Strangle Options Strategy: What Is It & How It Works

Making a profit on a cryptocurrency market is not an easy task, considering its volatility and unpredictability. However, there are instruments that can significantly improve investment portfolio performance. One such instrument is options, which is also perhaps the most undervalued instrument in this market.

There are various option trading strategies that provide substantial revenue potential and allow investors to manage risks. In this article, we will explore the strangle strategy. Read on to learn about different variations of this strategy, their pros and cons, and how to employ it.

Key Takeaways

- Strangle is a non-directional strategy that involves purchasing one put and one call option

- Long strangle variation allows option buyers to benefit from the price swing in either direction

- Option sellers can take advantage of short strangle on the flat market Short strangle is riskier than a long strangle since its potential losses are unlimited

- Compared to a similar strategy, straddle, strangle has a relatively low entry barrier for traders

What is Strangle Options Strategy?

The strangle option strategy involves buying or selling a call option and a put option on the same underlying cryptocurrency with identical expiration but different strike prices. It allows buyers to profit from a significant price movement of a crypto asset in either direction, and sellers — from the price fluctuation within a range.

It is worth noting that strangle is not a directional strategy. Therefore, investors do not need to predict the direction of price movement. The position can be profitable no matter in which direction the price of the cryptocurrency moves.

How a Strangle Works

While strangle lets all investors gain from the price changes in either direction, the strategy works differently for sellers and for buyers. Buyers executing a long strangle are betting on a significant downward or upward price movement in the underlying asset. On the other hand, sellers expect the underlying asset to trade in a narrow range. This way, they will profit by collecting the premium from the options' sale.

Short strangle is considered to be riskier, since the rise in the price of the crypto asset practically has no limit. Below, we will discuss both long and short strangle risks and potential profit.

What is Long Strangle Options Strategy?

A long strangle options strategy is a variation of the strangle strategy where an investor buys both a call and a put on the same underlying cryptocurrency. The options have different strike prices but the same expiration date. The goal is to profit from a significant move in the cryptocurrency price, regardless of which direction it moves.

If the asset price makes a large price swing in either direction, one of the options will be “in the money.” Therefore, its value will exceed the premium paid. This fact allows the investor to either sell the option at a profit or exercise it. At the same time, the other unprofitable option will not be exercised.

However, it is also possible that the price of the underlying asset stays between the two strike prices of the options. In this case, both options will be left unprofitable, and the trader will lose the value of the premium paid for the options.

How Does It Work?

Outlook

A long straddle is usually used when an investor expects an asset price to make a large movement in either direction in the short term.

Strategy

The trader simultaneously buys a call option and a put option on the same asset, with the same date and different strike prices. For example, if BTC is trading at $20,000, an investor can buy a $25,000 call option for $1,000 and a $15,000 put option for $500. The total premium paid is $1500.

Maximum Loss/Risk

The maximum loss for a long strangle is limited to the premium paid for both options. If the coin price remains relatively flat over the short term, both options will expire worthless, and the investor will lose the premium paid.

Profit

The profit potential for a long strangle is unlimited. If the coin makes a significant move in either direction, one of the options will be in-the-money and have a value greater than the premium paid, resulting in a profit for the investor.

Breakeven Asset Price at Expiration

Breakeven point calculation in the long strangle should include the strike prices of both options, the cost of buying options, and the number of purchased contracts. It is also necessary to take into account the broker's commissions.

For example, the asset price rises much higher than the strike price of a call option. Then, the breakeven point will be equal to the strike price of the option plus the premiums and the broker's commission. Imagine also the opposite situation, when the price of the asset drops significantly below the strike price of the put option. The breakeven point will be equal to the strike price of the put option minus the cost of buying the options and the broker's commission.

Breakeven 1 = put strike – premium paid – fees

Breakeven 2 = call strike + premium paid + fees

You can either calculate the breakeven point for each option contract or the total for the strategy, depending on your specific goals and objectives.

Payoff Diagram

The payout chart for a long strangle is nonlinear and has two break-even points. The chart shows a loss if the price of the cryptocurrency remains unchanged and a profit if the price makes a significant movement in either direction.

What is Short Strangle Options Strategy?

Another variation of the strategy is a short strangle, in which an investor sells a call option and a put option on the same underlying currency with different strike prices but the same expiration date.

How Does It Work?

Outlook

Unlike a long strangle, a short strangle is used when an investor expects that the price of a cryptocurrency will not change significantly in the short term.

Strategy

The short strangle strategy is even simpler than the long strangle. Executing a short strangle, the trader sells option contracts and receives income in the form of the premiums for the sold options. Thus, with a slight change in the price of the asset, sold options will not be exercised. As a result, the trader will receive a full profit from the options' sale.

Maximum Loss/Risk

The maximum loss for a short strangle is potentially unlimited. If the asset price makes a significant move in either direction, one of the options will be “in the money.” Therefore, the investor will be obliged to buy or sell the underlying cryptocurrency at the strike price (or pay the difference in price).

Profit

Unlike the loss, the profit in a short straddle is limited — to the premium received upon the sale of both options. If the price of the underlying asset stays between the two strike prices at the time of expiration, both options lose value, and the investor retains the premium received.

Breakeven Asset Price at Expiration

The breakeven point for the short strangle strategy is calculated in the same way as for the long strangle. The only difference will be in the fee calculation. That is, if the current market price of the asset is above or below the general breakeven point, then the trader will begin to bear losses. If the market price is within the range, then the strategy will not bring losses or profits.

Breakeven 1 = put strike – premium paid + fees

Breakeven 2 = call strike + premium paid - fees

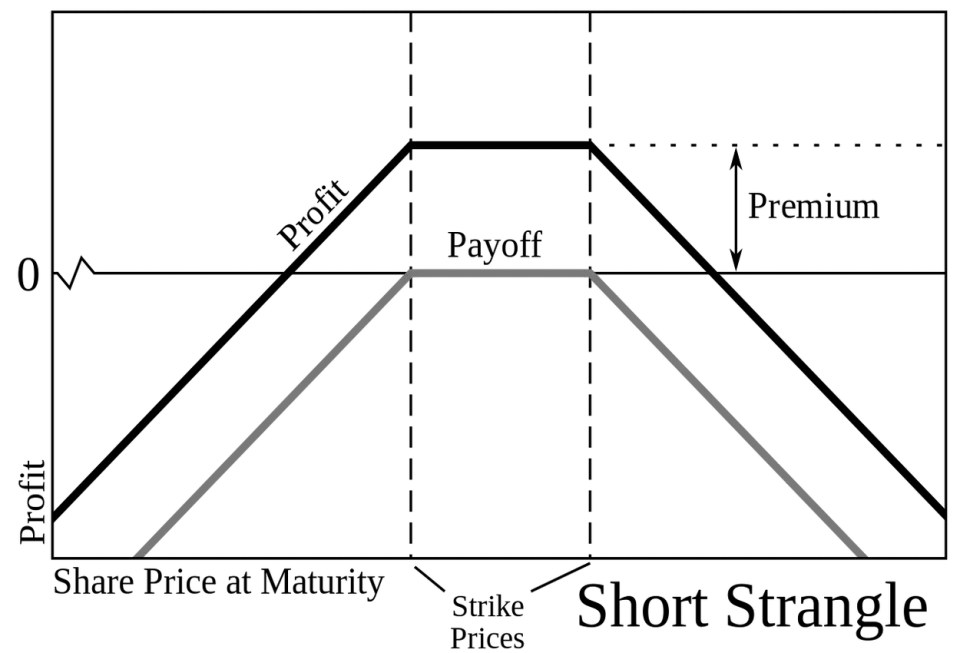

Payoff Diagram

The payout chart for the short strangle is nonlinear and has two break-even points. The chart shows a profit if the stock remains between the two strike prices at expiration and a loss if the stock makes a significant move in either direction.

Pros and Cons of Strangle

Long Strangle and Short Strangle strategies have their pros and cons.

Pros Explained

A long strangle advantages:

- Provides flexibility and opportunity to profit from asset price movements in any direction

- Allows protecting positions in case of unexpected movements of the asset price in the market

- Has unlimited potential profits.

A short strangle advantages:

- Allows capitalizing on low market volatility and the expectation that asset prices will not change significantly in either direction;

- Allows collecting two premiums;

- Can be used to protect positions to reduce risk in case the trader expects low volatility in the market.

Cons Explained

A long strangle disadvantages:

- May be costly to implement and therefore has a high entry barrier.

- Can lead to losses if asset price stays stagnant.

- Can lead to losses in case of high volatility, no matter if there is a price swing.

A short strangle disadvantages:

- Can result in losses if asset prices move strongly in either direction,

- Since it is extremely risky, the cost of buying options to protect a position in the event of an unfavorable price movement can increase the overall cost of the strategy and reduce the potential profit.

- May not yield significant profits since asset prices must be in a narrow range.

Examples

Now that we have covered the types of strangles and their features, let’s see how the strategy can be used in cryptocurrency trading.

Long Strangle Example

Let’s say that Bitcoin is currently trading at $20,000. Suppose an options trader believes there will be a swing in price but is unsure in which direction. The trader decides to execute a long strangle by buying a call option with a strike price of $22,000 for $400 and a put option with a strike price of $18,000 for $300. The total premium paid is $700.

If Bitcoin stays at $20,000 or the price moves only a little, both options will expire worthless, and the trader will lose the premium paid. However, if Bitcoin moves significantly in either direction, the trader can gain on their positions.

For example, if Bitcoin rises to $24,000, the call option will be in-the-money and worth approximately $2,000, while the put option will expire worthless. The trader's profit would be $1,300 ($2,000 – $700 premium paid). If Bitcoin drops to $16,000, the put option will be in-the-money and worth approximately $2,000, while the call option will expire worthless. The trader's profit would be $1,300 ($2,000 – $700 premium paid).

Short Strangle Example

Again, we suppose that Bitcoin is currently trading at $20,000. A trader believes that Bitcoin price will stay relatively flat over the short term. The trader decides to execute a short strangle by selling a call option with a strike price of $22,000 for $400 and a put option with a strike price of $18,000 for $300. The total premium received is $700.

If bitcoin stays at $20,000 or its price moves slightly within range, both options will expire worthless, and the seller will profit from the premium received. However, if Bitcoin moves significantly in either direction, the trader could lose money. For example, if Bitcoin rises to $24,000, or falls to $16,000 a call or put option would be in the money and the trader would have to pay about $2,000 to pay back the option.

Strangle vs. Straddle: What Are the Differences?

Although strangle and straddle options strategies are similar, and both involve buying or selling a call option and a put option on the same underlying cryptocurrency, there is still an important difference between them. It lies in the strike price of the options.

A strangle strategy involves buying or selling a call option and a put option on the same underlying cryptocurrency with different strike prices. In contrast, a straddle involves buying or selling options with the same strike price.

Straddle has a higher probability of profit in case of a strong asset price movement in either direction. At the same time, it also has a higher cost of entry. The reason is that Straddle uses options with close strike prices, which are more expensive.

Overall, the cost of the strategy depends on the specific market situation and the price volatility of the asset. If volatility is high, then the cost of options in both strategies can be high.

Conclusion

The strangle option strategy is very flexible since it allows profiting from both the upside and downside swings in the underlying crypto asset. Therefore, strangle can serve as an effective tool in protecting your positions from market uncertainty.

A long strangle involves buying a call option and a put option on the same underlying stock with different strike prices, while a short strangle, on the other hand, involves selling a call option and an option.

One of the main advantages of strangle is its relatively low cost of entry compared to its counterpart — straddle, which has a higher barrier of entry.

It is worth remembering that the strangle strategy requires knowledge and experience from a trader. It is worth noting that the choice of optimal strike prices of options depends on the specific market situation and the expected movements in the price of the asset. The trader must soberly consider his financial capabilities and risks.

FAQ

How Do You Calculate the Breakeven of a Strangle?

The breakeven of s strangle is calculated differently for a call and for a put option. For a put option, you need to extract the premium from the strike price. And vice versa, for a call option, you need to add the premium to the strike price. The fees are either deducted or added to the formula depending on which side of the trade you take — a seller or a buyer.

How Can You Lose Money on a Long Strangle?

A long strangle will result in a loss for the option buyer if the stock price remains relatively flat over the short term. If you are the option seller, then you will incur losses in the opposite situation when the price goes out of the narrow range between the two breakeven points.

What Is a Strangle in Trading?

Strangle is a non-directional trading strategy that involves buying or selling both a call option and a put option on the same underlying stock, with different strike prices and the same expiration date.

How Does a Strangle Make Money?

Strangle brings you a profit when the price of a cryptocurrency makes a significant movement in either direction, resulting in one of the options being in the money and having a value in excess of the premium paid. On the other hand, if you execute a short strangle, the relative flat prices will bring you profit in the form of premiums.

How Do I Hedge a Long Strangle?

Hedging long strangle is not necessary because this strategy allows you to earn from the movement of the price of an asset in either direction.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.