What is Open Interest in Options Trading?

The term “Open Interest” (OI) frequently makes an appearance in the realm of options trading. Yet, its understanding is not always common knowledge. So, what’s open interest in options? This article will shed light on the nuances of OI in trading, focusing primarily on the realm of cryptocurrency.

The Meaning of Open Interest in Options?

Primarily, Open Interest, often abbreviated as “OI”, signifies the full quantity of unsettled contracts for a specific strike price and expiration date that haven't been exercised, expired, or offset by an opposing trade. It represents the total activity and liquidity in a particular options contract, with changes indicating market sentiment.

Open Interest Only Increases With New Contracts

Options OI increases when a new buyer and a new seller create a new contract by either buying to open or selling to open. This results in one new option contract being added to the open interest count.

Nevertheless, if a current contract owner transfers their contract to a new purchaser, this doesn't augment the open interest. This is simply a change of contract ownership from one individual to another.

Furthermore, OI decreases when an existing holder of an option contract sells to an existing short holder (the person who originally wrote the contract) since they're effectively closing the contract.

So, OI can both increase and decrease, and it's not solely based on the creation of new contracts.

Let’s Go Through an Example

- Trader A buys 10 Bitcoin call options from Trader B who writes (or sells) those contracts. These are new contracts entering the market, so the OI is now 10 contracts.

- Trader A keeps their 10 contracts. Trader C buys 10 Bitcoin call options from Trader D who writes those options. The OI now increases to 20 contracts.

- Trader E decides to buy 5 Bitcoin call contracts. These are bought from Trader A who already owns 10 contracts. This is just a transfer of ownership from Trader A to Trader E. So, the OI stays at 20 contracts.

- Trader A decides to sell the remaining 5 of their contracts. Trader B, the original writer of Trader A's contracts, decides to buy them back to close the position. This effectively removes those 5 contracts from the market, and the OI decreases to 15 contracts.

Thus, this example illustrates how OI changes based on the entry and exit of contracts from the market. It's not only about new contracts being created, but also about how existing contracts are being traded.

What Is Trading Volume?

Trading volume, another key metric in trading, represents the total count of contracts that exchanged hands within a defined timeframe. Differing from open interest, which focuses on overall active contracts, trading volume narrows down to the activity within a specific period, usually a trading day. A hefty trading volume often indicates high market liquidity and frequent trading activity.

On the graph, trading volume is typically represented by green and red bars below the price graph. These bars represent the price performance compared to the previous period. A green bar signifies that the price is higher in this period, while the red bar means it is lower.

How To Calculate Trading Volume

Calculating trading volume involves a relatively straightforward process. You just add up the total amount of derivatives that have been exchanged over a particular time frame. This focus on frequency, rather than the total unsettled contracts in the market, differentiates trading volume from OI.

How Investors Use Trading Volume

Armed with the knowledge of trading volume, investors can use it as a potent tool to decipher market scenarios. Trading volume serves as a crucial indicator of liquidity, overall market sentiment, and impending price movement. A sudden upsurge in trading volume could be the precursor of a significant price swing, thereby providing traders with the opportunity to strategize their investments accordingly.

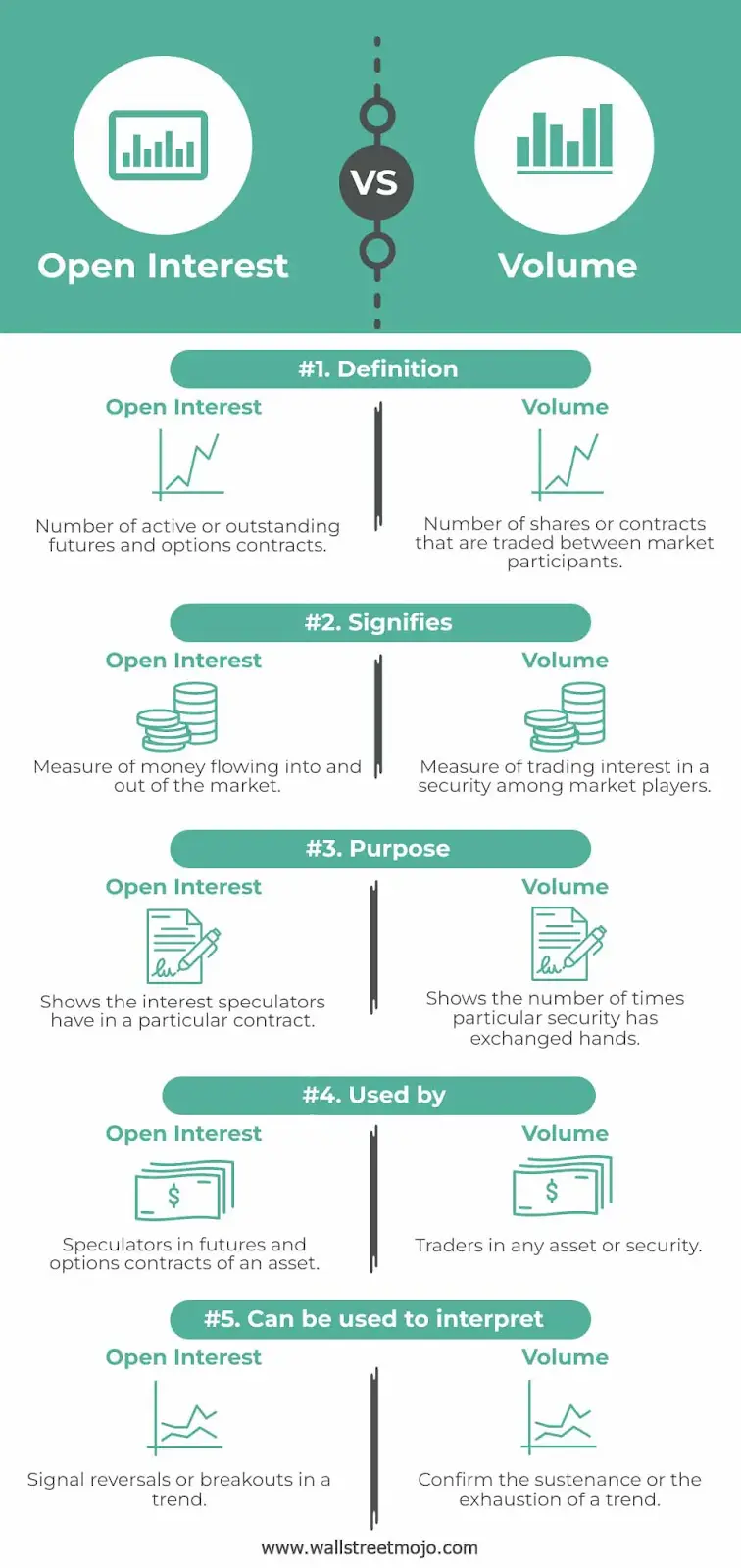

Open Interest vs. Trading Volume

Distinguishing between trading volume and OI is pivotal for any market player. While trading volume alludes to the number of derivatives exchanged within a specific period, OI reflects the aggregate number of active contracts. For a keen investor, observing the pattern of trading volume in tandem with open interest can provide key insights. For instance, a concurrent increase in trading volume and OI might suggest a strong likelihood of the continuation of the ongoing trend, be it bullish or bearish.

Why Open Interest Matters

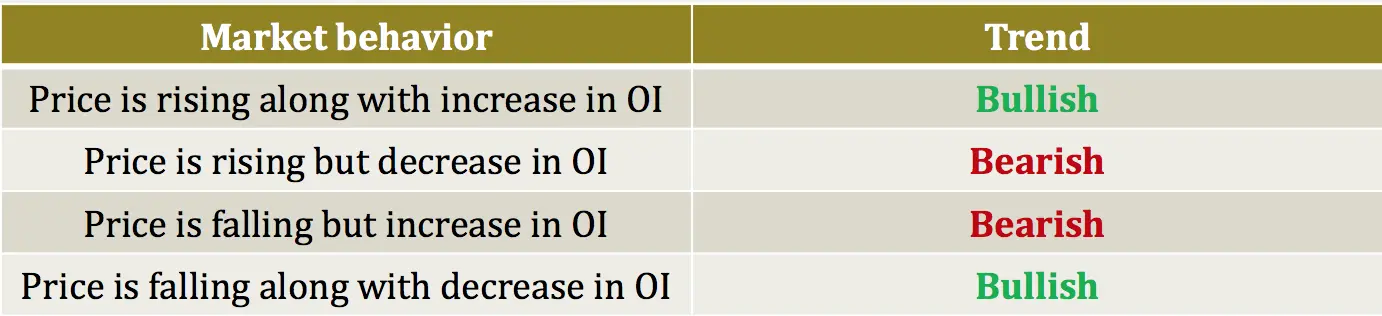

Open interest plays a crucial role in market activity. Its fundamental value lies in its ability to act as a compass, pointing investors towards the overall trend strength and market mood. As it provides an insight into whether money is entering or exiting the market, investors can rely on OI to make informed predictions. A standard rule investors adhere to is that if the market is on an upward trend with increasing OI, it signifies a strong trend. Conversely, decreasing OI could indicate a trend reversal.

Open Interest vs. Trend Strength

As stated above, open interest's ability to indicate the strength of a trend is incredibly valuable within trading. If a trend is rising along with an increase in OI, it suggests that new money is driving the trend, reinforcing its strength. In contrast, if the trend is moving in one direction and OI in the opposite, it might indicate that the trend is weakening and could soon reverse.

High Open Interest

High open interest often signals increased liquidity flowing into the market. More liquidity usually leads to tighter bid-ask spreads, making it more feasible for investors to execute trades without causing drastic price movements.

Indications from High Open Interest

High open interest can give several key signals. Primarily, it suggests that the current trend is gaining momentum due to the inflow of new contracts and increased liquidity. This inflow might result in more trading opportunities for market participants. However, one must tread cautiously as high OI could also indicate a market top or bottom if it is accompanied by a substantial shift in price.

Open Interest and Underlying Price

Generally, strong OI suggests that the asset is liquid, and it is easy to execute trades. It also indicates strong market participant interest and can be a sign of significant price movements.

The Importance Of Liquidity

Liquidity refers to the ability to swiftly buy or sell assets without causing a significant impact on the price. A liquid market, characterized by high open interest and trading volume, allows for smooth transactions and provides a greater number of trading opportunities. Hence, liquidity is of paramount importance in derivatives trading, especially when dealing with assets prone to high volatility, like Bitcoin.

Can Open Interest Help Options Traders Save with the SIP?

The Systematic Investment Plan (SIP) is a method where investors invest a fixed sum into their investment portfolio at regular intervals, regardless of the market conditions. By tracking OI, traders can gain insight into market trends, which can be useful for implementing a successful SIP strategy in general. However, it is worth understanding that while both Open Interest and SIP are important financial concepts, they are most often used in different contexts and for different purposes. Thus, open interest does not directly affect or help SIP.

Bottom Line

In conclusion, open interest plays a pivotal role in options trading. It offers essential insights into market liquidity, trend strength, and overall market sentiment. When interpreted alongside trading volume and price action, it can prove to be a formidable tool in an investor's arsenal.

FAQ

What Is the Open Interest for Options on Bitcoin?

In the context of Bitcoin derivatives trading, open interest refers to the total number of active, unsettled Bitcoin options contracts in the market at any given time.

What Is Open Interest in Stock Options?

In essence, the OI of stock options quantifies the total count of specific options available in the market.

How Does Open Interest Affect Bitcoin Options Trading?

Open interest can have a significant impact on Bitcoin derivatives trading by indicating the level of liquidity and the overall market mood. These factors can affect the ease with which trades can be executed and the potential for price movements.

What Does a High Open Interest in Bitcoin Options Mean?

A high OI in Bitcoin options could mean that there is an increase in market activity and liquidity. It could also suggest that there is strong investor interest in Bitcoin options, which could potentially lead to a continuation of the current trend.

How Can I Use Open Interest in Bitcoin Options Trading to My Advantage?

By closely monitoring the level of OI in Bitcoin trading, investors can obtain meaningful understanding about market attitudes and the robustness of trends. This information can help them to anticipate potential price movements and make informed trading decisions.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.