Is Compound Crypto a Good Investment?

Introduction

The advent of cryptocurrency and blockchain technology has resulted in a novel digital ecosystem that has proven beneficial to traders, speculators, and investors. Although the digital world is constantly evolving, there hasn’t been much improvement in traditional financial markets' processes, especially in lending and borrowing activities.

There have been several barriers to borrowing and lending fiat currency, such as outrageously high-interest rates, liquidity restrictions, absence of transparency and lack of collateral.

These barriers led many to turn to the digital and blockchain sector as a way of escape. But even then, many early blockchains projects could not fully solve this problem. This is where the Compound protocol comes into the picture.

The article explains in detail the crucial role played by Compound in the budding decentralised finance sector.

What Is Compound?

Compound, also known as Compound Finance, is a decentralised blockchain-based marketplace that provides an avenue for crypto investors to lend or borrow digital assets. The Compound protocol is built on top of the Ethereum blockchain.

Compound may also be technically viewed as a collection of openly accessible smart contracts.

The compound protocol allows investors to function as lenders by staking or locking their crypto assets in liquidity pools from where the borrowers can borrow assets.

What Is Compound Crypto?

The Compound token, or COMP, is the official governance token of the Compound platform. Ownership of this Compound token determines who gets to decide the future of the compound protocol, as each COMP token represents one vote.

Only these COMP token holders get to propose, suggest, and vote on important decisions relating to the protocol. COMP was recently listed on one of the largest centralised crypto exchanges, Coinbase.

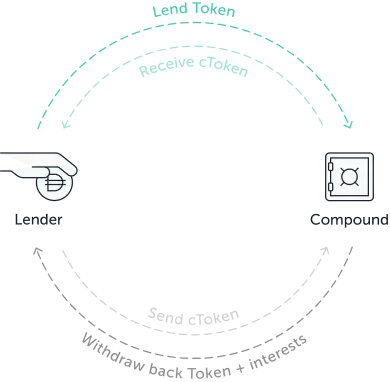

Another token, the cToken, is also an ERC-20 token that is used as proof of lending crypto assets; it represents the funds of a user in the Compound lending pool. cTokens are minted when the lenders add liquidity into the Compound protocol and deposited to the lenders. The cToken can be transferred, exchanged, or used on other dApps on the main Ethereum network.

To redeem his cToken, a user can only get the crypto he deposited. This process is automated by a smart contract, and although complex, it has proven effective.

Unique Features of Compound

Since its introduction in May 2018, the platform has received a welcome reception in the crypto and DeFi world. Here are some distinct features of Compound:

Flexible Interest Rates

A unique feature of this protocol is that the interest rates are variable, and borrowers only need to supply their cryptocurrencies as collateral. The interest rate is algorithmically determined by the forces of demand and supply controlling the particular crypto asset.

Autonomy of Operations

All the operations carried out on Compound are fully run using smart contracts. This ensures that the custody of capital, alongside its management and other vital processes, is carried out independently.

High security and efficiency are two terms that define Compound, so you can rest assured that your crypto fortune is safe.

DeFi Bitcoin

Compound is uniquely known for letting users utilise Bitcoin in the DeFi environment. This is achieved through the Wrapped Bitcoin (WBTC), an ERC-20 adaptation of the locked cryptocurrency, Bitcoin.

This token gives flawless access to Bitcoin holders into the DeFi world.

Yield Farming

It is interesting to note that the recently popular concept of ‘yield farming’ was introduced by Compound. It is highly respected as one of the founding pioneers of the world of DeFi.

Passive Income

Unlike earlier days when a user had no choice but to hold crypto and hope for a price increase, a user can now lend out unused crypto to earn interest without having to carry out any trading activity. This very feature has endeared a lot of users to the Compound platform.

How Does Compound Crypto Work?

As mentioned above, Compound is a crypto lending and borrowing protocol. It ensures that two parties can perform crypto transactions without an intermediary. It should be noted that not every kind of cryptocurrency is supported by Compound.

As of the time of writing, there are nine cryptocurrencies supported on the Compound protocol, and they are Basic Attention Token (BAT), Ether (ETH), Sai (SAI), Ox (ZRX), USD Coin (USDC), Tether (USDT), Wrapped BTC (WBTC), Augur (REP), and Dai (DAI).

But how exactly does Compound work? Let us take a closer look at that.

Compound Crypto Lending

Lending on the Compound platform is easy, fast, efficient, and doesn’t require third-party interference. If you have any of the supported tokens, you can decide to deposit or add any amount of crypto you deem fit into the protocol.

This is similar to saving in a commercial bank; the only difference is that with Compound, you’ll be saving in the completely decentralised Compound pool.

As soon as the crypto is locked, interest begins to be generated. The interest usually comes in the same crypto denomination you added to the pool. For example, if you lend out REP, your interest will also be in REP.

The crypto from different investors is collected in pools run by smart contracts. Crypto lenders earn interest for depositing their crypto, hence generating a passive income.

Compound Crypto Borrowing

The flip side of lending is borrowing. Here, a user can borrow any supported crypto asset as long as he has a certain amount of cryptocurrency locked or staked in the Compound platform.

This feature is permissionless, as anyone with cryptocurrency assets can borrow on Compound. However, the amount that can be borrowed depends on the size of the borrower's collateral.

For instance, if the borrower sends 2000 REP worth $600 and Compound’s borrowing limit is 50%, it simply means that the user can borrow $300 worth of any other crypto of choice out of the nine supported cryptos on the platform.

And like a commercial bank that requires interest when paying back a loan, borrowing via Compound costs money. However, unlike a commercial bank that keeps the interest for itself, the majority of the fees earned on Compound get split among lenders. Further, the interest rate isn’t fixed but market-driven (controlled by demand and supply).

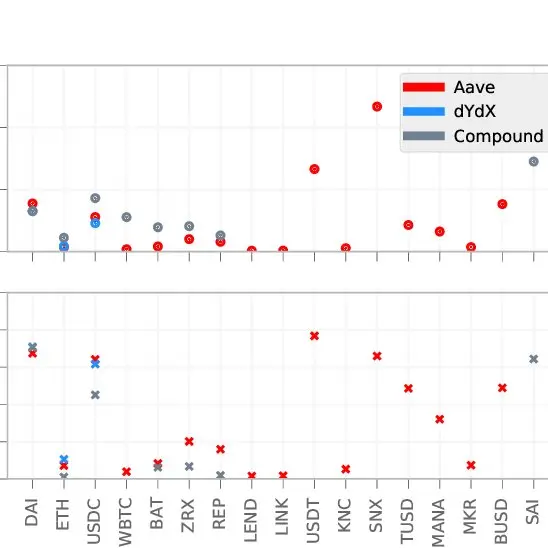

Compound Lending and Borrowing Rate

It should be noted that both lending and borrowing operations require the user to have staked assets in the Compound protocol. Once this is done, the user automatically gets Compound crypto (cTokens) that are reflective of the user’s stake in the platform.

Compound crypto interest rates are usually calculated algorithmically to reflect the real-time supply & demand and the amount of liquidity available in the crypto market.

The interest rates are usually displayed as ‘annual interest rates’, and each time an Ethereum block is mined (every 15 seconds).

Compound Liquidity Pool

To fully understand how Compound works; you must understand the working process of the liquidity pools. Simply put, the larger the liquidity pool, the smaller the interest and the lower you earn, provided that the amount of borrowed assets remains stable. This is because when the pool is large, without increased demand from borrowers, the fees collected by the pool will be distributed among a large pool of lenders.

To borrow from Compound, your collateral must be more than the amount you borrow. Therefore, the loan is referred to as over-collateralised. One major key player in the crypto market is volatility, which can affect the value of your fixed assets, causing them to change in value.

The cToken smart contract combats this by automatically liquidating the borrower when their position approaches the margin value. This process is known as margin call or liquidation, and when this happens, you get to keep the crypto you borrowed, but you lose your stake or collateral.

Should I Invest in Compound?

Since its inception in September 2020, Compound has proven to be a strong player in the crypto market. At the end of 2021, Compound gave an annual return of about 35%.

Experts also seem to agree on the fact that there is so much room for improvement for Compound. It has shown a high chance of yielding profit, both in the long and short term.

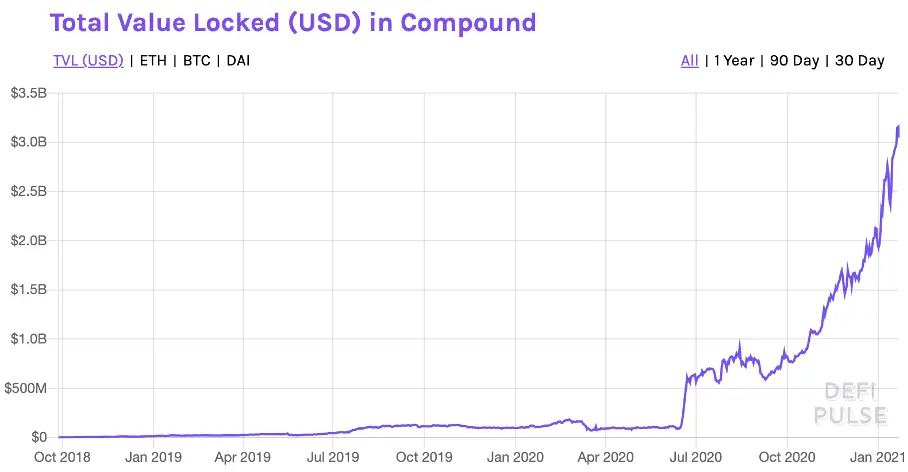

One of the foremost reasons to consider investing in Compound is its high TVL. The Total Value Locked is often defined as the number of assets staked in a given protocol. This means that if the TVL of Compound soars significantly, the Compound crypto price tends to also increase.

If this happens, the Compound coin will soon be on the list of the top crypto coins to invest in. This is good news for potential investors.

Despite the good prospects, however, you should carry out your own research before deciding on whether to invest in Compound or not.

What Will Compound Be Worth in 2022?

Even though there is no sure way to know exactly how much Compound will be worth, several expert investors have made predictions about how much the Compound coin will be by the end of 2022.

According to Coin Price Forecast, the COMP price is predicted to be around $214 by the end of 2022, with an 80% yearly increase in price going forward.

Crypto Ground, another expert, claimed to have studied the historical data of COMP using a deep learning algorithm and predicted that the coin might reach an approximate value of $289 by the end of the year, which is a 114% increase from the current market price.

Is Investing in Compound Risky?

Choosing to invest in cryptocurrency as a whole is risky as the asset class is prone to high levels of volatility.

Compound hit an all-time high of a $4.2 billion market cap in 2021, but since then, it has been on a download spiral, losing 90% of its value along the way. With the disarray in the macro economy and crypto market, we’re yet to see a next long-lasting bullish pattern.

Following the traditional rule of thumb, if you consider investing in Compound, you should not invest more than you can afford to lose.

Could Compound Be a Bad Investment?

Just like any other cryptocurrency, investing in Compound may turn out to be a bad decision. This is the foremost reason you must conduct extensive research before investing in Compound or any digital asset. Although DeFi is here to stay, wrong investment timing might prove costly and lead to huge losses at the end of the day.

Conclusion

Compound, although quite recent, has proven to be revolutionary. Introducing a decentralised money market system changed how lending and borrowing are done using the laws of demand and supply. Although Compound started with a centralized system of governance, it has slowly eased into a fully decentralized protocol over time. This allows functions such as listing new cTokens, updating the interest rate models and withdrawing the reserve of CTokens, all within the responsibility of the community and stakeholders.

It is believed that as more and more people become aware of the infinite possibilities of DeFi, its use and, of course, value is bound to increase.

From all indications - and from its priceless pioneering contribution to the crypto market (through a working money market and a safe positive-yield approach to storing assets) - Compound is here to stay.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.