Options Market Making: What do Market Makers do?

In the intricate world of financial markets, especially within the domain of options trading, market makers stand as pivotal players. Their influence is not just limited to traditional assets but extends to the growing world of cryptocurrency. But to truly grasp their significance, one must understand their functions, strategies, and the overarching impact they have on market dynamics.

What Is a Market Maker and Who Are They?

At its core, what is an options market maker? A market maker is a crucial entity in the financial landscape. They are committed to consistently offering buy and sell prices for assets, ensuring market liquidity. They act as both buyer and seller, filling the gap when there's an imbalance between demand and supply.

These entities can range from large banks to specialized firms, operating on major exchanges or in over-the-counter (OTC) markets. Their vast capital allows them to buffer against market volatility, and their continuous activity influences asset pricing. In the options market they not only ensure liquidity but also aid in accurate price discovery.

Key Takeaways

- Market makers are the backbone of liquidity in financial markets.

- Their presence in the cryptocurrency domain, especially Bitcoin, is becoming increasingly vital.

- Through various strategies, including delta-neutral trading, they manage to hedge risks and maintain a consistent profit trajectory.

Understanding Market Makers

Market makers are the keystones that ensure the financial markets operate with fluidity and efficiency. But what does this entail?

Market makers are entities that commit to buying and selling financial instruments, be it stocks, options, or even cryptocurrencies like bitcoin. Their primary role is to provide liquidity, which means ensuring that there are always enough buy and sell orders in the market to facilitate smooth trading. This is crucial because without them, a trader might face delays or even be unable to execute a trade due to a lack of counterparties.

Their presence becomes even more vital during times of market stress or volatility. When many traders might be looking to sell, market makers step in to buy, and vice versa. This continuous activity helps prevent extreme price swings and ensures that the market remains stable.

Moreover, market makers play a significant role in price discovery. Through their continuous trading activity and assessment of various market factors, they help determine the fair market price of assets. Their vast resources and sophisticated trading algorithms allow them to analyze market conditions in real-time and adjust their buy and sell orders accordingly.

In essence, market makers act as the market's shock absorbers. They smooth out the rough edges, ensuring that traders and investors have a more predictable and efficient environment in which to operate.

The Role of Market Makers in Options Trading

When it comes to market making, options market makers are essential players in options trading, ensuring continuous liquidity and availability of contracts. They act as the counterparty for traders, facilitating both buying and selling of options. By consistently offering contracts at various strike prices and expiration dates, they provide depth and variety to the market. Their sophisticated tools and algorithms help in accurate price discovery, ensuring options are priced based on factors like the underlying asset's value and market volatility. Additionally, their presence narrows the bid-ask spread, reducing trading costs.

How Do Market Makers Operate and Set Option Prices?

Market makers don't rely on intuition. Their operations are grounded in sophisticated algorithms and a profound understanding of market dynamics. When setting option prices, they consider a myriad of factors. These include the current price of the underlying asset, historical and implied volatility, time decay, and broader market sentiment.

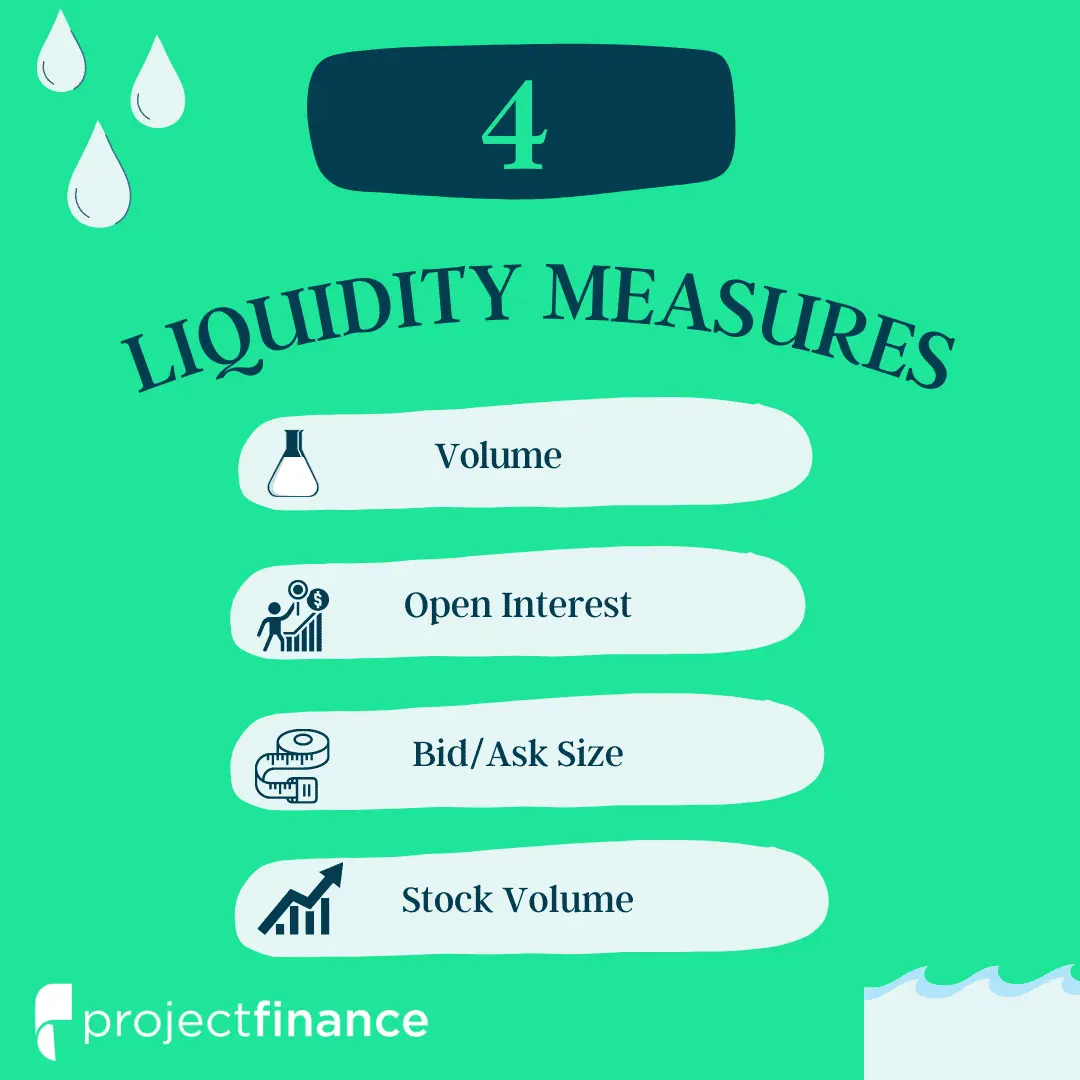

3 Liquidity Measures in Options

- Bid-ask spread: this is the difference between the buying and selling price. A tighter spread often signals a more liquid market.

- Volume: refers to the number of options contracts traded within a specific timeframe. The higher the volume, the more active the market is.

- Open interest: this metric provides insights into the total number of outstanding options contracts, reflecting the depth and long-term liquidity of the market.

What Is the Purpose of Market Makers?

Beyond ensuring liquidity, market makers play a role in stabilizing prices. Their continuous buying and selling activity, especially in markets for assets like Bitcoin, helps prevent extreme price fluctuations, ensuring a more predictable trading environment.

What Are Examples of Option Market Makers?

Major financial institutions typically have dedicated market-making divisions. And specialized firms like Citadel Securities, Susquehanna International Group, and Jane Street are dominant players in this arena. Using advanced algorithms and strategies, they provide consistent pricing for various markets.

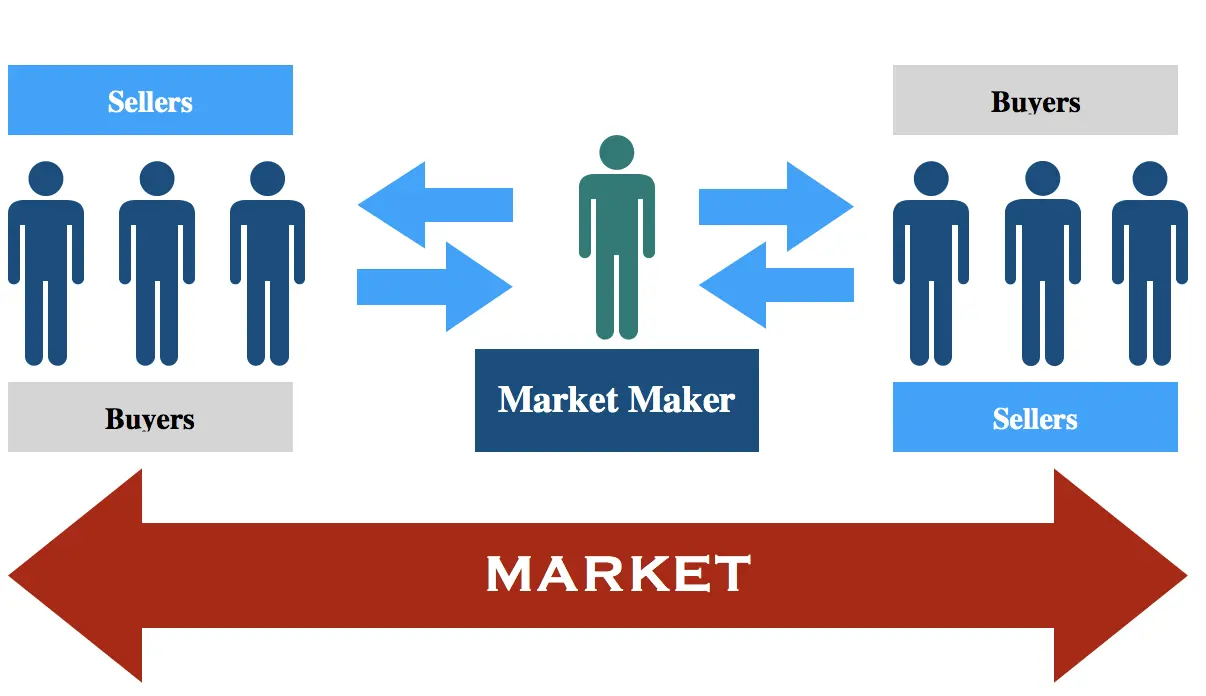

Market Making Visualized

To truly grasp the concept of market making, visualizing its mechanics can be immensely helpful.

Imagine a bustling marketplace where traders are shouting their buy and sell orders. In the midst of this chaos, there's a central figure – the market maker. They stand ready with a signboard displaying two prices: one to buy and one to sell.

For instance, with Bitcoin as the underlying asset priced at $30,000, the market maker's sign might read: “Buying at $29,950” and “Selling at $30,050”. This difference between the buying and selling price is known as the “spread”,' and it's how market makers often earn their profit.

Now, whenever a trader wants to buy Bitcoin options, they can immediately do so at the price of $30,050. Conversely, if they wish to sell, the market maker is ready to purchase from them at $29,950. This continuous availability of buy and sell prices ensures that traders don't have to wait to find a counterparty. The market maker acts as the counterparty for both sides, ensuring fluidity in trading.

Visualize this process as a revolving door. No matter which direction traders want to go (buy or sell), the door (market maker) is always there, rotating smoothly to allow them entry or exit from the market.

How Market Makers Hedge

Risk management is at the heart of a market maker's operations. They employ strategies like delta-neutral trading to hedge against potential adverse price movements in assets, ensuring that even in volatile markets, their exposure remains controlled.

What Does Delta-Neutral Trading Mean?

In essence, delta-neutral trading is a hedging strategy. It involves adjusting positions so that the overall sensitivity to price changes (delta) remains close to zero. This ensures that even if Bitcoin's price fluctuates, the market maker's position remains relatively unaffected.

Position Management

For market makers, position management is an ongoing task. They continuously rebalance their portfolios, buying and selling options and possibly the underlying assets like Bitcoin, to ensure they remain hedged and can capitalize on market movements.

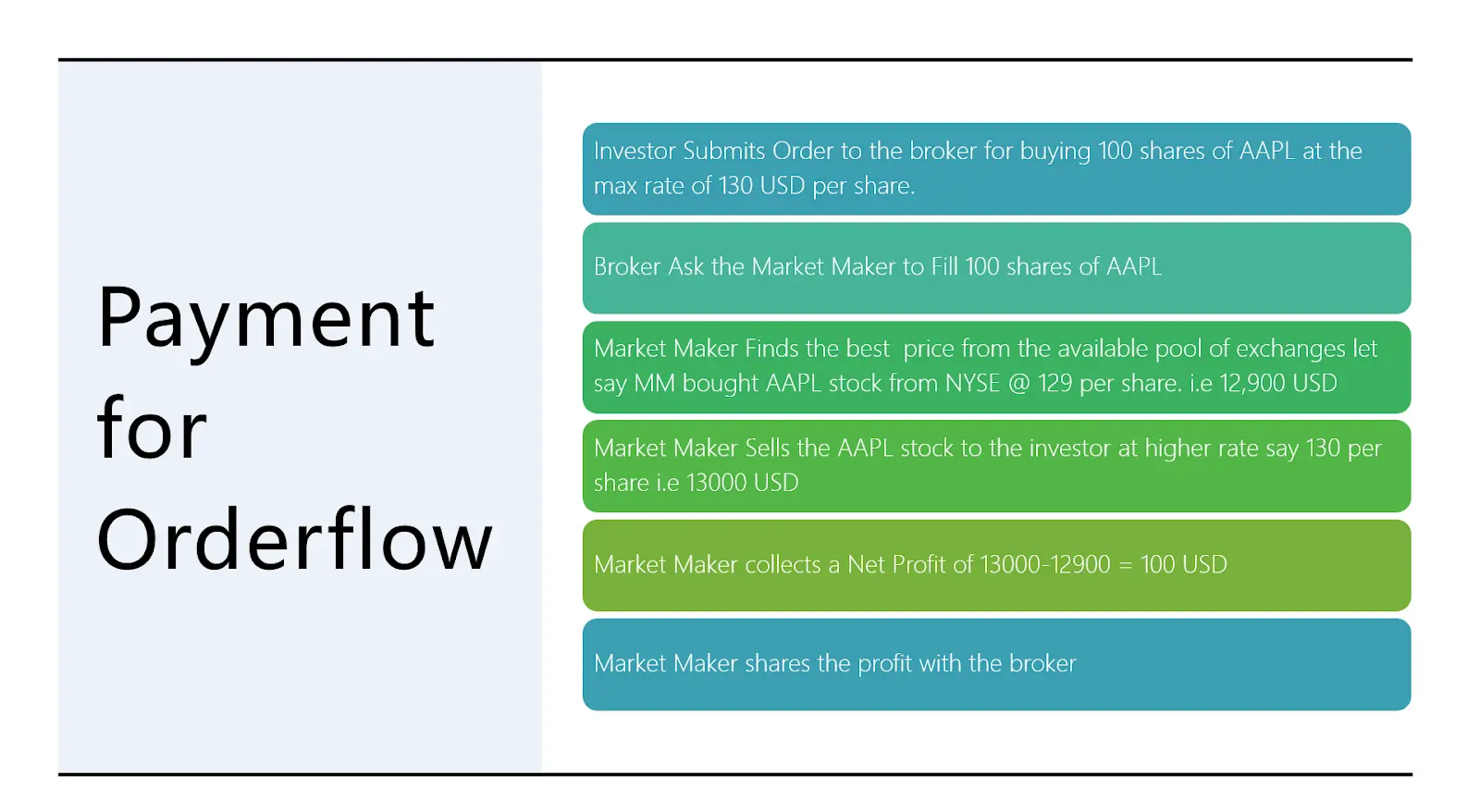

How Do Market Makers Make Money In Payment for Order Flow?

Market makers often receive compensation through a mechanism called payment for order flow. This involves getting a fee for each trade they facilitate. Given the sheer volume of trades they handle, especially in bustling markets like bitcoin options, these fees can accumulate into substantial profits.

However, it's essential to note that while many market makers operate with integrity, concerns about market maker options manipulation have arisen in some circles, emphasizing the need for regulatory oversight.

Who Are the Largest Options Market Maker?

Several dominant entities anchor the trading ecosystem, each employing their unique options market making strategies. Citadel Securities stands as a global leader with its advanced infrastructure, while Susquehanna International Group (SIG) is lauded for its quantitative trading prowess. Jane Street excels in electronic trading with a data-driven approach, Two Sigma Securities shines with its innovative algorithmic models, and Virtu Financial is a key player leveraging real-time data and high-frequency strategies. Together, these titans ensure the market's fluidity and efficiency.

What Is the Difference Between a Market Maker and a Broker?

Brokers and market makers, while both integral to the trading ecosystem, serve distinct roles. Brokers act as intermediaries, connecting traders, while market makers ensure there's always a counterparty available by actively providing buy and sell quotes.

The Bottom Line

Market makers, with their continuous presence and strategies, ensure that the dance of trading, especially in options markets for assets like Bitcoin, remains fluid. Their role, often behind the scenes, is indispensable in shaping the financial markets we know today.

Option Market Makers FAQs

What Is the Role of a Market Maker in the Options Market?

They ensure continuous liquidity, providing buy and sell quotes to facilitate smooth trading.

How Do Market Makers Make Money?

Through the bid-ask spread, payment for order flow, and strategic trading.

How Do Market Makers Set Option Prices?

By considering factors like the price of the underlying asset, volatility, time decay, and market sentiment.

What Is a Bitcoin Option?

A contract allowing the holder to buy or sell bitcoin at a set price within a specific timeframe.

Who Are the Biggest Option Market Makers?

Several major firms, each with its strategies and areas of expertise, dominate the options market.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.