Future of Bitcoin: What Will Happen to Crypto in the Next 5 Years

The Future of Bitcoin & Cryptocurrency: 2023 and Beyond

Since Bitcoin's launch in 2009, the technology behind it has sparked a new industry with a myriad of cryptocurrency projects. The cryptocurrency community has evolved from a small group of “cypherpunks” into a global community of people ranging from geeks to popular companies and large investment funds.

A huge number of investors stimulated Bitcoin growth up to a record high of nearly $69,000 in November 2021. However, by the end of November 2022, BTC fell by 75% to around $16,800. Since then, it has been moving in a narrow channel, showing record-low volatility.

The community is divided on whether the price of BTC will skyrocket or continue to decline in the coming year. There is evidence to support the positions of both sides. On the one hand, there is a strong argument that BTC is likely to fall sharply in the coming months. But on the other hand, it could potentially rise in mid to late 2023.

What Happened to Bitcoin in 2022?

After a huge hike in 2021, when Bitcoin price rose by 1,200% and almost reached $70,000 by early November, the cryptocurrency market collapsed by the end of the year. The so-called “crypto-winter” started, during which the price of Bitcoin rolled back to December 2020 levels. This bear market was supported by many factors:

- High unemployment caused by the COVID-19 pandemic;

- Tighter U.S. monetary policy aimed at lowering inflation;

- Tragic events in Ukraine;

- Tighter regulation of the cryptocurrency market;

- The collapse of UST and LUNA.

All of these factors drove the Bitcoin price to $17,600. After that, the market began recovering. Bitcoin attempted an upside break above the $22,000 resistance. However, in November, one of the largest crypto exchanges, FTX, collapsed. This event made Bitcoin plunge to $15,600.

Crypto Market Predictions for 2023

The global economy, especially the U.S. financial policy, had a major impact on the cryptocurrency market. Over the past 14 years, the world's leading central banks have pursued an ultra-soft monetary policy. Then, in the face of the post-COVID-19 crisis and escalating political issues, they had to tighten their policy.

However, in November 2022 Jerome Powell announced that in a few months, the Fed's monetary policy would gradually begin to soften. A slowdown in the key rate is expected in the first and second quarters of 2023. It is supposed to recover the cryptocurrency market.

Another important trend of 2023 expected to impact the entire cryptocurrency industry is the tightening of crypto regulation around the world. For example, in Europe, it is planned to introduce MiCA - Markets in Crypto-Assets regulation memorandum. It will establish a single approach to the regulation of all cryptocurrency projects in the EU. Similar policies are likely to be adopted in other jurisdictions.

It is also worth considering the "halving" factor. Due to the cyclical nature of halving, every four years Bitcoin sets a new price record and then pulls back by 70-80%. The third cycle ended in November 2021, when BTC was trading at a maximum price of $70,000. Based on the past cycle data and historical prices, the rollback to the minimum price takes 360–410 days. From this, we can conclude that the bearish cycle will end in early 2023.

Today, cryptocurrency assets are a mandatory part of investment portfolios. Blockchain-based projects have entered government programs in dozens of countries. Some countries have even adopted BTC as a national currency. Thus, despite the turmoil and contrary to the opinion of skeptics, the industry is firmly on its feet and will continue its development in 2023.

The Future of Crypto: 3 Possible Scenarios

Below, we take a detailed look at the different scenarios for the future of cryptocurrencies and the factors that determine them.

1. To the Moon: Why Crypto Could Recover

The first scenario is a new bull run with new Bitcoin price records. What could trigger an upward market jump?

The U.S.’s “Blessing” Could Increase Global Acceptance

Cryptocurrencies in the U.S. are regulated at both the federal and state levels. The regulation varies from state to state. Despite all the horrors of extraterritoriality, the United States is one of the most convenient countries for doing cryptocurrency business. Large hedge funds, cryptocurrency and stock exchanges, and other cryptocurrency-related companies are registered and operate here.

On March 9, 2022, U.S. President Joe Biden signed an executive order requiring federal agencies to form a unified approach to regulating cryptocurrencies in the country. The document does not contain any specific proposals but makes it clear that the U.S. authorities are quite loyal to the cryptocurrency sector. Moreover, the new decree even includes a proposal to launch the digital dollar.

The emergence of numerous bills on cryptocurrencies is a good sign. Not all of them are of practical use, but they have great symbolic value. Not long ago, cryptocurrencies were a niche market, and now the U.S. president himself is pushing the government to pass laws for crypto.

Increased regulation of cryptocurrencies is often frowned upon by crypto investors. However, CFTC (Commodity Futures Trading Commission) representatives believe that proper regulation can have a powerful bullish effect on the BTC price. The head of CFTC, Rostin Behnam, said:

“Growth is possible if we have a well-regulated space. Bitcoin can double in price if there is a market regulated by the CFTC.”

Behnam also explained that a clear regulatory framework could help the number of institutional investors in the market grow. “These incumbent institutions in the crypto space see a massive opportunity for institutional inflows that will only occur if there’s a regulatory structure around these markets," he commented.

Blockchain Tech Has Demonstrated Its Resilience and Maturity

The first generations of blockchains lacked speed and power capacity, as well as scalability. At the same time, there were many projects which were not interoperable due to the lack of standards.

The Proof-of-Work consensus mechanism created additional challenges. The calculation processes were complex and took a lot of time, energy, and money. Transactions were 10 minutes long.

However, by 2022, technology had improved dramatically. New standards and staking models sparked an institutional interest. Now, blockchain is a modern, rapidly evolving technology with a wide range of capabilities. At the moment, the technology is actively used in finance, payment systems, and retail trade.

Blockchain technology, as one of the most modernized virtual systems, is becoming increasingly popular. In this regard, there have been operational and functional shifts in global economic systems. Although the design of today's blockchains is still being actively refined, blockchain is already capable of helping people in different and varied scenarios.

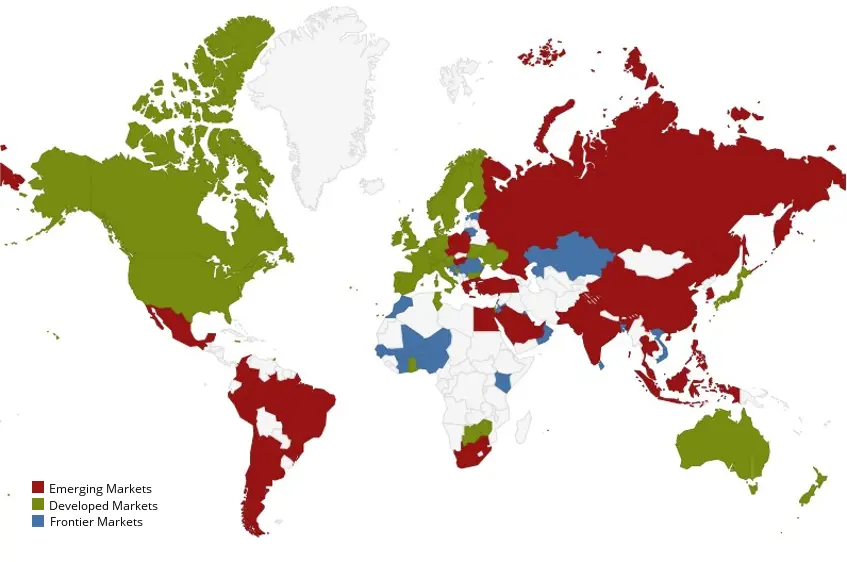

Emerging Markets Are Getting in on the Action

Blockchain technology is the salvation for emerging markets. The cryptocurrency community is more active in emerging markets than in developed countries.

Developed markets, such as Europe and the United States, tend to use blockchain mostly for cryptocurrencies. At the same time, emerging markets also use technology to create tools and products to solve complex problems.

As the head of KuCoin Labs says,

“For developed markets, it's a hobby, for emerging markets it's a necessity. In emerging countries, people are lacking a lot of tools and infrastructure and are probably limited by language barriers, political, geographical, technological, and economic barriers”.

Given that most of the world's population lives in developing countries, the active development of cryptocurrencies and blockchain technology in these countries can contribute to the growth of the entire cryptocurrency market.

2. Cruise Control: Why Crypto Could Stabilize

The second scenario for cryptocurrency market is a further continuation of the sideways movement.

Increased Tax Accountability Could Greatly Slow Down Trading

According to experts, taxation of cryptocurrency, if done within reasonable limits, will not dramatically affect the development of the industry. At the same time, the Biden administration predicts tax revenues of $6.6 billion between 2023 and 2032 from the application of so-called mark-to-market rules.

Mark-to-market is a way of valuing assets based on current market conditions. That means the U.S. is going to create a mechanism to tax unrealized gains. Here's how it works: imagine that over a year the value of your investment portfolio, which is 100 percent BTC, went up because of the rise in the price of BTC. Even if you don't sell the coins by the end of the year, you'll still owe taxes.

We can assume that investors will have an additional reason to hold crypto. They can conduct as few transactions as possible to simplify the records of transactions and financial results.

Such innovations, if adopted, would encourage coin owners to minimize transactions with their cryptocurrency. Well, in theory, this could reduce the pressure of sellers on the market and create additional conditions for its growth.

The Central Bank Digital Currencies (CBDCs) Could Dilute the Market

Central bank digital currency and public cryptocurrency are two fundamentally different phenomena. Central bank currency imitates the basic functions of cash. It serves as an official means of payment, exchange, and savings. At the same time, cryptocurrencies, according to regulators, are a special form of an investment asset.

However, the development of CBDC may well be a precursor to a direct ban on cryptocurrencies. Though countries such as the U.S., and Canada are trying to create a system in which cryptocurrency and CBDC can successfully coexist.

Indeed, CBDCs are likely to take some capitalization from the cryptocurrency market. On the other hand, both assets can complement each other. They are likely to occupy different niches of the financial market in the future.

Thus, we can conclude that CBDCs are not going to kill all cryptocurrencies. However, there is a probability that CBDC will cause the death of cryptocurrencies which serve only as a means of payment.

3. Crash and Burn: Why Crypto Could Die Off

And the last scenario, which perhaps many will not like, but which should nevertheless be taken into account.

Crypto Crime Is Still Running Rampant

Despite the fact that the cryptocurrency market has been there for a while, it still resembles the Wild West. After regulators and institutional investors came to the market, the number of bad actors decreases significantly. That said, it is impossible to completely eradicate culprits, especially in decentralized finance (DeFi).

The decentralized world often experiences hacker attacks. And even projects and exchanges, which seemed reliable yesterday, such as Luna and its UST and FTX fail. Such events lead to losses, even for multi-billion funds. In this sense, the cryptocurrency market is still very much inferior to traditional markets. That is why many people prefer to keep their coins in so-called cold wallets, isolated from the Internet connection.

The market still cannot recover from the collapse of Luna and FTX. Individual and institutional investors have lost a lot of money. Many of them, once disappointed, will probably never return to the cryptocurrency market. How many crypto newcomers have been discouraged by such events?

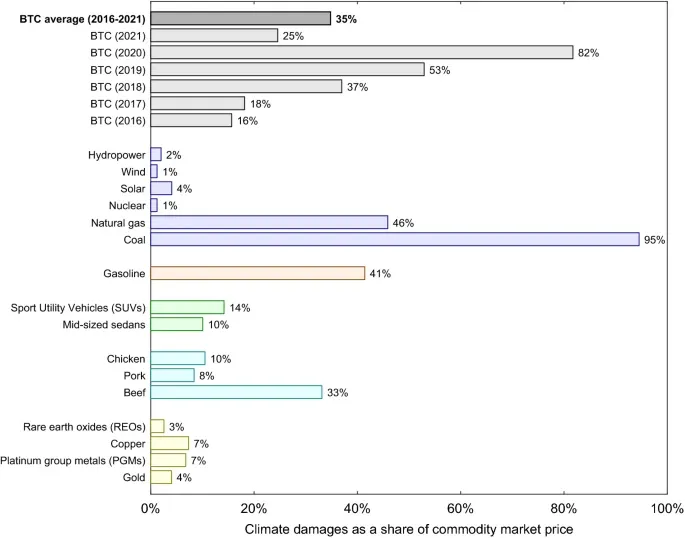

Bitcoin Is Worse for the Environment Than Beef Production

Bitcoin mining is as expensive to the environment as energy-intensive beef production.

According to an article published in the journal Scientific Reports, mining bitcoins and other cryptocurrencies uses a huge amount of energy, in fact, more than is used by entire countries. For example, Bitcoin mining uses 75.4 terawatt-hours per year (TWhyear-1); all of Austria uses only 69.9 TWhyear-1.

Against the backdrop of the worldwide energy crisis, many question the rationale of spending so much energy to run the Bitcoin network. There is a possibility that countries will go the way of China and ban mining. In that case, Bitcoin would probably have to switch to another consensus mechanism or disappear.

Why Cryptocurrency Could Be the Future of Money

About 320 million people, or 4.2% of the world's population, currently use cryptocurrencies. Most in the industry believe that this number could grow significantly by the end of the decade. According to Gartner, by 2024 at least 20 percent of large enterprises will use digital currencies to pay, store value, or pledge.

More than that, many governments around the world are beginning to be loyal to cryptocurrencies. They are moving toward regulation rather than prohibition. And some, such as the Central African Republic of El Salvador, have made Bitcoin the official currency of the state, increasing mainstream adoption.

In recent years, Bitcoin's influence has led to changes in various industries. Most online companies have begun to accept crypto as payment. This has opened up an opportunity for small businesses to establish themselves in the marketplace. The impact of Bitcoin and cryptocurrencies in today's world is enormous.

However, the transition to mass adoption of a new crypto-economy is not to be expected before one or two generations. That is, not before 40 years. But it is today that we are witnessing the beginning of this financial revolution.

Why Cryptocurrency May Not Be the Future of Money

Despite all the successes of blockchain technology and the cryptocurrency industry, no central bank will give up the right to dispose of financial flows. That, however, does not prevent state financial institutions from utilizing blockchain. In 2023, many states are seriously considering the idea of introducing their own digital currencies and are already actively testing CBDCs.

Cryptocurrency technology has as many opponents as proponents. The rapid digitalization of the market and high volatility makes crypto-assets an ideal financial tool for traders. On the other hand, it seems to be extremely difficult for cryptocurrencies to become the backbone of the financial system. If their volatility and difficulty of use could be overcome, cryptocurrencies could be adapted for purposes other than speculative trading. That is why many banks do not allow their financial resources to be used to buy crypto.

Bitcoin’s Future Outlook

No one can give an accurate Bitcoin analysis and outlook. However, if you rely on most bitcoin future value predictions, you can expect the average BTC price in 2023 to be around $40,000. And in five years, the maximum price of BTC will be about $120,000

According to the Price forecast from the website PricePrediction, Bitcoin will start 2023 at an average price of $17,000. For the entire year, BTC price will rise by $8,000, meaning the first cryptocurrency will be worth an average trading price of $25,000 in December. And in five years, the maximum price of BTC will be about $120,000. No information was given on its minimum price prediction though.

As the first digital asset in the world and the largest by market capitalization, Bitcoin reflects the state of the crypto industry as a whole. It is likely to remain very volatile in the short term and grow significantly in the long term.

Ethereum’s Future Outlook

Even though Ethereum is the largest altcoin and underpins most DeFi projects, its current price is still highly correlated with that of Bitcoin.

According to the website PricePrediction, Ethereum will start in 2023 at around $1,200. For the entire year, the average price level will rise by $500 based on historic price sentiment, meaning the first cryptocurrency will be at an average price level of about $1,700 in December.

Many crypto experts believe that it is worth buying Ethereum. Unlike Bitcoin, the Ethereum team continues to actively improve the protocol and regularly introduces updates according to the roadmap. The asset is believed to overtake BTC in terms of capitalization and become the flagship of the entire cryptocurrency industry.

The Future of Cryptocurrency

So, does cryptocurrency have a future? In general, most crypto experts agree that the crypto industry will soon recover from a severe price drop. However, it should be taken into account that 2023 may come as a disappointment for cryptocurrency investors. No one can predict exactly the future of crypto in the next 5 years, and even the above-mentioned price predictions are ideas and guesses. It is important to invest cautiously. Bitcoin and Ethereum will continue to set the bar for all other assets, but it is too risky to invest large amounts now. It is better to wait until there is more certainty in the market.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.