How Many Cryptocurrencies Are There: Types & The History of Growth

How Many Cryptocurrencies Are There?

Fifteen years ago the first cryptocurrency, Bitcoin, appeared. The first Bitcoin block generated on January 3, 2009, marked the birth of cryptocurrency.

In the following years, the first altcoins appeared: Namecoin and Litecoin. Already by the end of 2013, there were more than 50 different cryptocurrencies. Later, by the end of 2014 this figure exceeded 500.

You have probably heard of such coins as Ethereum, Dogecoin, Cardano, Polkadot. They are some of the most famous cryptocurrencies. However, there are tens of thousands of different coins and tokens besides them.

But what is the reason for such an abundance of digital assets? And what is a more or less precise number of cryptocurrencies at the moment? This article attempts to present an accurate number of cryptocurrencies and the reasons for the explosive growth in their number. We will also explore the most popular types of digital assets.

How Many Cryptocurrencies Are There in 2023?

In fact, it is impossible to tell with certainty the exact number of digital coins and tokens. The number of cryptocurrency projects, especially during the bull market, grows exponentially. However, many cryptocurrencies die just as quickly, sliding into oblivion.

There are many services out there providing quite exhaustive lists of cryptocurrencies. They use different listing criteria. Hence, the number of coins presented varies from site to site. For example, according to CoinGecko, the total number of cryptocurrencies tracked is almost 12,600. At the same time, Coinlore offers a list with a total of 1,084 cryptocurrencies. Investing.com site tracks 8852 cryptocurrencies.

Thus, we can conclude that there are about 10,000 cryptocurrencies being tracked on popular services at the moment. By comparison, the number of cryptocurrencies in 2022 was about 8,700.

Unfortunately, this information does not give an unambiguous answer to the question “How many cryptocurrencies exist at the moment?”. Despite the platforms' efforts to regularly update their lists, many tokens included belong to inactive projects.

Why Are There So Many Cryptocurrencies?

There may be several main reasons why there are so many cryptocurrencies. The most important is the ease of creating a new token. The creation of a coin is slightly more complicated, which is why there are fewer coins than tokens.

Thanks to the development of blockchain, this technology is becoming available everywhere. Many services have appeared, offering a convenient and clear UX design. They allow anyone to create their own cryptocurrency and even blockchain, regardless of their technical background. Thus, the creation of a new cryptocurrency, a token in particular, takes only a few minutes.

Since it has become extremely easy to create cryptocurrencies, it has attracted people trying to make a quick buck from the popularity of cryptocurrencies, specific events or personalities. From the charts of recently released cryptocurrencies, we can see many quite similar tokens which include words such as “Ilon”, “Shib”, or “Doge” in their names.

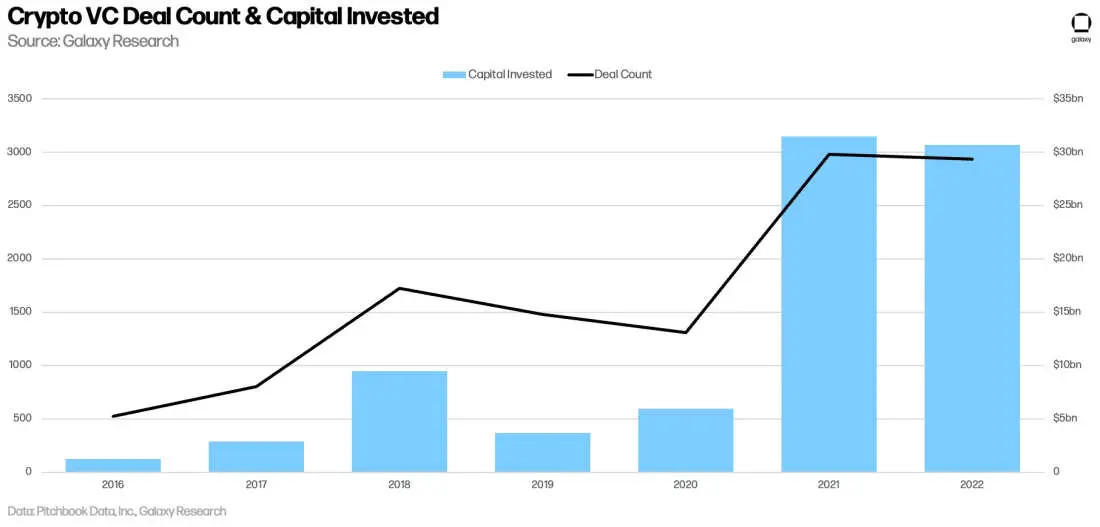

Another important reason for the growth of cryptocurrencies is the support of cryptocurrency projects by institutional investors. The blockchain industry is still considered young and promising, both in terms of technology and return on investment. That is why many big investors are pinning their hopes on this sector.

Thus, despite the sudden collapse of Celsius, Three Arrows Capital, BlockFi and FTX, 2022 was the second highest year for cryptocurrency in terms of number of deals and capital invested.

What Is the Difference Between Coins and Tokens?

When talking about the ease of creating new cryptocurrencies as the reason for an ample number of cryptocurrencies, we need to understand the difference between a token and a coin.

A coin is usually defined as a cryptocurrency which serves as the basis of an independent blockchain economy. An example of such coin is ETH. The functioning of the Ethereum blockchain is impossible without ETH. The coin is a means of paying transaction fees on the network and is used for staking in the Ethereum Proof of Stake consensus mechanism.

Typically, a blockchain has one or two native coins. Thus, we can conclude that the number of coins is roughly equal to the number of existing blockchains. Also, the creation of a coin is quite a complicated process, because it includes the creation of an entire blockchain.

However, in recent years, the process of creating blockchains has become much simpler. Such projects as Polkadot or Cosmos have emerged, offering ready-made SDKs (software development kits) for creating new blockchains.

Unlike coins, tokens do not have their own blockchains. They are created and run on already existing blockchain networks. For example, the most popular platform for tokens is Ethereum. More often than not, a token is a smart contract. Each blockchain uses a different smart contract standard. For example, Ethereum uses the ERC-20 standard.

Tokens occupy a separate niche in the cryptocurrency market. They are used for paying commissions or act as utilitarian tokens within the application ecosystem, driving user activity. Examples of well-known tokens include USDT, DAI, UNI, LINK.

The process of creating tokens is extremely simple. With most of the services you only need to specify the token’s name, its ticker, quantity, and pay a network fee.

Types of Cryptocurrencies

The cryptocurrency market is represented by digital assets of various types: Utility Tokens, Exchange Tokens, Payment Coins, Security Tokens, Privacy Coins, Stablecoins, Meme Coins and NFTs. Let's start with the most common type of cryptocurrency — Utility Tokens.

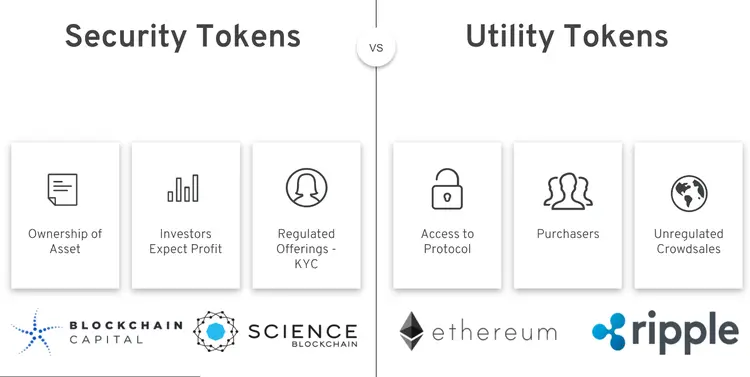

Utility Tokens

Utility tokens, known as user tokens or application tokens, are used to implement certain functions in applications. Utility tokens give users access to unique functions within a particular blockchain ecosystem and dApp (decentralized application). As blockchains with smart contracts such as Ethereum continue to scale, more and more blockchain developers are releasing unique service tokens for their Web3 projects.

Any crypto project can issue a utility token. For example, tokens help to implement a mechanism for purchasing in-game items in metaverses or to give token holders voting rights in a dApp. Utility tokens are thus commonly used in DeFi apps for governance, fees payment, or liquidity. It is important to understand, however, that such assets are most often not intended to be used as digital currencies to pay for goods and services outside a particular ecosystem.

A typical representative of such tokens is the UNI token. It gives the holders the right to vote for the management decisions on the Uniswap platform.

Exchange Tokens

Exchange tokens are the proprietary cryptocurrencies of centralized exchanges used to pay transactions and reward users. They are essentially utility tokens.

Exchange users who hold such tokens in their wallet or exchange account receive discounts on trading fees. They also gain access to exclusive features, and other unique opportunities.

A typical example of an exchange token is Binance's native token, BNB. It is used to pay transaction fees on BNB Chain and gives you access to exclusive token sales. Token holders receive discounts on trading commissions on the Binance platform.

Payment Coins

Payment coins are used as a form of digital money to pay for goods and services. Thus, they are intended to be a more convenient digital alternative to fiat currencies such as the U.S. dollar. Such coins can be used to pay for everyday expenses, transportation tickets, or real estate purchases.

In fact, projects such as Bitcoin or Litecoin were developed precisely as alternative payment systems. Due to its technical peculiarities, Bitcoin has not become widely used in everyday transactions. However, the Lightning network, as a second-tier solution, seeks to solve the Bitcoin scalability problem. The network allows for a significant increase in Bitcoin's transaction speed and a reduction of reducing transaction costs.

Also, many blockchains, such as Solana or Avalanche, posses technical characteristics enough to compete with giants such as Visa or MasterCard. They have all the makings of becoming the real means of payment in the not-too-distant future.

Security Tokens

Security tokens are digital analogues of securities that certify ownership and entitle their holders to shares, dividends, profit shares, etc. These rights are recorded in a smart contract, and the tokens themselves are traded on exchanges.

Unlike utility tokens, security tokens are linked to real securities. They are considered a financial investment and are traded in accordance with the legal regulations of various countries' financial regulators. One of such regulators is the Securities and Exchange Commission (SEC). It is highly likely that with tighter regulation coming to the cryptocurrency market, many utility tokens will eventually be recognized as security tokens.

A typical example of a security token is Science Blockchain. Lunched as the first incubator in the world, it was funded by its own tokenized compliant securities. The funds totaled roughly $100 million.

Privacy Coins

Privacy coins are a class of cryptocurrencies that enable private and anonymous onchain transactions. They hide the source and destination of the transaction, as well as the wallet balance. This makes it virtually impossible for third parties to track transactions through blockchain analytics services.

An important nuance of such coins is the uncertainty of their regulatory regulation. In fact, the legality of anonymous coins depends on the specific jurisdiction. For example, in South Korea, the government bans the trading of privacy coins on the local cryptocurrency exchanges to curb money laundering. However, those jurisdictions that have not banned anonymous coins have not approved them either. That is why private coins are in a gray area.

Examples of such coins are Monero (XMR) and Zcash (ZEC). Due to their anonymous nature, these coins have been delisted from several leading trading platforms.

Stablecoins

Stablecoins are cryptocurrencies with a fixed or stable exchange rate. Their main purpose is to serve as a universal unit of account. Thus, they are convenient for trading and storing capital. They are also an excellent tool to decrease the portfolio’s exposure to volatility. Popular Stablecoins are available on almost any platform.

Stablecoins can be classified by the type of the used collateral:

- Fiat Stablecoins — centralized digital coins secured by fiat currencies (the U.S. dollar mostly). One of the most popular is USDT;

- Commodity stablecoins — centralized digital coins secured by exchange-traded commodities, dominated by gold. For example, PAXG;

- Cryptocurrency Stablecoins — mostly decentralized digital coins secured by other cryptocurrencies. For example, DAI;

- Algorithmic (non-collateralized) stablecoins — decentralized tokens with price stability achieved through special algorithms. For example, FEI, AMPL.

Meme Coins

Meme coins are cryptocurrencies inspired by memes and viral events. They are actively promoted by influencers, and therefore they quickly gain popularity. At the same time, the value of meme coins largely depends on the sentiment in the online community. These coins are usually surrounded by a lot of noise and strongly associated with financial risks. As a rule, meme-coins have no intrinsic value or even utility.

The very first meme-coin, Dogecoin (DOGE), is based on the Doge meme, a picture of a Shiba Inu dog.

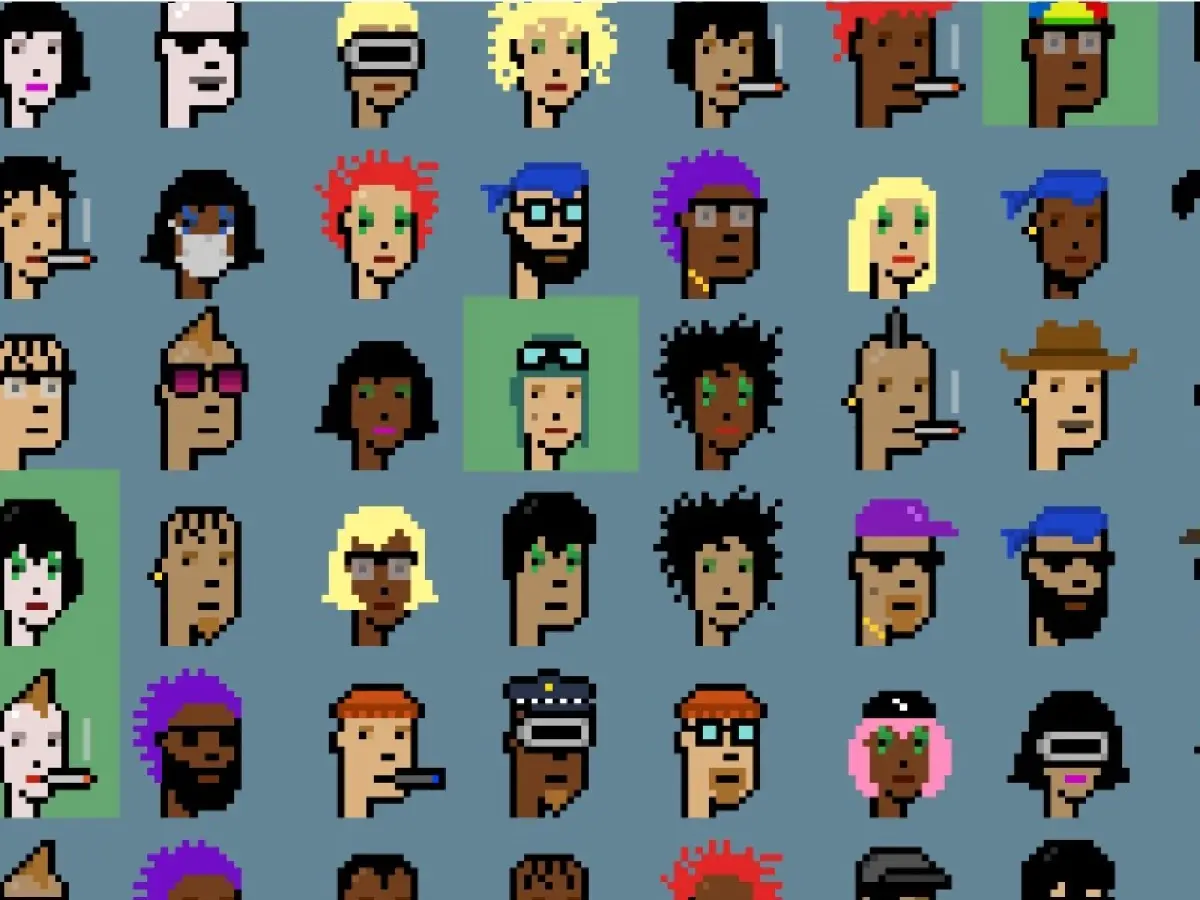

NFTs

NFT (non-fungible token) are tokens that represent ownership of various digital objects: texts, images, game items or characters, domain names, financial instruments, club cards, etc.

Each NFT token is unique and exists in a single number. It has its own identification information recorded in smart contracts, which makes NFTs different from the other.

NFTs enabled developers to solve the problem of securing ownership of digital objects. The information about the owner and their tokens are recorded in the blockchain. It is impossible to replace, fake or delete such information.

There are NFTs which became famous all over the world. Sometimes NFT art seems primitive, but even simple images may be worth millions of dollars. A prime example of such tokens is CryptoPunks. They are extremely simple but unique pixel avatars.

Growth of Cryptocurrency Over Time

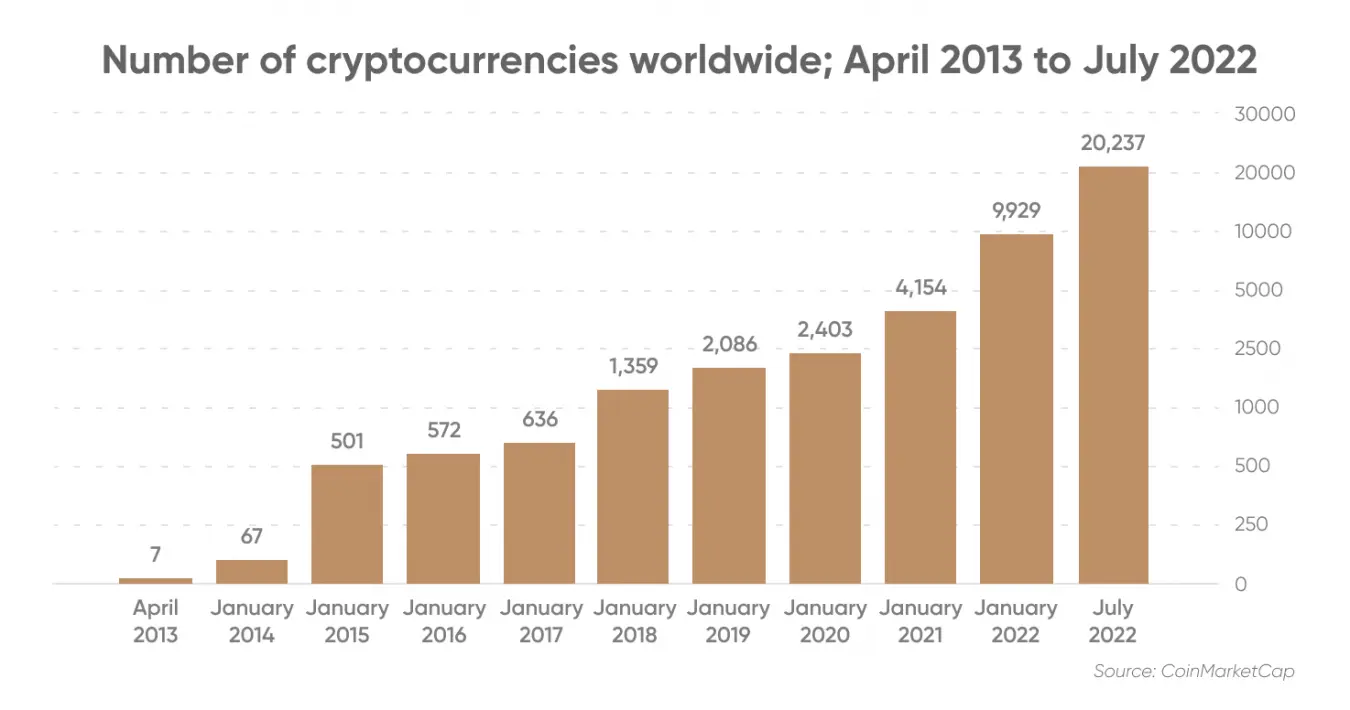

Very few new cryptocurrencies were created in the first years after the emergence of Bitcoin. Until 2013, such projects as Tenebrix, Namecoin, Litecoin and Peercoin were launched.

2013

By the end of 2013, there were already more than 50 different cryptocurrencies. The community was actively growing at that time. In addition to geek programmers, specialists in related industries such as economists, scientists, and lawyers joined the community. In this year, such well-known cryptocurrencies as Dogecoin, Primecoin, Ripple, and NXT appeared.

2014

The year 2014 was marked by even more rapid growth of the cryptocurrency market. By the end of the year, the number of projects rose above more than 500, which is 10 times higher than the results of the previous year, 2013. Such projects as Dash, Monero, Stellar and others appeared.

2015

A year later in 2015, there was no such explosive growth in the number of new projects. At the end of November 2015, there were 564 cryptocurrencies. However, the quantity has changed to quality, and this year was marked by the emergence of Ethereum. Being the first smart contracts platform, Ethereum, gave life to the decentralized finance industry (DeFi) and stimulated the ICO boom.

2016

Throughout 2016, the industry continued to grow. Over 600 cryptocurrencies already existed by the end of the year. The Zcash project was launched.

2017

In 2017, the total number of cryptocurrencies exceeded 800. It was in 2017 that many people realized that Bitcoin is not the only promising cryptocurrency: altcoins can be a real competition to it. In 2017, bitcoin's exchange rate and capitalization saw an almost 20x increase (according to year-end data). At the same time, the capitalization of the entire cryptocurrency market increased by 34 times. Such well-known projects as Bitcoin Cash, Cardano, TRON and EOS entered the market.

2018

By the end of 2018, there were more than 2,000 cryptocurrencies. And 12 of them had a market capitalization of more than $1 billion. This year, the Nervos Network was launched.

2019

In 2019, the total number of cryptocurrencies approached 6,000. This year saw the launch of such well-known projects as Algorand, Fantom, Cosmos, and a number of others.

2020

The year 2020 was marked by the COVID-19 epidemic crisis. However, this did not prevent the launch of such famous projects as Avalanche, Polkadot, Shiba Inu. Tthe total number of cryptocurrencies exceeded 7 thousand.

2023

Today, as stated at the beginning of this article, there are over 10,000 active cryptocurrencies.

Crypto Usage Demographics

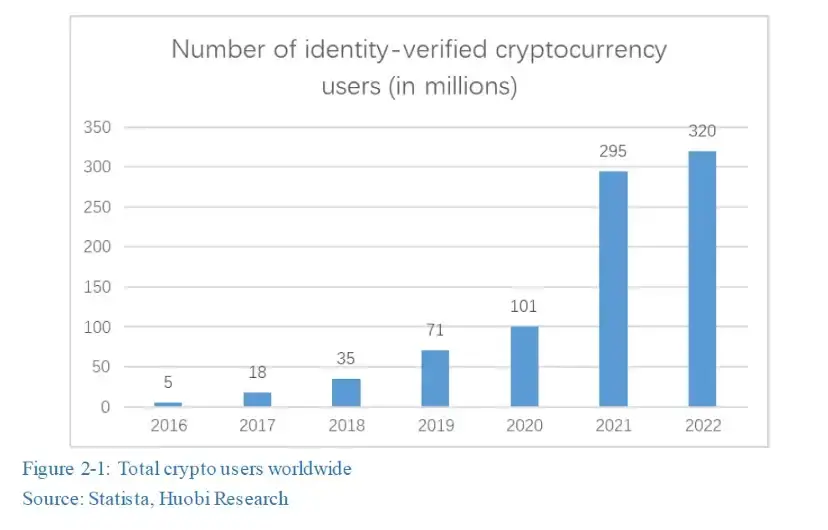

According to Huobi Research, more than 320 million people worldwide own cryptocurrency at the end of 2022.

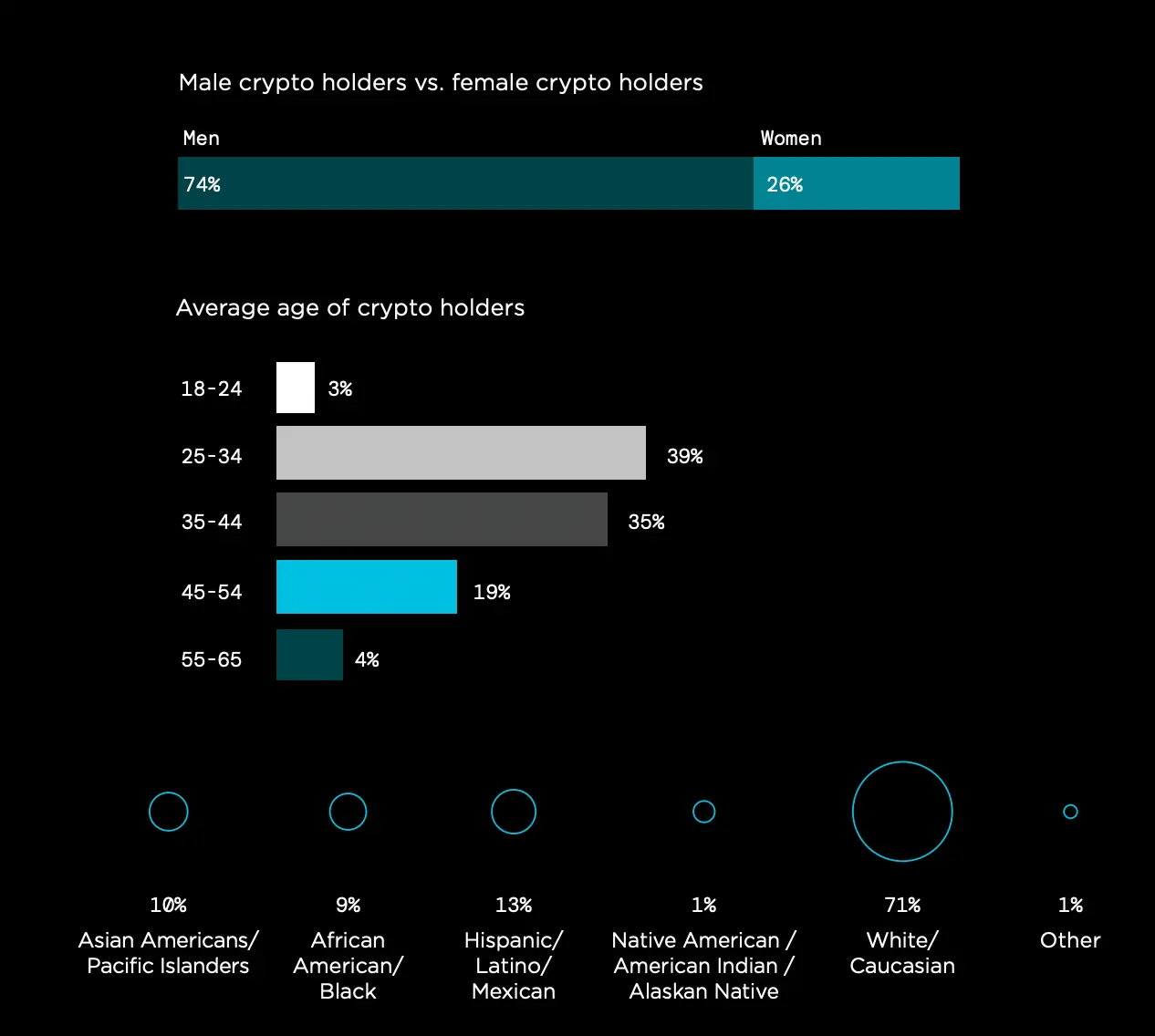

According to Gemini's report, the majority (74%) of cryptocurrency owners today are between the ages of 25 and 44. Another 19% are between the ages of 45 and 55. Three-quarters of them (74%) are men.

Cryptocurrency Awareness

According to Gemini's 2021 report, a total of 39% of people who don't own cryptocurrency described themselves as “somewhat or very” knowledgeable about cryptocurrency. And of those surveyed who say they already own cryptocurrency, 33% consider themselves “very knowledgeable” and 12% say they are extremely knowledgeable, with 11% of current investors considering themselves “not very knowledgeable”.

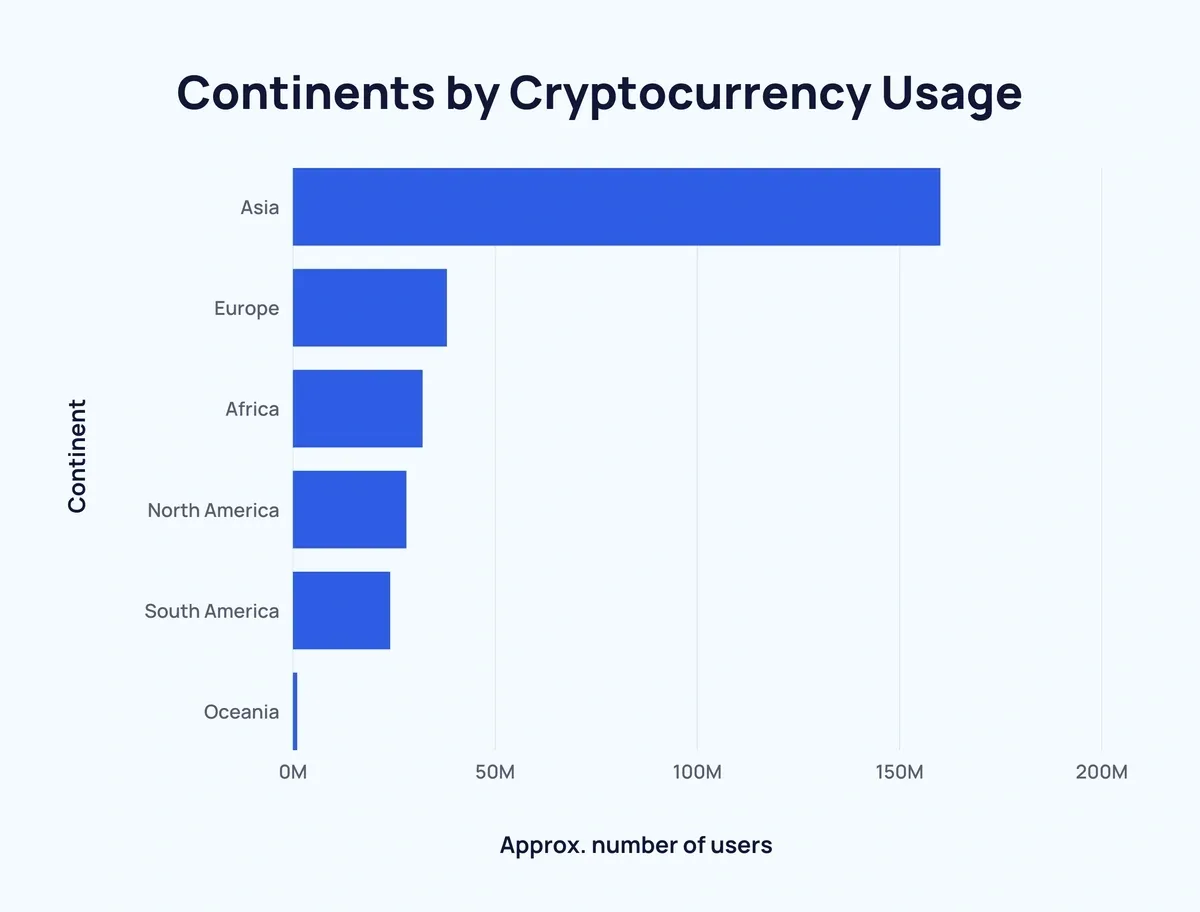

Continents by Cryptocurrency Usage

- Asia — about 160 million crypto-users;

- Europe — about 38 million crypto-users;

- Africa — about 32 million crypto-users;

- North America — about 28 million crypto users;

- South America — about 24 million crypto users;

- Oceania — about 1 million crypto-users.

Top 5 Countries by Cryptocurrency Usage

- India — about 100.7 million crypto-users;

- USA — about 27.5 million crypto-users;

- Nigeria — about 13 million crypto users;

- Vietnam — about 6 million crypto users;

- United Kingdom — about 3.4 million crypto-users;

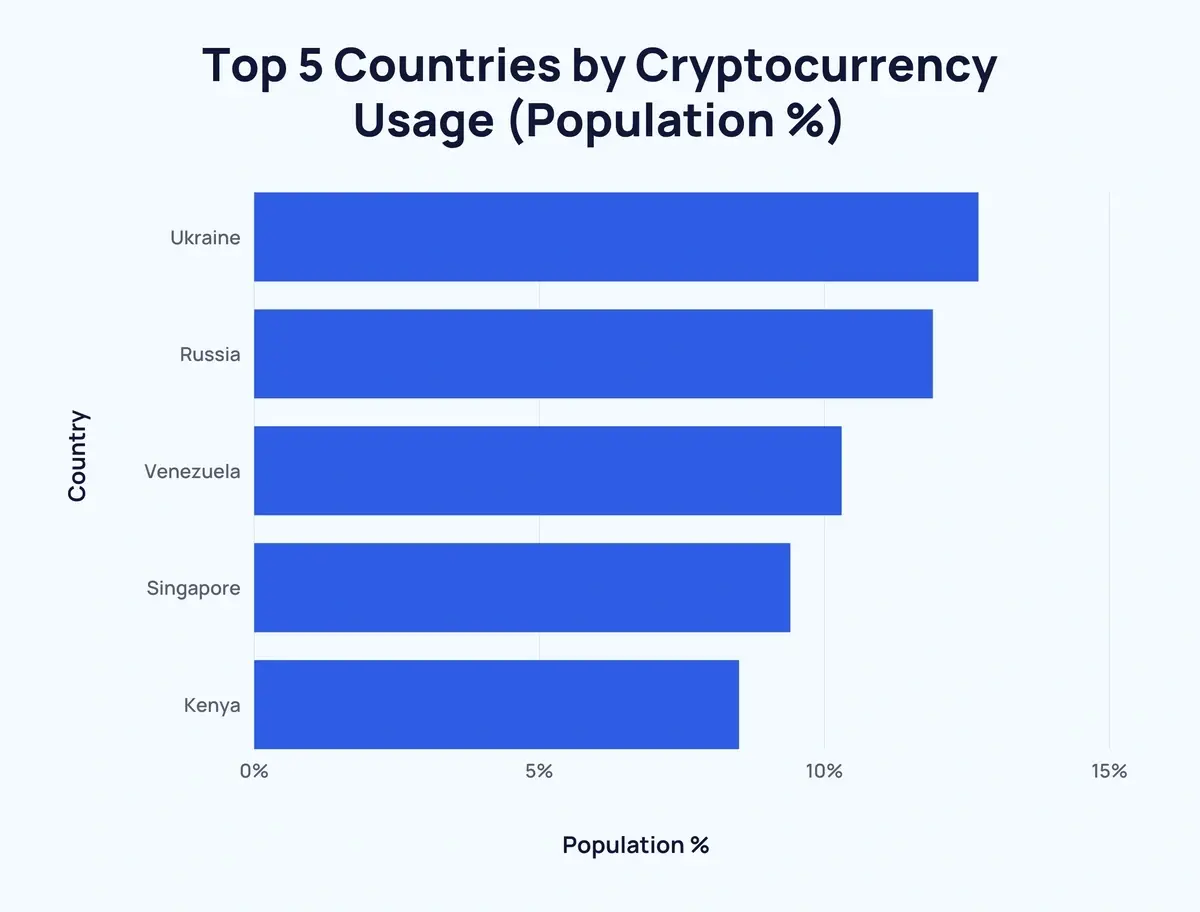

Top 5 Countries by Cryptocurrency Usage (Population %)

- Ukraine — approximately 12.7% of the population uses cryptocurrency;

- Russia — approximately 11.9% of the population uses cryptocurrency;

- Venezuela — approximately 10.3% of the population uses cryptocurrency;

- Singapore — about 9.4% of the population uses cryptocurrency;

- Kenya — about 8.5% of the population uses cryptocurrency.

Why Are Cryptocurrencies Important?

The most important property of most cryptocurrencies is their decentralized nature, which limits the governments or financial institutions control. This decentralized nature makes cryptocurrencies a reliable financial tool for much of the world's population. Bitcoin itself, as the first and one of the most decentralized cryptocurrencies, emerged amidst the international financial crisis of 2008 as a response to the imperfections of the current global financial system.

More than that, crypto assets have several other features that make them important:

- Cryptocurrencies and blockchain technology help to increase transparency in financial transactions and reduce corruption in financial systems;

- They can also provide people in countries with unstable economies and currencies experiencing hyperinflation with a way to store their savings. Already, we can see that cryptocurrencies are in high demand in countries whose economies are experiencing problems.

Conclusion: Will All Coins and Tokens Survive?

We can say unequivocally that not all coins and tokens will survive. The market is evolving. The coins which yesterday were considered to be the currency of the future today are becoming a thing of the past. And vice versa, the projects that were unknown yesterday are shining on the market now.

There are many reasons behind these changes. One of them is the rapid development of blockchain technology, which makes yesterday's promising projects obsolete. In addition, not all projects manage to survive the bear market. Another reason for the death of coins is the greed of the creators, incompetence, or even their fraudulent actions. One has only to recall the collapse of UST and Terra, as well as the FTX exchange. Even yesterday's top projects, overnight, can become the cause of the loss of billions of funds of their users.

However, it is safe to say that there are cryptocurrencies that will endure, if not forever, then for years to come. They are, of course, such coins as Bitcoin and Ethereum. They have proven their reliability over time and the capacity to successfully address the challenges they face.

FAQs

Why Are There So Many Cryptocurrencies?

One of the reasons is the ease of creating tokens. Another is the support of cryptocurrency projects by institutional investors.

Who Created the First Cryptocurrency?

The first successful cryptocurrency project, called Bitcoin, was developed by an individual or group under the pseudonym Satoshi Nakamoto. Nakamoto remained an active developer of the project until around 2010, but disappeared since.

Although Satoshi Nakamoto was not the first to come up with the concept of cryptocurrency, he was the first to solve the fundamental problem known as “double-spending.” This allowed him to launch Bitcoin in early 2009, which remains the most popular cryptocurrency to this day.

How Many Types of Cryptocurrency Are There?

There are many types of cryptocurrencies. Here are the eight most popular types: Utility Tokens, Exchange Tokens, Payment Coins, Security Tokens, Privacy Coins, Stablecoins, Meme Coins and NFTs.

How Many Cryptos Are There

There are currently about 10,000 cryptocurrencies.

How Many Cryptocurrencies Have Failed?

According to a study by CoinGecko portal, 3322 coins out of more than 8000 that were listed on CoinGecko in 2021 failed (categorized as dead coins).

Thus, CoinGecko analysts conclude that except for the abnormal year 2021, an average of 947 cryptocurrencies registered on the platform have failed and died in the last five years, from 2018 to 2022.

How Many Cryptocurrencies Will Be In 2023

It is impossible to accurately predict the exact number of coins in 2023. Most certainly, their number will continue to grow.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.