Scaling Ethereum - The Kryptonite of Blockchain Technology

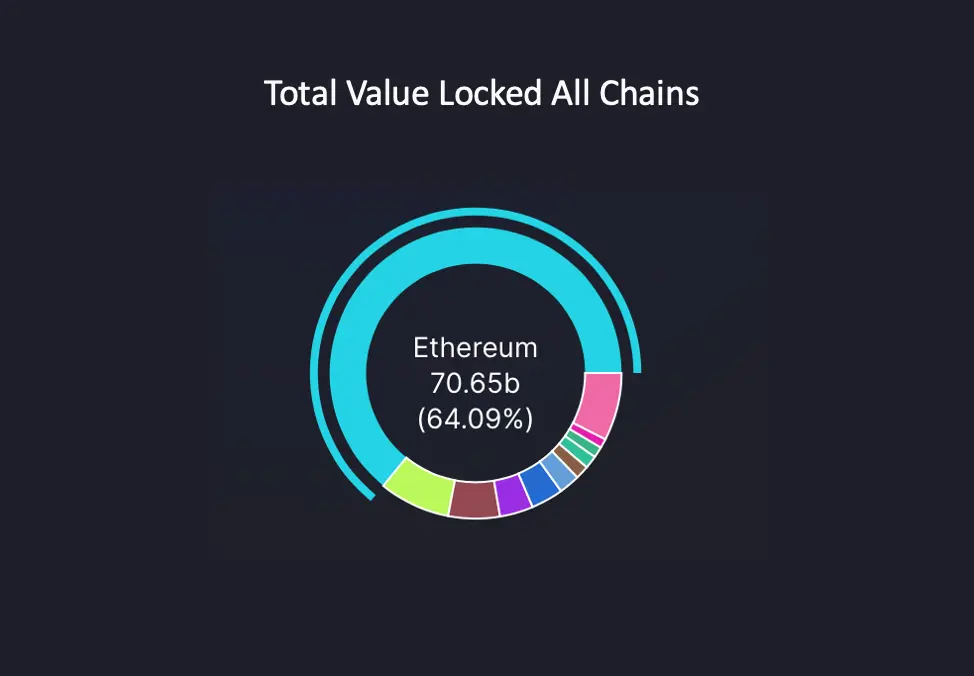

The network that powers the second most popular cryptocurrency — Ethereum — has seen a steady increase inflow of different projects resulting in augmented use cases for its native digital currency. Being so popular, the Ethereum network can't keep up with the number of transactions carried out by users. Thus, interacting with the blockchain is often subject to high transaction fees and rather long waits.

If billions of users worldwide should benefit from the blockchain growing to support web 3 applications and finance, Ethereum network scaling is necessary.

Scalability has been a big issue in the crypto market. Transactions on the network have been outpacing the number of transactions carried out per second (TPS) by a large margin. This results in networks operating at their maximum capacity. As networks draw closer to their maximum capacity, there is reduced transaction speed, affecting the overall users’ experience.

Simply put, scalability is the ability to adjust to the growth. In case of blockchain platform the enhanced scalability would mean the ability to process larger amounts of transactions at a given time without suffering additional congestion. However, it’s often thought that for a particular blockchain network to be scalable it must compromise on decentralization.

Since 2015, Ethereum has undergone several EIP upgrades focused on scalability issues, at the same time influencing its cryptocurrency price. Serenity, which began with Istanbul in October 2019, paved the way for the Ethereum 2.0 upgrade. The main aim of the EIP changes in Serenity is to improve Ethereum scaling. This is not so easy as developers have to choose between transaction speed, network independence, and network security. These internal core structures project a trilemma.

Scalability Triangle

This is a hypothetical triangle illustrating three internal core structures of any digital currency: decentralization, speed, and security. Developers of any digital currency are confronted with a trilemma of having two of these core structures emphasized and the third degraded. That is, a network can be well decentralized and secured but not fast, or can be secured and fast but not well decentralized. Hence the trilemma.

Ethereum developers attempt to keep the network decentralized and secure, but also increase the transaction speed. There are centralized means that could help in Ethereum scaling, but this is not a suitable way forward for Ethereum or any smart-contract platforms as it defeats the goal of decentralization entirely. Consequently, the way forward comes in two folds:

- Create new networks that can manage more activity and compete with Ethereum.

- Develop complementing networks that can accommodate Ethereum's excess capacity.

These two proposed scaling solutions differ in mechanism of operation and structure, but both have a single goal which is to improve transaction speed and beat down the Ethereum transaction cost.

Competing Networks

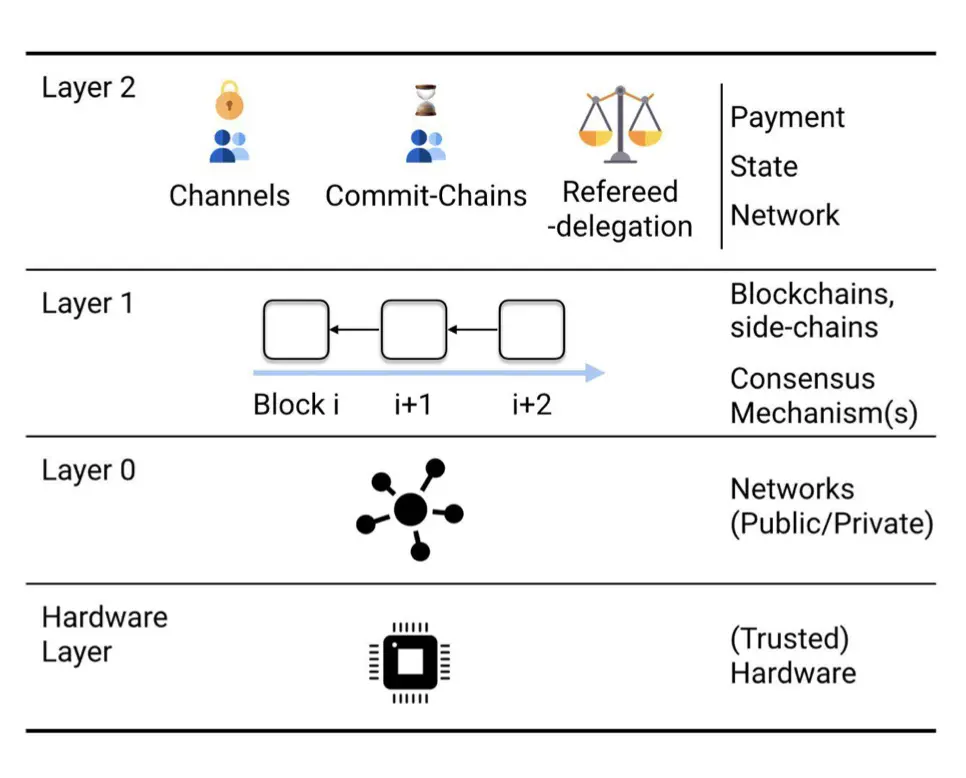

Networks that fall into this category would be Layer 1 blockchains — a base protocol that allows for the integration of other protocols. Layer 1 blockchains hold and keep users' funds safe, and complete all transactions on the chain. The Ethereum network is a Layer 1 blockchain.

Several blockchains do what Ethereum does but on an entirely different network. They operate on a unique system of design that allows higher throughput, beating down the cost of transactions at the expense of decentralization (increased centralization).

Several Layer 1s have surfaced on the crypto market in the past 11 months, having a total volume that sprung up to approximately $75 billion within that same period. The top competitive networks are Binance Smart Chain, Solana, Terra, and Avalanche, now having substantial market caps on their own.

These statistics attract users and developers, and Layer 1s compete for them. In most cases, for other competing networks to have the upper hand, they must be EVM compatible.

Ethereums' Transaction Brainbox

The EVM (Ethereum Virtual Machine) performs the computation involved to complete any transaction. In order to tilt the scale in their favor, the competitors ensure that their network is compatible with EVM; hence, Ethereum applications can be easily moved to a new Layer 1 network by Ethereum developers.

A good reference is Binance Smart Chain (BSC) which has a network that is EVM compatible, altering it to permit high throughputs and less expensive transactions. The BSC usage drastically increased across several decentralized finance applications.

Complementing Networks

In the crypto market, sidechains are closely related to Layer 1s and they are EVM compatible. Consider a sidechain to be a replica of a 'mother' blockchain that facilitates asset transfers to and from the mother chain. It's essentially an alternative to the parent chain that creates a new network with its block generation algorithm (consensus mechanism). Setting up a way of moving assets across the chains is required when integrating a sidechain into the main chain.

Sidechains are not Ethereum network rivals but are rather built to share the burden of excess capacity.

A sidechain called Ronin is a good reference. The non-financial token (NFT) is a sidechain on the Axie Infinity, a game based NFT on Ethereum that allows for the migration of NFTs and other tokens to a low cost environment from Ethereum. This is as a result of the prohibitive expenses incurred resulting from high Ethereum transaction fees. The game became more popular due to its easier accessibility by users.

Polygon POS

One of the public Ethereum scaling solution is Polygon, akin to a base network that is EVM compatible in that it maintains a specific link with Ethereum. Polygon was established as a structure to assist scale, not as a competition to cart away users from the Ethereum platform.

The vision of the polygon team is not to replace Ethereum but rather to enhance it by taking some of the transactions off the Ethereum chain in order to relieve its congestion, hence contributing to its scalability similarly to L2s.

All existing Ethereum features are supported by Polygon, including quick transactions that are as well less expensive, thanks to a customized implementation of a framework called Plasma with an account-based implementation.

Polygon POS is currently leading the industry with a value of over $5 billion distributed across 100 applications in the gaming world and the decentralized finance, like the Sushiswap and Aave which are one of the more popular Dapp running on Polygon.

Layer 2s

In line with the goal of Ethereum’s scaling, arguably the most promising scaling solution is the system of L2 networks. Layer 2 networks complement respective layer 1s, i.e. Ethereum, by processing multiple transactions off the main chain and then submitting them to layer 1 in bulk. This doesn’t really decrease the fees paid on the layer 1 network, but since the transactions are sent to it bundled up, the transaction fee is being split among more transactions.

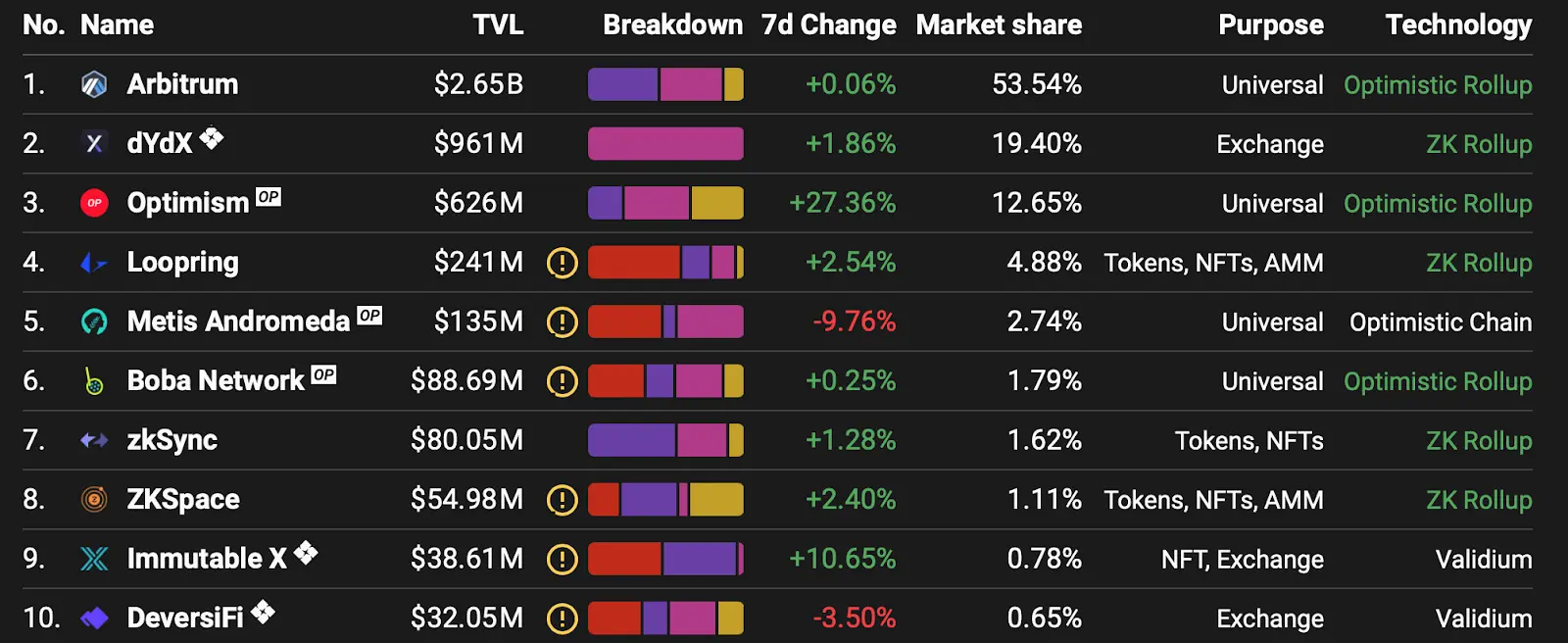

Make no mistake though, layer 2s don’t automatically mean negligible transaction fees. For instance, adding liquidity to Uniswap via its Arbitrum integration costs up to $20 in ETH at the time of writing this article. While this is not too little, it’s still much less than using the Ethereum L1 and spending over $100 for a single transaction.

Crypto market, including Ethereum key figure, Vitalik Buterin, thinks that the combination of layer 1s and layer 2s is the remedy to Ethereum’s scalability woes even after Ethereum fully migrated to proof of stake. There is a promise of 300,000 transactions per second throughput capabilities for Ethereum’s blockchain alone, but it’s questionable if even that could secure its mass adoption.

In summary, layer 2s are self-contained ecosystems that are constructed on layer 1s and rely on them for security. Essentially, a native token is not required for layer 2, however, one of the popular Ethereum layer 2 platforms, Optimism, just airdropped a digital currency to its users.

Rollups

This concept behind layer 2s is quite simple. Transactions are packaged and processed on a different layer and the revised data of the transactions are migrated back to Ethereum. As the name suggests, they 'rollup' or bundle transactions. It will be expensive for Ethereum to execute a thousand transactions on Uniswap, one at a time. It’s cheaper to execute transactions on a rollup (layer2) and then moved them back to Ethereum in bulk.

The difference between sidechains and layer 2s is that layer 2s rely on layer 1’s network security, which is a crucial point for this setup to work. As a matter of fact, security and immutability is often the single most important reason why people and companies use blockchains.

Circling back to the rollups design, Ethereum is faced with the challenge of determining the accuracy and validity of transactions moved back to the base layer. The big question is how can Ethereum ensure that the main network is not infiltrated by scammers? This is ensured by an added layer to the base.

There are two different ways about this: Optimistic rollups and ZK rollups.

Optimistic rollups

This type of rollup indiscriminately assumes the validity of a result when Ethereum gets it back. Simply put, rollup operators upload unrestricted data and by assumption take it as correct — an upbeat perspective, to be sure.

However, there are techniques to combat scams. There are observers on the network that inspect and report fraud. Once a withdrawal is made, it is not immediately executed, this provides the observers with enough time to report scams. The transparency of blockchains with the transactions carried out on the network makes this possible. If fraud is established mathematically by any observer, providing evidence, any transaction with suspected fraud is reversed, the illegal actor is penalized and the observer is rewarded.

The downside is a little lag when funds are moved from the second layer to Ethereum while watchers look for any signs of fraud. This can take up to a week in some situations after which the withdrawal is sent to the user's Ethereum wallet. Although it is expected that these delays decrease with time. Optimistic rollups provide a scaling solution to Ethereum and aid the feasibility of Ethereum scaling.

L2 Networks by TVL

ZK rollups

ZK rollups are quicker and readily confirm if a transaction is authentic or not. Unlike Optimistic rollups, ZK rollups verify every new transaction and submit validity proofs to layer 1 right upon the check. When transactions are carried out, the Ethereum smart contract receives a validity of proof together with the outcome of transactions. The Ethereum network is able to judge how valid a transaction is making the network somewhat immune to fraud. The movement of funds between the ZK rollup and the main network to the user’s Ethereum wallet is almost instantaneous because a fraud window is no longer required.

While rapid payout and quick payment execution look appealing, there are several drawbacks to ZK rollups. To begin with, the generation of proof of authenticity requires a lot of computing power, necessitating the use of powerful processors. EVM compatibility is more challenging, due to the intricate nature of proof of authenticity, restricting the variety of crypto contracts adopted by ZK-rollups. Even though currently, optimistic rollups solve Ethereum's scaling challenges at the moment, ZK-rollups promise to be a more beneficial and lasting technological answer in the long run.

Scaling solutions are inevitable for the blockchain systems to grow, allowing numerous platform participants to transact efficiently within a short period of time.

Ending Thoughts

Layer-1 blockchains like Ethereum are slow since every operation must be verified by the majority of nodes for transactions to be executed on the main network. New on-chain consensus mechanisms, like sharding and different Proof-of-X governance, are being suggested and developed all the time. With varied compromises, they make layer-1 blockchains faster, but they can't address the fundamental restrictions of on-chain consensus.

We need to explore scalability solutions beyond modifying the on-chain consensus in order to achieve Ethereum scaling of the blockchain systems. This way, we preserve decentralization, privacy, while not breaching the trust.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.