Protective Put: How It Works, and Examples

What Is a Protective Put?

Cryptocurrency investors often experience significant fluctuations in the value of crypto assets. As a result, they are forced to seek strategies that would safeguard their investments. This is where the concept of a protective put comes into play.

A protective put is a risk-management technique used by market participants to secure their holdings in a base asset. Essentially, it involves purchasing a put contract to insure the value of the investment against potential losses.

Key Takeaways

- Protective puts serve as insurance for investments, offering protection against market downturns.

- The strategy involves buying a put option in conjunction with holding the base asset, such as Bitcoin.

- Strike prices, premiums, and expiration dates are crucial factors to consider when executing a protective put.

- While protective puts can mitigate risks, they also have drawbacks, such as the cost of the premium and time decay.

How a Protective Put Works

To better understand the mechanics of a protective put, it is essential to first grasp the concept of a put contract. A put option is a contract that grants the owner the right, but not the obligation, to sell an asset at a predetermined price (the strike price) before a specified date (the expiration date).

Breaking Down a Protective Put

When implementing the strategy, an investor acquires a put option on the same base asset they already own. In the case of holding such a cryptocurrency as Bitcoin, a market participant would purchase a Bitcoin put contract. Thus, the put helps the investor to hedge the position by providing downside protection should the price of Bitcoin decline.

Strike Prices and Premiums

There are some critical factors to consider before implementing protective put:

- The strike price, or the exercise price at which the put option can be exercised.

- The premium, or the cost of the put contract.

Typically, market participants will choose a price close to the current market price of the base asset. For instance, if the current price of Bitcoin is $20,000, an investor might select a strike price of $19,000 or $20,000.

Potential Scenarios With Protective Puts

As for the possible outcomes of utilizing protective puts, there are several scenarios to consider:

- If the price of Bitcoin increases, the put contract will expire worthless. However, the market participant still benefits from the appreciation of their base asset.

- In case the price of Bitcoin declines, the put contract can be exercised, effectively limiting the investor's losses.

- And in the scenario when Bitcoin remains stable, the market participant will only incur the cost of the put contract premium.

Real-World Example of a Protective Put

Consider a trader, Alice, who owns one Bitcoin valued at $20,000. Concerned about potential declines in its value, she decides to use a protective put strategy. She purchases a put with a $19,000 exercise price and a three-month expiration date, paying a $500 premium.

Possible outcomes for Alice's protective put based on Bitcoin's price movement:

- Bitcoin increases to $22,000 by expiration date → the put expires worthless. Alice loses the $500 premium but benefits from the $2,000 appreciation in Bitcoin's value.

- Bitcoin declines to $18,000 by expiration → Alice can exercise her protective put, selling her Bitcoin for $19,000. She limits her losses to $1,000 (plus the $500 premium) instead of a $2,000 loss without the protective put.

- Bitcoin remains stable at $20,000 by expiration → the put expires worthless, and Alice incurs a $500 loss from the premium but retains her Bitcoin's value.

This example demonstrates how the strategy can provide downside protection for market participants. It effectively helps to mitigate potential losses in investments like Bitcoin, but at the cost of the option premium.

Protective Put Payoff Diagram

A payoff diagram can be an invaluable tool in visualizing the performance of a protective put. The diagram illustrates the maximum and minimum profits that can be realized, along with the breakeven point, which is the price at which neither a profit nor loss is incurred.

Entering a Protective Put

When initiating a protective put, the market participant should remember that first they need to determine the desired level of protection. This is contingent upon factors such as the chosen strike price and the cost of the put contract premium. Next, the investor must select an appropriate expiration date, which can impact the premium and the potential for time decay.

Exiting a Protective Put

In the event that the price of Bitcoin declines, the market participant can exercise the put option, effectively mitigating their losses. Conversely, if the price of Bitcoin appreciates, the investor may opt to let the put contract expire worthless, profiting from the increase in value of the base asset. Additionally, the investor can also sell the put contract prior to expiration, potentially profiting from an increase in implied volatility or changes in the market price.

Time Decay Impact on a Protective Put

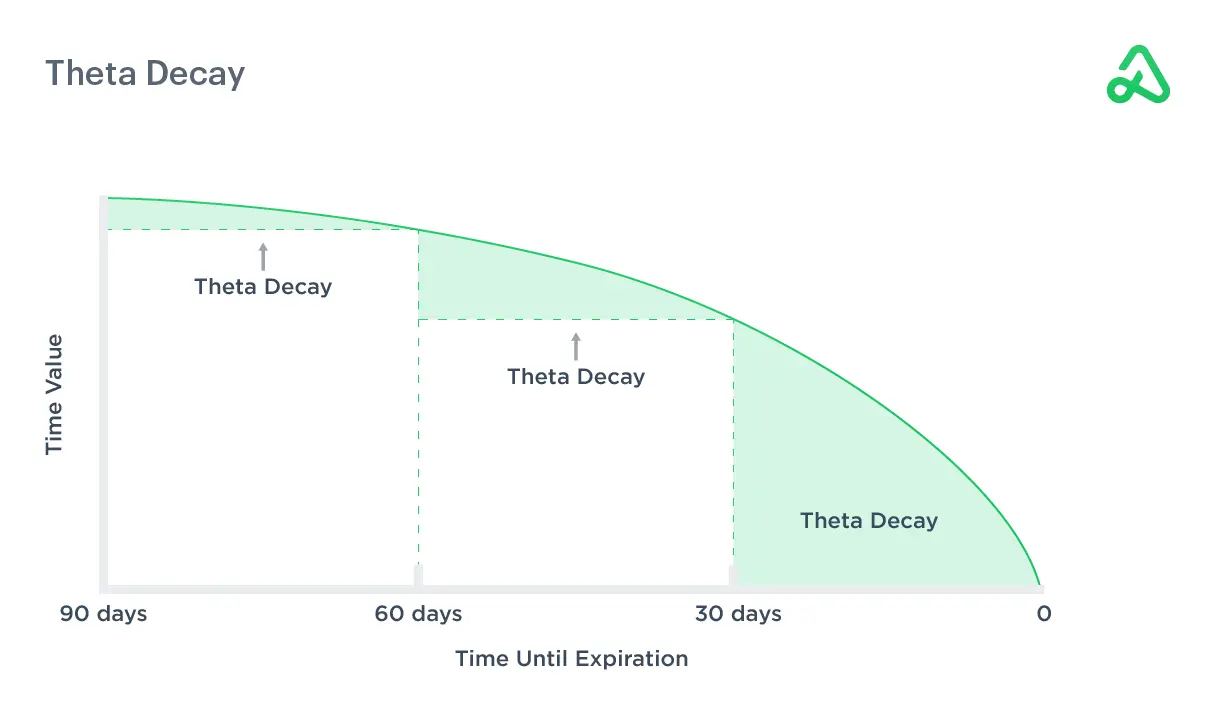

As mentioned above, time decay plays a significant role in the value of a protective put. With the passage of time, the value of the put option typically decreases, especially as it approaches its expiration date.

This is known as time decay or “theta”. It is essential for investors to factor in time decay when selecting an expiration date for their protective put.

Implied Volatility Impact on a Protective Put

Implied volatility reflects the market's expectation of future price fluctuations in the base crypto asset. Its impact on a protective put is crucial to consider.

When implied volatility increases, the put option's value typically rises, as the market expects larger price swings. This may allow the market participant to sell their put at a profit before expiration. On the other hand, when implied volatility decreases, the put contract's value may decline, making the strategy less effective in providing downside protection.

Adjusting a Protective Put

There may be instances where an investor needs to adjust their protective put position. This can be done by rolling the strategy or by altering the exercise price or expiration date. Adjustments should be made based on changes in market conditions, the investor's risk tolerance, or alterations in the base asset's value.

Rolling a Protective Put

Rolling the strategy involves closing the existing put option and simultaneously opening a new put with a distinct exercise price, expiration date, or both. This strategy enables the market participant to maintain their downside protection while adjusting the position based on market conditions or changes in their investment goals.

Hedging Strategies for Cryptocurrencies

In addition to the protective put strategy, there are other methods that investors can use to hedge their cryptocurrency investments. Here are a few examples:

- Diversification. By allocating funds across various cryptocurrencies or different asset classes, market participants can reduce the impact of a decline in the value of a single asset on their overall portfolio.

- Collars. A collar strategy involves simultaneously purchasing a put contract and selling a call contract on the same base asset. This can create a range in which the asset's value can fluctuate, limiting both downside risk and upside potential.

- Options spreads. Spreads are combinations of contracts positions designed to profit from specific market conditions or to hedge existing positions. Examples of options spreads include vertical spreads, iron condors, and butterflies.

- Futures contracts . A futures contract is an agreement to buy or sell an asset at a predetermined price and future date. By entering into a futures contract, an investor can lock in a price for their asset. Thus, they effectively hedge against potential price fluctuations.

- Short selling . In the context of cryptocurrencies, short selling involves borrowing a particular cryptocurrency, selling it at the current market price, and repurchasing it later at a lower price. This strategy allows the market participant to profit from the decline in the value of the cryptocurrency.

Pros & Cons

Like any other trading strategy, protective put has both its advantages and disadvantages.

Pros

- Downside protection. Protective puts offer a safety net against declines in the value of the base asset.

- Profit potential. If the base asset appreciates, the investor can still benefit from its increased value.

- Flexibility . Protective puts can be adjusted or rolled to accommodate changes in market conditions or investment goals.

Cons

- Premium cost. The cost of the put contract premium can erode profits or exacerbate losses.

- Time decay. As the expiration date approaches, the value of the put contract may decrease due to time decay.

Protective Put vs. Covered Call

While both protective puts and covered calls are popular options strategies, they serve distinct purposes and are best suited for varying market conditions.

A protective put is ideal for investors seeking downside protection, and it works well in bearish or volatile markets. On the other hand, a covered call involves selling a call contract while holding the base asset, generating income from the option premium. This strategy is more suitable for bullish or neutral market conditions.

Protective Puts and Married Puts

A married put is similar to a protective put, but with one key difference. In a married put strategy, the investor purchases the put contract at the same time they acquire the base asset. This strategy effectively “marries” the two transactions, providing immediate downside protection.

In contrast, a protective put is typically implemented after the market participant has already acquired the base asset.

Frequently Asked Questions (FAQs)

Protective Put Example With Bitcoin

Imagine a market participant owns one Bitcoin valued at $20,000. To protect their investment, they purchase a protective put option with a strike price of $19,000 and an expiration date three months away, at a premium cost of $500. If the price of Bitcoin declines to $18,000, the investor can exercise the put contract, selling their Bitcoin for $19,000 and minimizing their losses.

What Is a Covered Call and Protective Put With Bitcoin?

A covered call involves selling a call contract while holding the base asset, such as Bitcoin. In this case, a market participant might sell a call contract with an exercise price of $21,000, generating income from the option premium. This strategy works best in bullish or neutral market conditions.

A protective put, as previously explained, is used to provide downside protection for an investor holding a base asset like Bitcoin. By purchasing a put contract with an exercise price below the current market price, the market participant can hedge against potential declines in the value of Bitcoin.

Are Protective Puts Worth It for Bitcoin?

The value of utilizing the strategy for Bitcoin investments largely depends on the investor's risk tolerance and market outlook. Protective puts can provide a safety net against declines in Bitcoin's value, but they come at a cost – the put contract premium. Traders must weigh the cost of the premium against the potential benefits of downside protection to determine whether a protective put is the right choice for their specific investment goals and risk appetite.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.