How to Trade Options: Step-by-Step Guide for Beginners

Introduction to Financial Markets

In the vast universe of financial markets, investors and traders alike can explore a variety of financial instruments, each offering unique benefits and risks. These instruments range from traditional stocks and bonds to more complex derivatives like options and futures. In recent years, we've also seen the meteoric rise of digital assets, such as Bitcoin and other cryptocurrencies, which have introduced a new dimension to the financial landscape.

Financial markets provide a structured environment for buying, selling, and trading various assets. They are pivotal to the functioning of a modern economy, facilitating the flow of capital, providing mechanisms for price discovery, and offering opportunities for risk management, among other roles. As you delve into the world of options trading, it's essential to understand this broader context in which options exist and function.

Understanding Options Trading: Guide for Beginners

Investing in options opens up a world of possibilities beyond the straightforward “buy low, sell high” approach. It offers the potential for leveraging capital, diversifying portfolios, and hedging against risk. However, these opportunities come with a learning curve. The basics of options trading encompass understanding what options are, key options trading terminology, how options pricing works, and the mechanics of placing an options trade.

As you begin your journey in options trading, it's crucial to comprehend these foundational elements. They are the building blocks upon which successful options trading strategies are built. In the following sections, we will delve deeper into how to start options trading. Whether you're looking to speculate on a specific asset’s price, generate income, or hedge against price volatility, understanding options trading can be a valuable tool in your financial toolkit.

What Are Options?

At the most elementary level, an option is a contract that bestows upon its holder the right, but not the obligation, to buy or sell a base asset. Such a contract typically has a specified price, referred to as the strike price, at which the asset should be sold/bought. Also, the option can be exercised before a certain date, known as the expiration date.

Key Options Trading Terminology

Familiarizing oneself with key terminology is integral to understanding options trading for beginners.

As a trader, you will come across essential terms such as the “call option”, which gives you the right to buy an asset, and the “put option”, offering the right to sell an asset. Also, by opening a “long position” you are purchasing an option, while the “short position” is opened by an option seller (or “writer”).

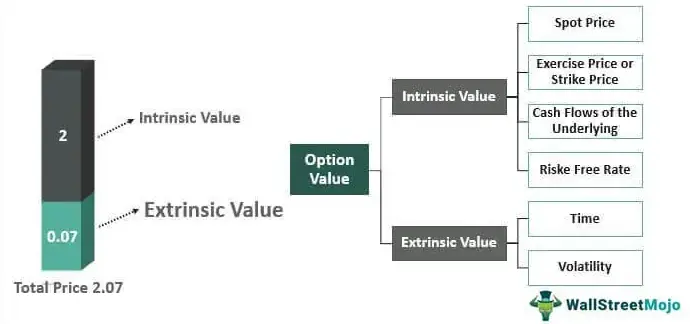

Another noteworthy term is “premium”, which is the cost paid by the buyer to the seller to acquire the option. Lastly, “intrinsic value” and “time value” are critical in determining an option's price, which we'll cover in the following section.

How Options Pricing Works

The pricing of options can be complex, as it hinges on a myriad of factors. Two significant components are:

- the intrinsic value, which refers to the value gained if the option was exercised immediately

- and the extrinsic (time) value, representing the potential for future profit.

Furthermore, variables such as the Bitcoin's current price, strike price, volatility, and time to expiration can greatly impact the options' price.

How Options Trading Works

Trading options is a multifaceted process. It begins with selecting an appropriate option based on market analysis and personal strategy, after which the trader places the option trade, typically through an online platform. Placing options trades involves specifying the order type, quantity, expiration date, and strike price. It's essential to remember that options trading isn't a one-size-fits-all endeavor, but rather demands an approach tailored in accordance with individual trading objectives and risk tolerance.

Key Takeaways

- Options trading is a type of derivative trading that provides traders the right, but not the obligation, to buy or sell a base asset at a predetermined price on a specific date or before it.

- There are two main types of options, namely call and put options. Call options give holders the right to buy, while put options grant them the right to sell the base asset.

- Familiarizing oneself with options trading terminology such as strike price, expiration date, and premium is critical to navigating the trading process.

- The price of an option, or the premium, depends on factors such as the base asset's price, the strike price, the time until expiration, and the asset's volatility.

- Various strategies like long calls, long puts, covered calls, protective puts, and long straddles are commonly used in options trading, each suiting different market expectations and risk tolerance levels.

- Options trading can yield substantial profits, but also carries potential risks, including the risk of losing the entire investment. It's important to understand these risks and adopt suitable risk management strategies.

- Starting with options trading involves learning the basics, choosing a reliable trading platform, developing a trading strategy, and practicing the skills continuously.

Buying Options

Long Calls

Long call is a suitable strategy for traders envisioning a rise in the base asset’s price. With a long call, you're essentially paying a premium for the right to purchase Bitcoin at a fixed price within a specified period.

Example

Let’s say Bitcoin is currently priced at $20,000. You purchase a call option with a strike price of $21,000, expiring in a month, with a premium of $500. If, at the expiration, Bitcoin's price soars to $23,000, you'd be able to buy it at $21,000, making a gross profit of $2,000 ($23,000 – $21,000). After accounting for the premium, your net profit is $1,500 ($2,000 – $500).

Risk/Reward

A vital consideration in the long call strategy is assessing the potential risk versus the anticipated reward. While your maximum risk is essentially the premium paid, the reward could be substantial, especially if Bitcoin's price surges beyond the strike price. However, keep in mind that if Bitcoin's price does not surpass the strike price by the expiration date, the option could expire worthless. Hence, while the long call strategy can be profitable, it necessitates a bullish outlook and a risk-acceptance attitude.

Long Puts

Contrarily, if you anticipate a drop in the asset’s price, a long put could be an ideal choice. In this scenario, you're buying the right to sell the asset at a predetermined price within a set timeframe.

Example

Suppose Bitcoin is presently valued at $20,000. You buy a put option with a strike price of $19,000, which expires in a month, and the premium is $400. If Bitcoin's price plunges to $17,000 at expiration, you could sell it at $19,000, generating a gross profit of $2,000 ($19,000 – $17,000). Factoring in the premium, your net gain would be $1,600 ($2,000 – $400).

Risk/Reward

While the potential for profit in long calls and long puts is considerable, it's equally crucial to acknowledge the risk involved. The maximum loss is the amount paid as premium, which happens if the option is out-of-money at expiration.

Covered Calls

When predicting mild price growth for Bitcoin, a covered call strategy could be beneficial. It involves owning the base asset (Bitcoin) and selling call options on the same.

Example

Suppose you own a Bitcoin valued at $20,000 and sell a one-month call option with a strike price of $21,000 for a $500 premium. If Bitcoin's price stays under $21,000, you keep the $500. If it exceeds $21,000, the option is likely to be exercised. You sell your Bitcoin for $21,000 and keep the $500 premium, but miss out on additional profit.

Risk/Reward

The primary risk with covered calls is opportunity loss if Bitcoin's price rises significantly. The reward, on the other hand, is the premium received, which provides income and slightly offsets potential losses.

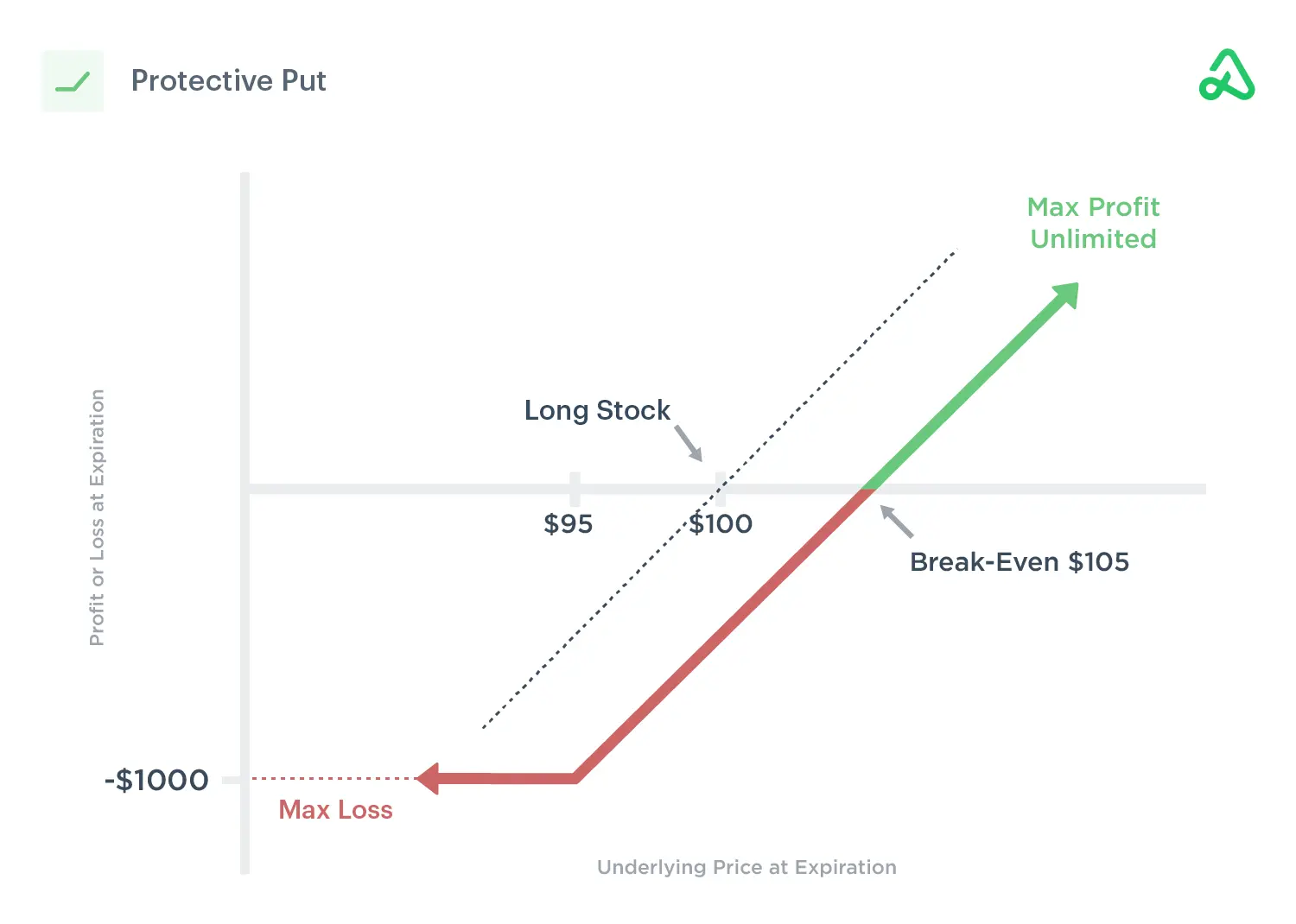

Protective Puts

In a volatile market, a protective put strategy can provide a safety net. It involves owning Bitcoin and purchasing a put option as an insurance policy against potential price declines.

Example

Imagine you own 1 Bitcoin currently priced at $20,000, and you buy a put option with a strike price of $19,000, costing you a premium of $500. If Bitcoin's price falls to $18,000, you can still sell it for $19,000 due to the put option, limiting your loss.

Risk/Reward

The major risk is the premium cost, which reduces profits if Bitcoin's price rises. The reward is the downside protection provided by the put option.

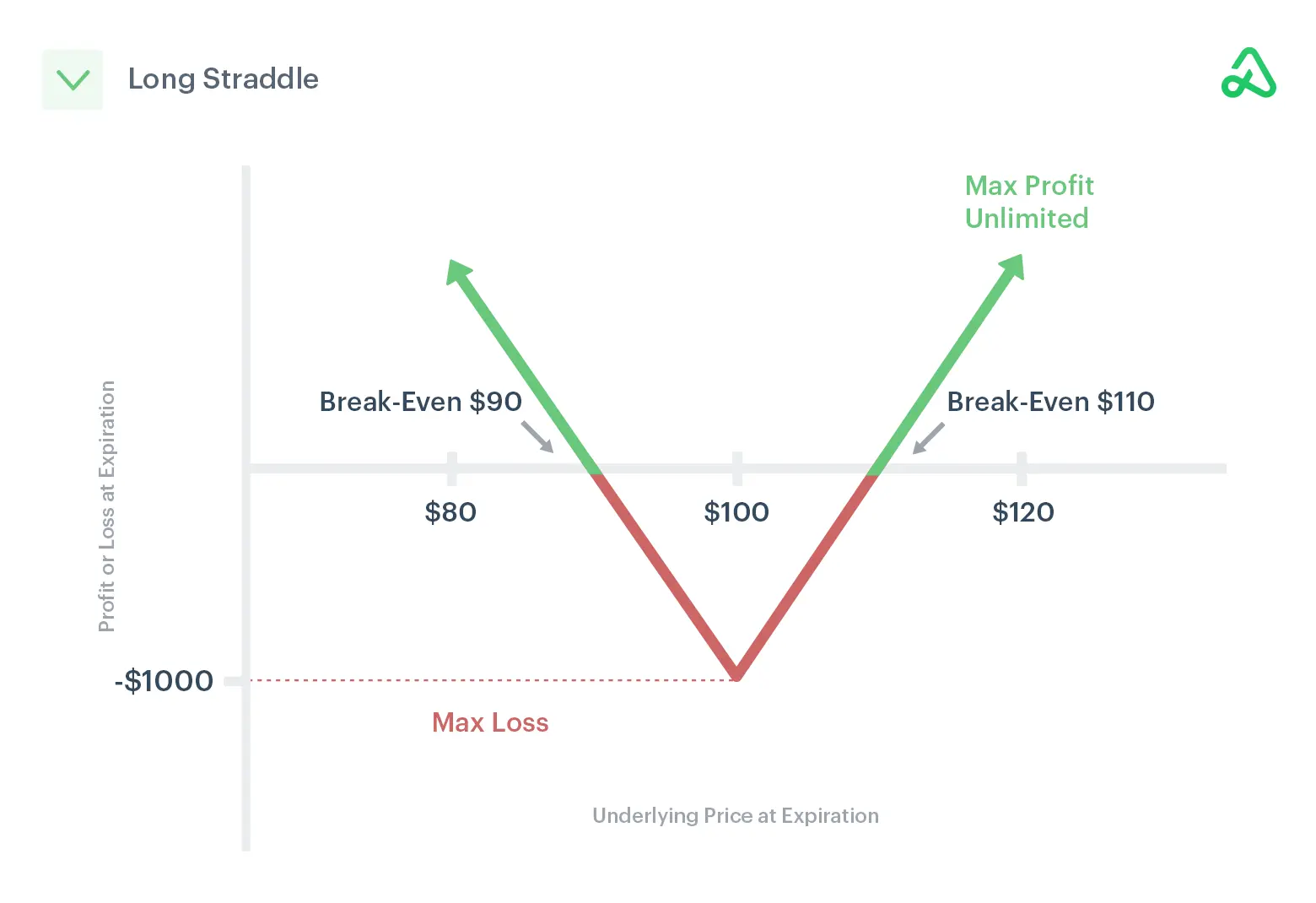

Long Straddles

For traders who foresee significant Bitcoin price movement but are unsure of the direction, a long straddle can be an effective strategy. It involves buying a call and put option with the same strike price and expiration date.

Example

Suppose Bitcoin trades at $20,000, and you expect big price swings, but you're unsure of the direction. You buy a call and put option at the same strike price of $20,000 for a combined $1,000 premium. If Bitcoin moves significantly, either the call or put option becomes profitable, offsetting the premium cost. If Bitcoin stays near $20,000, both options expire worthless, and you lose the $1,000 premium. This strategy relies on substantial price changes to be profitable.

Risk/Reward

The risk lies in the combined cost of the premiums, which could lead to losses if the Bitcoin price doesn't move significantly. However, the potential profit is unlimited, given a large enough price movement in either direction.

Understanding the Risks of Options Trading

Although options trading offers the possibility of high profits, it is not without its share of risk. Notably, there's a possibility of losing the entire premium paid if the market does not move in the desired direction. For sellers, potential losses can be significant, especially for those who sell naked options without owning the base asset. Additionally, options markets can be complex, requiring significant knowledge and skill to navigate. Lastly, factors such as price volatility and time decay can significantly affect the value of an option, adding further layers of risk.

Some Basic Other Options Strategies

Apart from the strategies covered earlier, other basic options strategies include short calls, short puts, bull spreads, bear spreads, and calendar spreads. These strategies involve different combinations of buying and selling call and put options at different strike prices or expiration dates, and they allow traders to tailor their trades to their specific market expectations and risk tolerance levels.

Getting Started with Options Trading

To start trading options, first, you need to educate yourself about options and how they work. Reading articles and books, taking courses, and learning from experienced traders can be helpful. Once you have a good understanding, choose a reputable trading platform that offers options trading and set up an options trading account. You should start trading with a small amount of money that you can afford to lose.

Choosing a Trading Platform

Selecting the right trading platform can make a big difference in your options trading journey. Opt for a platform that is reliable, user-friendly, and offers a good range of educational resources. It should also have robust security measures in place to protect your account and personal information. In terms of trading features, availability of different types of options contracts, advanced charting tools, real-time market data, and reasonable commission rates are also important considerations.

Developing a Trading Strategy

Having a well-defined trading strategy is critical for success in options trading. It should be based on your financial goals, risk tolerance, and market expectations. Whether you decide to use a simple strategy like buying calls or puts, or a more complex one like spreads or straddles, it's crucial to plan your trades in advance and stick to your strategy consistently.

Building Your Skills in Options Trading

Continuous learning and practice are key to becoming proficient in options trading. Make use of paper trading platforms to practice your strategies without risking real money. Stay updated with market news and developments, and constantly review and refine your trading strategies based on your trading performance and changing market conditions.

Pros and Cons of Options Trading

Options trading has its advantages and disadvantages. On the plus side, options offer flexibility, as they can be used for a variety of purposes, such as speculation, income generation, and hedging. They also provide leverage, allowing you to potentially make substantial profits from a small initial investment.

On the downside, options trading can be complex and risky, requiring significant knowledge and experience. Also, the possibility of losing your entire investment if the trade goes against you is a real risk.

Real-Life Examples of Options Trading

Let's take a closer look at a practical example of options trading using Bitcoin as the base asset. For illustrative purposes, we will consider a scenario involving a call option.

Suppose Bitcoin is trading at $20,000. Then you, as an investor, anticipate that the price will rise significantly over the next month. To capitalize on this, you decide to buy a call option with a strike price of $20,000 that expires in one month. The premium (cost) for this option is $500.

Two scenarios can occur at the option's expiration:

- Bitcoin's price rises. Let's say your prediction was correct and Bitcoin's price surged to $25,000 at expiration. Thus, the option is “in-the-money” (ITM). You have the right to buy Bitcoin at the strike price of $20,000. Therefore, you exercise your option and buy Bitcoin at $20,000. You could then immediately sell it at the current market price of $25,000, making a profit of $5,000. However, remember to subtract the initial premium paid for the option, which was $500. So, your net profit would be $4,500 ($5,000 profit – $500 premium).

- Bitcoin's price falls or doesn't change much. On the other hand, if Bitcoin's price drops to $15,000, or remains close to the strike price at expiration, the option would be “out of the money” (OTM) and hence worthless. In such a case, you wouldn't exercise the option, as you wouldn't want to buy Bitcoin at $20,000 when it's trading at a lower price in the market. The loss in this scenario would be limited to the premium you paid for the option, which is $500.

This example illustrates the risk and reward dynamics of buying a call option. As we can see, the profit potential can be substantial if the base asset's price rises above the strike price. The risk is capped at the premium paid if the price drops or doesn't rise enough to cover the cost of the premium.

What Are the Levels of Options Trading?

Different brokerages may categorize options trading levels differently, but generally, they represent the different types of trades that you're approved to make.

- Level 1 usually allows covered calls and protective puts

- Level 2 might include long calls and puts

- Level 3 often includes spreads and other more complex strategies

- Level 4 typically includes uncovered or naked options selling

The higher levels require more trading experience, knowledge, and a larger account balance due to their higher risk and complexity.

When Do Options Trade During the Day?

As we covered the information on how to trade options, now it’s time to learn about the trading hours and platforms for options trading.

Options trading hours depend on the market where the options are listed. For most U.S. options exchanges, trading hours typically run from 9:30 AM to 4:00 PM Eastern Time, Monday through Friday.

However, it's a different case when we look at the world of cryptocurrency options. Given the global and decentralized nature of cryptocurrencies, crypto options on both centralized exchanges (CEX) and decentralized exchanges (DEX) tend to operate 24/7. This means you can trade options contracts on cryptocurrencies like Bitcoin any time, day or night, and even on weekends. This non-stop market operation can lead to more opportunities as price changes happen around the clock, but it can also mean you need to stay vigilant to manage your positions effectively.

Where Do Options Trade?

Options contracts are traded on options exchanges, which can be centralized or decentralized. Centralized exchanges (CEX) are managed by a single organization that facilitates trading. Some of the most well-known centralized options exchanges include the Chicago Board Options Exchange (CBOE), the NASDAQ Options Market, and the NYSE American Options. These exchanges provide a marketplace for buyers and sellers to trade options contracts on a wide range of base assets.

On the other hand, decentralized exchanges (DEX) operate in a peer-to-peer manner, allowing direct trades between participants without the need for an intermediary. While DEXs are more commonly associated with cryptocurrency trading, they are also making their way into the options trading space, particularly in the realm of crypto options.

It's important to note that while DEXs offer benefits like enhanced privacy and reduced reliance on a single entity, they also come with unique risks, such as smart contract vulnerabilities and liquidity issues. Overall, whether you choose to trade on a CEX or a DEX, it's essential to do your due diligence and understand the specific features and risks of the platform.

Can You Trade Options for Free?

While some brokers offer commission-free trading for stocks and ETFs, it's not common for options. Most brokers charge a fee for each options contract traded. This can be a flat fee per contract, or it might be a base fee plus a per-contract fee. However, with the increased competition among online brokers, these fees have generally been decreasing. Currently, a standard fee ranges from $0.65 to $1 per contract.

The Bottom Line

In this options trading tutorial, we covered the essential concepts in options, which will be especially useful for beginners. Options trading can be an effective way to speculate on the price of Bitcoin and other assets, generate income, and hedge against risk. However, it requires a significant level of knowledge and understanding. Before venturing into options trading, it's essential to educate yourself, choose the right trading platform, develop a solid trading strategy, understand the risks involved, and practice continuously to hone your skills. Remember, while the potential rewards can be high, the risks can be equally significant.

Frequently Asked Questions (FAQs)

Can I Use Options to Trade Bitcoin?

Yes, there are exchanges offering options on Bitcoin. Bitcoin options function similarly to options on other assets, with call and put options available for trading.

What's the Difference Between Trading Cryptocurrency and Options?

Trading cryptocurrency involves buying and selling the digital currency directly, while options trading involves buying and selling contracts that give the right, but not the obligation, to buy or sell the cryptocurrency at a later date.

Can I Use Options to Hedge My Cryptocurrency Portfolio?

Absolutely! Options can serve as an effective hedging tool to mitigate potential losses in your cryptocurrency portfolio.

How to Learn to Trade Options?

To start trading options, you need to educate yourself about the market, choose a trading platform, and develop a trading strategy. Additionally, most brokers require an options trading agreement prior to starting, which involves an assessment of your knowledge and acceptance of the risks involved.

Is Options Trading Riskier Than Stock Trading?

Options can be riskier than stocks due to their complexity and the potential to lose your entire investment if the option expires worthless. However, they can also offer higher returns and more strategic flexibility compared to stock trading.

This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.