How Many Bitcoins Are Lost?

Since its inception, Bitcoin has been the subject of intrigue, investment, and innovation. However, alongside its meteoric rise and widespread adoption, there lies a lesser-known narrative – that of lost bitcoins.

These are coins that, for various reasons, have become inaccessible, potentially forever. This article delves deep into the enigma of lost bitcoins, exploring the magnitude of this phenomenon, its implications on the market, and the stories that accompany these digital treasures now locked away in the vastness of the blockchain.

Key Takeaways

- Bitcoins are considered “lost” when they become irretrievable within the blockchain, often due to lost access keys or forgotten passwords.

- Recent studies suggest that missing bitcoin accounts for up to 29% of all mined coins.

- Around 1.1 million BTC mined by the mysterious creator, Satoshi Nakamoto, have never been moved, adding to the enigma of lost bitcoins.

- Lost bitcoins reduce the active supply, potentially leading to increased price volatility and emphasizing Bitcoin's rarity.

- Common reasons include user errors like forgotten passwords, third-party security risks such as exchange hacks, mistaken transactions, and lack of inheritance plans.

- Safeguarding bitcoins involves using secure wallets, strong passwords, enabling two-factor authentication, avoiding public Wi-Fi, staying vigilant against phishing scams, keeping software updated, diversifying storage, and regularly reviewing transactions.

What is Bitcoin?

Bitcoin was created in 2009 by a mysterious person named Satoshi Nakamoto. It is a new type of digital money that is different from other currencies because of how it looks and works. Unlike traditional currencies governed by centralized institutions, Bitcoin operates autonomously, free from a singular authority.

At its core, Bitcoin transactions occur directly between users, eliminating the need for intermediaries. These transactions undergo rigorous verification by a network of nodes using advanced cryptographic techniques. Once validated, they are permanently recorded on a transparent and immutable public ledger known as the blockchain.

Each bitcoin, or BTC, represents a unit of this digital currency. However, as with tangible assets, these coins can be misplaced or lost, adding another layer of complexity to its already intricate ecosystem.

When is Bitcoin Considered “Lost”?

Bitcoins are categorized as “lost” when they are rendered irrecoverable within the blockchain network. This irrecoverability is rooted in the cryptographic nature of bitcoins.

Each bitcoin is associated with a specific digital wallet, which is secured by a unique combination of private and public keys. Losing access to these keys, essentially, locks away bitcoins.

Common scenarios leading to such loss include:

1) Misplacing hardware wallets — physical devices storing the private keys, or

2) Forgetting passwords to software wallets — digital applications safeguarding access credentials.

Additionally, some users may keep their assets on a cryptocurrency exchange. If a user loses access to their email accounts associated with the exchange and forget the account password, they may also lose bitcoins.

More permanent loss scenarios arise when a bitcoin holder passes away without leaving behind their access credentials. In such cases, due to the decentralized and irreversible nature of blockchain transactions, those bitcoins become permanently inaccessible and are effectively removed from the circulating supply.

How Much Of Bitcoin’s Existing Supply Is Lost?

Recent research indicates that a significant portion of the total mined BTC may be lost forever. These losses can occur due to various reasons, such as forgotten passwords, misplaced hardware wallets, or even intentional abandonment.

29% of Bitcoin Lost?

Analyses from firms like IntoTheBlock suggest that up to 29% of all mined bitcoins might be inaccessible. This represents a substantial fraction of Bitcoin's total supply, affecting its scarcity and potentially its market value.

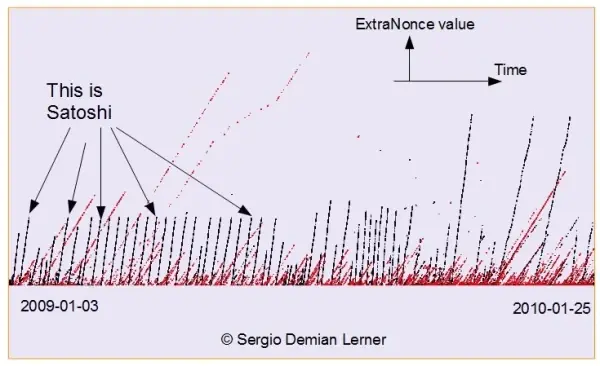

Satoshi's Stash

Satoshi Nakamoto, Bitcoin's anonymous creator, is believed to have mined up to 1.1 million Bitcoins in the currency's early days. This untouched treasure, valued at billions today, remains one of the largest untouched Bitcoin stashes.

Research by Sergio Demian Lerner suggests that a single entity, likely Satoshi, mined these coins. Despite the vast value, these bitcoins have never been moved, adding to the mystery of Satoshi's identity and intentions. The reasons for this inactivity could range from Satoshi's desire for anonymity to the potential loss of access to these coins.

How Lost Bitcoins Impact the Market and Price

The value of Bitcoin, akin to traditional commodities, is heavily influenced by the dynamics of supply and demand. When a sizable portion of bitcoins becomes lost or inaccessible, it effectively reduces the active supply in circulation.

This diminished supply, juxtaposed against a backdrop of growing demand, can lead to heightened price volatility. Especially during bullish market phases, the scarcity created by these lost bitcoins can accentuate price spikes. Furthermore, as Bitcoin's maximum supply is capped at 21 million, the loss of any portion of this finite number further emphasizes its rarity.

Investors and traders, recognizing this limited availability, might be more inclined to hold onto their bitcoin assets, anticipating future price increases. This holding behavior, often referred to as “hodling” in the cryptocurrency community, can further constrict supply, amplifying the price impact.

The Reasons Why Bitcoins are Lost

Several factors contribute to bitcoins’ losses, ranging from human errors to external threats. Understanding these reasons is crucial for both current and potential bitcoin holders to safeguard their investments. Here's a deeper dive into each of these reasons:

User Error

One of the most common reasons for lost bitcoins is user error. The decentralized nature of Bitcoin means that individuals are responsible for their own digital assets, which can be a double-edged sword. For instance:

- Backup Misplacement. Digital wallets typically come with backup phrases or seed phrases. Losing or misplacing these phrases means that if the wallet is ever deleted or the device is lost, the bitcoins cannot be recovered.

- Forgotten Credentials. Forgetting passwords or access keys to digital wallets is not uncommon. Without these credentials, accessing the stored bitcoins becomes impossible.

Third-party Security Risks

While third-party platforms like exchanges offer convenience, they also present risks:

- Hacks and Breaches. Over the years, several cryptocurrency exchanges have fallen victim to sophisticated cyber-attacks, leading to theft of millions of dollars worth of bitcoins.

- Platform Bankruptcy. If an exchange or wallet service declares bankruptcy, users might lose access to their stored bitcoins. That’s why users must first of all look for a reputable exchange with a clear insurance fund policy, and second, never use exchanges for long-term storage.

- Fraudulent Platforms. Some platforms might turn out to be scams, disappearing with users' deposits.

Mistaken Transactions

The immutable nature of the Bitcoin blockchain means its transactions are irreversible:

- Incorrect Addresses. Sending bitcoins to a wrong address, whether due to a typo or other error, means those bitcoins are permanently lost. There's no recourse or way to reverse such a transaction.

- Address Confusion. Users might mistakenly send bitcoins to addresses meant for other cryptocurrencies, leading to loss.

No Inheritance Plans

Digital assets, including bitcoins, present unique challenges in estate planning:

- Lack of Awareness. Many bitcoin holders might not consider their digital assets when drafting wills or inheritance plans.

- Access Challenges. Even if heirs are aware of the bitcoins, without the necessary access keys or passwords, they cannot access them.

- Legal Hurdles. In some jurisdictions, the legal framework around inheriting digital assets is still murky, leading to potential losses.

Ways to Prevent Bitcoin Loss

Keep Your Bitcoin in a Secure Wallet

There are different types of wallets you may consider for storing bitcoins:

- Hardware Wallets. These are specialized USB devices designed exclusively for storing bitcoins. They are considered one of the safest options because they generate and store private keys offline. Popular models include Ledger Nano X and Trezor Model T. They often come with OLED screens for transaction verification and PIN protection.

- Paper Wallets. This is a physical document that contains your Bitcoin public address and private key. It's generated offline and can be printed or written down. Since it's not connected to the internet, it's immune to hack but can be susceptible to physical theft or damage.

- Software Wallets. These are applications downloaded on a computer or smartphone. Examples include Electrum and Mycelium. While these wallets offer more convenience, it's crucial to choose providers with a strong reputation for security.

Use a Strong Password

- Length and Complexity. The strength of a password is often the first barrier against unauthorized access. A password with at least 16 characters is recommended, but the longer, the better. Combining uppercase letters, lowercase letters, numbers, and symbols creates a complex password that is harder to crack.

- Avoid Common Words. Avoid using complete words in your password. Instead, consider using a passphrase, which is a sequence of random words or a sentence. This approach offers both memorability and security, especially if you intersperse it with numbers and symbols.

Enable Two-Factor Authentication

- Authenticator Apps. Relying solely on passwords is no longer considered secure. Two-Factor Authentication (2FA) adds an extra layer of security. Instead of just an SMS code, which can be intercepted or redirected, authenticator apps like Google Authenticator or Duo are recommended. These apps generate time-sensitive codes locally on your device, ensuring that even if someone has your password, they can't access your account without the second verification code.

- Backup 2FA. Technology can sometimes fail us. Phones get lost, apps get deleted, and in such cases, you could be locked out of your accounts. This is why it's crucial to always keep backup codes, provided during 2FA setup, in a safe and offline place. These codes can be a lifesaver, allowing you to regain access to your accounts.

Avoid Public Wi-Fi

Public Wi-Fi networks, like those in coffee shops or airports, are often unsecured. This makes them a prime target for cybercriminals. These networks can host rogue devices, or hackers can deploy techniques like ARP spoofing to intercept data packets, leading to man-in-the-middle attacks.

Also, Virtual Private Networks (VPNs) are a must-have for anyone serious about their online security. When using a VPN, your internet connection is encrypted, ensuring that even on an open network, your data remains private. Always ensure you're connected to a reliable VPN service when accessing sensitive information or making Bitcoin transactions on public networks.

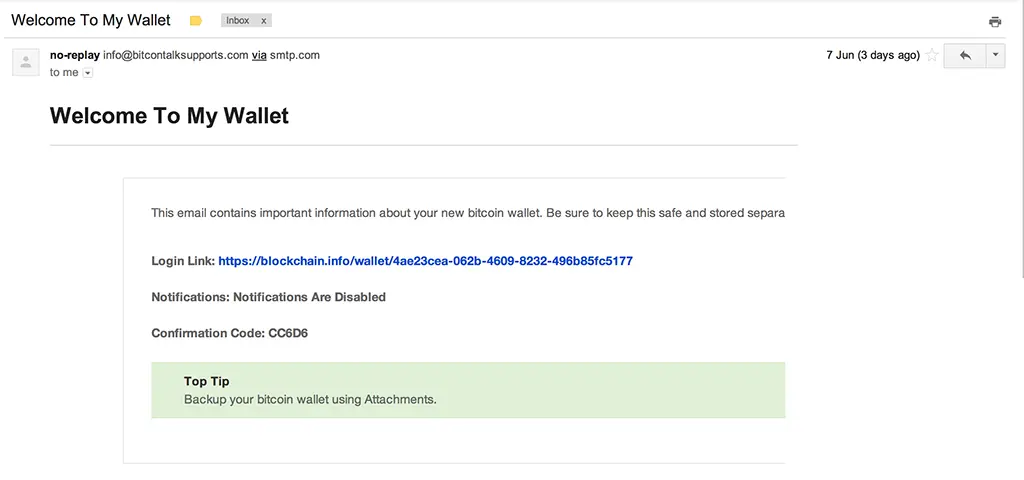

Be Aware Of Phishing Scams

Cybercriminals are becoming increasingly sophisticated in their tactics. One common method is creating websites that mimic legitimate ones. Before entering any sensitive information, always double-check the website's URL. Ensure it uses 'https' and look for any subtle misspellings or odd domain extensions.

Quite often, a link to the fake website is sent to the victim’s email. Phishing emails are crafted to look like they're from legitimate sources. They might urge immediate action, use generic greetings, or contain suspicious links or attachments. Always approach such emails with skepticism. Verify the sender's email address, and when in doubt, contact the organization directly.

Keep Your Software up to Date

As vulnerabilities are discovered, developers release patches to fix them. Running outdated software means you're exposed to these vulnerabilities. Regularly updating your software ensures you're protected from known threats.

It's not just individual applications that need updates. Your device's operating system is the foundation of your digital security. Ensure it's always updated to the latest version, benefiting from the most recent security enhancements.

Don't Store All Your Bitcoins in One Place

Just as you wouldn't keep all your physical assets in one place, the same logic applies to digital assets. Using multiple wallets or even different types of wallets can spread the risk. If one wallet gets compromised, it doesn't mean all your bitcoins are at risk.

Hot wallets are connected to the internet and are suitable for daily transactions. However, they're also more vulnerable to online threats. Cold storage, on the other hand, is entirely offline. Consider keeping the majority of your bitcoins in cold storage, accessing them only when necessary.

You can learn more about different wallet types from our comprehensive guide.

Review Transactions Regularly

Regularly reviewing your transaction logs helps you stay on top of your Bitcoin holdings. Any unfamiliar or unauthorized transactions can be a sign of a security breach, and early detection can help mitigate potential losses.

Many platforms offer notification services for transactions or account changes. These can act as an early warning system, alerting you to any unauthorized activity, and allowing you to take swift action.

The Future of Lost Bitcoins

Lost bitcoins, once deemed inaccessible, remain dormant within the blockchain. Their static presence in their respective addresses ensures they will never be moved again, effectively reducing the active supply of Bitcoin. This dormancy inadvertently contributes to Bitcoin's inherent scarcity, which can have implications on its value over time.

The unclaimed bitcoin holdings also serve as a historical reminder of the early challenges and learning curves faced by Bitcoin adopters. The decentralized and immutable nature of the blockchain ensures that, without the corresponding private keys, these bitcoins are forever irretrievable. This permanence underscores the importance of secure storage solutions and also highlights the transparent yet unalterable nature of the blockchain, where the status of these lost coins can be verified by anyone but never reclaimed.

Conclusion

The decentralized nature of Bitcoin, while offering numerous advantages, also presents unique challenges, particularly in the form of lost bitcoins. These lost coins, whether due to human error, technological mishaps, or unforeseen circumstances, have significant implications on the market dynamics and the perceived value of Bitcoin. As the cryptocurrency ecosystem continues to mature, understanding the nuances of lost bitcoins and implementing measures to prevent such losses becomes paramount for both individual investors and the broader community.

FAQ

How Many Bitcoins Have Been Lost

According to different sources, 25-29% of the total BTC supply might be lost. That is about 4-5 million coins.

How Can I Recover Lost Bitcoin?

Recovery options for lost Bitcoin are limited. If the loss stems from a forgotten password, certain services might assist in recovery. However, if bitcoins are erroneously sent to an incorrect address, recovery is virtually impossible.

What Does Lost Bitcoin Mean For The Rest Of The Bitcoin Network?

Lost bitcoins, by reducing the effective circulating supply, can potentially enhance the value of the remaining coins, given sustained or increasing demand.

How Can I Avoid Losing My Bitcoin?

Adopting a combination of secure practices, staying updated with the latest security protocols, and regularly backing up access credentials can significantly reduce the risk of Bitcoin loss.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.