy or sell Bitcoin at a certain price on or before a set date. Options differ from buying Bitcoin directly on your exchange because it deals with the future price of Bitcoin instead of its market price.

Options can be a useful tool for sophisticated investors who want to hedge their investments or speculate on the price of Bitcoin. However, they can be complex and risky, and they're not suitable for all investors.

Bitcoin mining

Investing in Bitcoin can be done by purchasing on a cryptocurrency exchange or through Bitcoin mining. Mining involves solving complex problems with computer hardware, earning Bitcoin as a reward. This process enhances the network's decentralization and security.

However, as more miners join, competition increases, making mining more challenging. Such tendency led to the creation of mining pools, where miners pool their resources to solve problems faster and share the Bitcoin rewards. Joining a mining pool can be a way to earn Bitcoin with less powerful hardware.

Note that mining requires significant hardware investment and high electricity consumption. Therefore, potential investors should consider these costs and their risk tolerance before investing in Bitcoin.

Tips for Investing in Bitcoin

Want to start investing in Bitcoin? There are a few things that will come in handy.

1. Do Your Research

This is the golden rule of investing in Bitcoin. Too often, people venture into the world of Bitcoin investing off recommendations from friends or social media. While you might get lucky, most times, you won’t. Take the time to learn how Bitcoin investing works and what pitfalls you should avoid.

2. Invest Responsibly

Don’t invest any money you need in a hurry. Rent, Tuition, and medical expenses are not money you should put in Bitcoin. There is always volatility in play, and often, it works against you.

3. Diversify Your Investment

Another important tip for investing in Bitcoin is to diversify your investment. This means not putting all of your eggs in one basket. Instead, invest in a variety of different cryptocurrencies. This will help reduce your risk.

4. Have a Long-term Outlook

When investing in Bitcoin, it is important to have a long-term outlook. Don’t expect to make a lot of money overnight. Instead, be patient and wait for the value of Bitcoin to go up over time.

Strategies For Investing in Bitcoin

When investing in Bitcoin, there are two schools of thought – buy and hold or trade frequently. Both have advantages and disadvantages, and which strategy best depends on your investment goals and risk tolerance.

Buy and ‘hodl' Bitcoin

If your goal is to grow your investment over time, buying and holding Bitcoin is a good strategy. The key to success with this strategy is to buy Bitcoin at a low price and hold it for a long time. This way, you can ride out the ups and downs of the market and still come out ahead in the end.

Of course, buying at a low price is easier said than done. One way to increase your chances of buying Bitcoin at a low price is to use dollar-cost averaging. This technique involves investing a fixed amount of money in Bitcoin every month, regardless of the price. By doing this, you're buying Bitcoin over time at an average price, which can help to smooth out the ups and downs of the market.

Trade Bitcoin’s Short-term Volatility

Day traders are looking to make a profit from the volatility in the price of Bitcoin. When the price of Bitcoin goes up, they sell; when it goes down, they buy. The aim is to buy low and sell high or vice versa, making a profit on the difference. Of course, this is easier said than done. Day trading is risky, and even the most experienced traders can lose money. That's why it's important to start small and don’t get greedy with leverage.

If you're considering getting into Bitcoin day trading, here are a few things you need to know.

- You need to have a plan

Before you start day trading Bitcoin, you need to have a plan. This means setting a profit target and a stop-loss. Your profit target should be realistic, and your stop-loss should be tight. For example, you might set a profit target of 10% and a stop-loss of 5%. This means you'll take profits when the price goes up 10% from your buy price, and you'll cut your losses when it falls 5%.

2. You need to be disciplined

Day trading requires discipline. This means sticking to your plan, even when the going gets tough. It's easy to get emotional when the market is volatile, but it's important to remember that you're not trying to make a quick buck. You're trying to make a profit over the long term, and that means sticking to your plan.

3. You need to be patient

Patience is also important in day trading. Just because the market is volatile doesn't mean you need to trade every day. In fact, it's often best to wait for the market to settle down before you start trading.

4. You need to have a system

When it comes to day trading, having a system is important. This doesn't mean you need to have some complicated technical indicator; it just means you need to have a set of rules that you follow.

5. You need to be flexible

Even though you need a system, you also need to be flexible. This means being willing to change your rules if they're not working.

For example, you might find that your system doesn't work well in a ranging market. In this case, you might need to tweak your rules or even abandon them altogether.

Is Bitcoin a Good Investment?

Bitcoin can be a good way to expose your finance to digital currencies. Risk tolerance and financial capacity are two major requirements determining if Bitcoin will be a good investment for you. Volatility can give room for profit on both sides o the market in the short term, and increasing adoption is a catalyst for long-term gains.

Bitcoin vs. Other Investments

Bitcoin is often compared to traditional investments like stocks, gold, and real estate. While there are similarities, key differences exist. As of mid-2023, Bitcoin's performance against other investments has been a mixed bag. In 2020, Bitcoin's price rose more than 300%, outperforming the S&P 500 and gold, which rose by 16% and 24% respectively. However, in the years following, Bitcoin's performance has been more volatile and closely tied to various factors, including the U.S. money supply indicator M2 and the U.S. real interest rate (RIR).

When the “printing press” stopped and M2 collapsed, both gold and Bitcoin weakened at different speeds. The rapid growth of RIR forced by the Fed has caused more damage to Bitcoin than to gold: -68% vs -22% since the bottom of RIR. This confirms the speculative nature of the main crypto.

One of Bitcoin's defining features is its decentralization, meaning it operates without a central authority. Unlike most traditional investments, which are controlled by entities like governments or banks, Bitcoin transactions are processed by a global network of computers.

In summary, Bitcoin's performance against other investments like the S&P 500 and gold has varied in recent years. It has had periods of high returns, but it has also been subject to significant volatility. As always, potential investors should consider their risk tolerance and do thorough research before making any cryptocurrency investment decisions.

The Pros of Bitcoin Investing

Transparency

The crypto market is more transparent and does not need third-party platforms like banks to facilitate transactions. Although the identity of wallet holders is represented by strings and numbers, the details of their transactions can be seen by everyone. This allows anyone from anywhere in the world to invest openly and transparently.

Round-the-clock Trading

Another advantage of investing in Bitcoin is that you can buy or sell around the clock. There is no opening or closing bell, and the market doesn’t close for public holidays.

Fortune Favors the Brave

Even in Bitcoin investing. Bitcoin can give astronomical returns over a longer timeframe, and proper timing can be vital to your investment success. For instance, Bitcoin rallied by over 1,000 % between 2020 and 2021 and over 9,000% between 2015 and 2017.

The Cons of Bitcoin Investing

Understanding Cryptocurrency Takes Time and Effort

Being a new concept for people, learning how Bitcoin works might take time. Anyone willing to venture into Bitcoin investing must spend quality time learning how it works.

Cryptocurrencies Can Be Extremely Volatile

The cryptocurrency market is extremely volatile, and Bitcoin is no exception. The market can swing between overbought and oversold in a few days, and it might not be favorable for you. If you want to make stable and consistent returns over time.

Security Risks

Although Bitcoin investing does not have the risks that come with traditional investing, it has its fair share. Misplacing your private keys or a security hack on centralized exchanges can leave you empty-handed. Newbies are also susceptible to phishing or online giveaway scams.

Is Bitcoin Bad for the Environment?

Bitcoin emits over 50,000 tons of carbon dioxide yearly due to its environmentally-unfriendly consensus mechanism. The proof-of-work consensus uses mining rigs to mine new Bitcoins, which are energy-intensive and environmentally unfriendly. While this is deemed bad, it is still a fraction of what banks and other traditional institutions emit to produce and maintain fiat currencies.

Do Financial Institutions Support Bitcoin?

Yes. Many financial institutions are offering exposure to cryptocurrency holdings. From hedge funds to major banks, cryptocurrencies have fast become a sensation in the financial space. Some notable institutions that have exposure to cryptocurrencies include: JP Morgan, Wells Fargo, Goldman Sachs, and even Barclays are some popular banks that have gotten into crypto niche.

Summary

Bitcoin is slowly becoming a part of our everyday life, and Bitcoin is leading that charge. With many companies integrating Bitcoin payments and some countries even accepting Bitcoin as legal tender, we probably have not scratched the surface of Bitcoin adoption. You can get in on the rave by following some of the methods listed above.

FAQ

How Much Does It Cost to Buy Bitcoin?

There is no minimum amount you can invest in cryptocurrencies. Although some exchanges have minimum deposit amounts, buying Bitcoin through a peer-to-peer system can be done with as little as $1.

Is Investing in Bitcoin a Good Idea?

Yes. You can diversify your investment portfolio with a little exposure to Bitcoin. The level of exposure will depend on your risk tolerance, though.

What Happens If You Invest $100 in Bitcoin Today?

You will have $100 worth of Bitcoin, and the price will depend on the next direction of Bitcoin. The cryptocurrency market is very volatile, so the value of your holdings will fluctuate extremely. It is advisable to invest with a long timeframe in view, except if you want to trade with Bitcoins.

Is It Smart to Invest in Bitcoin Now?

Yes. Like every other market, the cryptocurrency market is reeling from quantitative tightenings by the federal reserves. This has made it lose over 60% of its value. You might as well consider investing in Bitcoin now if you have the knowledge and means to.

How to Invest in Bitcoin Stock

Buying Bitcoin ETF is one of the best way to invest in bitcoin. It is getting exposure to Bitcoin in a traditional investing environment.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.