Swing Trading Options Strategies

Swing trading options strategies are a sophisticated blend of timing and precision. This approach is not merely about capturing profits from the market's ups and downs; it's about understanding the nuanced dance of price movements and harnessing them to one's advantage. By learning these strategies, beginners can make a foray into a realm where strategic planning meets market psychology.

Key Takeaways

- Swing trading is a strategy to profit from short- to medium-term market moves.

- Swing traders can profit from both upward and downward swings.

- As premium costs and time decay can erode profits, options require careful timing and management.

- Risk management in swing trading involves careful selection of strike prices, expiration dates, and use of stop-loss orders.

- Swing trading strategies range from simple directional bets to complex spreads and straddles, suitable for different market scenarios.

What Is Swing Trading?

At its core, swing trading is a strategy employed to profit from price short-term fluctuations in the market. Swing traders take advantage of the “swing” or wave-like movements, often identified through technical analysis.

Typically, “swing trades” last a period of several days to a few weeks. This method is designed to capture gains in a stock, crypto, or any financial instrument within an intermediate time frame. In this article, we will focus on options swing trading.

Understanding Swing Trading

Swing trading is an investment strategy that capitalizes on the inherent oscillations of the financial markets. It operates on the premise that by identifying shifts in market momentum, an investor can enter and exit positions to secure capital gains. This method necessitates an astute awareness of market behavior. It also requires the discipline to await the end of formation of these trends.

The complexity of swing trading also requires a fundamental knowledge of technical analysis. It involves a meticulous examination and interpretation of chart patterns, indicators, and other quantifiable data. It’s different from fundamental analysis, which seeks to ascertain the intrinsic value of a security. Swing trading is more concerned with gauging market sentiment and predicting price trajectories.

Proficiency in interpreting chart patterns is another essential skill for the swing trader. You can learn about some patterns from our guides about cup and handle and bear flag. Patterns work as indicators of the market's collective psychology, providing clues to future price movements.

Similarly, technical indicators such as moving averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) are instrumental in assessing the momentum of a trend and pinpointing potential reversals.

Patience is a virtue of paramount importance in swing trading. The markets do not conform to individual timelines. In fact, significant trends require time to unfold. Premature actions can result in missed opportunities or substantial losses. It is critical for those embarking on swing trading to apply a methodical approach to market entry and exit.

What Are Options?

As we’ll further discuss options swing trading strategies, let’s briefly cover the concept of options contracts.

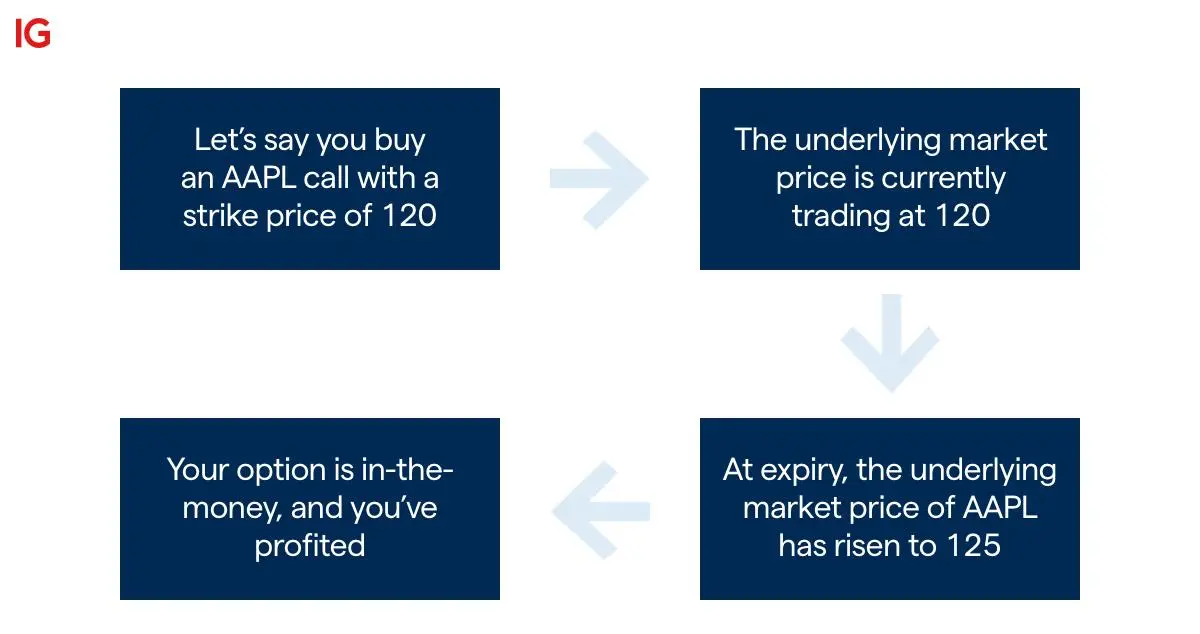

Options are financial derivatives that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) within a certain time frame (before expiration). They are used for hedging against market volatility or for speculative purposes to capitalize on the anticipated direction of a market's movement.

The cost to purchase an option is called the premium, which is affected by factors such as the asset's price, time until expiration, and volatility. Options can expire worthless if not exercised before the expiration date, and their value comprises intrinsic value and time value.

Call Options vs Put Options

There are two primary types of options: calls and puts. A call option gives the buyer the right to purchase an asset at a set price, known as the strike price, within a specific timeframe. Conversely, a put option gives the buyer the right to sell an asset at the strike price before the option expires. Traders choose call options when they anticipate the price of an asset will rise and put options when they believe it will fall.

Can You Swing Trade With Options?

Options are particularly suitable for swing trading. They offer the ability to control a larger amount of the underlying asset with a smaller initial investment compared to buying the asset outright. This leverage makes them an attractive choice for swing traders who can benefit from price swings without committing a large amount of capital. Moreover, options can provide a risk management tool, as the trader's maximum loss is limited to the premium paid for the option.

Pros & Cons Of Swing Trading Options

Swing trading options strategies offer a compelling blend of leverage and flexibility, yet they come with inherent complexities that must be navigated with care.

Advantages

- Enhanced Leverage: Options allow swing traders to leverage their positions significantly. With a smaller investment, traders can control a larger number of shares than they could by purchasing the stock outright.

- Flexibility: Swing traders can use options to profit from both upward and downward price swings. This flexibility is a significant advantage over stock trading, which typically profits only from upward movements unless short-selling is involved.

- Strategic Variety: Options provide a diverse array of strategies that can be tailored to different swing trading scenarios. Traders can use simple long calls or puts to capitalize on directional swings or employ more complex strategies like spreads to manage risk while still participating in market moves.

Disadvantages

- Premium Costs: The cost of the premium can take a considerable bite out of potential profits if the market doesn’t move enough to offset this cost.

- Time Decay: Options are time-sensitive instruments. Their value decreases as the expiration date approaches — a phenomenon known as time decay. For swing traders, who may hold positions for several days to weeks, time decay can significantly impact the profitability of an options trade if the anticipated price swing does not occur promptly.

- Complexity: Swing trading with options requires a nuanced understanding of options pricing and active management. One needs to predict not only the direction and magnitude of a price swing, but also identify the right timing. Managing these trades often involves a deeper knowledge of the Greeks and other options valuation metrics. Thus, it can be challenging for those new to options trading.

How to Swing Trade Options

Select an Asset

The initial step in swing trading options is to identify an appropriate asset. This could be a stock with a history of stable price movements, an ETF that tracks a specific sector or index, or a cryptocurrency such as Bitcoin. The chosen asset should demonstrate sufficient volatility to offer profitable swing trading opportunities without being so erratic as to be unpredictable. Liquidity is another critical factor; it ensures that you can execute trades promptly and at predictable prices.

Choose a Direction

Once an asset is selected, the next step is to ascertain the likely direction of its price movement. This is a pivotal decision as it determines whether to purchase a call option, anticipating a price increase, or a put option, expecting a decline. Employing technical analysis tools is crucial here. Trend lines can show the direction and strength of the market's movement, while moving averages can help smooth out price action to identify trends. Candlestick patterns and price action can also provide insights into market sentiment and potential reversals or continuations in price.

Pick a Strike Price

The strike price is the predetermined price at which the underlying asset can be bought or sold should the option be exercised. The goal is to choose a strike price that is realistic for the asset to reach within your trading timeframe, without paying an excessive premium for the option. Beginners may find it prudent to opt for at-the-money options, where the strike price is close to the current market price, or slightly out-of-the-money options, which are cheaper but require more significant asset price movement to become profitable.

Decide on an Expiration Date

The expiration date of an option is the deadline by which the option must be exercised or allowed to expire worthless. This decision should align with your forecast for how long the swing will last. An expiration date that is too near may result in the option expiring before the expected price move occurs, while a far-off expiration date can be more expensive and may suffer from time decay. A balanced approach for swing trading is to select an expiration date that is several weeks to a few months in the future. Thus, there will be time for the anticipated price swing to occur.

Time Your Entry

Timing your entry in swing trading with options is a critical step that can significantly impact the outcome of your trade. Here's how you can approach this step with more specificity:

- Monitor Technical Indicators. Before you enter a trade, you should be looking at various technical indicators that can signal the beginning of a trend. These indicators might include:

- Moving Averages. A crossover of a short-term moving average above a long-term moving average (golden cross) can indicate the start of an uptrend, while the opposite (death cross) can signal a downtrend.

- Relative Strength Index (RSI). An RSI reading above 70 might indicate that an asset is overbought and could be due for a pullback, while a reading below 30 might indicate an oversold condition and a potential upward reversal.

- MACD (stands for Moving Average Convergence Divergence). A MACD line crossing above the signal line can be a bullish sign, while a cross below can be bearish.

- Volume. An increase in volume can confirm the strength of a price move. For example, a price breakout on high volume is more credible than one on low volume.

- Wait for Confirmation. It's important not to jump in on the first sign of a potential trend. Wait for confirmation from multiple indicators or a second move in the desired direction to reduce the risk of entering on a false signal.

- Set Entry Points. Decide in advance the specific conditions under which you will enter the trade. This could be a particular price point, a certain time of day, or following a specific event.

- Use Price Patterns. Recognize common price patterns that precede significant movements. Patterns such as triangles, flags, and head and shoulders can provide insights into potential breakouts.

- Look for Catalysts. Identify any upcoming events that could serve as a catalyst for price movement, such as earnings reports, product launches, or regulatory decisions.

Execute Your Trade

With a strategy in place, the next step is to execute your trade by purchasing the option at the selected strike price. Discipline is key; adhere to your strategy and avoid emotional decision-making. Utilizing limit orders can help you control the entry price, potentially saving you from overpaying for an option in a volatile market.

Manage the Position

Active management of your position is essential once your trade is in play. This includes setting stop-loss orders to mitigate potential losses and designating target prices at which to take profits. It's also vital to reassess and potentially adjust your strategy in response to significant market shifts. Beginners should be cautious of holding a losing position for too long in the hope of a market reversal that may not materialize.

Swing Trading: Different Options Strategies

Swing trading options strategies are not one-size-fits-all. They range from straightforward directional plays to complex volatility-based approaches, each with its nuances and applications.

Directional Options Strategies

When the market's direction seems clear, traders may opt for directional options strategies. These include purchasing calls when anticipating an uptrend or puts in expectation of a downturn. Such strategies are relatively straightforward to implement.

For instance, a trader expecting a stock to rise after a positive earnings report may buy call options to leverage their position, aiming for higher returns than purchasing the stock outright. Conversely, if a trader believes a stock is overvalued and will soon correct, they might buy put options.

Combination Plays

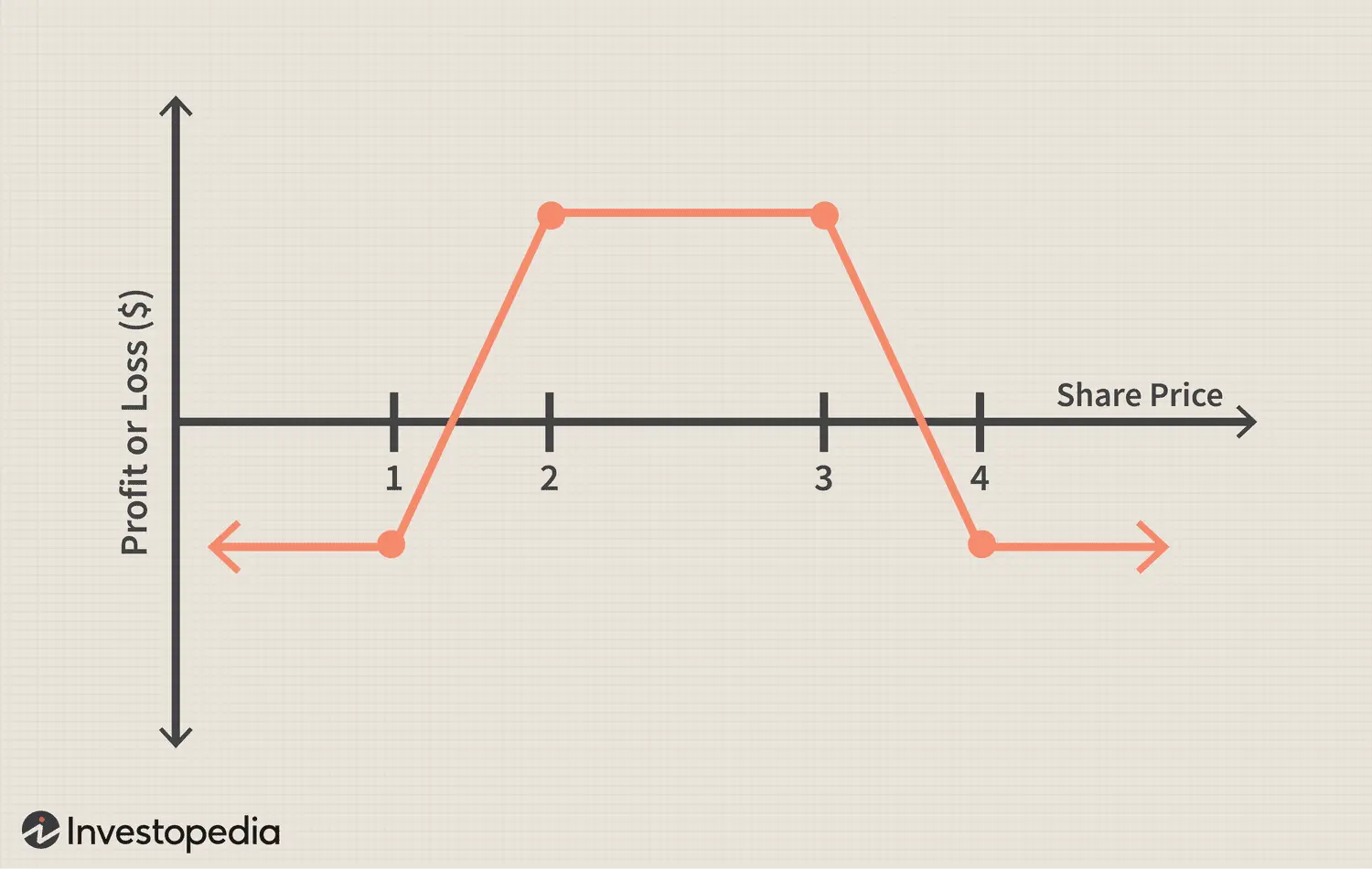

Traders with a more nuanced market outlook might engage in combination plays. These strategies, such as credit and debit spreads, involve simultaneously buying and selling options with different strike prices or expiration dates.

A bull call spread, for example, involves buying a call option at a lower strike price and selling another call option at a higher strike price. It can limit both the potential loss and gain but allows for a strategic approach to a bullish outlook.

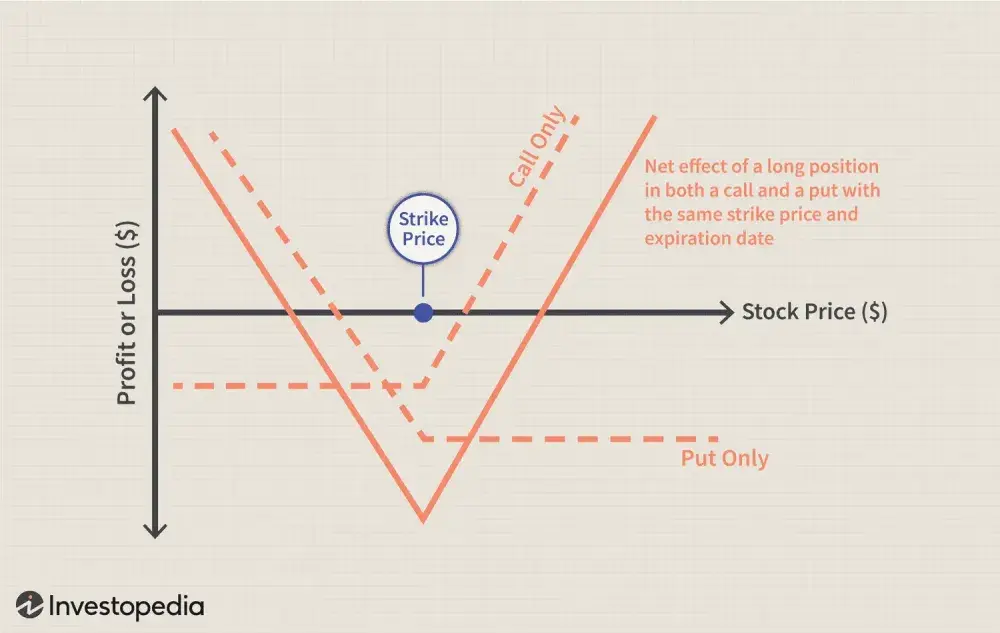

Straddles, another form of combination play, involve buying a call and a put option at the same strike price and expiration date, betting on a significant price movement in either direction, typically around events like earnings reports.

Non-Directional Options Strategies

For markets lacking a clear trend, non-directional options strategies can be employed. They include the iron condor and butterfly spread, designed to profit from the underlying asset's price staying within a specific range.

An iron condor, for instance, is created by combining a bear call spread with a bull put spread, setting up a position that profits if the asset remains between the two spreads.

Volatility Combination

Some traders focus on volatility rather than price direction. A classic volatility strategy is the long straddle. This strategy can be particularly effective when a trader expects a substantial move in the underlying asset's price, but is uncertain about the direction. It's a bet on market instability, often placed ahead of major announcements or economic events that are likely to cause significant price action.

Bottom Line

Each swing trading options strategy presents a compelling avenue for traders who seek to profit from market movements over a short to medium time frame. These strategies can offer flexibility, leverage, and the potential for significant returns, but they also require a commitment to continuous learning and disciplined risk management. For beginners, the key to success in swing trading options lies in a solid understanding of market trends, option dynamics, and a well-constructed trading plan.

As with any trading approach, there is no one-size-fits-all strategy. Each trader must develop a system that aligns with their risk tolerance, investment goals, and market perspective. It's also vital to stay informed about market conditions and to be adaptable as strategies that work in one market environment may not be successful in another.

FAQ

How Many Options Swing Trades Can I Do in 1 Week?

The number of swing trades you can execute in a week is not limited by any regulatory standard. But it is constrained by your trading strategy, risk management rules, and the capital available. Beginners should focus on quality over quantity. Ensure that each trade is well-thought-out and aligns with their overall trading plan.

Is Option Trading Good for Swing Trading?

Yes, option trading can be an excellent method for swing trading. Options provide the flexibility to make profits from price swings without requiring a significant investment in the underlying asset.

Which Pattern Is Best for Swing Trading?

There is no single “best” pattern for swing trading. Different patterns can be effective in different market conditions. However, some common patterns that swing traders look for include flags, pennants, breakouts, and retracements. The key is to identify patterns that signal a continuation or reversal of a trend within the time frame of your swing trade.

Why Is Swing Trading Risky?

Swing trading involves risks such as market volatility, the possibility of gap events (where prices change dramatically with no trading in between), and the risk of losses, especially when using leverage through options. The time-sensitive nature of options means that timing errors can lead to the complete loss of the trade's investment, known as the premium.

Swing Trading vs. Swing Options Trading

Swing trading is a strategy that focuses on taking advantage of short- to medium-term price movements in stocks or other securities. Traders using this strategy typically hold positions for several days to several weeks, aiming to profit from price “swings” in the market.

Swing options, on the other hand, are a type of option contract used in commodity markets that give the holder the flexibility to adjust the quantity of the commodity that is delivered or received under the contract. This type of option is particularly useful in markets where demand can fluctuate significantly, such as natural gas or electricity.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.