How to Short Sell Crypto

The cryptocurrency market is extremely volatile. In a matter of hours or days, the price of cryptocurrencies can change drastically. Most traders exploit this volatility by purchasing crypto with the basic principle — buy cheaper and sell dearer. However, traders can also make money when cryptocurrency prices are falling. Trading in anticipation of a decline in the price of the asset is called “shorting”.

A short on crypto is a bet that a cryptocurrency’s price will fall. Usually, a long position (i.e., buying the asset) is more understandable for newbies. They may think that shorting is very complicated and incomprehensible. In fact, short selling cryptocurrency is just another popular way of trading. Let's explore the main options to short cryptocurrencies.

3 Ways of Shorting Crypto

Shorting cryptocurrency is a way to profit from the decline in the asset’s price. There are several ways to do it.

Buy Crypto on Margin

Margin trading is considered by many the best way to short crypto. If a trader shorts crypto using margin, they are simply borrowing coins from the exchange to sell them immediately. If the price of the cryptocurrency falls, the trader buys the coins at a lower price to give them back to the exchange. The difference between the selling and buying prices is the trader’s profit.

For example, the trader supposes that the BTC price will go down from $20k to $19k during the next day. They open a short position for 1 BTC, with 1 BTC borrowed from the exchange, and immediately sell it for $20k. A day later, if BTC reaches $19k, the trader purchases 1 BTC and pays back the debt to exchange. Thus, the trader's income amounts to $1k.

Use a Contract for Difference (CFD)

Another, less popular instrument for shorting crypto is the Contract for Difference (CFD). This is a type of derivative financial instrument, with which you don’t actually own the underlying asset. Instead, you hold a financial contract which allows you to bet that the price will go down. If the price falls, you earn the difference between the initial and final prices of the contract.

Like margin trading, CFDs also allow using leverage. Suppose a trader decides to short 1 BTC at $20k with 1:10 leverage. Without leverage, the minimum deposit should have been at least $20k. The leverage allows reducing the threshold down to $2k.

If the coin falls in value, then at $19k the trader exits the deal and gets the difference multiplied by the leverage: (20 - 19) x 10 = $10k.

In the opposite scenario, if the price keeps growing, the loss will also be multiplied by the leverage. The loss will continue to grow until the price turns around and goes down again. In the worst case scenario, if the collateral goes below a certain threshold, then the position will be liquidated.

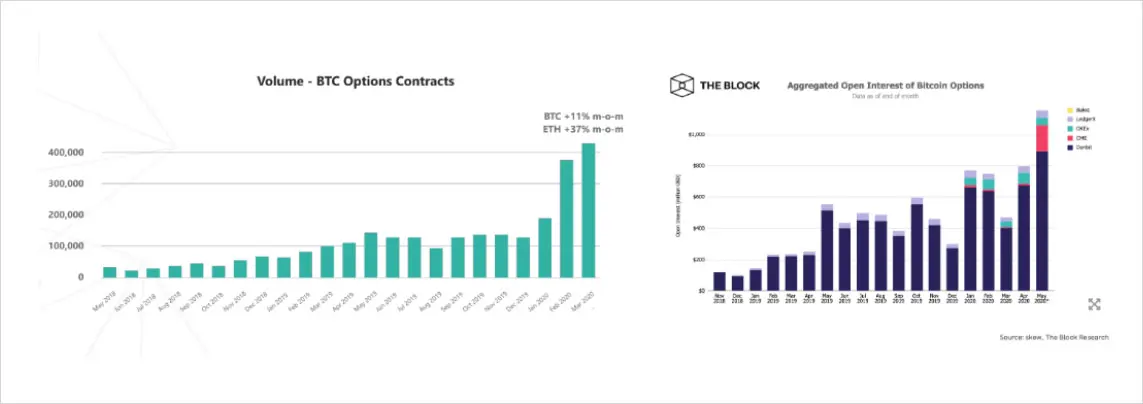

Use Crypto Futures or Options

The third, quite well-known way to short cryptocurrencies is trading derivatives such as futures and options. Futures contracts oblige the seller to sell and the buyer to buy the underlying asset at a certain price in the future. Traders can short crypto by buying a short selling futures contract.

Since futures contracts settle at the specified date (except for perpetual futures), there is a risk of a loss in case the price of the underlying asset will go above the purchasing price. But if the price at the expiration date is lower than the purchase price, you will make a profit.

For example, BTC is trading around $20k. You believe its price will fall to $19k and open a short position at the current price. If the price reaches $19k, you can sell the contract to lock in profit. However, if the price goes above $20k, your position can be liquidated if there is not enough collateral. The liquidation occurs because futures trading is also done with borrowed funds (margin) just like margin trading or CFD trading.

Speaking of options trading, there are two types of them — put and call. We are interested in put options as they enable traders to profit on a falling market.

For example, the BTC is worth $20k, and you are expecting its price to fall. Then you buy a put option for $1k (that is the so-called premium to the seller). The price of BTC falls down to $18k. But the strike price of your put option is still $20k, that is, you can still sell Bitcoin for $20k. So your profit is $1k ($20k – $1k premium – $18k). If you had not purchased the put option, you could only sell bitcoin at $18k.

If the price of BTC had risen to $22k, your loss would still only be $1k (the premium to the seller) because with the option you have the right, but not the obligation, to exercise it. And if the price of bitcoin remains the same, your loss would also be $1000, which you paid to the seller.

Risks of Shorting Cryptocurrency

Despite cryptocurrency shorting being a useful tool, it also carries certain risks. It is strongly recommended to learn the basics of trading, develop a trading strategy and carefully analyze the selected asset before short trading.

In most cases, short positions are opened with derivatives which are traded with leverage. Leverage increases not only your profit, but losses, too. In case the market takes a bullish turn after you open a short position, you run the risk of triggering a stop loss or worse — a liquidation mechanism.

Can You Short Sell Crypto?

Any trader, even the novice one, can benefit from shorting cryptocurrency, if they can manage the risks properly. Cryptocurrency exchanges with high trading volume and liquidity are considered ideal venues for this. However, you should keep in mind that short trading has both advantages and disadvantages.

Pros of Shorting Crypto

Short trading has a number of positive aspects:

- Allows to make a profit even in a bear market;

- Enables to gain larger profits due to the use of leverage;

- Allows for starting with a small capital;

- Helps to hedge against volatility.

Cons of Shorting Crypto

Due to the use of leverage and borrowed funds, shorting is much riskier than simple buying and selling cryptocurrency. Also, shorting has the following disadvantages:

- Potential losses are unlimited;

- Access to margin trading is required;

- Lending costs — you must pay interest to the exchange;

- Hedging with short trades can reduce overall portfolio returns.

Can You Make Money Shorting Crypto?

Opening a short position is probably one of the fastest ways to make a profit. This is because the market usually rises for a long time, but falls quickly. However, keep in mind that shorting cryptocurrencies using large capital is suitable only for experienced traders. Moreover, there should be a pronounced downtrend on the market.

Experienced traders say that under favorable conditions, the profit from shorting is 7-10% of the investment amount. While considering this rate, it should be taken into account that mostly borrowed funds are used for opening short positions. And leverage, as it was mentioned above, enlarges not only your profit, but losses, too.

Shorting Bitcoin: Factors to Consider

Bitcoin is one of the most popular instruments in the crypto market. Shorting bitcoin might be a good option on a bearish market. However, there are several factors to consider that may affect short-trading BTC.

Bitcoin Price Is Volatile

The price of Bitcoin is highly volatile and prone to abrupt increases and decreases. Volatility can come both as an advantage and disadvantage. Seasoned traders exploit the money-making opportunities that the volatile market provides. For short traders, such a highly volatile asset as bitcoin can provide almost endless opportunities to profit.

However, one must remember that volatility can backfire. Particularly dangerous in this context is the condition called the “short-squeeze”. It is characterized by a rapid increase in the price of the asset, increased trading volume and high volatility. Such conditions can lead to significant losses for short traders.

Bitcoin, as an Asset, Is Risky

Bitcoin has already proved its reliability. It displayed the pronounced characteristics of a safe-haven asset during the COVID-19 pandemic. However, many investors still consider it risky due to its volatility and ambiguous regulations in many jurisdictions. They believe that until this narrative reaches more than 100 million people, the remaining 7.8 billion people will not see Bitcoin as a reliable asset.

The Regulatory Status for Bitcoin Is Still Unclear

Bitcoin regulations vary greatly across the countries around the world. There is no consistent legal approach everywhere. This means that where Bitcoin and derivatives trading is not regulated today, it could become illegal tomorrow.

Knowledge of Order Types Is a Must

For short traders, it is essential to be able to work with pending orders. These orders help to fix profits and limit losses. If a trade turns out to be unprofitable, a pending order can help to close the position before its liquidation. Thus, only a portion of the position will be lost instead of the entire margin.

Can You Short Bitcoin?

Many novice traders ask, “Can I short bitcoin?” The answer is unequivocal — yes, bitcoin volatility allows you to make substantial profits by short trading.

What Are the Risks of Shorting Bitcoin?

There are a number of risks to consider prior to shorting Bitcoin. One of them is that potential losses from a short position are infinite, because the price can show unlimited growth. If the price of BTC rises due to some sudden news (which happens quite often), that jump may ruin a short position.

Standard risk-management principles apply to short positions. Protect against potential losses, use a stop-loss, consider carefully the size of the position, and make sure you understand the risks of liquidation.

Can I Short Bitcoin Using Leverage?

Most cryptocurrency exchanges offer leverage trading for BTC. Leverage provides an opportunity to increase the capital faster. The amount of leverage is usually indicated with an ”x”. If the platform provides a leverage of x100, then, having invested $1, a crypto trader can make a deal of up to $100. However, the risk of losing capital increases in proportion to the size of leverage.

Ways to Short Bitcoin

There are several ways to open a short position on BTC. They vary in popularity, difficulty, and potential profitability.

Short-Selling Bitcoin Assets

Probably the easiest strategy is to sell BTCs, hoping for a drop in price so that you can buy those coins back cheaper. In case the price doesn't go downward, you “miss the train” but do not lose any capital.

It's hard to call this strategy a truly short trade, because you are not earning directly on a Bitcoin drop. It is more of a reversed variation of the “buy low, sell high” strategy.

Futures Market

Perhaps the most popular way to short BTC is trading futures. Futures enable you to purchase a contract that specifies when and at what price the BTC will be sold. In order to open a short position, you need to buy contracts that bet on a lower price for the BTC.

Futures trading is available on a variety of platforms. You can trade BTC futures on the Chicago Mercantile Exchange (CME) as well as most popular cryptocurrency exchanges.

Binary Options Trading

Cryptocurrency binary options involve predicting whether the price of the asset will rise (call option) or fall (put option). There are only two possible outcomes — either the trader wins or loses. Hence, their name is “binary”.

Put options enable traders to short bitcoin. If the bet on the fall of the price within a time limit turns out to be correct, a trader receives a payment on the option (usually 50-80% of the bet). In case of an incorrect prediction, the loss is 100%.

It is worth noting that binary options are very similar to simple gambling. Their nature is unpredictable, and it is difficult to manage risks and control the trading process. That is why the major platforms do not allow them to trade. In some jurisdictions, binary options are even considered illegal.

Margin Trading

Margin trading is a fairly popular way to open a short position on BTC. It is available at the vast majority of cryptocurrency platforms. This method allows for shorting BTC using bitcoins provided by a third party (in our case, a cryptocurrency exchange) for sale. To open a margin position, all you need to do is to deposit the right amount of margin into your margin account.

Prediction Markets

One of the newest tools for shorting BTC are prediction markets. They are similar to binary options as they also allow betting on the outcome of events.

With prediction markets, investors can create their own event to bet on its outcome. For instance, you can predict that the price of BTC will fall by a certain percentage of the current price. If somebody accepts your bet, you will make a profit if it turns out to be right. There are not many prediction markets currently. Augur, PlotX, and Polymarket are the most popular ones.

Using Bitcoin CFDs

A contract for difference (CFD) is a derivative in which one party pays the other the difference between the value of the BTC at the beginning and the end of the contract period. CFDs are similar to futures in that they are essentially bets on the BTC price. You can short BTC by purchasing a CFD predicting that prices will fall. This is not the most popular tool among crypto traders, and therefore it is not available on all cryptocurrency platforms.

Using Inverse Exchange-Traded Products

Inverse exchange traded products provide an opportunity to hedge risks and profit from a decline in the price of BTC. They are similar to futures contracts. Currently, the only exchange-traded inverse product available to US residents is the Short Bitcoin Strategy ETF (BITI) ProShares. Investors outside the US can invest in the BetaPro Bitcoin Inverse ETF (BITI) from Canada or the 21Shares Short Bitcoin ETP from the European Union.

Short Strategies in Crypto Trading

After choosing the way to short cryptocurrency, it is advisable to develop a trading strategy. Using technical analysis tools can help you to get long-term benefits from trading. We will describe the most popular reversal patterns such as Head and Shoulders and Double Top to help you get started.

Head and Shoulders Pattern

The Head and Shoulders pattern indicates the possibility of a trend reversal. Traders believe that three sets of peaks and troughs with a large peak in the middle mean that the asset price will start the downward movement. The neck line represents the point at which bearish traders begin to sell.

Double Top Pattern

A double top is an extremely bearish technical reversal pattern which forms after an asset reaches a high price twice in a row, with a moderate decline between the two highs. The pattern is confirmed when the price of the asset falls below a support level equal to the low between the two previous highs.

Double tops are very effective if correctly identified. However, they can be extremely damaging if misinterpreted. Therefore, one has to be extremely careful and patient before jumping to any conclusions.

Shorting Crypto Summary

Shorting is an advanced method of making money in a falling market. Experienced traders can take advantage of the volatility in the cryptocurrency market and maximize profits in a bear market. However, this trading option is not recommended for beginners due to limited earnings and high risk of unlimited losses.

FAQ

Can You Short Sell Crypto?

Yes, crypto can be shorted just like traditional financial instruments.

What Is Shorting Crypto?

Shorting cryptocurrency is the act of selling borrowed funds in the anticipation of the downward trend. As soon as the prices fall, a trader buys back the asset at a lower price and pays back their loan. The difference in prices is the trader’s profit.

What Does It Mean to Short Crypto

Shorting cryptocurrency is selling it at a high price and buying it back at a lower price.

Is Shorting Bitcoin A Good Idea?

This is a complicated question and the answer depends on the current market situation. It is advisable to place a short position on BTC only after learning the basics of trading and carefully analyzing all prerequisites for a possible decrease in the rate of Bitcoin.

Is Shorting Crypto Illegal?

The answer to this question depends on the specific jurisdiction. For example, in 2020, the European Union and the UK Financial Services Authority banned the sale of cryptocurrency derivatives to retail investors.

At the same time, there are no direct bans on short sales of digital assets in the U.S. Many popular cryptocurrency exchanges allow customers to use derivative contracts to short sell BTC and the like.

Can Dogecoin be shorted?

Yes, Dogecoin can be shorted just like any other cryptocurrency.

Can Ethereum be shorted?

Yes, Ethereum can be shorted just like any other cryptocurrency.