Intrinsic and Extrinsic Value in Options Trading

In this article, we will take a close look at some key components of options — extrinsic vs. intrinsic value. Understanding these concepts lays the foundation for the informed options' trader.

How are Options Priced?

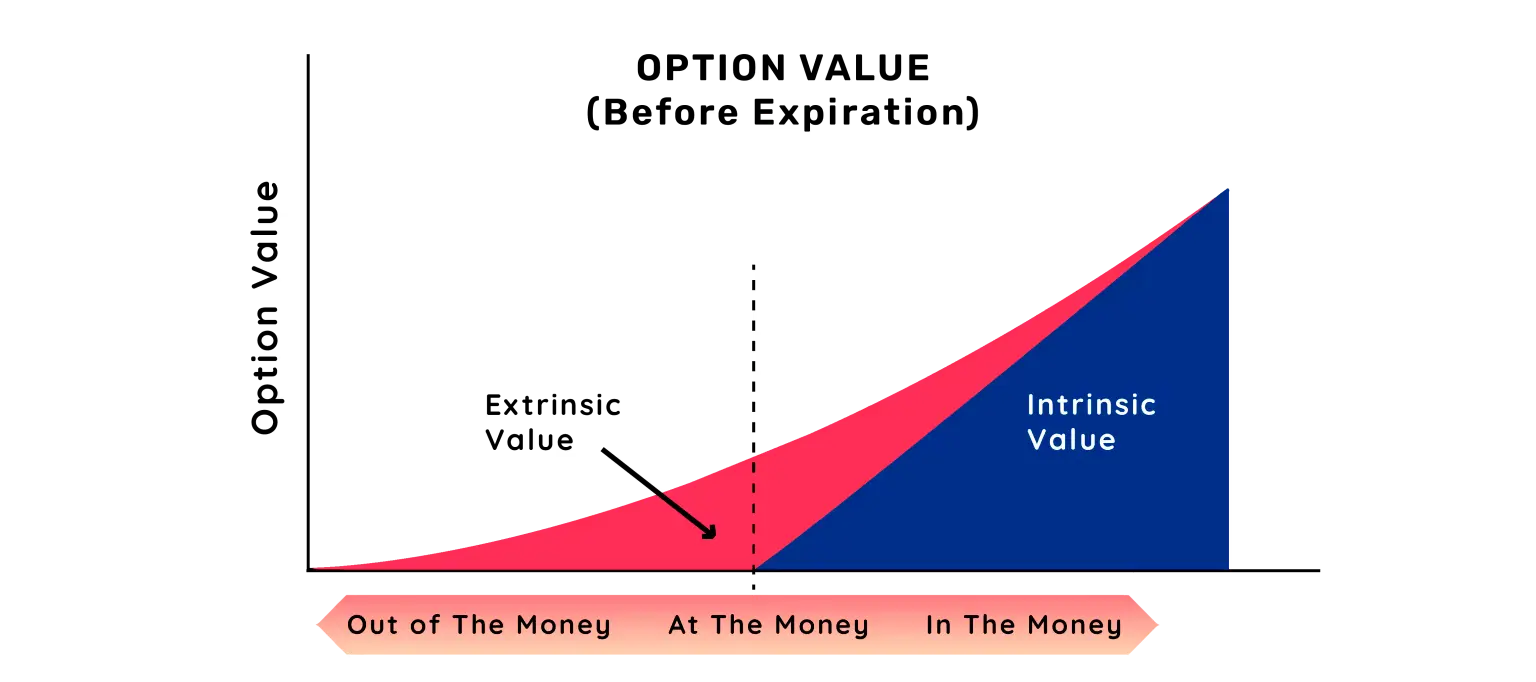

Diving into the specifics, an option's price, which is often referred to as its “premium”, consists of two components — intrinsic value and extrinsic value. While the former pertains to the immediate profitability, the latter refers to the potential future worth of an option.

What is the Intrinsic Value of an Option?

Stripping it down to its core, intrinsic value of options reflects the immediate profitability that an option offers based on the current market price of the base asset (in this case, Bitcoin). For a call option, it is the surplus of the Bitcoin's current price over the strike price, provided the result is positive. So, if you are in possession of a call option with a strike price of $19,000 and Bitcoin is trading at $20,000, the intrinsic value would be $1,000. It represents the immediate profit embedded in the option if executed.

What is the Extrinsic Value of an Option?

Commonly known as “time value”, the concept of extrinsic value signifies the additional cost that a trader is expecting to acquire over the intrinsic value.

Consider the example above of a call option for Bitcoin with a strike price (exercise value) of $19,000. Given the prevailing Bitcoin price of $20,000, the extrinsic value would be any premium that a trader receives above the intrinsic value of $1,000. For instance, $1,050. Below, we will look at the factors which influence the extrinsic value.

Factors Affecting Extrinsic Value

Numerous elements shape the extrinsic value of an option. The major influences include time to expiry, implied volatility, interest rates, and anticipated dividends.

Time to Expiration

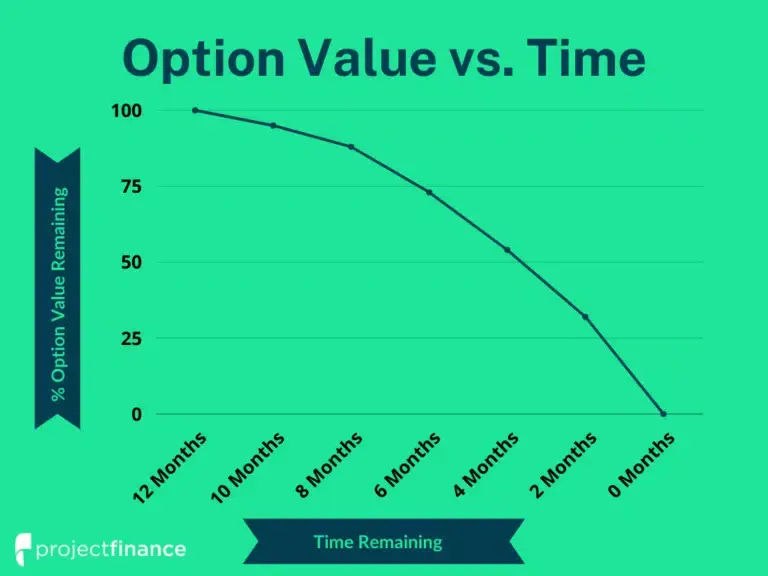

Every option contract comes with an expiration date — the final day when the option can be exercised. Time to expiration can drastically influence a contract's extrinsic value. With every passing day, the uncertainty around the base asset's price movement decreases.

Therefore, as the expiration date nears, the extrinsic value, which is a representation of this uncertainty, begins to reduce, a phenomenon known as time decay. A long-term option, all other factors being equal, will typically have a greater extrinsic value than a short-term option because it has more time for the price of the base asset to move favorably.

Implied Volatility

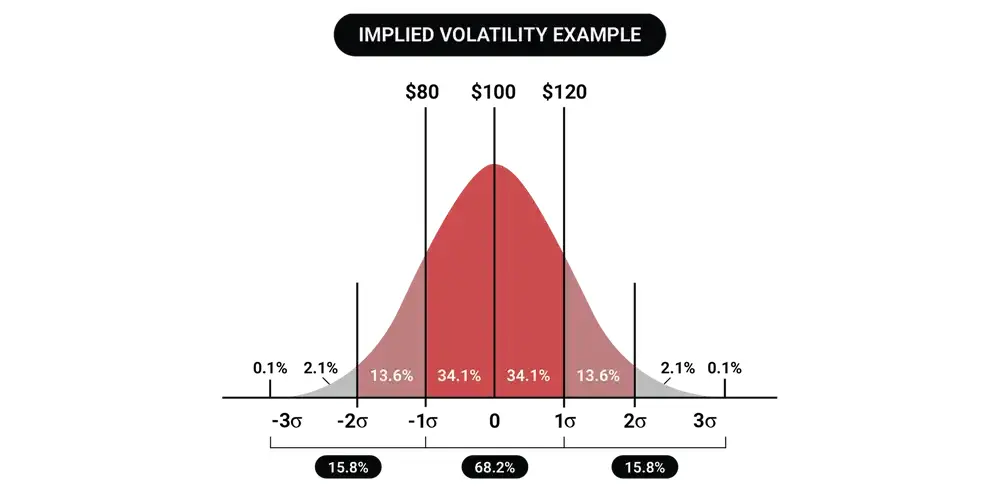

Implied volatility (IV) is an estimation of an option's future volatility and is reflected in the option’s premium. An option with a high IV indicates that the market anticipates significant price movement of the base asset.

Consequently, contracts with higher implied volatility will have a larger extrinsic value, as there's a greater chance of the option moving into the money. For Bitcoin, which is renowned for its price volatility, options will typically carry a high extrinsic value due to this heightened IV.

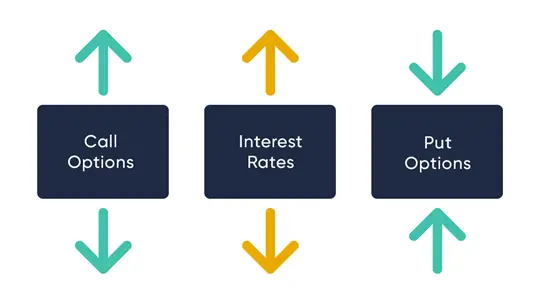

Interest Rates

Interest rates also indirectly impact the pricing of options. The anticipated change in interest rates over the lifetime of the option can affect the extrinsic value. Higher interest rates mean higher costs of capital.

Therefore, call options tend to increase in price (because you are deferring the purchase of the asset), while put options usually decrease (because you are deferring the sale of the asset).

Dividends

Although Bitcoin doesn't distribute dividends, in traditional markets, expected dividends impact the pricing of options. If an asset is likely to generate dividends during the lifespan of an option, it will affect its extrinsic value. The anticipation of dividends typically lowers the price of call options (since the asset's price will reduce once the dividend is paid) and increases the price of put options.

Extrinsic Value and Option Pricing Models

The pricing models deployed in options trading heavily hinge on both intrinsic and extrinsic values. A few prominent ones include the Black-Scholes model, binomial option pricing model, and others.

Black-Scholes Model

Developed by economists Fischer Black and Myron Scholes, the Black-Scholes Model, which earned them the Nobel Prize, calculates options pricing by incorporating several variables. They include the current price of the base asset, the option's exercise price, time until expiry, IV, and risk-free interest rates. While it enjoys widespread use, the assumptions that the model is based on are often violated, making its applicability limited in certain scenarios.

Binomial Option Pricing Model

The binomial option pricing model provides a stepwise approach to estimate option prices. It divides an option's life into intervals, each with two potential paths—an increase or decrease in the base asset's price.

For a call option on an asset worth $55,000, the model calculates the option's intrinsic value for each potential asset price at expiration, using a strike price of $60,000.

Future option values are then discounted back to the present using a risk-free rate. This process repeats for each interval, finally determining the option's present value.

Despite its complexity, the binomial model effectively gauges a contract's intrinsic and extrinsic value, considering key factors like asset price, expiration time, and volatility.

Other Option Pricing Models

Other sophisticated models have emerged, such as the Monte Carlo simulations or finite distinctive methods, which provide even more nuanced methods of capturing extrinsic value. However, they also tend to be more complex and require the use of robust computing power and advanced mathematical concepts.

3 Differences Between the Intrinsic and Extrinsic Value of Options

Crucial disparities between extrinsic and intrinsic values are situated within the realms of the underlying price aspect, the volatility facet, and the time constituent

Underlying Price Component

While intrinsic value is greatly influenced by the base asset price and the exercise price, extrinsic value is relatively unresponsive to these elements. It factors in potential future changes rather than the current state of affairs.

Volatility Component

A key differentiator is that extrinsic value inflates with higher volatility, while intrinsic value remains unaffected. Hence, options on assets like Bitcoin, notorious for their price fluctuations, often command a higher extrinsic value.

Time Component

Time, as a dimension, significantly impacts extrinsic value but has no bearing on intrinsic value. The diminishing time to expiration generally erodes extrinsic value due to the time decay phenomenon.

Time Decay and Extrinsic Value

The concept of time decay, or “Theta” as it is typically termed, is a crucial aspect of options trading. Read more about this concept in our article.

Definition of Time Decay

Time decay measures the rate at which an option's value dwindles as time passes by, assuming all other factors are kept constant. It specifically targets the extrinsic value of contracts.

Impact of Time Decay on Extrinsic Value

As each day passes, the extrinsic value of options undergoes erosion due to time decay. As the option inches towards its expiration date, the scope for future profitability diminishes, which consequently decreases its extrinsic value.

Strategies for Managing Time Decay

Savvy investors devise tactics to manage the impact of time decay on their options trading. They may choose options with longer expiry dates to maximize the extrinsic value. Alternatively, they employ advanced strategies like calendar spreads, to take advantage of the time decay.

Extrinsic Value and Option Strategies

The strategies employed in options trading can be heavily influenced by extrinsic value.

Buying and Selling Options

When buying an option, the trader pays a premium, a price comprising both intrinsic and extrinsic value. Contracts with high extrinsic value might indicate a high potential for profit due to either increased time to expiration or high IV. However, it also signals a larger risk. That is, the premium may never be recovered if the price of the base asset does not move favorably. On the contrary, selling options can benefit from time decay, with the option's extrinsic value eroding over time, leading to profits if the option expires out of the money.

Vertical Spreads

Vertical spreads involve the simultaneous purchase and sale of two options with the same expiry but different exercise prices. Such spreads can significantly benefit from the comprehension of extrinsic value. A trader could take advantage of a vertical spread when they expect a moderate price move in the base asset. For instance, if a trader anticipates that Bitcoin will rise but only moderately over a given period, they might implement a bull call spread.

This strategy involves buying a call option at a specific strike price, while simultaneously selling another call option with a higher strike price. By doing so, the trader can benefit from the rise in Bitcoin's price, up until the higher exercise price. The extrinsic value plays a crucial role here. It can affect the net premium paid or received and ultimately the profitability of the spread.

Calendar Spreads

Other names for a calendar spread are a time spread or a horizontal spread. It involves the simultaneous purchase and sale of two options of the same type (all calls or all puts) and strike price, but with different expiry dates. Traders employ this strategy hoping to benefit from the differential time decay of options, which directly relates to their extrinsic value.

For instance, if a trader believes that Bitcoin will stay relatively flat over the short term but expects a significant price movement in the long term, they might sell a short-term option and buy a longer-term option. The goal is for the short-term option to lose its extrinsic value faster than the long-term option due to time decay, allowing the trader to profit from the spread.

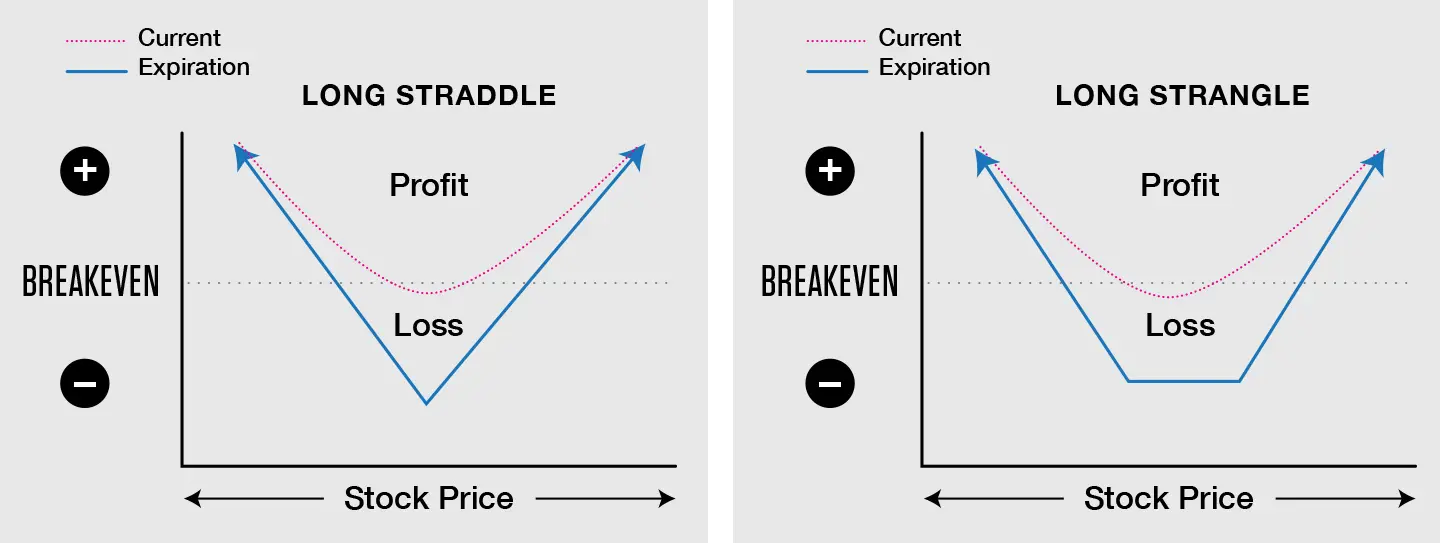

Straddles and Strangles

Straddles and strangles are advanced options strategies that allow traders to profit from significant price movements in either direction. A straddle involves buying a call and a put at the same exercise price and expiry date.

On the other hand, strangle involves buying a call and a put with the same expiry date but different strike prices. The aim is to take advantage of high IV, often around major news events that could significantly affect the price of the base asset.

Example Scenario

TSLA and AAPL Call Options

Let's consider real-world assets such as Tesla Inc. (TSLA) and Apple Inc. (AAPL) for an illustrative example of intrinsic and extrinsic values in options trading.

Assume TSLA trades at $700. An investor buys a TSLA call option with a exercise price of $720 and expiry in 45 days at a premium of $30. Here, the intrinsic value is $0, as the option is out-of-the-money. The $30 premium equals the contract's extrinsic value, reflecting the potential for TSLA's price to exceed the strike price within 45 days.

Fast-forward 30 days, TSLA appreciates to $750. The contract's intrinsic value is now $30 ($750 – $720), and if the option's total value is now $40, the remaining $10 is the extrinsic value.

On the flip side, imagine AAPL trades at $150. An investor buys an AAPL put option with a strike price of $140, expiring in 60 days, at a premium of $10. The intrinsic value is $0, making the whole premium the extrinsic value.

30 days later, AAPL drops to $130. The intrinsic value becomes $10 ($140 – $130), and if the option's total value is now $15, the remaining $5 is the extrinsic value.

These examples showcase the dynamics of intrinsic and extrinsic values and their adjustments with changing asset prices and expiration timelines.

Final Thoughts

Decoding the mystery of extrinsic value vs. intrinsic value in options is a vital stepping stone for anyone venturing into options trading. By understanding their intricate differences and the factors influencing them, traders, speculators, and investors can not only mitigate risks but also spot lucrative opportunities. This knowledge holds, whether dealing with traditional assets like stocks or such volatile, cutting-edge assets as cryptocurrency.

FAQs

How Does the Intrinsic and Extrinsic Value of an Option Affect My Trading Strategy?

The interaction amidst the intrinsic and extrinsic value of an option is like a see-saw that balances potential profits and losses. Gaining insights into this dynamic helps in formulating effective risk management and profit-taking strategies, fine-tuning your approach to trading.

Can I Trade Options on Bitcoin?

Absolutely, numerous platforms facilitate trading options on Bitcoin. However, it's essential to be mindful of the high volatility involved and how it can influence the contract's intrinsic and extrinsic value. Detailed comprehension of these aspects can help you navigate the waters of Bitcoin options trading more effectively.

How Is the Extrinsic Value of a Bitcoin Option Calculated?

Extrinsic value isn't calculated in isolation. It factors in several elements such as time to expiry, IV, interest rates, and anticipated dividends. Bitcoin, given its unique characteristics, has its extrinsic value majorly influenced by IV, often a reflection of market sentiment and future expectations.

How Do Changes in the Bitcoin Market Affect the Intrinsic and Extrinsic Value of a Bitcoin Option?

Any fluctuation in the Bitcoin market directly impacts the intrinsic value of a Bitcoin option, due to the direct correlation with the base asset's price. Simultaneously, changes in IV and market expectations borne out of these fluctuations can cause shifts in its extrinsic value. Hence, staying attuned to market movements, news events, and trends can significantly aid in optimizing your options trading strategy.

What Is the Difference Between Intrinsic and Extrinsic Value

Intrinsic value is the option’s is a so-called immediate value of an option, should it be exercised. Essentially, it’s the distinction between its strike price and the market price of its base asset. On the other hand, extrinsic value is anything extra than the intrinsic value. This extra value is determined by different factors, such as IV, expiry date, etc.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.